Posted on 12/07/2014 8:10:04 AM PST by Kaslin

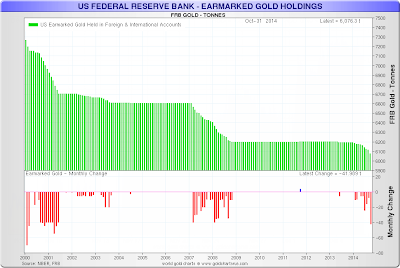

Nick at Sharelynx Gold, also known as Gold Charts "R" Us emailed an interesting chart last week showing gold drain at the New York Fed.

Earmarked gold dropped 42 tonnes for the month of October as foreign countries repatriate their gold home.

Here's a link to Earmarked Gold with a second chart that shows all Fed holdings.

Gold Charts "R" Us has 1,000's of pages and over 10,000 charts on a subscription basis, but you can check out the site for free until December 14. Click on the first link at the top for a look.

Where's the Gold Going?

This was the largest monthly drawdown in 13 years and the largest series of drawdowns since 2007 (drawdowns in red on above chart).

So, where's the gold going? Three answers:

Germany

Koos Jansen at BullionStar reports German Gold Repatriation Accelerating.

That article is interesting because it takes to task extremely sloppy Bloomberg reporting regarding German golf repatriation.

Netherlands

On November 21, Jansen reported Netherlands Has Repatriated 122.5t Gold From US.

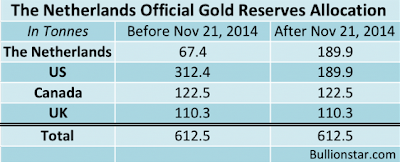

The Dutch central bank, De Nederlandsche Bank (DNB), has repatriated in utmost secret 122.5 tonnes of gold from the Federal Reserve Bank of New York (FRBNY) to its vaults in Amsterdam, The Netherlands, according to a press release from DNB published today (November 21).

DNB states it has changed allocation policy from 11 % in Amsterdam, 51 % at the FRBNY, 20 % in Canada and 18 % at the Bank Of England (BOE); to 31 % in Amsterdam, 31 % at the FRBNY, 20 % in Canada and 18 % at the BOE. According to the World Gold Council’s latest data DNB has 612.5 tonnes in official gold reserves.

Belgium

Yesterday, Jansen reported Belgium Investigating To Repatriate All Gold Reserves.

Countries want their gold back. Who can blame them?

Countries thought that their gold was safer in New York than in vaults in their home countries. Not so much anymore. Thanks, Barry.

Gold will remain a valuable and important source of stability as long as rational people want it and accept it as payment for goods and services. It has been a central tenet of the Left that it is nothing more than a metal historically favored by the unenlightened. History has shown they have been wrong.

Do the feds have any legal obligation to keep a minimum amount of gold and/or silver? If not, is the US dollar backed by nothing? Is there an inventory of how much gold the gov actually has?

Well, let's see....are there any democRATic-socialists in New York?

No.

The Dollar is only backed by our ability to create more of them. Its only “value” is the confidence that it will be accepted as a medium of exchange.

No.

Far as I know, it’s going to China.

We lost some lawsuit to China, over gold and their reward is a about $1 trilion dineros.

The fed "claims" to have something like $350 billion dollars worth of gold. So, in a $7 Trillion dollar economy, the dollar certainly isn't back by gold.

The fed refuses to allow congress to inventory the so called stores of gold. Making it logical IMO that they have been playing fast and loose with the gold and how much is really there.

If you believe that guy on the radio, China has all the gold and the price is set to skyrocket.

Yeah.

I believe this is known as a “vote of no confidence”

itll get interesting when people start to realize there isn’t enough in the vaults to cover the demand

Gold bug Ping!

There have been rumors for years about Ft. Knox being empty. Now, other countries have no confidence in the US’ Kenyan. Add to that the kissy face going on between Russia and China. Countries are trying to get their ducks in a row before the start of WWIII.

That is a favorite episode of TZ.

It went to the Netherlands.

China, being a dictatorship, does not publish how much gold it has. And the U.S., also being a dictatorship, refuses to allow the people’s representatives in Congress to determine how much gold it has.

But we do know that Russia is buying large amounts of gold — and why shouldn’t it, since it’s been using its falling rubles to pay for much stronger gold deposits from its domestic producers?

And we also know that India, the world’s second-largest user of gold, which also has the second-largest population in the world, just repealed its ban on gold imports.

Gold will go up when investors understand these facts, just as most dot.com companies’ stocks fell in 2000 when investors finally understood the weakness of those companies. Patience.

That in itself should be a very good reason for other countries to bring their gold home.

I, personally, would never have gold mutual funds or gold held in storage for me. But people do. If the gold the gov is holding is not what they claim, in some way does that trickle down to mean that other "in storage" and other indirect gold assets may not be there? I mean, is it that the gold actually in existence is much less than the total "owned" by people and governments?

(I'm suspicious of what the answers are, but would really appreciate input from those who know more than I do)

But Bernanke said it was a “barbarous” relic.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.