Posted on 04/23/2011 5:11:22 PM PDT by blam

Silver Black Swan If Rampant Speculation Is Not Reigned In

Commodities / Gold and Silver 2011

Apr 23, 2011 - 11:49 AM

By: Dian L Chu

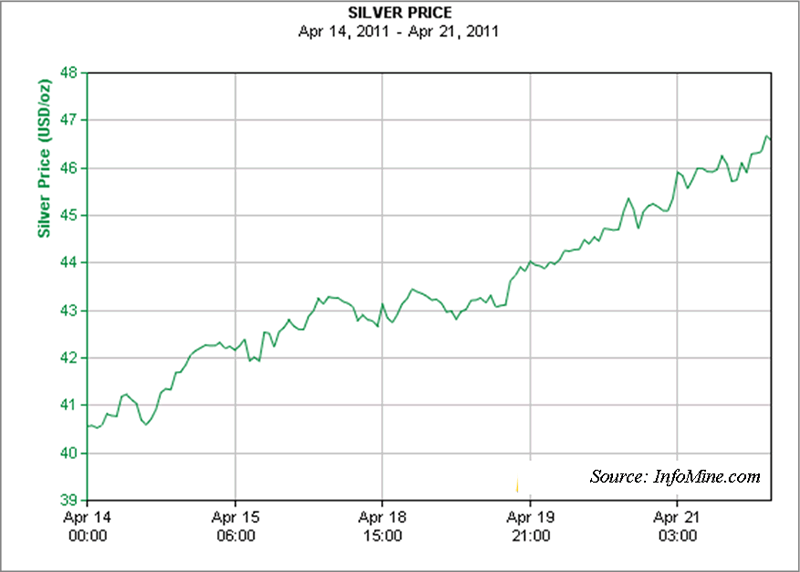

If you think the crude oil market has gone totally out of control in the past month or so, observe the Silver. The Silver market has basically gone parabolic the week of April 17, going from $41.75 on April 15th to $46.69 on April 21st--a 12% move in 5 trading days, topping off the move with a 5% move on Thursday (See Chart).

As Silver is a thinly traded market, one thing the CME could do is to raise margin requirements for Silver speculators; otherwise risk is setting up the silver market for an record-setting crash, which could impact many other markets in the process of correcting, especially other commodities like Gold and Crude Oil.

A Silver Contagion

We are not talking about a 5% correction setting up at these levels for silver, we are talking in terms of a 20% down day that poses a contagion effect to markets in general.

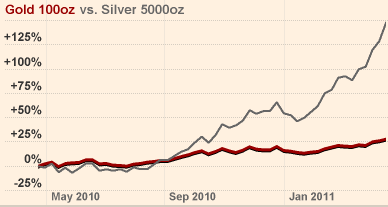

The reason the contagion risk in the Silver market is that while Gold is going up half a percent to one percent, Silver is logging in 3.5% days routinely (See Chart below). Well, what goes up, must come down... eventually. So, when this market breaks, it is going to break hard to the order of 10% easily.

That kind of market selling will not occur in a vacuum, especially since commodities have been trending up as a group, i.e., the same hedge funds and banks are trading all the risk-on commodities as well, like Gold, Copper, Crude Oil, Wheat, etc.

In other words, if Silver gets a 10% down day, which it almost will for sure, and if it isn`t cooled off considerably with proper margin requirements instituted by the CME, then, the rest of the commodities will be forced to overshoot to the downside as well.

ETF Trading & Portfolio Rebalancing

There are a couple of reasons for this. With the advent of commodity funds, silver is part of the basket of commodities in the funds. Also, because traders will not want to fight the tape, shorts will come in and take advantage of the selloff in Silver to push other commodities down through ETF trading vehicles.

Moreover, the same banks and hedge funds trading silver are also involved in the major commodity groups as well, and they will be liquidating other positions to keep their portfolios balanced with regard to risk. So expect a lot of portfolio rebalancing to take place if the Silver market drops 10% in a day across many hedge funds.

Price & Margin Out of Balance

The CME routinely sets margins based upon contract prices. So, if Silver goes up $10 more in price, then the ratio of margin to price goes down. In order to realign margins with the higher price, CME would raise the margins.

The reason this becomes a problem is that if price gets too far out of balance with margin requirements, the risk goes up, because traders will not be properly sized with regard to risk for a potential correction, and many trading accounts could be devastated due to overleverage.

Black Silver Swan

In addition, if Silver speculators are all heavily leaning towards one direction as the action of recent silver price movement suggests, then, there is an increased risk of a major market dislocation, thus creating a ‘black silver swan' day. That’s exactly the kind of event that exchanges try to prevent from occurring, as it is extremely unhealthy for markets, and bad for business.

It is obvious to anyone observing the Silver market that it is overheated to the Nth power. The longer CME ignores the problem, the worse the consequences will be down the line. When all the other risk-on commodity trades are putting in 1% days, and Silver is putting in 5% days, then you know the longer this goes on, the higher probability that this trade and market could end very badly.

Flash Crash 2.0?

As the very real possibility of a 20% two-day correction is moving towards becoming a very real probability, it could bring down a lot of other markets in the process. Remember, we had the flash crash around this time last year? Well, if the Silver market isn`t cooled off, it could potentially be one of the catalysts for another broad flash crash this year.

Raise Margin Requirements by 30%

The easiest way for the CME to lessen the probability of an epic crash in the Silver market, and the subsequent public and regulatory inquisitions, would be to raise margin requirements by at least 30%, as the starting point.

Actually, the CME could be a little late based upon the manner in which silver speculation has gone bizzerk, especially over the last trading week--the market has simply become parabolic. The CME could have raised margin requirements once Silver broke $40 an ounce, and without a doubt they should have raised margin requirements on the 14th of April, before this latest 12% weekly move.

The longer the CME fails to address the problems in the Silver market to rein in excessive speculation, the more risk there is of an extreme market crash. Just as I said before--"The white metal appears overbought and could be heading towards a bubble stage," and without QE2, that bubble would have formed and burst by now.

Silver A Screaming Short

With gold/silver ration setting new 28-year low record almost everyday in April, it looks like the necessary elements are already set in motion for another horrid crash and burn contagion scenario--but this time originating from Silver--due to the interconnected nature and electronic evolution of modern day markets. Any intervention effort by that time would most likely be futile in the face of a multi-market algo contagion.

Thanks for posting.

Let us not forget that the last time we had silver prices skyrocketing a dingbat Democrat was our President.

Obama is going to make Jimmy Carter look good!!!!!

Blam, I’m addressing my post to you, since we’ve talked before, but this post is really to everyone. For those who say that silver is in a bubble, or that silver is “over speculated” I say baloney.

Here’s why. Today, I went shopping, and I took the time to do some pricing. I looked at the price of meat, yeast, eggs, and a few other things, that I just took note of today.

Sirloin steak, used to be 2.29 on sale here (last two years), or about $2.89 regular, and as of today, was around $7.59 or so, not on sale. Yeast used to be 2.50/lb not on sale, and is now 5.99 regular, $4.00 was the sale price. Eggs used to be about $0.79/large dozen, now about $1.89 for a dozen medium eggs, not on sale. Gasoline has also gon up by about 150% or so. Last year veggie plants at the hardware store were about $2.00-$2.49 per pack, today they were nearly $4.00. I did not price them today, but two years ago, I checked the price of socks and undergarments, Socks were about 3.49 for a dozen, now they are about $7.00 for 8-10 pair. One brand of undergarment was $8.50 for 5 pair, now are 2 parif for $7 (And previous to that, 4 years ago, were 6 pair for 7.50).

The price of silver has NOT gone up. The dollar is merely dropping like a rock. Everything relative to silver, in food, fuel, clothing, etc., etc., has gone up by double to triple in the last two years. The recent food, fuel, and commodity gains and clothing retail prices have shot up in the last 30 to 60 days also, not just silver. the thing is, that the companies that were trying to hold prices down through Christmas, didn’t slam us all at once after new years, they’ve incrementally raised prices every few weeks, to not shock us (and to thwart anger and compete for customers), but the fact of the matter is that retail prices are up, whether or not some bureaucrat says they are. I’ve done my price checking, I keep a budget and am a very regular buyer. I have no reason to believe that silver (or gold, to say, “real money”), or any other good necessary for civilized life (soap, food, fuel, clothing, NOT ipads), will go down relative to the dollar. I believe there may be a slight drop as some people sell to capitalize on another good they may need, but it will not last long. People will flee further to PM’s if there is a depression, the demand WON’T go away. It never has (though it has been of less value to some), and probably never fully will, even if you can’t eat it. The fact is, people want stability, and fiat money never will provide it.

My two cents (worth less everyday).

“””Today’s problem are the speculators who ‘buy’ something, ie ETF’s, Oil, without the physical delivery.”””

The ETF takes physical delivery. Letting someone act as your agent has been part of business for centuries.

See my post at #23, I think it’s along the lines of what you were saying.

Raise margin requirements (again) on silver, but only on silver.

Yeah!....

Thats the ticket.

It’ll fix everything.

I bought some $35 silver the other night and thought I was in the Twilight Zone as I snapped it up.

I agree with you that there is likely to be a powerful silver dump at some point. From where, nobody can say.

But I also think that it is nothing to be feared because that dunp will be bought up, worldwide, like nothing we’ve ever seen (except Beanie Babies or Cabbage Patch dolls)

I sure as heck will.

“I believe this “bubble” is just getting legs, and won’t break until $150-$200/oz. silver is upon us. A 10-20% correction will not burst the bubble.”

Bears repeating. Plus, the amount of usable silver for trade (there’s more in the ground to be mined), has been rapidly diminishing in recent years, not to mention that it’s historic ratio to gold (1:15 or so) is off by a long shot, and that the amount of silver (due to use), in relation to gold (saved), is dropping fast. China has told it’s people to buy gold for personal investments, I’m sure people take that to mean silver too. There is no more reason to believe that silver will drop than there is to believe we’re in a “recovery.” In fact the reasons why both are patently false are one in the same, ironically.

Interesting. Thanks for posting.

I don’t have enough for 1,000 oz. but put me down for a bit more too.

Where did I say anything about the Democrat party?

I mentioned the left, who are socialists/communists and who attack the free market and capitalism whenever they can.

And I disagree with you. If you and I buy gold and silver, that is quite different from the mega-investment firms that I listed WHO USE TAXPAYER MONEY and NEWLY PRINTED FIAT MONEY to invest heavily in commodities.

What they are doing is manipulating the market, which should warrant an SEC investigation, not praise. You and I don’t have that kind of “capital” advantage. And they are at one in the same time printing new money, receiving it before the velocity of money increases, which means money is moving on the streets which is what finally results in inflation and the devalued dollar. Once again, it is the Corporate Socialists who use the newly printed money before it devalues to invest in something that will go up in value as the dollar devalues.

This is classic “central banking.” And that is why “central banking” is really “Socialist banking.”

Hell, yeah, republicans and democrats, they are irrelevant. What matters is money and gross profit PRIVATIZED while the losses are SOCIALIZED.

Huge difference between that and some schlep employee of a small firm speculating at what cotton will sell at in a year.

Yep.

The FED is a FASCIST socialist commie dream come true.

Fiat money is a ponzi scheme that is killing the middle class. Just like they WANT TO.

End the FED.

Debt slavery is not capitalism.

Why would this be a black swan? A “black swan”, in Taleb’s nomenclature, is an exceedingly rare event that almost no one expects or plans for.

Price is always a function of supply and demand; why fill vaults with silver instead of gold? Unless you think that gold is too high (which given the historical ratios, is an impossible case to make if you’re also saying silver is going to go higher).

True, silver moves on black swan events, it isn’t a black swan in and of itself. Further, on the link I posted, most of those events are not really black swans.

The Japanese Earthquake would be a black swan. The markets just seemed to shrug that off. The endless printing is not really a black swan. Will the markets continue to shrug that off (or eat it up, as the case seems to be)?

bttt

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.