Skip to comments.

"January Effect" an omen for 2015? --Investment & Finance Thread - Jan. 4

Weekly investment & finance thread ^

| Jan. 4, 2015

| Freeper Investors

Posted on 01/04/2015 9:26:15 AM PST by expat_panama

A good January for stocks promises big gains for the year --or so goes the story goes (from Down January for stocks is bad omen for 2014 - USA Today) "How stocks fare in January often sets the tone for the full year". A lot of work's been done on this, and TradingSim reports that

When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

--but the downside is:

A down January is a bad omen for the stock market. Yale Hirsch of the The Stock Traders Almanac suggests that since 1950, every down January in the S&P500 preceded a new or extended bear market, or in some cases, a flat market. They go on to further suggest that down January’s are followed by substantial declines averaging -13%.

| |

|

|

|

|

|

| |

|

% above avg. months |

% times the following year is above avg. |

% times month predicts following year |

|

| |

|

|

|

|

|

| |

January |

55% |

66% |

59% |

|

| |

February |

48% |

66% |

55% |

|

| |

March |

60% |

66% |

56% |

|

| |

April |

53% |

62% |

55% |

|

| |

May |

47% |

63% |

60% |

|

| |

June |

44% |

62% |

53% |

|

| |

July |

57% |

63% |

55% |

|

| |

August |

59% |

62% |

55% |

|

| |

September |

38% |

62% |

49% |

|

| |

October |

51% |

66% |

51% |

|

| |

November |

56% |

62% |

57% |

|

| |

December |

67% |

64% |

58% |

|

| |

|

|

|

|

|

| |

average |

53% |

64% |

55% |

|

| |

|

|

|

|

|

That's nice, but let's do our own thinking.

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so most months predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

* * * * * * *

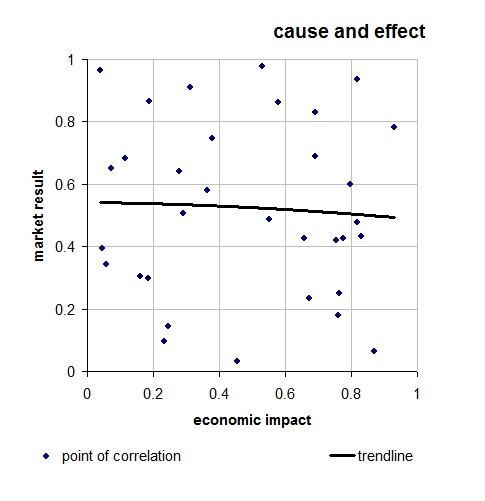

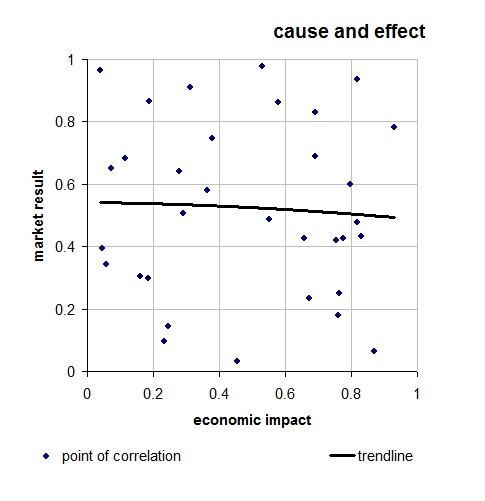

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Wisdom from experts on high ping.

To: expat_panama

I thought a good year for stocks comes when the NFC wins the Super Bowl.

To: sparklite2

Of course!! Now why is it that all these institutional investors spend all that money on so much research...

To: expat_panama

... because someone else is willing to pay them for it.

There are good reasons to invest in a S&P 500 index fund.

1. Fees are very low because no research is needed or being paid for.

2. Successful investments are measured against the S&P 500, which usually include a lot of research being paid for. Just skip the middle man.

3. Is large scale research worth it? Remember the anecdote that ends with, “Where are the customers’ yachts?”

To: expat_panama

We’re doomed, doomed I say! 2015 is the year of the Smitah; see Rabbi Johnathan Caan.

6

posted on

01/04/2015 12:08:40 PM PST

by

Rich21IE

To: sparklite2

Years ago, I heard someone say that since the S&P index represents the 500 largest companies in the U. S., an investment in the index was sound. You don’t get to be that big without knowing what you’re doing, he said.

7

posted on

01/04/2015 12:13:50 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

After so many years of fed manipulation and outright statistical government lies, is anything to do with the stock market is real?

8

posted on

01/04/2015 12:45:28 PM PST

by

nomad

To: nomad

The only thing real is “real” estate. And they aren’t making any more. As the old billboard said, “Get a lot while you’re young.”

To: expat_panama

"January Effect"

Gets me every time!

10

posted on

01/04/2015 2:26:44 PM PST

by

jaz.357

(never mind.)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

It's a beautiful new weird day with broader futures markets up +0.39 --and it's metals leading (+0.65%) with stock indexes lagging (-0.09%). Our econ report coworkers will be back this afternoon w/ Auto and Truck Sales. Good to be up early to have time to read all this:

-

The Obama Economic Record is Even Worse than You Realize Chad Stafko The degree to which Barack Obama has failed, as seen in the data, is quite staggering. More

- 2015 May Actually Feel Like 'Recovery' - Robert Samuelson, Washington Post

- WH's Mindless Energy Rules Could Trip Up Economy - Steve Moore, IBD

- GLOBAL MARKETS-Euro falls to 9-year low; Greece and ECB in focus Reuters - an hour ago . * Euro slumps to 9-year low. * "Grexit" fears resurface, ECB QE eyed. * Stocks volatile as oil extends losses. By Jamie McGeever.

- Oil Extends Decline From 5 1/2-Year Low as Glut Seen Persisting Businessweek - 10 hours ago Oil fell for a third day, extending its drop from the lowest close since 2009, as record supplies from Iraq and Russia bolstered speculation a global glut that's driven crude into a bear market may persist this year.

- Here's What 13 Top Wall Street Pros Are Predicting For Stocks In 2015 In 2014, Wall Street's stock market forecasts... Business Insider

- Gold climbs on Chinese buying but dollar could keep gains in check By A. Ananthalakshmi SINGAPORE (Reuters) - Gold reversed early losses on Monday to trade higher for a second straight session, supported by strong buying from top consumer China, which offset a firm dollar. ... Reuters

To: nomad

It’s as real as can be. My dividend checks from PP&L, KMI, IBM, BA, etc. spend just the same as any paycheck I ever earned.

12

posted on

01/05/2015 3:01:37 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

ISI Economic Summary from Sunday night:

Happy New Year!

1. It’s pretty certain the US economic expansion is now self-sustaining, eg, bank loans have accelerated y/y to +7.7%.

2. Foreign economies are soft and DXY surged +1.2% w/w. This combination is keeping downward pressure on commodity prices, eg, Brent -$3 and corn -19 cents.

3. The CPI in the US is likely to slow to just +0.3% y/y in Jan and the Eurozone CPI to -0.1% y/y, ie, deflation.

4. PBoC, ECB, and BoJ will all ease further in Jan. Draghi’s comments last week helped push German bond yields down -9bp to 0.50%!

5. In the past, plunges in oil have helped bolster growth, and the S&P has rallied +10% on average after the low in oil.

6. Judging by Evercore ISI hedge fund survey, investors are still neutral. And the continued decline in bond yields also suggests investors are not bullish on equities.

To: Wyatt's Torch

pretty certain the US economic expansion is now self-sustainingAgreed. OK, so we got lots of complaints but that's a sign of an expansion getting under way. Many people don't realize that an economic boom that's peaked and leveling off is what's called the beginning of a recession.

To: expat_panama

Many people don't realize that an economic boom that's peaked and leveling off is what's called the beginning of a recession. And it's going to be really funny when the dolts on FR start yelling "See! I told you we've been in recession for 7 years!"

SMDH

To: expat_panama

On the positive side my company got upgraded this morning :-)

To: expat_panama

UST yield curve changes today:

#Flattening

To: Wyatt's Torch

my company got upgradedNeat! If it's listed send me the ticker --I do well w/ companies w/ happy employees...

To: expat_panama

I didn’t say I was a happy employee..... :-)

To: Wyatt's Torch

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.