Skip to comments.

"January Effect" an omen for 2015? --Investment & Finance Thread - Jan. 4

Weekly investment & finance thread ^

| Jan. 4, 2015

| Freeper Investors

Posted on 01/04/2015 9:26:15 AM PST by expat_panama

A good January for stocks promises big gains for the year --or so goes the story goes (from Down January for stocks is bad omen for 2014 - USA Today) "How stocks fare in January often sets the tone for the full year". A lot of work's been done on this, and TradingSim reports that

When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

--but the downside is:

A down January is a bad omen for the stock market. Yale Hirsch of the The Stock Traders Almanac suggests that since 1950, every down January in the S&P500 preceded a new or extended bear market, or in some cases, a flat market. They go on to further suggest that down January’s are followed by substantial declines averaging -13%.

| |

|

|

|

|

|

| |

|

% above avg. months |

% times the following year is above avg. |

% times month predicts following year |

|

| |

|

|

|

|

|

| |

January |

55% |

66% |

59% |

|

| |

February |

48% |

66% |

55% |

|

| |

March |

60% |

66% |

56% |

|

| |

April |

53% |

62% |

55% |

|

| |

May |

47% |

63% |

60% |

|

| |

June |

44% |

62% |

53% |

|

| |

July |

57% |

63% |

55% |

|

| |

August |

59% |

62% |

55% |

|

| |

September |

38% |

62% |

49% |

|

| |

October |

51% |

66% |

51% |

|

| |

November |

56% |

62% |

57% |

|

| |

December |

67% |

64% |

58% |

|

| |

|

|

|

|

|

| |

average |

53% |

64% |

55% |

|

| |

|

|

|

|

|

That's nice, but let's do our own thinking.

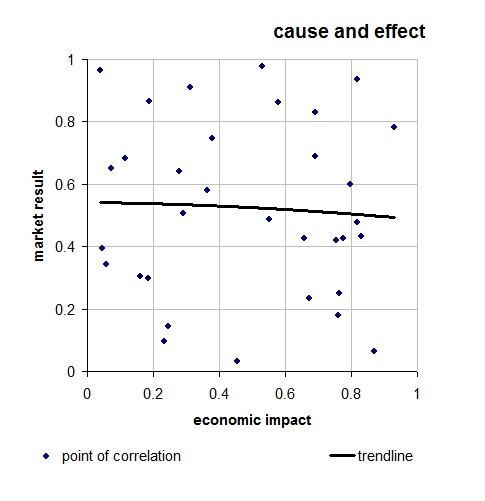

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so most months predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

* * * * * * *

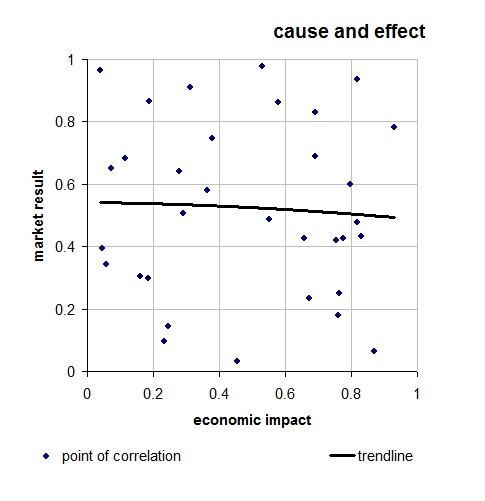

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

To: expat_panama; Wyatt's Torch; All

Patiently awaiting the Ringing of the Bell that will signal a bottom. Or a top. Or a sideways market. Or anything.

Surely, someone, somewhere KNOWS!?!?!?!?

41

posted on

01/06/2015 10:44:55 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Looks like there are a lot of bells getting rung today.

42

posted on

01/06/2015 10:48:05 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

That does it!!! I’m buyin!!

43

posted on

01/06/2015 10:56:54 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

—or how do we explain what happened from Oct to Dec. of ‘08 when five trillion dollars in assets somehow ceased to exist?

To: expat_panama

In hindsight, what we had with the 08-09 Bear Market was a buying opportunity that comes along only about every thirty or forty years. IIRC, the last time such a significant event occurred was in the early ‘70s.

45

posted on

01/06/2015 11:00:41 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Wyatt's Torch

10Y UST < 2.00% Wasn't this the year that interest rates were fer shure gonna go up?

46

posted on

01/06/2015 11:06:03 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

To: expat_panama

Haven’t we been expecting it?

48

posted on

01/06/2015 11:25:11 AM PST

by

sarasota

To: sarasota

Haven’t we been expecting it?Yeah, yesterday the trading seemed to be the kind that would wrap up w/ an IBD "correction" call. As far as which way stock prices will go next is an entirely different question, and right now I'm only selling stuff that's already begun to smell --trying to be ready instead for the next run-up. My experience w/ IBD's market calls is that there's more money to be gained by buying when they say 'sell' and viseversa.

To: expat_panama

Woo-hoo!

I own too much ex-employer stock, so I sold a chunk of it on Dec. 31. That stock has now gone down 6% from Dec. 31, but I locked in a nice gain on some of that stock with that sale (bought ~$4/share, sold for >$64/share).

I have money to shop and stocks are on sales! Woo-hoo!

50

posted on

01/06/2015 11:49:30 AM PST

by

ConstantSkeptic

(Be careful about preconceptions)

To: abb

Wasn’t this the year that interest rates were fer shure gonna go up?

Was until the ROW collapsed then it’s “Flight to Safety” time. As Yahoo! Finance said today, the US is the best house in a bad neighborhood.

To: abb

Remember in March 2009 Obama said "might be a good time to buy stocks"...

To: ConstantSkeptic

way to go!! The fact keeps coming back that sell rules are even more important than buy rules.

To: expat_panama

Ah, c’mon, you know I’m referring to the past and current FED policy, commonly referred to as a zero interest rate.

“Under ZIRP, the central bank maintains a 0% nominal interest rate.”

http://en.wikipedia.org/wiki/Zero_interest-rate_policy

As for continuing to refer to FED money printing (in it’s various forms) as Bernake Bucks, the alliteration is ever so much more pleasant sounding than, by comparison, the somewhat more jarring term Yellen Bucks.....um, how about Janet Juice? Besides that it is, in fact, a continuation of Uncle Ben’s “only-the-little-people-have-to-pay” policy.

Neither of the above are signs of a healthy economy. They are continuing signs of the opposite.

54

posted on

01/06/2015 12:20:46 PM PST

by

citizen

(Hopefully, the MSM will again be making a big deal of high gas prices come Jan 20, 2017.)

To: Wyatt's Torch

But how about today?!?! This afternoon, right when I said I was gonna buy, the market turned!!!! Might even close up today!!

“THEY” know!!! It’s rigged, I tell ya!!

55

posted on

01/06/2015 12:28:54 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

3:30 RAMP CAPITAL, LLC began at 1:30 today :-)

To: Wyatt's Torch

Now it’s ticking lower again! “THEY” must be monitoring this thread. Yes. That’s it!!!

57

posted on

01/06/2015 12:37:20 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

The solution for you would seem to be that you need to be one of “them.”

I pretty sure I don’t qualify. So, how do you qualify?

It’s analogous to the cost of a Cadillac. If you have to ask, you can’t afford it.

58

posted on

01/06/2015 12:48:43 PM PST

by

citizen

(Hopefully, the MSM will again be making a big deal of high gas prices come Jan 20, 2017.)

To: citizen

Indeed, if I could only be one of “them.” Unfortunately, I’m afflicted with the same problem that Groucho Marx used to complain of: Groucho Marx’s letter of resignation to the Friars’ Club: “I don’t want to belong to any club that would accept me as one of its members.”

http://quoteinvestigator.com/2011/04/18/groucho-resigns/

59

posted on

01/06/2015 12:55:25 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

:-)

@zerohedge 3:30pm inverse ramp

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.