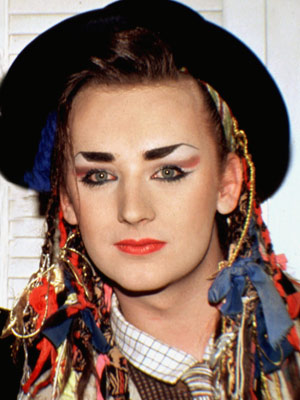

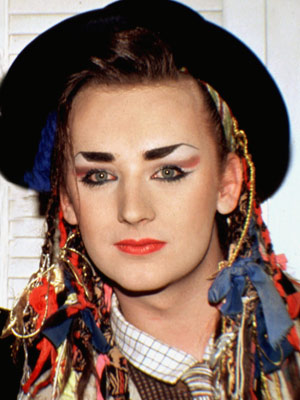

1983

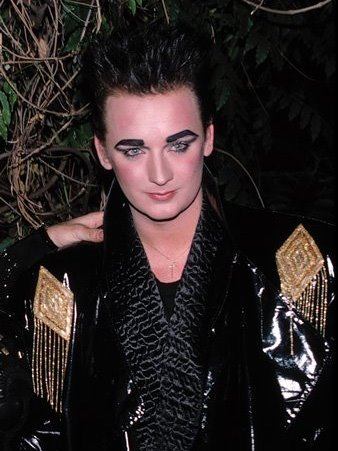

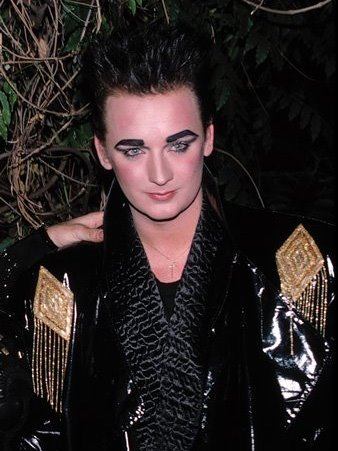

1986

1992

2001

2011

2012

Posted on 11/24/2012 5:33:22 PM PST by upchuck

[Note: This editorial published on Nov 10, 2012]

We are now rushing down a course that is going to create incredible economic hardships for millions of Americans. The increase in the amount of debt that has been added to our economy is astronomical. And there is no end in sight. We now have over $16 trillion of debt, and with Obama’s policies it will be almost impossible to reverse that course.

Debt is the problem. Big debt is a big problem. There are only four ways to tackle it: increase taxes to bring in more dollars, reduce spending to save dollars, reduce entitlements to save dollars, and/or increase job growth which will result in more overall tax dollars coming in to the government.

Increasing taxes in the immediate future is going to be highly counterproductive in that it is going to put a damper on job creation by removing money from the private sector, which in the long run is the only sure way out of this mess.

Reducing entitlements will most certainly have to take place, but is going to be very difficult due to all the lobbying pressures and the fact that Obama has no intention of doing so. Obamacare will make the situation much worse.

Reducing other spending offers some avenues to help fix the problem, but the impact of such reductions will be smaller and will, again, take time to become effective.

Increasing jobs so as to increase revenues is really the only way out. But this would take quite a number of years to accomplish even with someone who knew what he was doing at the helm. Obama is not that person. He doesn’t know how.

At the very least, after another four years the debt load this country will be carrying will be well over $20 trillion dollars. This is close to an impossible load to bear. Our tax base right now, in a good year, is only $2.5 trillion, and in a bad year is around $2 trillion. That means we have a debt to income ration of 8 to 1 or 10 to 1.

In addition, we are spending about $3.5 trillion per year, which means we are borrowing about 40% of everything we are spending. It’s pretty hard to pay off any debt when you are doing that. And how long can that be sustained?

The crux of this problem is that we are unable to deal with the huge debt without facing massive inflation. The big debt has led us right into the ugly face of inflation, the major problem we face.

Generally speaking the amount of money in an economy should be enough so that products and goods and services can be paid for with the existing supply. If the amount of product goes up, it stands to logic that there should be more dollars printed and put in circulation to go with the demand for those products. However, if a great deal more money is printed than would fill that demand, then inflation will follow. For example, if we say that $100 is equal to 1/10th of an ounce of gold, and you print more dollars and don’t add any more gold to the pile, then each dollar will buy less and less gold as the dollar becomes inflated.

In the past four years, we have done just that. Since 2008, our monetary supply has increased over 300%. This is a great more money than was needed to keep up with any increase in the supply of goods, which certainly did not increase by anywhere near 300%. Unfortunately, a great deal of this money was just wasted. What we got instead was just a lot of debt.

In addition, it needs to be noted that 36% of the debt owed by the U.S. has a maturity of less than one year. That makes it subject to frequent refinancing, which will have a severe impact as interest rates go up. The higher rates will make it necessary to print more money to pay just the interest, which in turn will add to the inflationary pressures.

We are all living just now in a ‘dollar bubble’ which is equal in specter to the ‘housing bubble’ and ‘stock market bubble’ we have recently experienced. We are living in a ‘bubble economy,’ no matter how it feels. It is always hard to see the ‘bubble’ when you are inside it. But it would be prudent to plan for it even if it is hard to see and difficult to believe.

It’s going to happen. Massive, high inflation is coming. There is no stopping it now. The “dollar bubble” is going to pop.

1983

1986

1992

2001

2011

2012

Such is the danger of fiat money. You are correct, for a short time after this happens, cash will be king. For a short time. Know that time when it comes and use the cash you have on hand (stock up!) to convert to real, tangible assets. The real problem is, when the fiat money hyper inflates, the price of gold and silver will rise 1000%.

-—— There are only four ways to tackle it: ——

That is as far as was necessary to read. He left out the only way to reduce the debt. The way is time tested and proven over and over. The process is and has been working for sometime and will increase.

The way is devaluation. The US$ and other mainstream countries will continue to devalue at an increasing rate. The value of the debt will become less and less in real terms until it is manageable by the methods the author noted.

Obagoober can't exactly sell it to the Chicoms but the entire federal power infrastructure is saleable in several chunks ~ (1) operating rights, etc. ~ just like any building.

Keeping “mattress money” in a safe place at home, has many advantages.

To start with, nobody can refuse to give you your money. In the Great Depression, some “bank holidays” lasted from 3 to 300 days. A long time to not be able to access your money. And now, banking regulations have changed so that not only can banks, on their own, declare a holiday for up to two weeks, but they may even refuse to remit “demand funds.” Mattress money can also be converted quickly, if there is inflation, deflation, or panic.

Second, while the government has lusted for a “cashless society” for decades, large segments of the economy want nothing to do with virtual money. While they are seemingly dwarfed by the huge virtual money flow of the virtual economy, in real terms, “they are real”, whereas much of the virtual economy is “imaginary”. Our society cannot exist without this “real” cash economy.

Third, the credit portion of the virtual economy, while enormous, is terribly weak. A credit card company may make $3b in profit every year, but there is no way they could possibly underwrite their cardholder’s debt of hundreds of billions of dollars. So the cc companies have to issue bonds, currently regarded as the “next safest” bonds to USG Treasury bonds.

These bond issues are offered at auction, and the fragility of the system is seen every now and then, when a bond auction “fails”. A single auction failed a few years ago. Immediately the cc companies went into “full panic mode” to reduce their cardholder exposure. They started by canceling hundreds of thousands of inactive cards. They then did a reassessment of cardholder “blocs”, each of which has hundreds of thousands of cardholders in it, to calculate which blocs were least profitable, so should be canceled first if more auctions failed.

Millions of Americans live “a month behind”, paying for this month’s rent, groceries and gasoline by credit, then paying off their cc bill when they are paid. For them to lose their credit cards would mean their financial ruin.

It is estimated that the cc companies could withstand the failure of 3-5 auctions before they went bust.

Still, if you want milk and baby goats you gotta’ have a stable breeding group ~ so, more than one fully potent male sheep is going to be around, somebody in the block will have them ~ and God help them if they try to live indoors with them!

Still, if you want milk and baby goats you gotta’ have a stable breeding group ~ so, more than one fully potent male sheep is going to be around, somebody in the block will have them ~ and God help them if they try to live indoors with them!

I have long been a great fan of Samuel Clemens (Mark Twain). Always remember what Twain said, “The Earth is the insane asylum of the universe.” You’re not crazy, you are just trying to survive in a crazy world and it gets crazier every day.

In an earlier, more sensible time people who were unable for some real reason to earn their own way were offered a home at a “poor farm”. My parents used to joke about being “headed for the poor house” when things were tough. That is really the only reasonable way to provide for such people and it was a dark day when we allowed someone to suggest that such persons should be given cash to spend on their own. You don’t give small children money and tell them to go out and buy groceries, you buy the groceries and prepare a meal for them or you take them to an eating place and supervise them. Adults who are unemployable should be treated the same way.

We have millions of “EBT” cardholders who will solicit to sell their benefits at half price to raise cash to spend on drugs, alcohol, concert tickets, fancy wheel spinners, tattoos and the list goes on and on. This is what actually goes on even as the number of “EBT” cardholders continues to rise at a rapid rate. Anyone looking at this country from a disinterested perspective must be morbidly fascinated by the sight of such a looneybin.

Two things: first of all, gold and silver will not inflate 1000%, because inflation is tied to currency. So it could be 10,000%, 100,000%, etc. Think in dynamic terms. With inflation, gold and silver will track inflation, probably plus a little. But with hyperinflation, starting in commodities including gold and silver, the brakes have failed. The sky is the limit.

However, this starts invoking the laws of economics, such as Gresham’s law. This could mean that even though gold might be thought of as worth $1m/ounce, *nobody* will sell their gold for that amount, because it is stable, and currency is not. So everyone would spend their currency as fast as they could, it being the “bad money”, and nobody with gold will part with it, because it is “good money”.

In turn, this creates a “convertibility crisis”, where gold is so valuable that nobody can “make change” for it. This means that gold becomes dependent on other “good currencies”, whether they are actually currency, or commodities.

Like I said, this has all the hallmarks of tin foil hat thinking, but I can’t really establish a better motive to explain all the actions that I’m watching.

No tinfoil needed, as you're spot on. I've been thinking this same thing for some time now. They cannot defeat America externally, but if you elect one of THEM, or a Senate full of THEM, and a House full of THEM, they can defeat america legislatively. All they have to do is lie their way into office.

Hey! If you look closely at your chart, you can tell when Newt was in charge of the House.

“And nobama’s plan to handle the dollar bubble is...? “

QE Infinity. With a minimum wage of $500 p/hr, a lot of old debt can be paid off fast.

I like John Wesley Rawles' suggestion; Invest in gold chains of various link sizes...24k preferably. When gold is worth millions per ounce, purchases can be made by one, two or thre small links...or a larger link and 1 smaller link, etc, etc. Snip them off as needed to barter.

However, that is not the proper use for gold. It should only be used to "buy back in" to whatever economic system replaces the one we are going to see collapse. Or whatever currency replaces the dollar. Asset protection is the key.

Pointless.

Grains are for selling, and then only worth the time if you have acres of land and water. Best if sold as booze as it keeps and transports better.

Think in terms of beans, squash, pork and poultry. That is the diet of the subsistence farmer.

This is why I am such a big proponent of scrip.

http://en.wikipedia.org/wiki/Scrip

Scrip is legal in the US, and a modern version of it could, at a local level, be invaluable in keeping markets functional, maintaining asset and commodity (including gold and silver) value, and even keeping local government essential functions (police, fire) operating.

It just needs an organization that is trusted, and “buy-in” from retailers and the public that uses it.

It is a controlled market, so no inflation or deflation, can have respectable encryption security, even a scheme to prevent hoarding. Indirectly it can provide supplies that are not produced locally, like pharmaceuticals, at a lower price by bulk purchases.

I strongly encourage gold and silver investors and preppers to study up on scrip, as a huge insurance policy for what they are doing.

“Greengargoyle”...may I use that one?

The Republicans will win the White House in 2016, and it makes no difference at all who is the Oval Office figurehead. Even Congress obeys the sources of their reelection money.

It’s always been this way.

The trick is to predict how the Big Money going to manipulate the system, and ride their coattails for a tidy profit. (I bought gold years ago, averaged at $400/ounce, for instance. Wouldn’t touch it now, and have no interest in selling my holdings. When the peasants are allowed adult jobs again, inflation will kick in big time...)

McKinley tried to buck the system, and see where it got him?

That is true, hopefully a little fruit off a tree or vine for variety occasionally

America gave a Chicago thug the keys to the Treasury, and now they’re surprised he fleeced it? Cry me a river...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.