Skip to comments.

Investment & Finance Thread (week July 20 - July 26 edition)

Weekly investment & finance thread ^

| July 20, 2014

| Freeper Investors

Posted on 07/20/2014 4:02:51 PM PDT by expat_panama

Year-to-date wrap-up time.

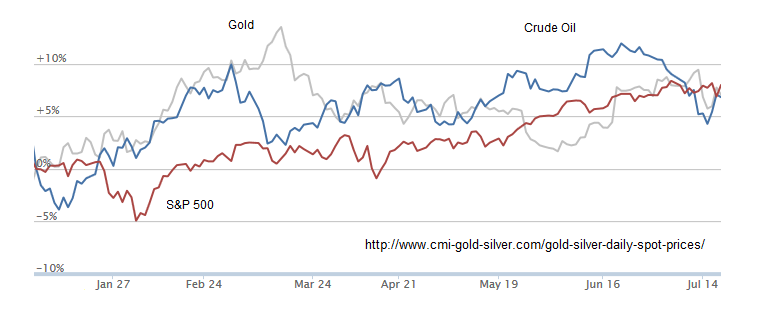

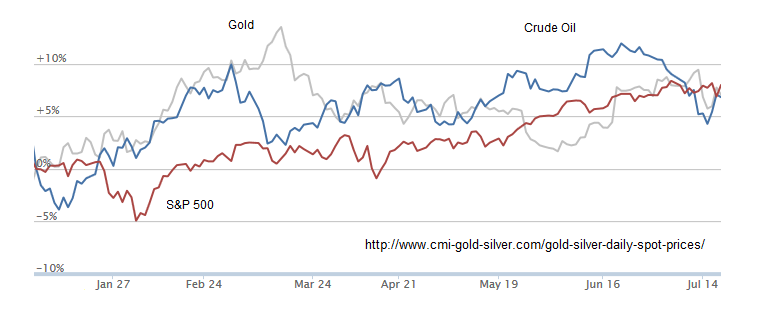

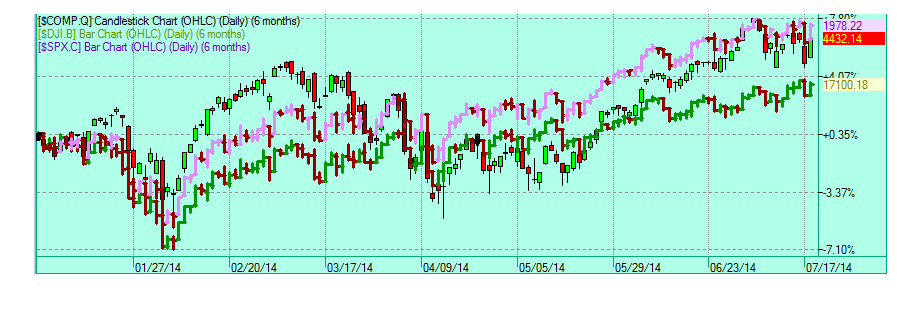

General markets varied a lot but right now they're all together at 5-10% up so far. Actually that's pretty good as it represents a 5-year doubling time. click to enlarge |

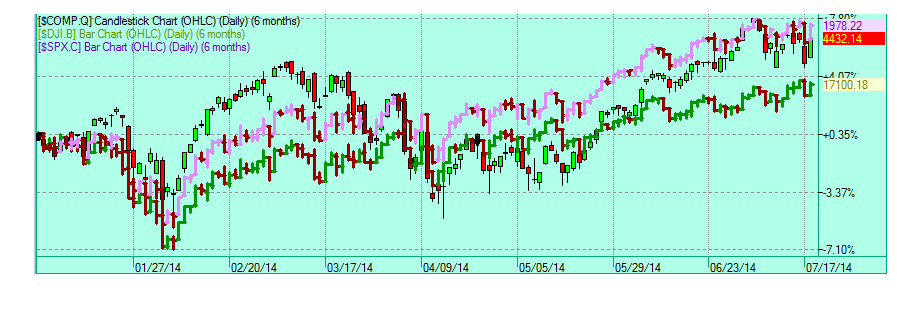

A closer look at stock indexes so far this year are showing roughly the same track but my dim eyes are somehow seeing us having a plateau for the past 3 weeks. That's usually a good sign; witness the run-up after the mid-April basing. click to enlarge |

.As Torch says, "Discuss".

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

To: Wyatt's Torch

I hate buybacks... huh, I find buybacks a good sign. First that management sees their company as a great investment, and second that they've demonstrated they can create wealth.

To: 1010RD

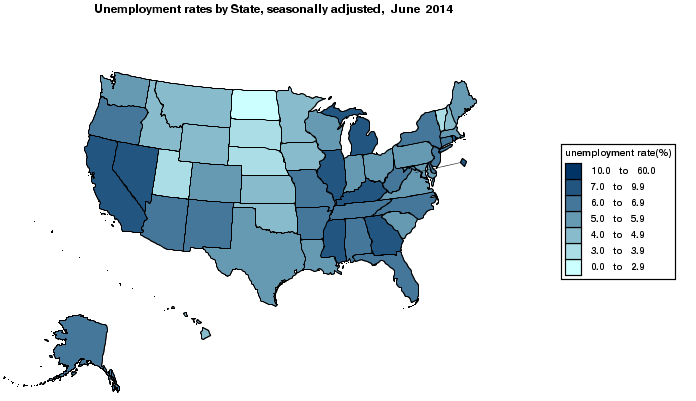

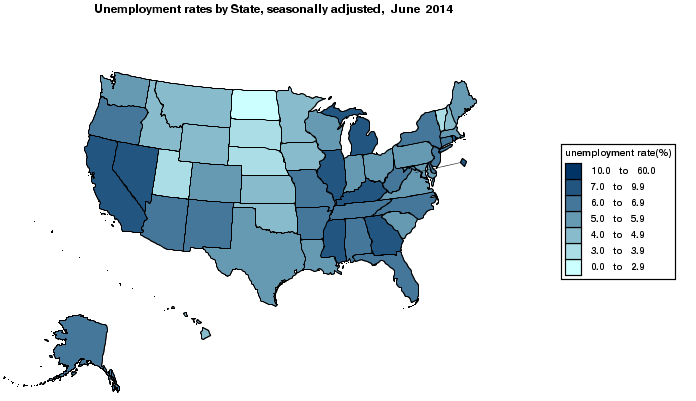

fattening profit margins... ...by laying off workers..." knowing that the Fed's BEA numbers say otherwise. Depends on which state of the union they are talking about. Illinois workforce shrink

--and that's where corporate management ends and government policies trump. These two maps show what the left prefers to hide from:

To: expat_panama

They have a history of never providing any real value. The theory is decent, but they never work. Better to spend the cash on something that will generate higher returns.

To: expat_panama

This one is for the "inflation truthers" (i.e. the "ShadowStat Sycophants")

To: expat_panama

Interesting...

The 5.5-Inch iPhone 6 Will ‘Cannibalize The iPad, Which Is A Good Thing’

Martin Hajek

Apple’s June quarter was pretty much a snooze, with everything in line with expectations.

There was one thing that stood out, though: The iPad was worse than expected, and the Mac was better than expected.

This runs contrary to the story line that had been forming as of late. We’re supposed to be in a post-PC world where tablets become the new PC, and the PC dies.

On a unit basis, this story is still true. Apple sold 13.3 million iPads and just 4.4 million Macs. On a revenue basis, however, the product lines are nearly even. iPad revenue was $5.9 billion, and Mac revenue was $5.5 billion.

The iPhone was strong, with Apple selling 35.2 million units, which generated $19.7 billion in revenue.

There are a number of logical reasons for the iPad’s slow down: Apple sold 225 million iPads since it launched in 2010. The iPad doesn’t need to be upgraded as often as a phone, since it’s not used as much as a phone. And, duh, it’s not as productive/useful as a laptop, and people are probably due for laptop upgrades. Plus, the growth for tablets is coming from low end of the market, and Apple doesn’t do low-end.

(A simpler theory comes from our own Henry Blodget, who put it best on Twitter last night: “Basically, you just don’t need iPhone, iPad, and Mac… pick your two.”)

The deterioration of the iPad business is particularly interesting right now. Apple is expected to launch two new iPhones with bigger screens at the end of September. The current iPhone has a 4-inch screen. The iPhone 6 is expected to come in 4.7-inch and 5.5-inch screen sizes.

What happens to the iPad when Apple launches a 5.5-inch iPhone? “Kaboom,” says Blodget. After all, a big iPhone will do pretty much the same stuff an iPad does.

Apple analyst Gene Munster agrees. And he thinks it “is a good thing.” He lowered his iPad estimate for 2015 from 78 million to 74 million as Apple looks to release its 5.5-inch iPhone.

“Overall, we see this as a positive trade off given we expect the 5.5 inch iPhone ASP to be around $700 (in line with Samsung Galaxy Note pricing) with gross margins of ~45%, which compares to iPad Mini ASP of around $400 with gross margins of ~30%,” says Munster.

If the iPhone 6 eats the sales 4 million iPads, it actually adds $1.2 billion to Apple’s sales and $780 million in gross profits.

So, while the iPad business is slowing, and shows no signs of getting better, it’s not that big a problem for Apple. The iPhone is going to pick up the slack.

To: Wyatt's Torch

for the "inflation truthers" (i.e. the "ShadowStat Sycophants"--who'll never be convinced of what is no matter what. The fact that humankind becomes better off as the years go by is not surprising, but what always amazes me is how we keep hearing from too many folks that still long for the "good'ol'days".

To: expat_panama

So once again, why aren’t conservative leaders carrying this and putting it out there. I believe there is a very strong case for conservative populism. It’s the necessary next step to get back our republic.

47

posted on

07/23/2014 9:19:02 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

You aren’t saying for conservatives to attack businesses improving profit margins because of labor efficiencies are you?

To: Wyatt's Torch

Of course. If conservatives and liberals both attacked corporations we could make them hire all the unemployed and get back to the good old days under FDR!

If we got rid of all our corporations we could go back to living just like the Founders did...

49

posted on

07/23/2014 10:36:00 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

Okay I feel better... :-)

To: Wyatt's Torch

51

posted on

07/23/2014 10:46:07 AM PDT

by

1010RD

(First, Do No Harm)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Whoa, morning coffee finally kicking in --so yesterday we had the S&P hit an all time high and the drop in metals was still with in the past month's tight range. Now futures traders are seeing more gains in stocks w/ metal easing again. Claims and New Home Sales reports due today; morning news:

- Euro-zone PMI shows recovery regaining momentum MarketWatch - 34 minutes ago The eurozone's economic recovery appears to have regained some lost momentum in July, as surveys of purchasing managers pointed to an increase in private-sector activity driven by Germany and the services sector.

- S&P 500 ekes out record high as earnings roll in Glens Falls Post-Star - 5:23am NEW YORK (AP) - The stock market eked out a record high Wednesday, as investors weighed positive earnings from the technology industry against disappointing news from Boeing and other companies.

- Apple Hints New Products Near With Bigger IPhones Looming Apple Inc. (AAPL) signaled that the long wait for new products is nearing an end. With bigger-screen handsets in development, Apple said yesterday that shoppers are delaying buying new iPhones, which will weigh on sales in the current quarter ending in September. Yet rather than dissuade buyers… Bloomberg Inflation is about to fall-and fall hard: Insana I would bet inflationistas a truckload of scarce limes that inflation pressures are temporary and inflation is about to fall, says Ron Insana. CNBC

- Wealth-Building Secrets of the Millionaire Next Door The tenets they follow can also put you on the path to financial prosperity and security. In the words of Knight Kiplinger, editor in chief of Kiplinger's Personal Finance magazine and Kiplinger.com, "discretionary spending -- the chic apartment, frequent travel and restaurant meals, consumer… Kiplinger

- For stocks, Dow 20,000—then a crash? Famed asset manager Jeremy Grantham predicts short-term gain and long-term pain for stocks, writes Brett Arends. MarketWatch

- Is There Any Value Left In a Rallying Market? - John Kimelman, Barron's

- An Econ. Discussion Investors Should Monitor - Noah Smith, Bloomberg

To: 1010RD; Wyatt's Torch; Lurkina.n.Learnin

What I'm noticing is that what's bad has been easing off. Any other ideas here?

[click to enlarge]

To: expat_panama

From Business Insider: Good morning! Here’s what you need to know:

Facebook Is Doing Better Than Expected. Facebook reported Q2 earnings and revenue that beat analysts expectations, and the stock is up by almost 8% in premarket trading. At $0.42, earnings per share beat expectations by a whopping $0.12. Monthly active users jumped 14% to 1.32 billion. Mobile monthly active users exploded 31% to 1.07 billion.

China Is Doing Better Than Expected. China’s flash manufacturing PMI jumped to an 18-month high of 52.0 in July, signaling accelerating growth in the sector. Economists were expecting a reading of 51.0. “Economic activity continues to improve in July, suggesting that the cumulative impact of mini-stimulus measures introduced earlier is still filtering through,” said HSBC’s Hongbin Qu. “We expect policy makers to maintain their accommodative stance over the next few months to consolidate the recovery.”

Germany Is Doing Better Than Expected. Germany’s flash PMI jumped to a 3-month high of 55.9 in July, beating expectations for 53.8. “Following the joy of lifting the football World Cup trophy, July’s flash PMI results provide further positive news for Germany,” said Markit’s Oliver Kolodseike. “A deeper look into the data shows that the main driver of the strong PMI reading was the service sector, where companies reported the steepest increase in activity for just over three years. That said, manufacturing also made a positive contribution to the numbers, suggesting that the economic upturn remains broad-based.”

France Is Doing Better Than Expected. France’s flash PMI jumped to a 3-month high of 49.4 in July, beating expectations for 48.3. “The French private sector economy remained in reverse gear in July, dragged down by weakness in the manufacturing industry which offset a small improvement in services,” said Markit’s Jack Kennedy. “PMI data remain consistent with quarterly GDP close to stagnation levels, as the economy continues to show little sign of turning around its recent sluggish performance.”

Japan Is Not Doing Better Than Expected. Despite policymakers’ ongoing efforts to stimulate the economy by making export goods more competitive via a weaker yen, trade numbers disappointed. The trade deficit narrowed to 822.2 billion yen in June, but it was wider than the 642.9 billion yen estimated. Japan’s flash PMI was nothing to celebrate either, falling to 50.8 in July from 51.5 in June. “Japanese manufacturers’ new orders remained in growth territory for the second month running, while there was a rise in new exports for the first time in four months,” said Markit’s Amy Brownbill. “These weren’t enough to prevent output stagnating, although this most likely reflects a little payback from the solid gains seen in June and the on-going unwinding of the impact of the the hike in sales tax earlier in the year.”

Ford’s Doing Better Than Expected. Ford announced Q2 earnings of $0.40 per share, which was better than the $0.36 expected. Revenue of $37.4 billion was also higher than expected. Management attributed the healthy quarter to improvement in Europe and robust growth in China.

Markets Like All This. The S&P 500 closed at an all-time high on Wednesday, and futures are pointing to another day in the green. U.S. futures are up modestly with Dow futures up 28 points and S&P futures up 3 points. In Europe, Britain’s FTSE 100 is up 0.1%, France’s CAC 40 is up 0.6%, and Germany’s DAX is up 0.4%. Asia closed with Hong Kong’s Hang Seng up 0.7%.

Housing Market Update At 10:00 A.M. ET. Economists estimate sales fell 5.8% to an annualized pace of 475,000. “Given the outsized increase in May, a downward revision is also possible,” said Bank of America Merrill Lynch economists. “Smoothing through some of the monthly swings, we see an improving trend for housing demand after a weak winter.This is also consistent with the modest recovery in the NAHB homebuilder sentiment survey.”

Keep An Eye On Claims. Economists estimate weekly initial jobless claims ticked up 307,000 from 302,000 a week ago. “Initial jobless claims probably remained near the 300,000 mark as seasonal factors likely continued to misestimate actual claims activity during the July auto factory shutdown season,” said Citi’s Peter D’Antonio. “We posit that filing have been artificially low, relative to the May-June average, reflecting in part the inability of the seasonal factors to account for two post-crisis trends in the auto sector: (1) the auto sector is much smaller, resulting in fewer hourly worker claims than before; and (2) many factories stay open in order to accommodate stronger demand. Separately, beneficiaries and the insured rate likely also remained low due to factory retooling period seasonal factor idiosyncrasies.”

The SEC’s Going After S&P. “The parent of Standard & Poor’s, which is defending against a $5 billion lawsuit by the federal government over its credit ratings, said on Wednesday it may soon also face U.S. Securities and Exchange Commission charges over another set of ratings,” reported Reuters’ Jonathan Stempel and Sarah Lynch. “In a regulatory filing, McGraw-Hill Financial Inc said it received a “Wells notice” on July 22 indicating the SEC is weighing filing civil charges for alleged securities law violations over S&P’s ratings of six commercial mortgage-backed securities transactions issued in 2011.”

To: Wyatt's Torch

...S&P 500 closed at an all-time high on Wednesday, and futures are pointing to another day in the green...Good to hear nothing can possibly surprise us on the downside today.

To: expat_panama

Claims +284K vs +308K exp - lowest since 2006

4WMA lowest since 2007

To: expat_panama

To: Wyatt's Torch

That’s the kind of info left out of the IBD graph in post #42. Doesn’t mean IBD lies, it means there’s more going on than can be shown in one graph.

To: expat_panama

Look at what typically happens shortly after the 4WMA drops below 300K.......

To: Wyatt's Torch

The argument there is that the 300K line could be a structural limit at full employment as the expansion is used up. In the case we’re in now however the claims level is more like headline unemployment —distorted by the shrinking workforce.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson