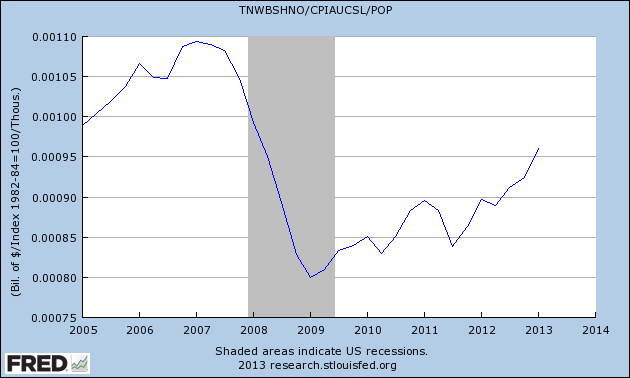

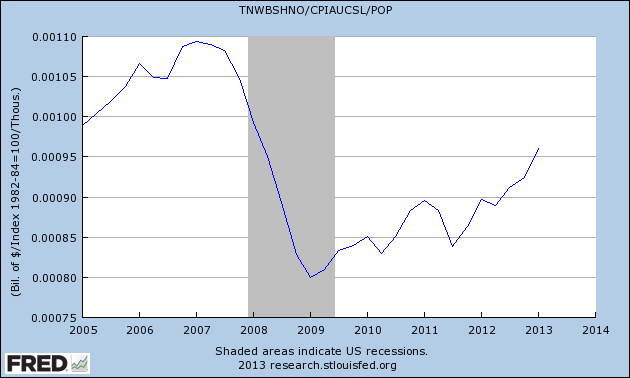

That $70trillion is not only inflated dollars but it's spread across a bigger population. Correcting for the CPI and population growth--

--we're seeing per capita real net worth still way behind where we were.

Wealth gains don’t translate into similar amounts of higher spending.

And that number may well continue steadily to increase even as actual assets decrease in real value. The soaring of the stock market and the increase in RE values is arguably merely the primary price effect of the current inflation.

The aren’t spending it because the present trajectory of events and policy scares every rational person stiff. Moreover, this trajectory takes us right into Rampant Inflation Land, that means the direct destruction of all wealth stored in any form of money.

Financial crisis

2008 - 2016

You’ve all heard of double-speak. This is at least quadruple-speak.

While this may be true, and I will admit to having a very hard time believing it, it’s like being thrilled for having $1000.00 when by rights you should have had $1333.00.

We have 23.5% of our potential workers out of work. None the less, these entities whoop it up and make happy faces for all to see.

I AM NOT impressed.

Some have barely more than they used to giving strength to this shameful announcement, and one third have nothing. Who heralds that? Certainly not these Orwellians.

I'm typical of retirees and others who worry about future resources. Used to be, money in the bank generated at least 4% interest that could be depended on. That was money that was spent by those on fixed income.

Now, with interest rates so low, the assumption is that you have to hold on to and increase savings as much as possible.

That $70trillion is not only inflated dollars but it's spread across a bigger population. Correcting for the CPI and population growth--

--we're seeing per capita real net worth still way behind where we were.

Fear of coming inflation, rational or not, plays into the saving over spending mentality. Baby boomers and even younger generations are focused on high tuition costs for their offspring (and are treated to daily horror stories about student indebtedness), and on spiraling medical costs, a big consideration for those who are getting into their 50s and 60s.

A high priority for many, given their fear of a relapse in the overall economy, and/or their fear of rising taxes at the federal, state, and local levels, is to become debt-free -- with the possible exception of a mortgage on their primary home, and even there, some are aggressively paying down their mortgages, and/or refinancing to shorter-term (10 or 15 year) fixed-rate mortgages.

With that sole exception (and mostly because mortgage payments are still treated -- for now, at least -- favorably by taxation policy), the goal for many is to get out of all debt, despite the fact that financing rates on big-ticket items such as cars, home improvements, and appliances are at a near-record low rate. Whether this reflects an overly cautious attitude, or a prudent one, the fact is that many people are absolutely refusing to use their credit. No margin account with their broker; no new car unless or until they can pay cash; and obviously, no credit card balances being carried. And so, spending gets cut across the board -- dining out; vacations; clothing; home furnishings.

At the lower end of the socio-economic scale, such economies are not matters of choice, but necessity. What seems to have changed (if you buy the premise of the column -- and I largely do) is that those who can spend are increasingly opting not to.

Higher still in the socio-economic spectrum, sales of super-yachts and private jets are growing. But I see a great deal of caution in the upper-middle class, and even among those who are economically comfortable, but a notch short of great wealth.

And the elephant in the room: we have $110T+ in unfunded liabilities. It took ~100 yrs. for the ‘promises’ of the 2-party cartel to have stripped each and every one of We the People of any/all Posterity; with nary a peep from Peter nor Paul in the process.