Skip to comments.

Capital Market Update; Investment & Finance Thread (Sept. 14 edition)

Weekly investment & finance thread ^

| Sept. 14, 2014

| Freeper Investors

Posted on 09/14/2014 12:55:21 PM PDT by expat_panama

Capital Market Update; Investment & Finance Thread (Sept. 14 edition)

In a phrase it looks like everything's beginning to bust loose for stocks, metals, bonds --something here for everyone!

Stocks chalked up another distribution day last Friday as the S&P nudges toward the famous 10-week moving aveage that serves as a floor in the good times and a ceiling in the bad. Traders are also noticing that over the past week or two up volume was slight while down volume was strong. Like maybe some kind of consensus or something, at least for the short term. Remember however that major indexes only got 2 distribution days (downtrends usually want say, 6) plus things are looking more and more like we're finally tearing into our next 'super-cycle' leap (tx Wyatt!). Bottom line though, stocks are dangerous. In fact a while back there was a story in the Miami Hearald about a guy that put his life savings in stocks and the next day he was killed by a huge pile of money falling on him. Dave Berry column... |

Metals dropped the other shoe this past week as Gold'n'Platinum were flirting w/ mult-year lows and silver actually made it to 2010 levels. Historic prices is one the arguments some traders consider when they act like they're expecting further price drops. This is beginning to look like the broader commodity price trend, on this other thread --Oil demand growth slips to 'remarkable' 2½-year low (tx Chgogal!) we're seeing crude, gas, heating oil prices all in fade mode. On top of all that, even the bond markets are romping into new territory as T-bills tank and the dollar soars. (Talk about yer cash hoarding.) |

fwiw over the past few weeks the Yen, British Pound, Swiss Franc, Mexican Peso have all been falling while the Dollar's been climbing. fwiw over the past few weeks the Yen, British Pound, Swiss Franc, Mexican Peso have all been falling while the Dollar's been climbing. ************** So while everyone's got their own view point, what I'm seeing (mho) is we're into the end of the month/wrapping up the 3rd quarter, war breaking out in Syria-Iraq-Ukraine, and we're on the home stretch of the 2014 elections (maybe even getting some relief from headlines like Plans to Turn ‘Politically Binding’ UN Climate Change Accord Into Federal Law -hat tip to Lurkina.n.Learnin). Anyway, other than those things there's really no reason for all these new breakouts. |

|

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-75 last

To: expat_panama

http://online.wsj.com/articles/u-s-household-wealth-hits-fresh-record-1411056031?mod=WSJ_hp_LEFTWhatsNewsCollection

U.S. Household Wealth Hits Fresh Record

Consumer Borrowing Climbs at Fastest Pace Since the First Quarter of 2008

By Neil Shah - Sept. 18, 2014 12:00 p.m. ET

Americans’ wealth hit the highest level ever in the second quarter amid a rise in stock and home prices, prompting consumers to ramp up their borrowing—a development that could boost the economic recovery.

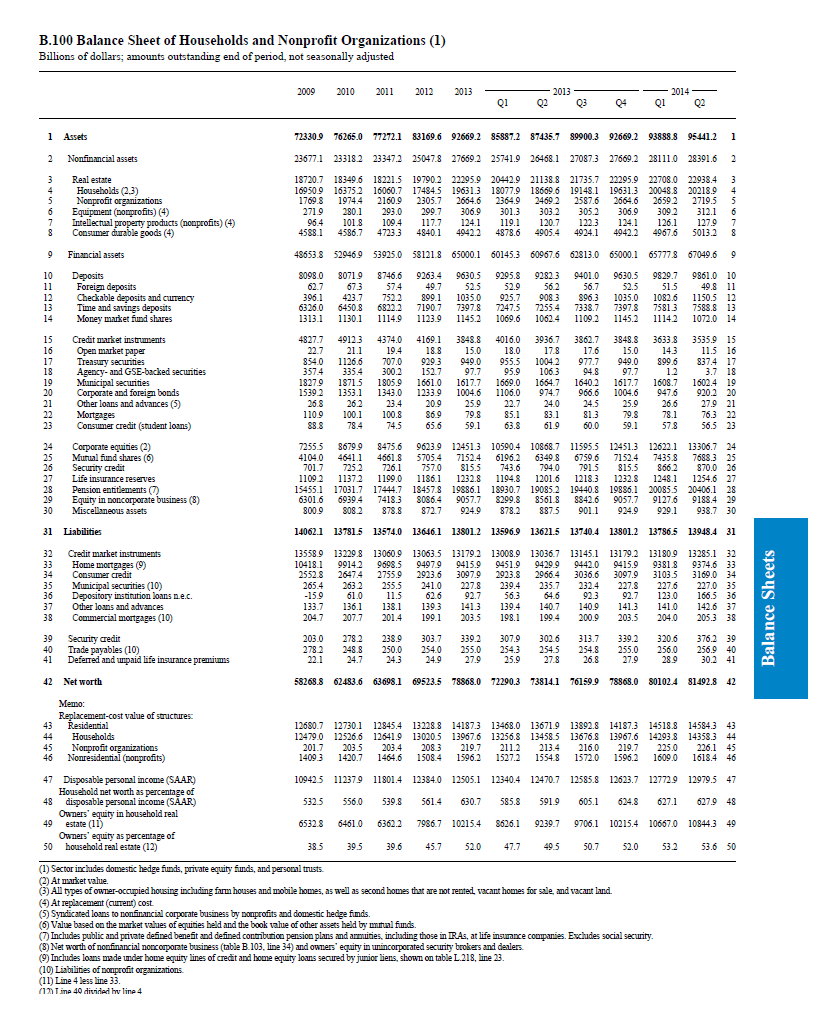

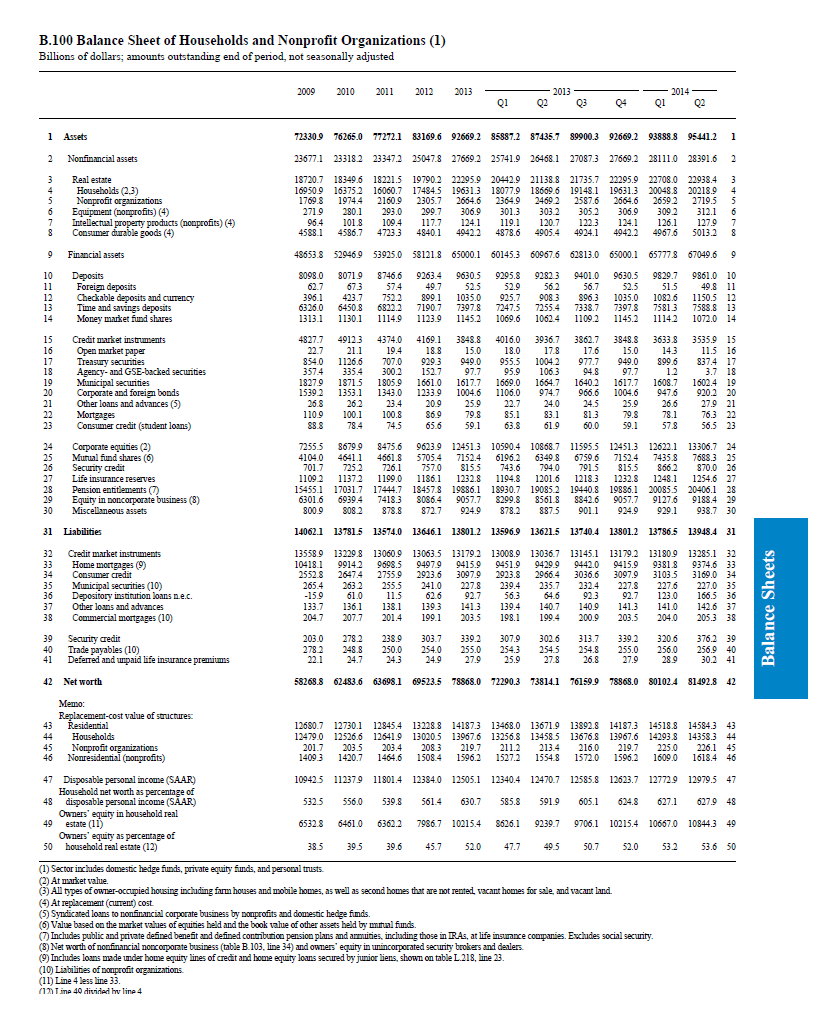

The net worth of U.S. households and nonprofit organizations—the value of homes, stocks and other assets minus debts and other liabilities—rose 1.7%, or about $1.4 trillion, between April and June to $81.5 trillion, the highest on record, according to a report by the Federal Reserve released Thursday.

The figures aren’t adjusted for inflation or population growth. Much of the nation’s rising wealth also goes disproportionately to the wealthy, who tend to own stocks and save their money, reducing the benefits to the overall economy.

61

posted on

09/18/2014 12:44:37 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

“The net worth of U.S. households and nonprofit organizations”

Be interesting to see that breakdown.

62

posted on

09/18/2014 12:48:12 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

--and a very good Friday morning to everyone as stocks'n'metals continue their divergent directions. In fact, while metals settle into levels from four years ago, the S&P punched a record high so IBD changed the outlook back to 'confirmed uptrend'. Only reports today are Natural Gas Inventories and Leading Indicators. Some headlines:

To: Lurkina.n.Learnin; abb

The net worth of U.S. households and nonprofit organizations—Thanks sooo much for the heads up-- didn't realize it was that time again (the "Flow of Funds Report" only comes out every 3 months. Here

interesting to see that breakdown

That's the best part, Table 100 on page 117 (page 131 of the pdf).

At first glance I'm seeing that since 2009 private debt has gone down while people's stocks'n'mutual funds have almost doubled. Real estate's only gone up about 20% --that's a 4% annual rate compared to stocks at 15%.

To: abb

The figures aren’t adjusted for inflation or population growth. Yeah, that's what I wanted to check too...

OK, pretty much as expected. Including inflation + pop. growth shows we were better off before the 110th congress took over.

To: expat_panama

http://online.wsj.com/articles/three-mistakes-investors-keep-making-again-and-again-1410533307

Three Mistakes Investors Keep Making Again and Again

Spend less than you earn. Put the difference in a low-cost broad-based index fund. Leave it alone and let it grow over time.

Incorrectly predicting your future emotions.

Too many investors are confident they will be greedy when others are fearful. None assume they will be the fearful ones, even though somebody has to be, by definition.

Failing to realize how common volatility is.

You needn’t have been a genius to have done well in stocks over the past decade. You just had to not have panicked in 2008, when everyone around you was going crazy.

Trying to forecast what stocks will do next.

You have no control over what the market will do next. You have complete control over how you react to whatever it does.

66

posted on

09/19/2014 6:51:13 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

So are you gaga for Alibaba?

67

posted on

09/19/2014 8:05:50 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Chinese internet companies have done very well by me (CTRP, BIDU, for a while PWRD), but only after they’ve been listed long enough to show stable growth.

IPO’s may get lots of headlines, but they’re sure hard to predict. mho

To: expat_panama

“IPO’s may get lots of headlines, but they’re sure hard to predict. mho”

Especially one as over hyped as this. That’s all they’ve been talking about all week.

69

posted on

09/19/2014 10:44:17 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

70

posted on

09/19/2014 2:18:50 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Wyatt's Torch

Ping me when you do. Have you heard any discussion on the student debt drag on housing?

71

posted on

09/19/2014 4:27:36 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama; Wyatt's Torch

72

posted on

09/21/2014 10:34:46 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: 1010RD; expat_panama

I will. Some discussion on the subject. The Zelman lead analyst (the guys is extremely well researched) showed a slide that of 25-29 year olds living at home, more of them (23%) were WITHOUT student debt than those who had student debt (17%). 30-34 year olds with was 14% and without was 13% so no difference. for all of 25-34 year olds living at home 16% had student debt while 18% did not have student debt. Conclusion - no correlation to household formation.

To: Wyatt's Torch

74

posted on

09/25/2014 6:00:49 PM PDT

by

1010RD

(First, Do No Harm)

To: Wyatt's Torch

There’s also going to be some legislative issues affecting RE:

GSE Reform – Fannie Mae / Freddie Mac were place in conservatorship as a result of single family subprime lending. During this time multifamily delinquencies were less than 1% but many in congress don’t understand that multifamily lending contributed little to the problems that caused the recession. Guidelines for taking Fannie and Freddie out of conservatorship without punishing multifamily are crucial.

Repeal of 1031 Tax Deferred Exchanges – Current proposals would eliminate IRS Section 1031 from the tax code and a majority of the citizens in our country simply view this tax code as a benefit to the wealthy without understanding the positive implications for our entire economy. NMHC is working to educate lawmakers on the value of redeploying capital and the number of jobs that would be affected.

Streamlining Government Financing – HUD and LIHTC financing is instrumental to the creation of additional rental units in our industry but the process is expensive and lengthy. Meeting with the new Secretary of HUD, Julian Castro, we received commitment to reduce the amount of time it will take to complete these processes.

Carried Interest – Carried Interest is currently taxed as capital gains and has been a fundamental part of real estate investment partnerships for decades. Some political forces would like to tax carried interest at ordinary income rates which could discourage real estate investment given that 41 percent of all investment partnerships are real estate related.

I suspect inertia. It’s just easier that way.

75

posted on

09/26/2014 8:24:38 AM PDT

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-75 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

fwiw over the past few weeks the Yen, British Pound, Swiss Franc, Mexican Peso have all been falling while the Dollar's been climbing.

fwiw over the past few weeks the Yen, British Pound, Swiss Franc, Mexican Peso have all been falling while the Dollar's been climbing.

--and a very good Friday morning to everyone as stocks'n'metals continue their divergent directions. In fact, while metals settle into levels from four years ago, the S&P punched a record high so IBD changed the outlook back to 'confirmed uptrend'. Only reports today are Natural Gas Inventories and Leading Indicators. Some headlines:

--and a very good Friday morning to everyone as stocks'n'metals continue their divergent directions. In fact, while metals settle into levels from four years ago, the S&P punched a record high so IBD changed the outlook back to 'confirmed uptrend'. Only reports today are Natural Gas Inventories and Leading Indicators. Some headlines: