Posted on 08/17/2014 1:35:32 PM PDT by expat_panama

Alternate Title: UPTREND SPECIAL EDITION!

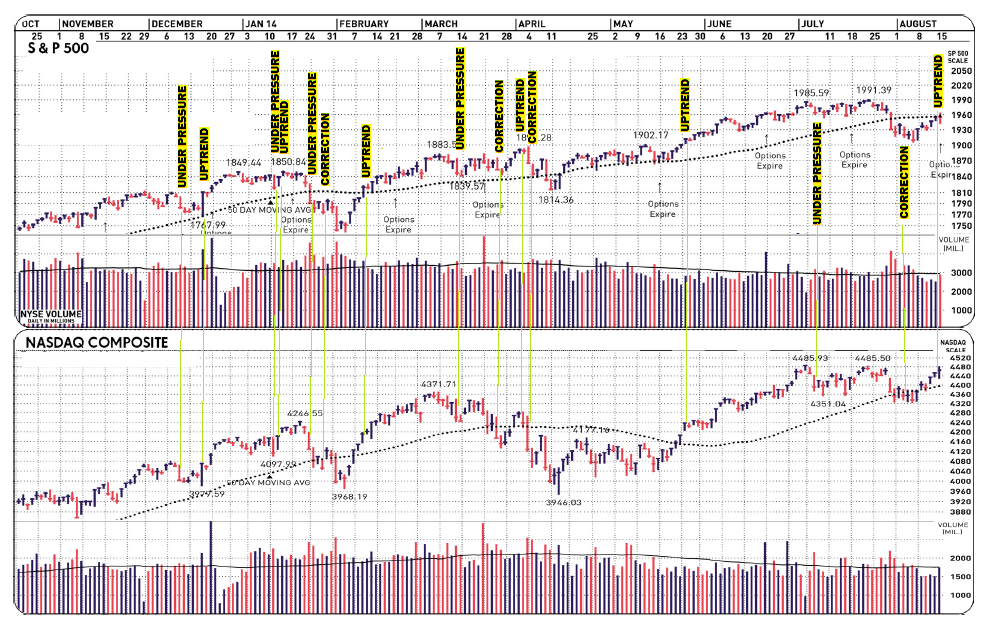

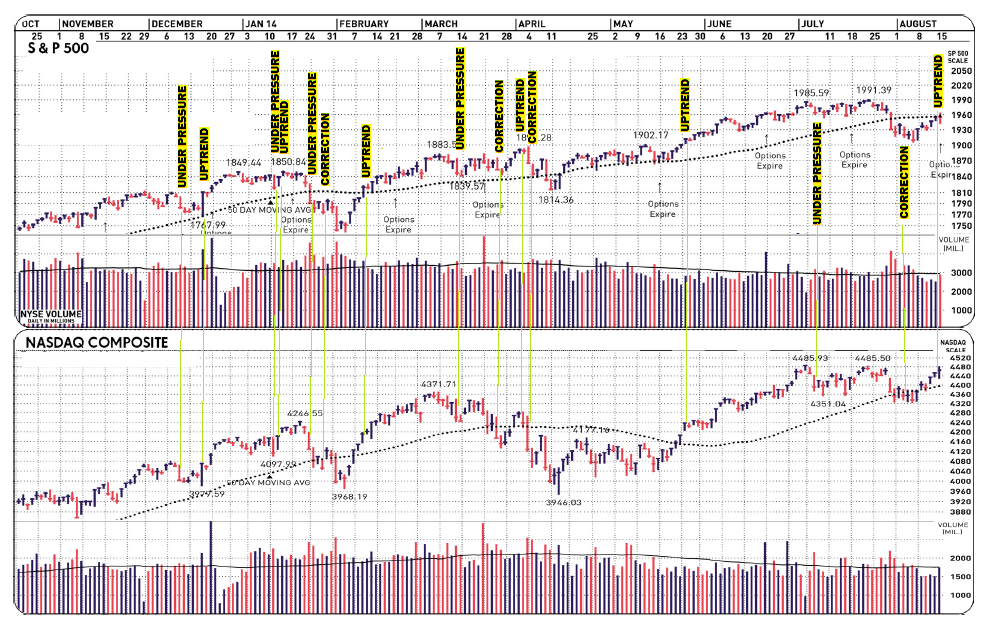

That's right, last Thursday IBD announced that NASDAQ had its "follow-through-day" so investors in the driver's seat just saw the light turn green. That said, we also know that nobody walks across a one-way street without looking both ways, and even though the signs say 'buy' here's what they've been saying so far this year--

--and this is the problem we got driving down the road while only being able to look out the back window.

Remember these market designations are not arbitrary, they're signals proven with decades of research. That said, we're still looking at a market where price trends have not yet proven themselves. We've gotten so many false signals this year that a person would've done better by buying on the 'corrections' and selling when uptrends begain.

Of course, if we're concluding that past patterns don't mean anything for seeing the future, then to be honest we'd also have to admit that simply being contrary promises nothing.

OK, so imho 'honesty' is highly over-rated.

Maybe our bottom line here is that it's IBD's job to show what usually has happened before when stuff looking like today's headlines popped up --and truth betold they do it superbly. When it comes to guarding our family's wealth and keeping the kids fed, well that's our job. It means we can still learn from folks like NEWSMAX/FINANCE, IBD, WSJ, but we also need to kick those guys around on this thread too...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Awsome... —and I mean that in the sense before the word came be used to describe ‘pizza’.

Your brother is in very good company, and watching market sentiment can tell us a lot even while it tries to make people buy high and sell low. Some people just say the market's rigged and it's sinister forces that are sticking to the little guy. My take is that it's the human emotions that are what's messing up market prices and that the more sophisticated we get then the more we can overcome fear and greed and do what works.

(Wyatt, a while back you posted a terrific graphic on market sentiment on surges and dips and how natural human emotions were so counterproductive --if you remember where it was please repost.)

IMO, market sentiment is one of the best historical technical indicators there is.

Emotion is the key driver. I’ve seen people walk away from once in a lifetime deals because somebody hurt their feelings. The efficient market hypothesis doesn’t fail because people are emotional. It’s part of the deal and smart investors watch sentiment. The more people hate a sector or investment the more reasons I like to look at it.

I love buying out of favor bargains, particularly when the “smart” money rejects it. That’s why rental housing has me nervous. Too many “smart” guys in it right now. There’ll be a washout one way or the other.

Fed chief Janet Yellen coined a new phrase today - “pent-up wage deflation”. What does that mean?

http://news.investors.com/economy/082214-714501-fed-chief-janet-yellen-sees-rate-hikes-but-not-yet.htm?p=full

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.