Stock Rally Stalls with Republican Win; Investment & Finance Thread Nov. 9, 2014

Stock Rally Stalls with Republican Win; Investment & Finance Thread Nov. 9, 2014Posted on 11/09/2014 9:53:35 AM PST by expat_panama

Stock Rally Stalls with Republican Win; Investment & Finance Thread Nov. 9, 2014

Stock Rally Stalls with Republican Win; Investment & Finance Thread Nov. 9, 2014

Whoa, the past week was decisive in more ways than one!

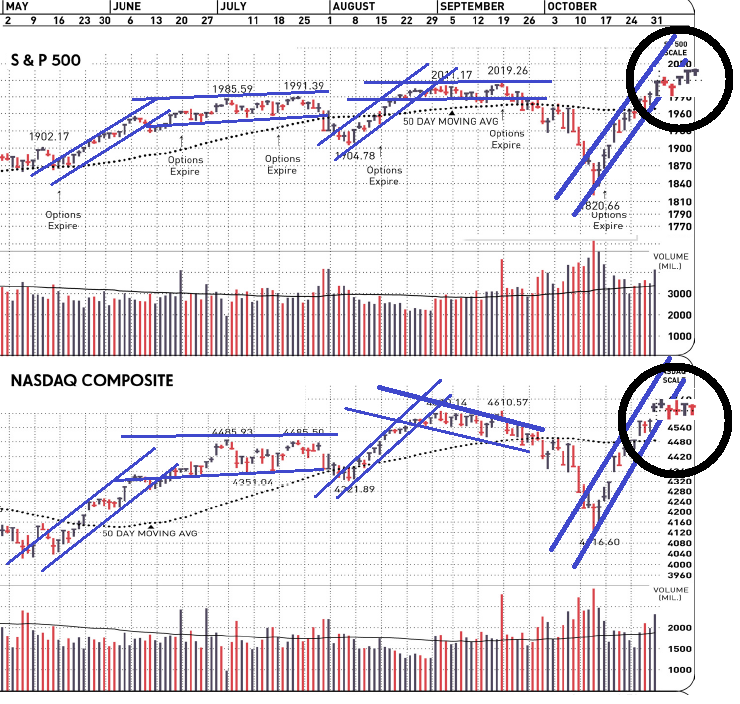

A week ago we took inventory of then-current trends and considered which scenarios would lead where. All we knew for sure was that either things would stay their courses or we'd change direction. What happened is we dumped 'business as usual' --as far as trend-lines went-- and we now got signals pointing at "something new". That 'something new' might even be a basing/stage prep for a continued price surge (Stock Indexes In Pause Mode, But That Can Do Uptrend Good). Maybe. Or then again it might be what we got w/ the previous two rallies over the past half year and we're in a top-off.

OK, so we're not saying the Republican win halted the stock rally. One idea is that the election results had already been priced into indexes last week and the current upheaval is nothing more than static --like what we had w/ the 2010 midterms (h/t oblomov) when the uptrend staggered for a few weeks before taking off like gangbusters.

As or metals this past week's been a continuation of the general down turn w/ silver dropping almost 2% and gold down more than 4%.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

--and now's the time we remember the old saying "nobody ever went broke taking a profit".

You know really why? Because if the FED keeps shoring up the market with stupidly low interest rates (like they’ve been doin’ for that MORON in the WH) the GOP just might start getting some credit also.

did the QE stop the 1st of Nov???

did the QE stop the 1st of Nov???

As far as i know yes qe is history

might that not put the brakes on and stall the fake rally?

might that not put the brakes on and stall the fake rally?

Or maybe the polls changing to “lean Republican” right before the election caused the rally and it ended when everyone was happy with the outcome.

a little quick profit taking

a little quick profit taking

did the QE stop the 1st of Nov???

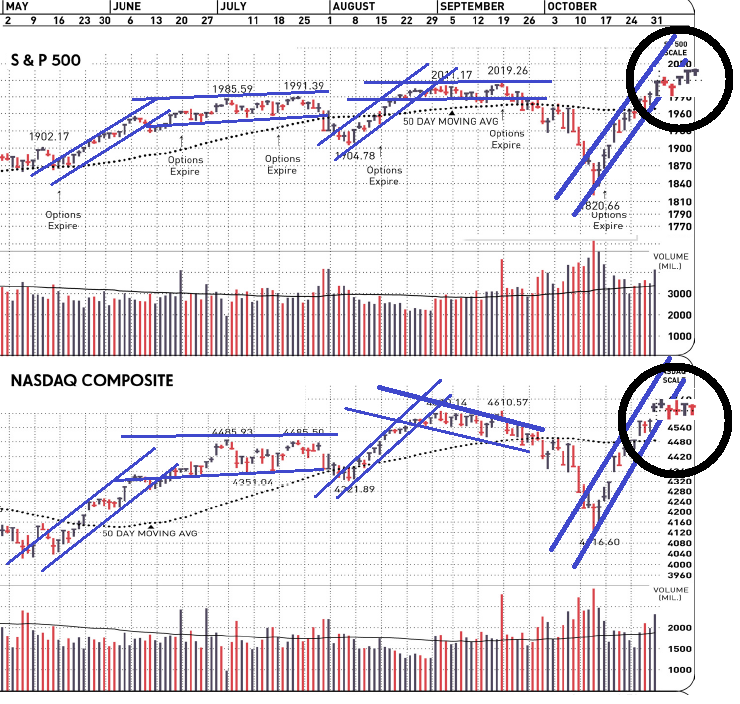

That's a take lots of folks are into, but it's not very useful for guessing which way the market's going next. I mean, here's what the fed's doing along with what the market's doing:

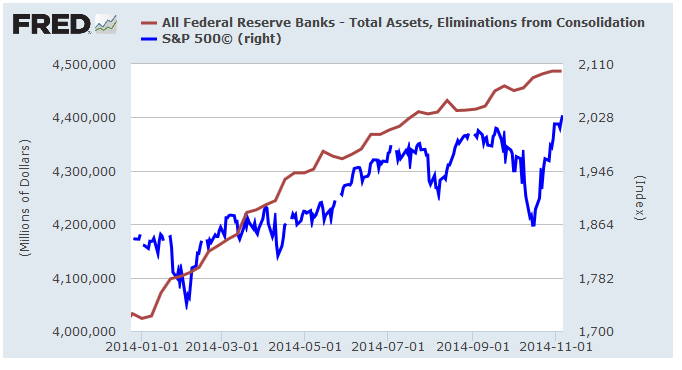

So right now the Fed's doing nothin. In the past having the Fed do nothin sometimes meant stocks would go up, sometimes down, and other times stay the same. So much for mere money making. When it comes to politics we use a different approach w/ stocks:

It's a lot easier to follow, it makes sense, but the only problem is there's no money in it.

LOLOLOLOL...100%

LOLOLOLOL...100%

Fascism has been very profitable for Wall Street, and the Republican sweep threatens to shake that up, at least change the nature of the partnership.

Buy on the rumor, sell on the news.

We've been seeing the president's popularity jumps'n'drops do the opposite for stocks for years now. I first saw it in IBD (can't find it now) but it gets plotted all the time. Here's 2008, 2011, and '09-'11 So knowing where leftist strength is going will tell us where stocks will go. Only problem is knowing which how far left America wants to go --before it goes there. That's not easy, I mean, back in mid '08 even Rush was saying "Obama is unelectable".

While trying to find out where that came from I found:

"Buy on the rumor, sell on the news," is an old saying on Wall Street that dates back to the 1920s.

Seems right, it was an era when the trading floor (w/o computer monitors) would be abuzz w/ half-heard stories that couldn't be confirmed until the daily news paper would hit the streets the next day. Nowadays we're in a situation where maybe we should say "day-trade on the tweet, post derivative on the talk-radio".

Or something like that...

“day-trade on the tweet”

If you’re following Carl Icahn you will probably do OK.

Yeah! Raise the funds rate to 5% now!

;-)

fwiw my portfolio had it’s best single day ever the day after the election.

I'm personally expecting a continued bull market for years given all the pent-up demand and the fact we've had a decade and a half of basing. For the imediate short term I'm having to force myself to take profits and watch for the kind of corrections we had at the end of July and early Oct.

Then again, I sure wouldn't mind being wrong though, having to buy back in for another 3-week run-up...

The chins stopped buying....dont know what might happen....now their boy is losing ..power.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.