[click pix to enlarge]

[click pix to enlarge]Posted on 10/19/2014 11:18:38 AM PDT by expat_panama

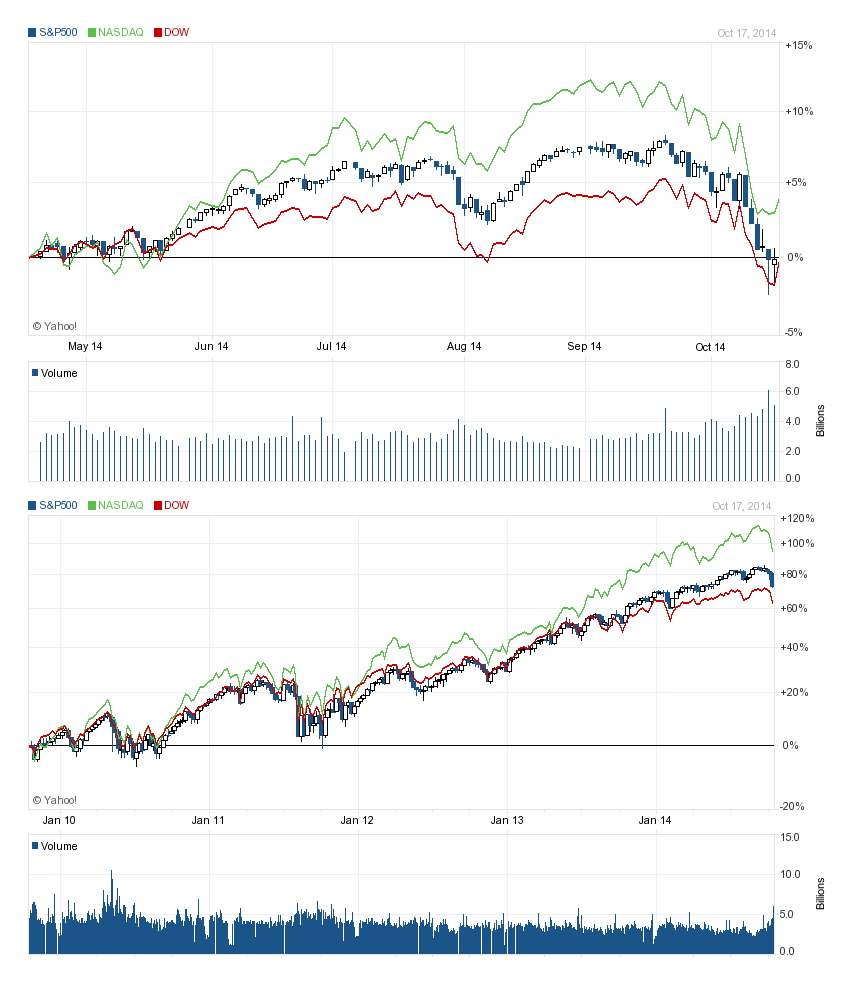

This past week saw upside reversals across the board coming out with prices holding steady in spite of the hammering we had over the past month or two.

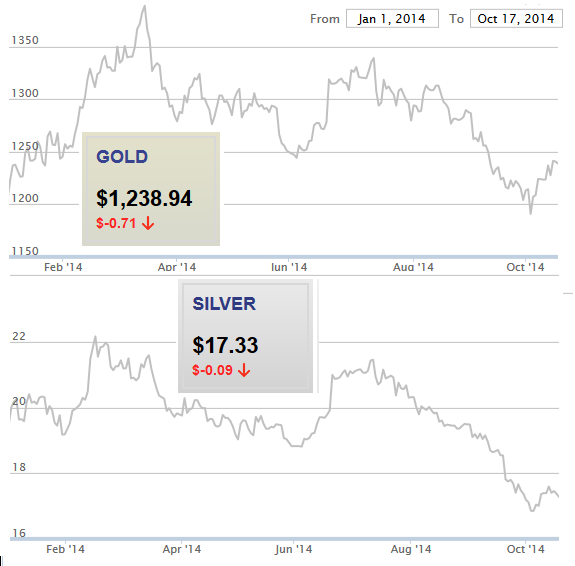

The October metals rally held on to its gains, in fact market prices show gold's just about clawed back to break-even for 2014. That's said, metals' role in price trends ahead is become increasingly controversial (re Gold And Silver - Financial World: House Of Cards Built On Sand) even while many see a bright tomorrow with other commodities (We Maintain Our Outlook For Higher Prices For Commodities).

Stocks. OK, so IBD won't call it an "uptrend" (the follow-through has got to be no earlier than the fourth day of the rebound or it ain't official), but the upside surge was led by leading stock leaders. They call them 'leading' stocks for a reason. Well, sometimes they call 'em 'bellwether' stocks but the term makes me nervous 'cause a bellwether is often the animal trained to lead the mindless unquestioning herd into the meat packing plant.

I digress.

So we've been in "market in correction" for a while and we punched down through the famous 200-day moving average, so for 2014 it really is a big deal. Maybe that says more about how spoiled we've been getting lately. I mean the earlier swings over the past half decade kind of make these past two years seem well, nice.

[click pix to enlarge]

The big question of course is whether stock indexes are right now 'over priced' or not, and for that I like to compare say, the S&P500 to total U.S. corp. net worth. Someone correct me if they see anything I don't but I honestly think they've been tracking together since the last decade's high. Not only that, but recent growth seems actually subdued --check out this 1950-2014 plot showing total corp networth and how the trend in raising business capital has been more and more turning away from bonds over into stocks.

Also on that note. Please forgive my broken record but it has got to mean something that historic American growth for corp net worth has always been over 7% yearly, but since 2007 growth has only averaged a paltry one percent.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

I had to find this thread again. The world market will probably crash some day. (bible says it will). But its not gonna happen this week.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.