Investment & Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

Investment & Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!Posted on 11/16/2014 10:11:33 AM PST by expat_panama

Investment & Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

Investment & Finance Week Ending Nov. 16, 2014 --NOTHING HAPPENED!!

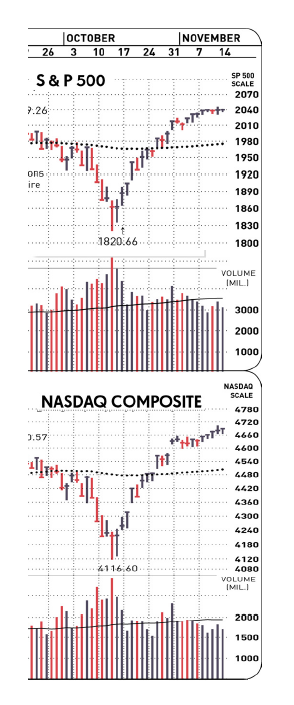

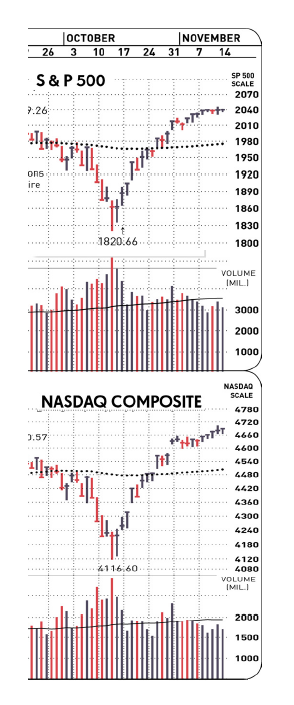

Investor's Business Daily said it well with their headline: "Stocks Wrap Up Do-Nothing Week With More Small Gains". For both S&P and NASDAQ this week's been tepid gains w/ falling volume Key question is whether we're looking at a top or not, and that's where analysts cite "quite volume" and "the di stribution count remains low" (re "How To Tell An Uptrend In Stocks Is All But Over"). On the other hand (as they used to tell Truman) if we look at where we were a couple weeks into the last two tops (June 20 and Sept. 5), we see this very same low volume and distribution count.

stribution count remains low" (re "How To Tell An Uptrend In Stocks Is All But Over"). On the other hand (as they used to tell Truman) if we look at where we were a couple weeks into the last two tops (June 20 and Sept. 5), we see this very same low volume and distribution count.

[Note to myself; time to pick positions I need close sooner & not later...]

Just the same on the other hand (what, I already said that?) this time we've also got the Washington cliffhanger. I mean, rumors aside to date there's been no big concessions, sneak thru's, cave-in's or blow-outs. iow we've just been though a soap-opera-like plot where they drag out of all the unresolved issues that we thought were hitting the fan last week.

It's almost like Congress is waiting to pass everything 3AM Christmas morning or something. Again. Whatever they do it ought to affect not only stocks, interest rates, real estate, and metals/commodities too (imho). The reasoning being that they've been tracking flat for a bit too. Fer instance, take my gold & silver. (Please.)* The jump they had for the past few days (back up over $1150 and $16 respectively) in all honesty is looking much more like a 'pause-while-plunging' then any 'serious-rebound-building'.

On the other hand things are not always what they appear to be.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

*rim shot

Reruns of "Déjà Vu All Over Again" ping.

I enjoy checking your thread when posted. Thanks!

I need to go on vacay more,, the market recovered losses and cruised to new highs.

A very happy profit-taking Monday morning to all! --futures traders say indexes are down -0.25% and metals -0.64%; some how the phrase "aging uptrend" keeps going through my mind. Starting even before opening we'll get reports on Empire Manufacturing, Industrial Production, and Capacity Utilization. Busy day also for news:

--and threads:

Japan in recession, according to CNBC.

yeah, folks are saying it’s why today’s overall market sentiment is so gloomy.

Markets |

yesterday |

today |

||

| metals | Steady at gold $1,186.95 and silver $16.15 | Futures @ 3 hrs. before opening +0.80% | ||

| stocks | Slower trade ending w/ S&P up 0.1% and NASDAQ slipping -0.4% |

Futures -0.05% |

Good morning team! Moving along from yesterday's sub-par econ reports (Japan in a funk, manufacturing lower than expected, production down) into today's PPI, NAHB Housing Market Index, and Net Long-Term TIC Flows. Global buzz:

Asia stocks sag while Japan rebounds, euro dips Asian stocks sagged on Tuesday amid profit taking in Hong Kong and Chinese markets, while Tokyo shares rebounded on expectations that Japan will opt for a snap election that may lead to fresh stimulus ...

Pressure mounting on OPEC nations to cut productionJPMorgan Says Sell U.S. Stocks, Buy Europe on Valuation JPMorgan Chase & Co. told investors to dump U.S. equities in favor of their European counterparts. The brokerage cut its rating on U.S. stocks to underweight, similar to a sell recommendation, from the ... Bloomberg

Red warning lights' flashing for global economy LONDON (AP) — The global economy's problems seem to be multiplying. Associated Press

Meanwhile, no one with any degree of real economic knowledge can point to a U. S. interest rate rise in the foreseeable future. This, despite predictions for the past several years that it was both imminent and inevitable.

As with every other forecast on every other measure, this time of the year since 2009 they always “shift to the right” :-)

Thing is that these low interest rates just don't make sense from a hisorical perspective. Rates on T-bills and prime loans have hit bottom for several years now while Corp. bonds and mortgages came up a bit last year but they're falling again too. I confess: I've been expecting rate hikes for a while now, although I personally have expected us to be a lot farther off from deflation too...

And now that we’ve all agreed that they WON’T rise, they’ll do JUST THAT next week, lol!!

October PPI Analysis-No Material Change in Underlying Trend

For more information, please contact Ray Stone.

Key “Take Aways”

(1) PPI Final Demand +0.2%, Core +0.4%

(2) PPI up 1.5% yoy, Core +1.6%

(3) PPI Goods -0.4%, PPI Services +0.5%

(4) PPI Personal Consumption +0.3%, yoy +1.9%

(5) PPI Finished Goods -0.3%, yoy +1.7% (Old PPI)

—Stone & McCarthy (Princeton)— The October PPI increased 0.2% after declining 0.1% in September and being flat in August.

The PPI has become more difficult to project, as the coverage of the PPI in its new form has basically tripled. Compared to a year earlier the new headline PPI increased by 1.5%, a downtick from 1.6% in September.

The PPI for Personal Consumption Goods & Services increased by 0.3% in October, following a decline of 0.2% in September. This accounts for about 2/3rds of the overall PPI Final Demand.

The old version of the PPI, that is the PPI for Finished Goods dropped by 0.3% in October following a 0.2% dip in September for a 12-month increase of 1.7%, down from a 2.2% 12-month gain in the period ending September..

Of course, the big difference between the New and the Old versions of the PPI is that the new version is mostly Services, whereas the old version was only Finished Goods.

The New Core PPI rose 0.4% in October after being unchanged in September. Compared to October 2013 this series was up 1.8%, up from 1.6% in the 12-months ending September.

PPI Goods

The PPI for Goods decreased 0.4% after inching down 0.2% in September. Food Prices surged 1.0% after falling 0.7% in September, and 0.5% in August.

Energy prices dropped 3.0% in October after dropping 0.7% in September. The drop in energy prices was an artifact of a 5.8% decline in gasoline prices, and an 11.4% decline in Liquefied Petroleum Gas prices.

The Core Price measure for Goods fell 0.1% in October after rising in September. This series was up 1.7% in comparison to October 2013, a slight deceleration from 1.8% in the period ending September.

PPI Services

The PPI for Services rose 0.5% in October following a 0.1% decline in September and a 0.3% gain in August. The October softness herein was primarily attributable to a 1.5% gain in Trade Services.

The PPI for Personal Consumption rose 0.3% in October following a 0.2% decrease in September and a 0.1% gain in August. The PCE for Goods dropped by 0.5%, led by energy goods. The PPI for the PCE for Services increased 0.6% in October following a 02% decrease in September and a 03% gain in August.

The PPI for Personal Consumption tends to exhibit a pattern similar to the overall PCE deflator, although the 2 series are not identically aligned.

In the 12-months ending October the PPI for Personal Consumption was up 1.9%, same as in the 12-months ending September.

Ah, they remapped the inflation index. It’s what they have to do for it to make sense, the only problem being that we’ll once again be hearing the same ol’ “inflation stats are rigged” song’n’dance...

Mid-week already! Yesterday's downbeat index futures ended up w/ actual trading spouting record highs; volume mixed (NASDAQ down & S&P up) and metals fared well too This mornings futures (2-1/2 hrs. before opening) have all markets off -0.08% with Metals +0.09% and Indices -0.11%. Lots of reports this morning:

MBA Mortgage Index

Housing Starts

Building Permits

Crude Inventories

FOMC Minutes

--and to hell w/ the news, check out these threads posted yesterday:

My guess(s):

HS on target.

Permits below.

crude above target.

Huh. The ‘experts’ say HS off and BP up. We’ll find out in an hr...

—and the experts were right this time. We do live in weird times...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.