and the futures market update --so let me know if anyone wants on or off this ping.

and the futures market update --so let me know if anyone wants on or off this ping. Posted on 03/23/2014 4:10:35 PM PDT by expat_panama

Investment & Finance Thread (Mar. 23 edition)

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here.

We usually see this showing up on Monday mornings w/ a ping to freeper investors, but it seems the write up is being done on Sunday night anyway so starting now it's being shared as it comes out. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

Tomorrow morning of course we'll still have our -- and the futures market update --so let me know if anyone wants on or off this ping.

and the futures market update --so let me know if anyone wants on or off this ping.

======================

======================

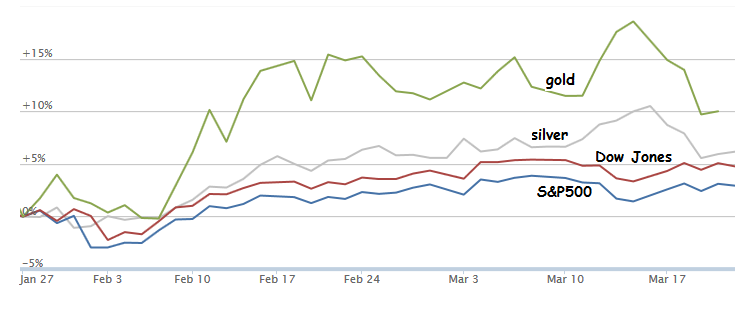

Last week's thread began wondering if stocks were going into the bigger drop like we had back around the beginning of Feb., but instead the drop happened with metals and stocks leveled up.

OK, so this is when the guy on the radio says "past performance is no guarantee of future returns" --that and you've been following IBD TV (free to non-subscribers) the market pulse is still 'market under pressure'.

what, should we ping everyone now or wait to tomorrow AM as usual?

Bumping to find out sure investment strategy on Monday.

In my own case things were doing well until last Thursday nite a bunch of House Democrats declared war on medical stocks by demanding to know why drugs cost so much. Technically their inquisition was directed at Gilead Sciences but at the time I owned BIIB --it had begun the day at $355/share and by the end of the day it closed at 318. Of course the good news is I bought it at $322/share but hey, it's the principle of the thing.

Full story at http://news.investors.com/technology/032114-694211-biotech-stocks-fall-as-house-questions-gilead-sovaldi-price.htm?ref=HPLNews

Good evening,can you please add me to this ping list?

Thanks :)

Likewise, please add me to the ping list, thanks.

Likewise, please add me to the ping list, thanks.

Gooooood MORNING INVESTORS!!!!!

The view as seen from the futures trading floor is solid/upbeat looking at the overall picture. Now that I think of it, it seems like a continuation of the past week with stocks slightly up and metals off (again). Lots of econ reports coming out Tues-Fri but none today (sched here). News today:

Euro Factory, Services Growth Stays Near Highest Since 2011

China data hits Europe shares, Crimea keeps nerves taut

Nokia Handset Sale to Microsoft Delayed

Scores of ships trapped by Texas oil spill

Australia & NZ dollars dip modestly on disappointing China factory activity

Done!

Morning Look from KCG Securities:

U.S. stock-index futures advanced, following the Standard & Poor’s 500 Index’s gain last week.

Apple Inc. added 1.2 percent in early New York trading as the Wall Street Journal reported that the company has held talks with Comcast Corp., America’s largest cable operator, about streaming live and on-demand television. Herbalife Ltd. jumped 7 percent after it agreed to nominate three people proposed by billionaire Carl Icahn to its board.

Futures on the S&P 500 expiring in June climbed 0.3 percent to 1,861.9 at 7:45 a.m. in New York. The equity benchmark rose 1.4 percent last week. Dow Jones Industrial Average contracts gained 32 points, or 0.2 percent, to 16,253 today.

“U.S. futures are pointing slightly higher, looking to carry on last week’s positive momentum,” Richard Hunter, head of equities at Hargreaves Lansdown Plc in London, wrote in an e-mail. “Investors are for the moment not concerned by geopolitical events and are remaining more U.S. centric. Economic data to be released later this week should add further color to the strength of the still nascent U.S. recovery.”

U.S. President Barack Obama arrived in Europe as Russia, which completed its annexation of Crimea last week, positioned its armed forces on the border with eastern Ukraine. U.K. Foreign Secretary William Hague wrote in yesterday’s Sunday Telegraph that the troop buildup means the crisis may worsen,

calling the situation the most serious risk to Europe’s security this century.

A report from Markit Economics Ltd. at 9:45 a.m. will probably show U.S. manufacturing activity slowed this month. The index dropped to 56.5 from 57.1 in February, according to the median estimate of economists in a Bloomberg News survey.

A Commerce Department report tomorrow will show new house sales fell to 445,000 in February from 468,000 in January, according to economists surveyed by Bloomberg News.

European stocks retreated, after the Stoxx Europe 600 Index’s biggest weekly advance in more than

a month, as world leaders gather in The Hague to discuss tension over Ukraine and a manufacturing gauge for China and Germany slipped. U.S. index futures and Asian shares rose.

Royal KPN NV lost 2.4 percent after Citigroup Inc. downgraded the stock. Centrica Plc declined 1.2 percent after a report said U.K.’s biggest utilities may be split. CEZ AS, the biggest Czech utility, climbed 3.3 percent after the nation’s finance minister said the government is seeking a 100 percent

dividend payout.

The Stoxx 600 fell 0.6 percent to 325.83 at 10:11 a.m. in London. The benchmark index advanced 1.8 percent last week as Russian President Vladimir Putin said he won’t seek territory beyond Crimea. Standard & Poor’s 500 Index futures added 0.2 percent, while the MSCI Asia Pacific Index gained 1.1 percent.

• Support:1858, 1850, 1830

• Resistance: 1879, 1891, 1912

By annexing Crimea, Russian President Vladimir Putin is decoupling his nation from the very source of much of its wealth.

The CHART OF THE DAY shows that the 120-day correlation between the Micex Index of Russian stocks and Brent crude reached minus 0.2 this month, the most negative since 2003, compared with an average of 0.42 over the past five years. A reading of 1 would indicate the two assets are in lockstep. Minus 1 would represent complete divergence.

While Putin’s intervention in Crimea has fueled a $127 billion slide this year in the value of companies listed on the country’s stock market, oil prices have remained steady. Standard & Poor’s and Fitch Ratings cut Russia’s credit outlook last week on concern that U.S. and European Union sanctions will slow growth in the world’s largest energy producer.

“If there are sanctions against the use of Russian oil and gas, that’s going to economically hurt Russia and also prop up the prices of commodities,” Timothy Ghriskey, chief investment officer at Solaris Asset Management LLC in New York, which manages about $1.5 billion in assets, said by phone on March 21.

“We have no clue what the resolution will be. Eventually, the correlation between Russian stocks and oil will reassert itself, but we don’t know when.”

Oil prices have jumped more than fivefold since 2001, stoking a 536 percent advance in the Micex as Russia recovered from the 1998 debt default to become the world’s eighth largest economy. Revenue from crude and gas exports account for more than half of the government’s budget.

Russian stocks entered a bear market this month as America penalized officials and business leaders tied to Putin. U.S. President Barack Obama also signed an executive order authorizing, though not plementing, sanctions affecting unidentified parts of the economy.

U.S. futures are pointing slightly higher

The higher was 'slightly' a couple hours ago, now they've come up a bit more.

By annexing Crimea, Russian President Vladimir Putin is decoupling his nation from the very source of much of its wealth...

At first that line made me want to scoff until I saw--

...intervention in Crimea has fueled a $127 billion slide this year in the value of companies listed on the country’s stock market,

“Well then, business is going to have to suffer.”

—as many an arrogant leader has said, only to end up being destroyed by enemies with greater resources.

Time and time again world conflicts have been begun by those that thought they were superior to commercial interests, and these same conflicts eventually ended up being settled by which ever coalition was more wealthy.

“Sonny, God rest his soul, was a good soldier but a bad Don.”

PMs are down (again). Only my SODA and TZA are in the green. I’ll sell the TZA if I see the markets going back up.

Maybe I’m getting less tolerant of drops in my old age but last Fri and this AM I’ve moved out by half. So much for my ‘no wimping’ new year’s resolution...

NYSE MAC DESK MID-DAY MARKET UPDATE:

DOW 16,237 (-65 points), S&P500 1852 (-13 handles), Brent Crude $107.25/barrel (+$0.33), Gold $1,311.50/oz. (-$24.50)

MARKET DRIVERS: (Stocks are trading to the downside as a weaker-than-expected flash manufacturing PMI and continued uncertainty in Ukraine weigh on trader sentiment.)

• The U.S. Markit flash PMI dipped to 55.5 in March, missing consensus, after rebounding 3.4 points to 57.1 for the final February print - which was the strongest reading since May 2010. The slowdown in manufacturing growth represented by the index is consistent with Asian and European indicators which were also released today.

• The Chicago Fed’s national index rose to 0.14 in February versus the forecast of +0.1. It was revised to minus 0.45 in January from minus 0.39.

• China’s March Flash PMI was worse than expected, falling to 48.1, an eight-month low. New orders were especially weak at 46.9. The Shanghai stock market closed up 0.9%, however, on speculation that the government may have to embark on a stimulus program. We get the “official” manufacturing data in a week or so, but if this keeps up, analysts see Q1 GDP almost certainly coming in below 7%.

• The flash estimate of the Markit Euro-zone PMI Composite Output Index came in at 53.2, only slightly lower than February’s 32-month high of 53.3, but topping the consensus of 52.6.

• President Obama arrived in Europe for talks as Russia, which completed its annexation of Crimea last week, masses soldiers on the border with Ukraine.

Dead last place… That is where I stand in our $10 “Friends and Family” NCAA Bracket Pool… It’s embarrassing… My six-year old niece is even kicking my butt. And all she does is play with dolls(?!)… Have to admit, Wichita State losing yesterday really killed me because I had them winning the whole tournament. After the Shockers missed a three-pointer at the buzzer, I kind of felt like this dude. (Which reminds me, I also had Duke going to the Final Four. Genius!) Okay – enough with my bracket issues… Today, in the market we’re seeing recent market leaders and big momentum names selling off hard. For instance, looking at the ETF-space, we see biotech stocks (XBI) trading down 5%; Gold miners (GDX) down 3.7%; and semi-conductors (XSW) down over 1%. In addition, the big high-tech momentum names are trading down between 5% to 7% on the day. Conversely, we are seeing a rotation out of these “high-fliers” and into some older blue chip names… What’s going on?? Any time traders are concerned with a little frothiness in the market, or when they are concerned that interest rates are headed higher, you historically will see some profit-taking in market leaders and big momentum, (Big Mo’), names… On another note, (although not as much of a factor in today’s trading), earnings expectations have been reduced substantially, as analysts now anticipate no earnings growth in Q1 from a year ago, according to FactSet. For the record, profits among S&P 500 companies this quarter were forecast to grow at 4.4% at the start of the quarter. Not anymore…Technically, the S&P made a new intraday high on Friday’s opening surge, (circa 1884). As we observed, it then rolled over and closed in negative territory. Large one day reversals like that can often be a warning signal for the overall market. Friday, however, was a Quarterly Expiration/S&P re-weight so that puts a big asterisk on the one day reversal. At the current level of 1852 in the S&P, next support is at the 30-day moving average, last at 1846. Resistance can be found at 1866.52, Friday’s closing price… Moving on, the Dow remains near session-highs, while volume has picked-up a bit, (remember tomorrow is a huge Quad-witch/S&P re-weight day), with 265M shares on the tape at this time… Internally, breadth is mixed with issues and volume bearish while new highs to new lows are bullish (positive divergence). Advancing Issues: 1262 / Declining Issues: 2949 — for a ratio of 0.4 to 1. New 52-Week Highs: 103/ New 52-Week Lows: 35… Meanwhile, in the trading pits, Gold is near a five-week low amid the firmer dollar… By the way, on Friday, NYSE total volume exceeded 2 billion shares(!), and over 1 billion were executed on the close(!!). A huge day, indeed… Have a tremendous day!

John’s Options Commentary: Friday afternoon the Emerging Market ETF (EEM)saw a large spread trade. With the EEM trading $39.16 an investor sold May 37 puts on the fund at 60 cents to buy the May 40-41 call spread for 40 cents, 28,000 times. The three way, at 20 cents, appears to be expressing a bullish short term outlook for emerging markets as well as hinting the EEM may have bottomed. Breakeven is $36.80 (37.00-.20) while the ideal close at May expiration is with the fund at $41.00. The maximum profit potential is $1.20 with the investor collecting 60 cents on the sale of the puts and 60 cents on the call spread. Across the board, option markets are fairly quiet today. In individual names, the flow is mostly focused on April upside calls. It looks as if investors are betting on rebound in equities over the next 4 weeks-We shall see! With today’s slide, the VIX has popped, up .93 to 15.93, right near resistance of 16.00.

Sector Highlights brought to you by http://www.streetaccount.com/

• Healthcare the worst performer with the S&P Healthcare Index (1.7%)

o Biotech underperforming and continuing its recent move lower, with NBI (4.1%) and BTK (3.6%). Recall the space came under heavy selling pressure on Friday, attributed to concerns about government pushback on pricing and valuation concerns. IDRA (23.9%), ARWR (20.3%), GALT (15.4%), NVAX (11.1%), ITMN (7.1%) and INCY (6.2%) among the notable decliners today. Note ARWR began dosing in Phase 2A trial of ARC-250 in chronic hepatitis B patients. GALT reported earnings and filed a $100M common share shelf. BIIB (4.3%) and GILD (1.8%) both continuing their moves lower as well.

o Pharma underperforming with the DRG (1.3%). ENDP (6.4%), MYL (4.2%), BMY (2.4%) and ACT (2.4%) the notable performers.

o Managed care lower with the exception of WLP +0.8%. Recall the space rallied last week on the back of the latest exchange enrollment figures, dampened risk surrounding Q1 earnings and relative valuations. HNT (2.5%), WCG (1.8%) and CNC (1.6%) leading the space lower today.

o Other notable performers: HCA (2.3%), MCK (1.9%)

• Consumer discretionary underperforming with the S&P Consumer Discretionary Index (1.4%)

o Homebuilders underperforming with the XHB (1.4%). Recall the space underperformed last week on the backup in rates. KBH (3.9%), BZH (3.1%) and SPF (2.9%) leading the way lower this morning.

o Retail underperforming with the S&P Retail Index (1.9%). WTSL (9.7%) leading the apparel space lower on a downgrade at B. Riley. Recall the stock fell ~11% on Friday after it reported earnings. ARO (2.2%) and EXPR (1.9%) the other notable decliner, while JOSB +0.1% outperforms. Housing-related space led lower by PIR (2.3%) and LL (1.7%). The latter continuing its move lower from Friday, when it fell >4%. Dollar stores underperforming with DG (2.3%) and DLTR (1.1%). BBY (2.5%) and HGG (1.9%) the notable performers among the CE names. Department stores lower with the exception of BONT +5.1%. Buckingham had a positive note out on the stock, saying it sees the potential for an acquisition of the company. SHLD (2.6%) and M (1.5%) the notable decliners.

o Media space underperforming. DISH (4%), AHC (3.7%), MNI (3.6%) and GCI (2.3%) the laggards.

o OTAs underperforming, with TRIP (3.7%), PCLN (3.6%) and EXPE (3.1%).

o Apparel and accessories led lower by KORS (4%), TIF (3.1%) and MOV (3.1%). TIF was removed from the Conviction Buy List at Goldman Sachs.

o Restaurants lower with the exception of MCD +1%. WEN (2.8%), CMG (2.7%), SONC (2.2%) and GMCR (2.2%) the notable decliners.

• Tech underperforming with the S&P Information Technology Index (0.9%)

o Hardware: IBM +0.8% the best performer. AAPL +0.7% faring well on back of positive mention in Barron’s (UBS also positive) and WSJ report on TV-streaming talks with CMCSA (0.8%). NTAP (3.7%) lagging on the Morgan Stanley downgrade. EMC (0.9%). HDD names weaker with STX (1.9%) and WDC (1.5%).

o Semis: Mostly weaker after last week’s outperformance. SOX (0.4%). LEDs lagging with RBCN (1.8%), and CREE (1%). FSL (1.9%), TXN (1.2%) and SNDK (0.3%) some of the other notable decliners. CRUS +1.3%, MU +1.2%, BRCM +0.9% and MXIM +0.5% among names bucking the trend.

o Software: Most of the SaaS names have lagged today. Note a lot of the momentum groups in the market have underperformed over last couple of days. ADBE (2.3%) and CTXS (1.6%) leading the move lower. JIVE (4%) another big decliner.

o Internet: Group largely under pressure. P (7.5%), NFLX (6.7%), LNKD (4.8%), FB (4.4%), ANGI (3.9%) and YHOO (3.4%). Nothing specific behind selloff. WSJ discussed threat to online advertising from bogus traffic.

• Financials relatively outperforming with the S&P Financials Index (0.4%)

o Banking group a tad firmer overall with the BKX (0.2%). Recall group put in a strong performance last week with the backup in yields stemming from the FOMC developments. Loan growth dynamics also seemed supportive (though C&I did slip in latest weekly Fed data). Capital returns in focus this week with the CCAR results on Wednesday. JPM +0.6% the standout among the money center anmes. BAC (1.1%) a laggard following a downgrade at Atlantic. Firm cited strong performance over past year, along with weakness in FICC and poor stress test performance. Also upgraded USB +0.4% and WFC (0.2%). ZION (2.8%) downgraded at BMO. STT +1.6% extending its recent outperformance vs the trust group. Investment banks lagging with MS (1.2%) and GS (0.9%).

• Energy outperforming with the S&P Energy Index (0.02%)

o Brent crude slightly higher at $107.25, up $0.33.

o Majors mixed. XOM +0.6% and CVX +0.3% outperforming, while OXY (0.6%) and HES (0.4%) among laggards.

o Refiners mostly lower, giving back some of strong mtd gains. WTI-Brent spread narrowing today. WNR (2.3%) and HFC (1.7%) sharply lower, but MUR +1.5% outperforming.

o Coal mixed. JRCC +10.2% rallying, while WLT (1.1%) and ANR (0.3%) lag.

o E&Ps mostly lower. KWK (7.6%) and PXD (3.1%) continuing recent weak performance. GDP (2.5%) underperforming after announcing CMR 8-5H-1 well results and providing an operational update in the Tuscaloosa Marine Shale. XEC (2.7%) reaffirmed Q1 and FY production. FST +1.6% outperforming.

Oil services broadly lower with OSX (0.8%). CAM (1.4%) and TDW (1.3%) among the laggards. NBR +0.5% trading higher despite saying it expects Q1 EPS to be below consensus. WFT +0.2% higher after announcing the sale of pipeline and specialty services business for $250M to BHI (0.5%). SLB +1% continuing strong recent performance.

Humph. Rough start for many yesterday--

Top Industry Groups Take Big Hits In Market Sell-Off Few top industry groups were spared Monday as stocks across the board got hammered again, picking up where they left off on Friday. Biotechs, ranked No. 1 among the 197 industry groups tracked by IBD, sank more than 4% Monday as Alexion Pharmaceuticals (ALXN) and Biogen Idec (BIIB) extended losses ...

--but this morning futures are flat/upbeat for stocks & metals--

US stock futures see quiet trade USA TODAY - 3 hours ago U.S. stock futures were in a narrow range while Asia markets also traded little changed on Tuesday

--so the adventure continues. More headlines:

Asian stocks in defensive mode; global worries weigh Reuters India - 8 hours ago TOKYO (Reuters) - Shares were in a defensive mode on Tuesday on uncertainty over Ukraine and the global economy,Survey: Economists see US growth pickup this year Washington Observer Reporter - 7 hours ago WASHINGTON, D.C. - With the pace of U.S. economic growth seen speeding up later this year and next, many business economists expect the Federal Reserve to end its bond purchases

Retail Job Growth Illusion: More Workers, Fewer Hours The rank-and-file retail workforce has never been through an employment drought like the kind seen in the past two years, outside of a recession or its immediate aftermath. While retail-industry woes are a regular news staple, the sector's addition of 308,000 nonmanagerial jobs from December 2011 ...

U.S. stock-index futures rose, after the Standard & Poor’s 500 Index fell for two days, as

investors awaited data on consumer confidence and new-home sales.

Walt Disney Co. climbed 1.9 percent after agreeing to buy Maker Studios, a supplier of online video content to YouTube. Sonic Corp. rallied 7.1 percent after the owner of drive-in restaurants posted second-quarter earnings yesterday that beat analysts’ estimates. Netflix Inc. dropped 1 percent following

its biggest decline since October.

Futures on the S&P 500 expiring in June added 0.3 percent to 1,855.4 at 7:42 a.m. in New York. Dow Jones Industrial Average contracts increased 58 points, or 0.4 percent, to 16,260 today.

“It’s the quiet before the storm,” said Andreas Nigg, head of equity and commodity strategy at Vontobel Asset Management in Zurich. “Investors will be looking for more confirmation that the U.S. economy is gaining traction as we head into spring. The economic data will be closely watched.”

The S&P 500 slid yesterday as economic data signaled a slowdown in American manufacturing and biotechnology shares slumped. The benchmark index lost 0.8 percent in the last two days.

A U.S. report at 10 a.m. in New York will probably show the Conference Board’s consumer-confidence index rose this month, according to a Bloomberg News survey of economists. Consumer spending accounts for about 70 percent of activity in the world’s largest economy. New-house sales declined last month after rising in January to the highest level since July 2008, a separate report may show.

European stocks rose, following their biggest drop in more than two weeks, as investors awaited

American data to gauge whether the world’s largest economy has rebounded from the harsh winter. U.S. index futures also climbed, while Asian shares were little changed.

EasyJet Plc gained the most in four months after forecasting that its loss will narrow in the six months through March. Luxottica Group SpA advanced 4.3 percent after saying it will design spectacles that use Google Inc.’s Glass technology. Baloise Holding AG increased 2.6 percent after the Swiss insurer

unexpectedly increased its dividend.

The Stoxx Europe 600 Index rose 0.9 percent to 327.32 at 10:57 a.m. in London. World equities have regained $2.7 trillion since a low on Feb. 4 as economic data improved and concern dissipated that Russian President Vladimir Putin will seek territory beyond Crimea. Stocks have still lost $270 billion

globally so far this year. Standard & Poor’s 500 Index futures increased 0.2 percent today, while the MSCI Asia Pacific Index slipped less than 0.1 percent.

• Support:1846, 1836, 1812

• Resistance: 1870, 1883, 1907

Consumers in the U.S. are showing a renewed willingness to borrow that bodes well for the shares of banks, according to Pavilion Global Markets Ltd.

The CHART OF THE DAY compares year-to-year percentage changes in household debt, as compiled by the Federal Reserve, with the price-to-book-value ratio for the KBW Bank Index. The latter gauge compares the index with the total value of assets owned by its 24 companies after subtracting liabilities.

Household debt rose in the third and fourth quarters of last year from year-earlier levels. The consecutive increases were the first since 2008, when the bursting of a debt-fueled bubble in housing triggered a financial crisis.

The revival is “the most critical structural force impacting banks,” Pierre Lapointe, Pavilion’s head of global strategy and research, and two colleagues wrote yesterday in a report with a similar chart.

Greater demand for loans will help the banks deal with interest-rate increases and the effect of the Dodd-Frank Act’s regulatory changes on their business, the Montreal-based firm’s analysts wrote.

Even so, regional lenders may lose a valuation advantage over larger banks because they are more dependent on consumer deposits and home mortgages, the report said. A regional-bank index compiled by KBW was at 1.6 times book value yesterday, according to data compiled by Bloomberg. The ratio for KBW’s bank index, tracking the largest companies, stood at 1.2.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.