Skip to comments.

Investment & Finance Thread (week July 27 - August 2 edition)

Weekly investment & finance thread ^

| July 27, 2014

| Freeper Investors

Posted on 07/27/2014 10:28:41 AM PDT by expat_panama

While this past week may have been pretty much nothing in the way of general asset growth (metals flat off --stocks flat in market under pressure), it's been a great week for geek number thingees, in fact we updated the link list to include Business Insider's Chart page (hat tip to Wyatt's Torch) and we've been into the income shifts that have turned the Great Recession into the gift that keeps giving.

Chgogal gave us the headsup to the NYTimes piece "The Typical Household, Now Worth a Third Less" and Wash. Post Chart study Median household incomes have collapsed since the recession (more here). Seems that even the NYT and WaPo are talking about middle class money problems and they included the Census Br's Real Median Household Income crash that's been raising so many eye brows lately. |

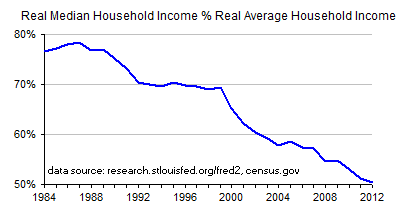

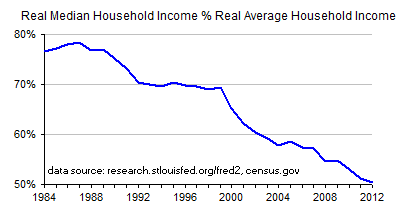

They focused on the trend since 2000, but what we need to remember is that (if you believe the Census Br.) we had growth before the early 2000's-- |

|

--and that contrasts with the steady growth of average incomes reported by the Bureau of Economic Analysis. (Lots of agencies w/ lots of numbers for lots of our tax dollars). |

Some folks say the problem we got is too much inequality --rich are richer but suddenly the rest of us are getting left behind. No so; at least that "suddenly" part; it's actually a long term trend and the percent median of the average has been falling at a steady rate for decades. What we got new in '09 is flat out income loss for all. |

mho.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-102 next last

To: expat_panama

Is this Argentina default going to way on the markets like Greece did?

61

posted on

07/31/2014 4:40:30 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Samsung stock was going up last year while Apple was going down from its “darling of Wall Street” heights of 800 or so.

Amusing to see South Korea hi-tech having greater world penetration and visibly than Japans. The Japanese look at S Koreans as racial inferiors. Used to be the prevalent thinking in Nippon

Japan population 120 million

Korea population 45 million or so and they are beating Japan. I’ll bet they have a much better birth rate than Japans

So is Taiwan (beating Japan) in consumer electronics with only 25 million people. A leader in laptop/Tablet/smartfone tech. They do lots of Apples design and engineering

62

posted on

07/31/2014 5:30:46 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: expat_panama

Initial claims 4WMA lowest since 2006:

To: dennisw

AAPL never hit $800. The split adjusted peak was also in 2012 (9/19/12 to be exact) $100.30 ($702.10 pre-split). Stock opened on 1/2/2013 at $78.43 and closed 12/31/13 at $80.15 up 2.2% for FY13. Since then the stock is up 22.5%.

To: dennisw

587.71B -————Apple market cap

183 billion-— Samsung market cap

65

posted on

07/31/2014 5:54:53 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: Wyatt's Torch

You are right. Taking the split into account today APPLE is very near that 9/19/12 $700 plus peak

66

posted on

07/31/2014 5:58:01 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: expat_panama

Enormous miss in Chicago PMI - Act 52 vs exp 63

To: Wyatt's Torch

Now I see your point. There's both fact and fiction on both sides

What we got is that while there really has been a serous shift of millions going from full-time to part-time, we've also made serious improvement. Our goal is not to reduce the number of part time jobs. What we want are more full time jobs and the fact is that we're already well on our way.

To: expat_panama

I think if the full-time to part time conversion is possible then yes that should absolutely happen. The question is can it (or will it) given the Obamacare impact which has to be real. We might very well have seen a permanent level change in part-time jobs because if it.

To: dennisw

587.71B -————Apple market capConsidering the aspect of capital employment, if anyone thinks this company is actually worth this much should get in contact with me concerning some land in FL, I'd like to sell them.

70

posted on

07/31/2014 8:10:24 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: catfish1957

Considering AAPL is 12X FCF while GOOG is 19X, AMZN in 144X, NFLX is 268X then it’s really pretty cheap...

To: Wyatt's Torch

Private has surpassed prior peak. Government is down... People here do NOT want to know that.Or maybe most people on these threads understand it fine but we're only hearing from the noisy minority.

To: expat_panama

:-)

By “here” I meant FR not this thread. People on this thread are great. The ones that jump on the main threads who constantly bleat “the numbers are all made up”! All job creation is part-time or government jobs without once having looked at the data were the “here” I was referring to.

To: Wyatt's Torch

Stocks punching to new lows; not sure whether it's good news = higher rates = bad news or whether a correction is just long over due. Thinking that IBD's about to announce "Market in Correction".

To: Wyatt's Torch

NFLX is 268X =

A Wall St Darling to force up and down and to profit on the ride up and down. 268x is ridiculous because others will expand their streaming business and eat them up. Amazon could slam them if they had a mind to do it. Maybe fear of anti-trust stops them.

How netflix is perceived as having a permanent dominance stumps me. If you want permanent dominance and a lock in many business areas then look to Amazon. Google comes in second then apple third

75

posted on

07/31/2014 9:12:19 AM PDT

by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: expat_panama

Well The Maestro said yesterday we were due for a correction...

To: Wyatt's Torch

COnsumer confidence blows away expectations. 7-year high.

We live in strange times. Confidence is the best it's been in a half dozen years and has soared up to levels typical for normal recessions. The hope is that in another half dozen years it'll climb to expansion levels.

To: dennisw

Korea population 45 million or so and they are beating Japan. I’ll bet they have a much better birth rate than Japans So is Taiwan (beating Japan) in consumer electronics...What snags me is how we see these powerful democratic economies going out of their way to ally themselves w/ the U.S. and our foreign policy always seem to favor their enemies. Reminds me of our Israel/Palestine approach.

To: dennisw

From Business Insider: http://www.businessinsider.com/its-pretty-clear-that-apple-is-winning-the-war-with-samsung-2014-7

It’s Pretty Clear That Apple Is Winning The War With Samsung

If there’s one thing that’s clear today, it’s that Apple has been completely right in its smartphone strategy so far.

While there were many people (including people who work for Business Insider) shrieking that Apple was going to get knocked flat by Samsung and Android, it’s looking increasingly like that’s not going to happen.

Samsung delivered a rough earnings report yesterday. For the third straight quarter it posted a drop in operating income. This time, operating profit dropped 25% on a year-over-year business. It was dragged down by the mobile business which actually saw profits drop 30% on a year-over-year basis.

During the same period, Apple’s operating income was up 12%. Apple doesn’t break out its iPhone line in terms of operating profit, but iPhone sales were up 9%.

It gets worse for Samsung. Its market share slid to 25.2% of the smartphone market for Q2, down from 32.5% last year in the second quarter. Apple’s market share slid as well, but by a smaller amount, going to 11.9%, down from 13.4%. Reuters reportsSamsung was the only major manufacturer to report a drop in absolute number of shipments” during the quarter.

So, what’s eating Samsung? It’s fighting, and losing, two battles.

At the high end it’s competing with Apple. Apple isn’t going anywhere. It remains strong thanks to a sterling brand, high-quality phones, and iOS, the best mobile operating system in the world.

At the low-end of the market it’s competing with upstarts like Chinese phone maker Xiaomi, and an army of Android phone makers that use Android. There’s little reason for a consumer to pay a premium for Samsung phones instead of a Samsung clone.

This is all instructive when thinking about Apple and what it should do in the future. While there are people pushing Apple to lower prices on the iPhone, it seems like Apple is doing the exact right thing by keeping it’s phones priced at a premium. It has expensive, new high-end phones that generate healthy sales and profits. They also establish Apple as a premium phone maker.

Apple isn’t ignoring the low-end of the market, though. It sells older iPhones at lower prices. Those phones are doing very well and it’s reflected in the company’s earnings.

The danger for Apple is that it whiffs on the next wave of mobile users who are coming from emerging markets. But in the last two earnings calls Apple has made it clear that it’s doing well in those places despite selling relatively expensive phones.

Sales in the Greater China region were up 28% on a year-over-year basis last quarter. On the earnings call, CEO Tim Cook said sales in Brazil, Russia, India, and China (the BRIC countries) were up 55% on a year-over-year basis.

On Apple’s March quarter earnings call, Cook said, through the first half of fiscal 2014, iPhone sales in Brazil were up 61%, in Russia up 97%, in Turkey up 56%, in India up 55%, and in Vietnam they were up 262%. Cook pointed out that these are not “historic strongholds” for Apple.

Looking at those numbers, and comparing them to where Samsung is at, it’s hard to argue that Apple is making a mistake with the iPhone business.

Apple was right to ignore the pundits calling for a lower cost phone last year. And if it ignores them again this year, it will probably be the right call once again.

Bottom line: Apple knows what it’s doing.

To: expat_panama

T Mobile shares halted pending news

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-102 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson