Skip to comments.

Labor Participation Rate Drops To 36 Year Low; Record 92.6 Million Americans Not In Labor Force

Zero Hedge ^

| 10/03/14

| Tyler Durden

Posted on 10/03/2014 6:31:19 AM PDT by Enlightened1

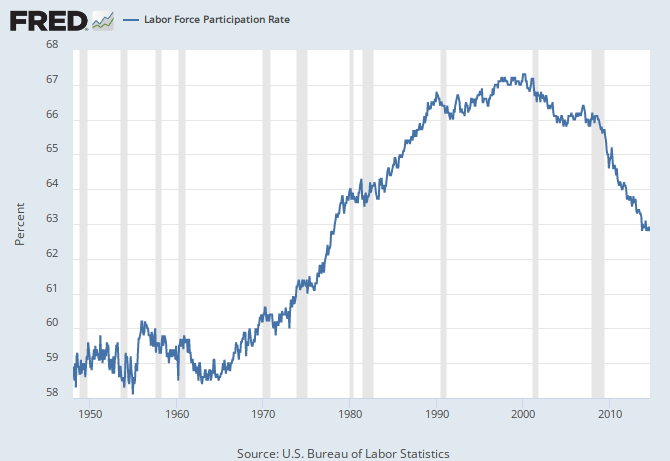

While by now everyone should know the answer, for those curious why the US unemployment rate just slid once more to a meager 5.9%, the lowest print since the summer of 2008, the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slide from an already three decade low 62.8% to 62.7% - the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232K people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million!

(Excerpt) Read more at zerohedge.com ...

TOPICS: Business/Economy; Government; News/Current Events; Philosophy

KEYWORDS: drops; labor; low; rate

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Crooking the books 101. How can Wall Street take this seriously???

To: Enlightened1

2

posted on

10/03/2014 6:34:16 AM PDT

by

E. Pluribus Unum

("The man who damns money obtained it dishonorably; the man who respects it earned it." --Ayn Rand)

To: Enlightened1

” How can Wall Street take this seriously???”

Wall street income has been disconnected from the domestic economy for years. They couldn’t care less about the American labor force.

3

posted on

10/03/2014 6:34:24 AM PDT

by

wrench

To: Enlightened1

Given that far fewer women were in the paid labor force 36 years ago than now, today’s number is even worse.

4

posted on

10/03/2014 6:37:18 AM PDT

by

jalisco555

("My 80% friend is not my 20% enemy" - Ronald Reagan)

To: wrench

"Wall street income has been disconnected from the domestic economy for years. They couldn’t care less about the American labor force."

Because corporate profits are SOARING.

Crony Capitalism. Hamilton must be rolling over in his grave....

5

posted on

10/03/2014 6:41:22 AM PDT

by

Psalm 73

("Gentlemen, you can't fight in here - this is the War Room".)

To: Enlightened1

What the......!!!! I could have sworn that the lyin’ king said, just the other day, that there’s been 10 gazillion jobs added in the last 6 years and that every segment of the economy is better now that when he took office and everybody is better off than 6 years ago. I guess I need a s/ tag here?

6

posted on

10/03/2014 6:42:17 AM PDT

by

rktman

("The only thing dumber than a brood hen is a New York democrat." Mother Abagail.)

To: wrench

What Wall Street does care about is a rise in interest rates. When, not if, that happens, stocks will take a nosedive. The Fed may be forced to raise interest rates sooner than 2015. They are already reducing their T-bill buys.

7

posted on

10/03/2014 6:42:23 AM PDT

by

kabar

To: Enlightened1

Doesn’t this mean that the Food Stamp recipients are growing? and if so, isn’t that in and of itself good for the Economy?? The Demonrats said so a couple years ago.

8

posted on

10/03/2014 6:43:31 AM PDT

by

eyeamok

To: Enlightened1

Can someone explain what Labor Force participation rate measures?

I've heard it's dropping because the Baby Boomers are retiring. I've also heard it's actually higher in that group and it's younger workers with the lower LFPR

9

posted on

10/03/2014 6:43:34 AM PDT

by

LMAO

(("Begging hands and Bleeding hearts will only cry out for more"...Anthem from Rush))

To: LMAO

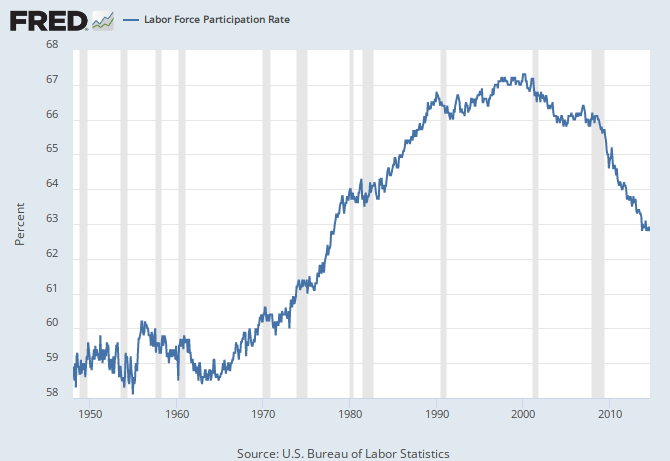

Here are the long term trends:

Total:

Interestingly it corresponds to the rise and subsequent fall in women entering and leaving the labor force as participation rate for men has been declining steadily since the 1950's.

Here is the data by gender:

Women:

Men:

Now the question is, how much of the decline since the peak in the 1990's is "structural" versus "cyclical."

Participation rate in 55+ year olds had been increasing until recently and appears to have rolled over and started declining as baby Boomers start to retire:

Meanwhile participation rate for 20-24 year olds has been declining but appears to have flattened out and will likely start to rise along with the Millennial population boom entrance into the workforce.

Keep in mind that there are more 24 year olds in the US than any other age group.

To: Enlightened1

“Well golee!”, as Gomer Pyle used to say. This is the last count before Election Day, so we all knew the numbers would be twisted and mangled to show the unemployment rate below 6% so the Democrats could brag about this phony recovery.

To: LMAO

while the workforce overall has shrunk nearly 10 million since 2009, the cohort of workers in the labor force ages 55 to 64 has actually increased over that same period, with many delaying retirement due to poor economic conditions.

over two-thirds of all labor force dropouts since that time have been under the age of 55.

http://www.freerepublic.com/focus/f-news/3208166/posts

12

posted on

10/03/2014 7:09:08 AM PDT

by

george76

(Ward Churchill : Fake Indian, Fake Scholarship, and Fake Art)

To: Wyatt's Torch

Excellent graphs, thanks for providing them!

To: Enlightened1

14

posted on

10/03/2014 7:14:31 AM PDT

by

WayneS

(Don't blame me, I voted for Kodos.)

To: george76

By what definition has the “ workforce overall has shrunk nearly 10 million since 2009”?

Thanks

To: kabar

Wouldn’t raising interest rates immediately make our government insolvent?

Is the Fed holding off raising rates until the Republicans retake the Senate so that they can poison the victory by causing the crash on their watch?

16

posted on

10/03/2014 7:32:39 AM PDT

by

PTBAA

To: Wyatt's Torch

In January 2009, when he took office, there were 80,507,000 Americans not in the labor force. Thus, the number of Americans not in the labor force has increased by 10,102,000 by September 2013.

according to BLS, Americans not participating in the labor force climbed to 90,609,000 by September 2013.

Thus, the number of Americans not in the labor force has increased by 10,102,000

http://cnsnews.com/news/article/terence-p-jeffrey/90609000-americans-not-labor-force-climbs-another-record

17

posted on

10/03/2014 7:41:38 AM PDT

by

george76

(Ward Churchill : Fake Indian, Fake Scholarship, and Fake Art)

18

posted on

10/03/2014 7:48:05 AM PDT

by

george76

(Ward Churchill : Fake Indian, Fake Scholarship, and Fake Art)

To: george76

Okay that's different from "workforce has shrunk". Total employed has gone from 133,976,000 in January 2009 to 139,435,000 today (which is a record high. Also of note the recession low was 129,655,000 in February 2010) so the workforce has grown by 5.5 million over the timeframe you reference.

Here is the chart for that timeframe:

To: PTBAA

It won’t make us any more insolvent than we are now. If we were to return to normal, historic interest rates, our debt servicing costs would approach $1 trillion a year. We would have to drastically reduce the size of government, including the entitlement programs, or we could raise taxes or some combination thereof. It would be a disaster for our economy. The only thing that holds us afloat is that the dollar is the world’s reserve currency. If that changes, the whole house of cards collapses.

20

posted on

10/03/2014 8:30:41 AM PDT

by

kabar

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson