Skip to comments.

"January Effect" an omen for 2015? --Investment & Finance Thread - Jan. 4

Weekly investment & finance thread ^

| Jan. 4, 2015

| Freeper Investors

Posted on 01/04/2015 9:26:15 AM PST by expat_panama

A good January for stocks promises big gains for the year --or so goes the story goes (from Down January for stocks is bad omen for 2014 - USA Today) "How stocks fare in January often sets the tone for the full year". A lot of work's been done on this, and TradingSim reports that

When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

--but the downside is:

A down January is a bad omen for the stock market. Yale Hirsch of the The Stock Traders Almanac suggests that since 1950, every down January in the S&P500 preceded a new or extended bear market, or in some cases, a flat market. They go on to further suggest that down January’s are followed by substantial declines averaging -13%.

| |

|

|

|

|

|

| |

|

% above avg. months |

% times the following year is above avg. |

% times month predicts following year |

|

| |

|

|

|

|

|

| |

January |

55% |

66% |

59% |

|

| |

February |

48% |

66% |

55% |

|

| |

March |

60% |

66% |

56% |

|

| |

April |

53% |

62% |

55% |

|

| |

May |

47% |

63% |

60% |

|

| |

June |

44% |

62% |

53% |

|

| |

July |

57% |

63% |

55% |

|

| |

August |

59% |

62% |

55% |

|

| |

September |

38% |

62% |

49% |

|

| |

October |

51% |

66% |

51% |

|

| |

November |

56% |

62% |

57% |

|

| |

December |

67% |

64% |

58% |

|

| |

|

|

|

|

|

| |

average |

53% |

64% |

55% |

|

| |

|

|

|

|

|

That's nice, but let's do our own thinking.

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so most months predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

* * * * * * *

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-118 last

To: Toddsterpatriot

As long as it isn’t the other way around :-)

To: Wyatt's Torch

But is it denominated in Bitcoin or Wampum beads?

102

posted on

01/08/2015 11:04:37 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Great theater!--and probably not much else. Americans love to work and create wealth, and most work is done for corporations --total value of U.S. corps has been doubling every decade for hundreds of years yet there are still people who say it's all going back to the way is was when --1800?

To: expat_panama

Yup. It’s a shame, because my buddy is a naturally thrifty person. He’s on the county commission (we call them the “Police Jury” here in Louisiana), and is as thrifty with the public’s money as with his.

Had he a lifetime ago put his savings into an S&P index fund instead of into CD’s, he would be a multimillionaire now.

But that time is past, and he’ll never get it back.

104

posted on

01/08/2015 11:23:00 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Get your Fed themed ties :-)

To: Wyatt's Torch

106

posted on

01/08/2015 12:37:47 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

107

posted on

01/08/2015 12:53:03 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Wyatt's Torch

108

posted on

01/08/2015 12:53:18 PM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Wyatt's Torch

Got to tell the admin —w/ this kind of merchandising we could skip the next freepathon!

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

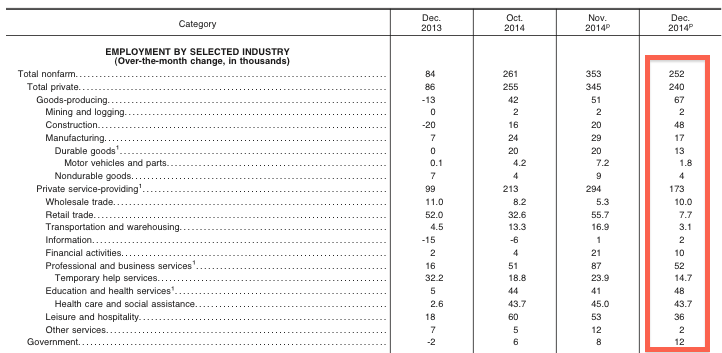

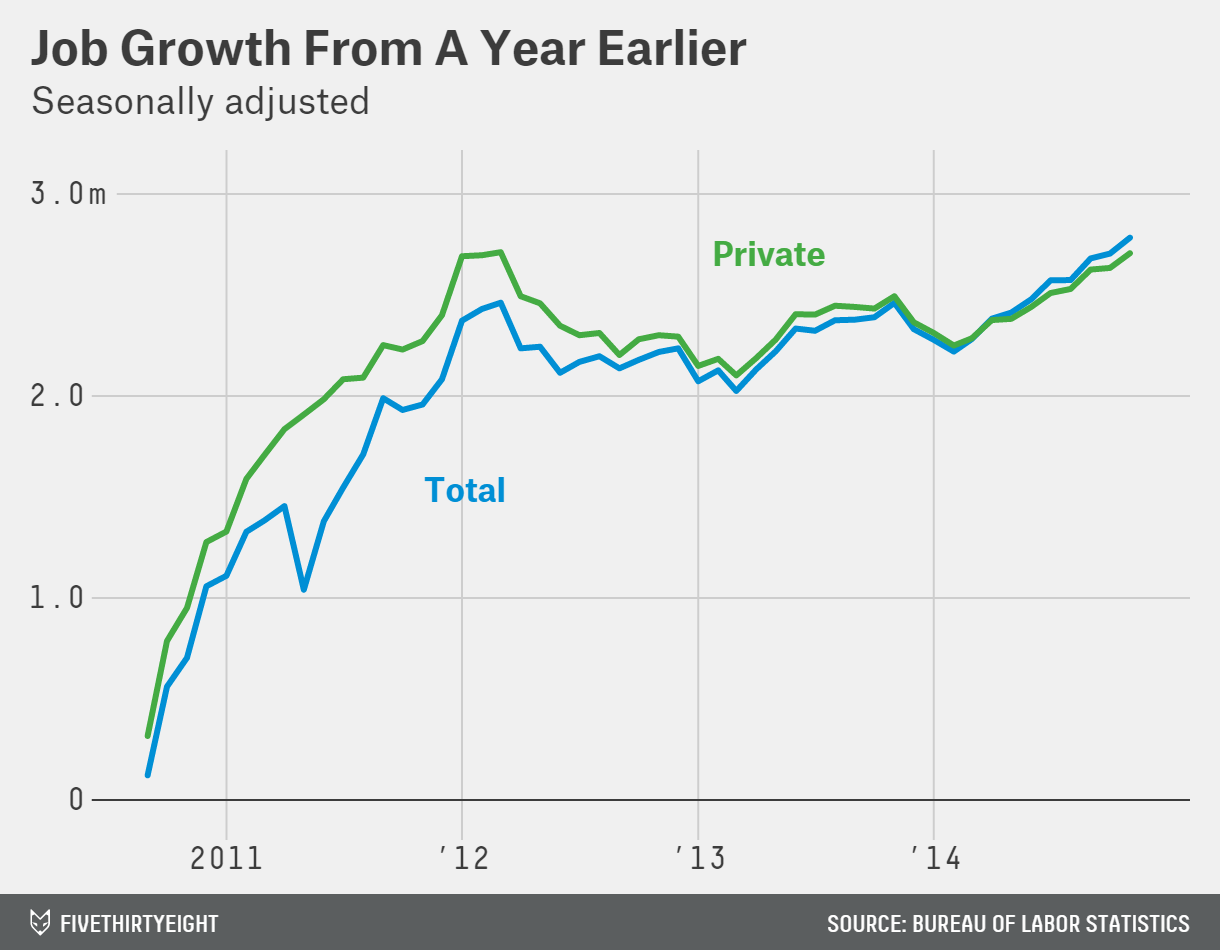

Good morning team! "Nasdaq, S&P 500 and Dow Jones industrial average each rolled 1.8% higher" all in higher volume as IBD changes the flag to 'uptrend'. Meanwhile metals were only off a bit holding on to a base that started last Halloween. Futures right now see profit taking all around w/ stock indexes off -0.09%, metals -0.22%. Labor-report-day today an hour before opening:

Nonfarm Payrolls

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Wholesale Inventories

fwiw:

To: expat_panama

Jobs Friday!

FactSet consensus +243K NFP, +225K private, manufacturing +12K, U3 5.8%

To: Wyatt's Torch

To: expat_panama

Wage growth lackluster (+1.7% annual, December -0.25)

Nov revised UP to +353K

To: expat_panama

To: expat_panama

To: expat_panama

To: Wyatt's Torch

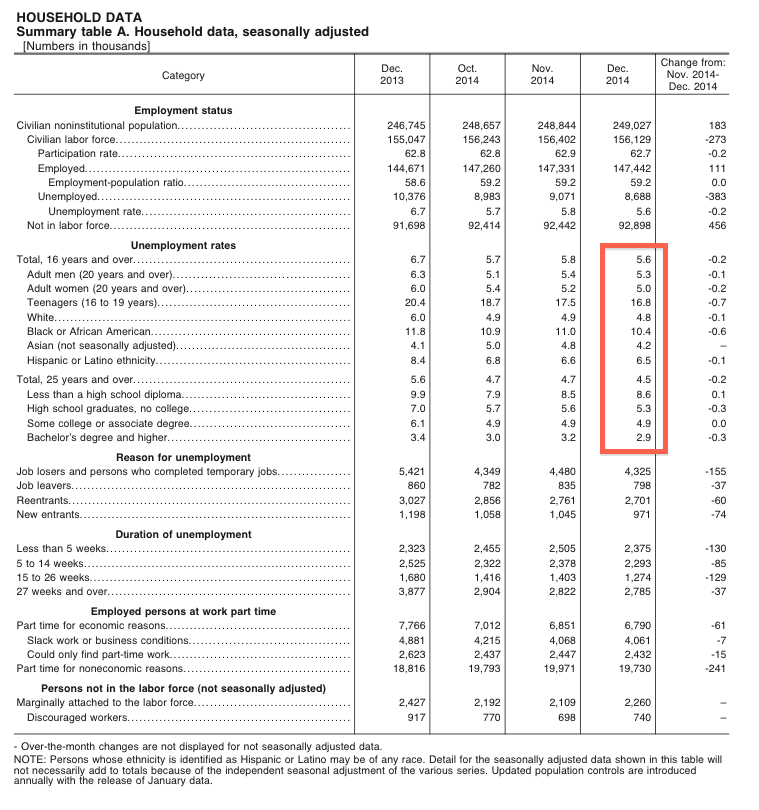

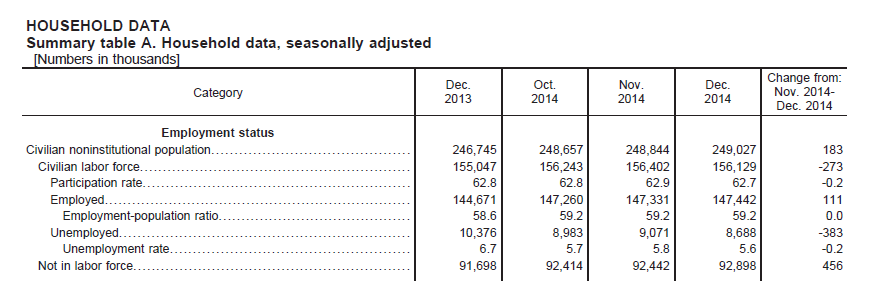

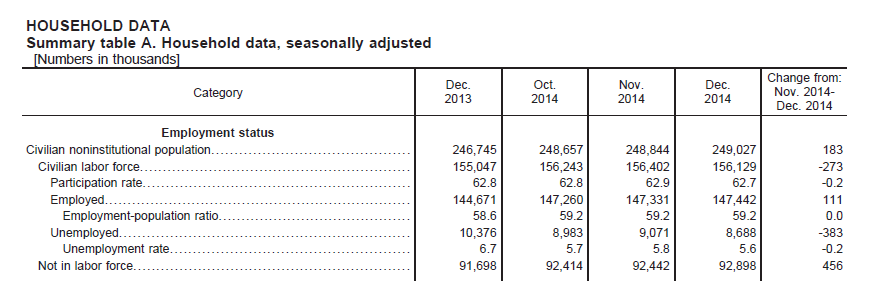

While there is in fact good news there (stock futures very happy) the household data--

--show while the number of employed increased 111,000, the population increased 183,000 and the labor force shrank 456,000. Figures don't lie but liars figure; we may be better off a tad but we're still far worse off than we once were and where we should be by now.

To: Wyatt's Torch

ah —you’re way ahead of me...

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-118 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.