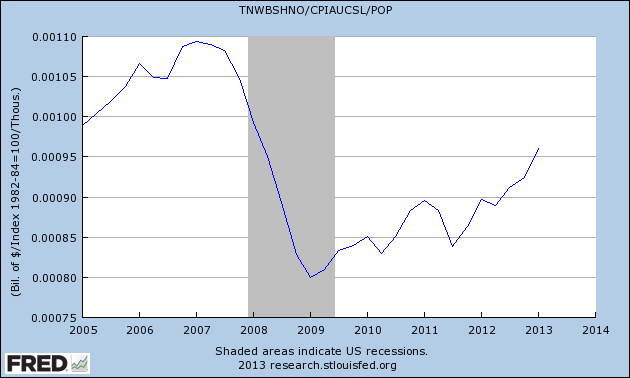

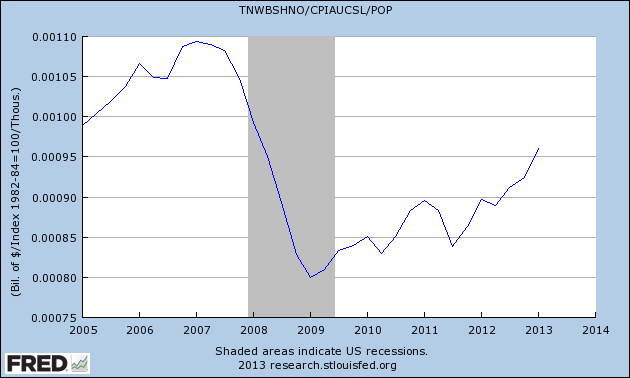

That $70trillion is not only inflated dollars but it's spread across a bigger population. Correcting for the CPI and population growth--

--we're seeing per capita real net worth still way behind where we were.

Posted on 06/18/2013 5:50:17 AM PDT by SeekAndFind

In the economic history of our time, June 6, 2013, ought to occupy a special place. That’s the day the Federal Reserve disclosed that the net worth of American households — the value of what they own minus what they owe — hit $70 trillion, a record that exceeded the previous peak before the 2007-09 financial crisis. Higher stock prices and a long-awaited housing recovery are slowly restoring Americans’ lost wealth. By all rights, this symbolic crossing ought to improve confidence, prompt consumers to spend more freely and increase the economy’s growth.

Maybe it will. But don’t hold your breath.

The “wealth effect” isn’t what it used to be. For those who have forgotten, this refers to households’ tendency to spend some part of their increased real estate and stock market wealth and thereby boost the economy. During the boom years, Americans borrowed lavishly against rapidly appreciating home values. One Federal Reserve study estimated the extra cash at $700 billion annually from 2001 to 2005. Now psychology has changed. Careless optimism has given way to stubborn cautiousness. Wealth gains don’t translate into similar amounts of higher spending.

(Excerpt) Read more at washingtonpost.com ...

No you’re not wrong.

This is why inflation is relatively low. When people do start spending money freely watch out.

You’ve all heard of double-speak. This is at least quadruple-speak.

While this may be true, and I will admit to having a very hard time believing it, it’s like being thrilled for having $1000.00 when by rights you should have had $1333.00.

We have 23.5% of our potential workers out of work. None the less, these entities whoop it up and make happy faces for all to see.

I AM NOT impressed.

Some have barely more than they used to giving strength to this shameful announcement, and one third have nothing. Who heralds that? Certainly not these Orwellians.

I'm typical of retirees and others who worry about future resources. Used to be, money in the bank generated at least 4% interest that could be depended on. That was money that was spent by those on fixed income.

Now, with interest rates so low, the assumption is that you have to hold on to and increase savings as much as possible.

Anything to get your way out of them. Took us 7 years of hard work, a refi was part of the plan. Now it and all financial debts are gone.

You don't want to be in late in life and have a Mortgage around your neck!

That $70trillion is not only inflated dollars but it's spread across a bigger population. Correcting for the CPI and population growth--

--we're seeing per capita real net worth still way behind where we were.

On Individual Mortgages? - your whistling Dixie.

When it does happen it is collapse no matter if you had short or long term debt.

Not for those on fixed interest rates or those having no mortgages or better yet no debt.

Fear of coming inflation, rational or not, plays into the saving over spending mentality. Baby boomers and even younger generations are focused on high tuition costs for their offspring (and are treated to daily horror stories about student indebtedness), and on spiraling medical costs, a big consideration for those who are getting into their 50s and 60s.

A high priority for many, given their fear of a relapse in the overall economy, and/or their fear of rising taxes at the federal, state, and local levels, is to become debt-free -- with the possible exception of a mortgage on their primary home, and even there, some are aggressively paying down their mortgages, and/or refinancing to shorter-term (10 or 15 year) fixed-rate mortgages.

With that sole exception (and mostly because mortgage payments are still treated -- for now, at least -- favorably by taxation policy), the goal for many is to get out of all debt, despite the fact that financing rates on big-ticket items such as cars, home improvements, and appliances are at a near-record low rate. Whether this reflects an overly cautious attitude, or a prudent one, the fact is that many people are absolutely refusing to use their credit. No margin account with their broker; no new car unless or until they can pay cash; and obviously, no credit card balances being carried. And so, spending gets cut across the board -- dining out; vacations; clothing; home furnishings.

At the lower end of the socio-economic scale, such economies are not matters of choice, but necessity. What seems to have changed (if you buy the premise of the column -- and I largely do) is that those who can spend are increasingly opting not to.

Higher still in the socio-economic spectrum, sales of super-yachts and private jets are growing. But I see a great deal of caution in the upper-middle class, and even among those who are economically comfortable, but a notch short of great wealth.

And the elephant in the room: we have $110T+ in unfunded liabilities. It took ~100 yrs. for the ‘promises’ of the 2-party cartel to have stripped each and every one of We the People of any/all Posterity; with nary a peep from Peter nor Paul in the process.

Exactly. That's the customer base for our stores, and they are spending much more carefully than they did even two years ago.

Since it became apparent - around last June - that Obama was likely to be reelected, discretionary retail spending has fallen sharply. Most of the retail sales "up" figures you hear in the MSM are about price increases for gasoline and food.

The last election campaign featured great angst over the loss of manufacturing jobs. The number of U.S. manufacturing jobs has fallen, but it has little to do with outsourcing and a lot to do with technological innovation — and it’s a worldwide phenomenon. During the seven years from 1995 through 2002, Drezner notes, U.S. manufacturing employment fell by 11 percent. Globally, manufacturing jobs fell by 11 percent. China lost 15 percent of its manufacturing jobs, and Brazil lost 20 percent. But guess what. Globally, manufacturing output rose by 30 percent during the same period. Technological progress is the primary cause for the decrease in manufacturing jobs. -Walter E Williams

Well China now produces and exports more than America.

We are the world’s leading importer.

Which means basically, we are giving China the historic lead.

Call it what you will, I am sure as heck ready to bring back American manufacturing.

Now.

Are there actual numbers on that or is that just someone's 'feeling'?

I saw it on a website a couple months ago.

Let me look.

Here’s one link.

Sign me up! I can't wait to quit my job as a software engineer!

The "tradable goods" balance is all defined by what you consider a "good". What you want us to do is the equivalent of going long on whale oil in the late 1800's.

The downside to automation is that, eventually, there won’t be anything left for human people to do. You may call this a Luddite fallacy, but the logic is inescapable: Returns to productivity get undermined by ever larger pools of people unable to generate an income stream. You say there will be more need for people to service the robots, but that requires a baseline cognitive profile that is likely higher than what we have now (thanks in big part to immigration-fueled dysgenia), or higher than what we needed in the past when new tech supplanted older tech.

With all due respect to your professional accomplishments, how about we bring back some jobs, and work to decrease our unemployment rate, toward what is was?

And meanwhile, even out our terrible trade balance.

We are not moving forward right now.

What’s really needed is a nice long war between China and India. That’ll even things out. :-)

And you’ve described me to a “T”. I’ve become allergic to debt and financial obligations. Shoes have dropped on me twice in twenty years and what is coming next is Imelda Marcos’ whole closet.

The same can be said for a lot of major corporations which are currently sitting on a lot of cash. Apple, Johnson & Johnson, and Chevron are examples.

Some people (including "activist" shareholders) criticize them for not hiring, not building new plants, not buying other companies, not leveraging their assets in the current low lending rate environment, or not increasing their dividends. I make no such criticism, however -- they may well see hard times on the horizon. I wouldn't blame any person or any corporation for not taking needless risks in the current environment.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.