Skip to comments.

Rotten to the core (Food and energy inflation cannot be ignored)

Market Watch ^

| 2/08/2011

| IRWIN KELLNER

Posted on 02/12/2011 7:24:14 AM PST by FromLori

It’s time to look at all prices — including food and energy.

One of the biggest canards ever to be foisted on the American people is the notion that removing food and energy from the price indexes provides a clearer picture of inflation.

In reality, it’s just the opposite.

The so-called “core” rate of inflation (the headline price indexes minus food and energy) is grossly misleading. It was designed in the 1970s to take our eyes off what’s really happening to prices so the Federal Reserve could maintain an ultra-easy monetary policy.

(Excerpt) Read more at marketwatch.com ...

TOPICS: Business/Economy; Front Page News; Government; News/Current Events

KEYWORDS: economy; energy; food; goldbugs; inflation

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-69 next last

To: thackney

p.s. if you really need someone to explain the article I will but I don’t think that’s the case is it? I know who you always agree with on site you two should post to each other.

41

posted on

02/12/2011 11:17:24 AM PST

by

FromLori

(FromLori">)

To: FromLori; Toddsterpatriot

You simply refuse to understand and accept that it IS used. It isn’t used for EVERYTHING, but the federal COLA calculations DO use it. I don’t know how to help you if you won’t read.

I understand Toddsterpatriot previous comment far better now.

Cheers.

42

posted on

02/12/2011 11:18:40 AM PST

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: thackney

lol I knew you were todds lackey did he tell you how I pointed out what a liar he is? Like I said you two should post to each other instead of continually harassing others.

43

posted on

02/12/2011 11:36:08 AM PST

by

FromLori

(FromLori">)

To: thackney

She has a few talking points which she'll repeat over and over, even when I show her they're wrong.

One of her favorites was the claim that banks were borrowing from the Fed discount window (at 0.75%) to buy long term Treasuries, because that was risk-free, easy money.

I reminded her that Bear Stearns and Lehmann Brothers thought that financing a long-term bond portfolio with overnight loans was a good idea too.

If I feel like it, maybe I'll show her how much those "risk free" long term Treasuries have dropped in the last few months. Show her how much that strategy would have lost since she first posted it, but the math would probably make her cry.

44

posted on

02/12/2011 11:48:31 AM PST

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: FromLori

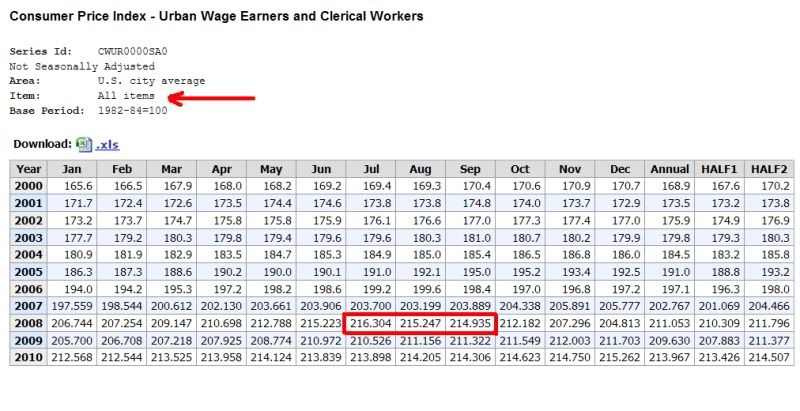

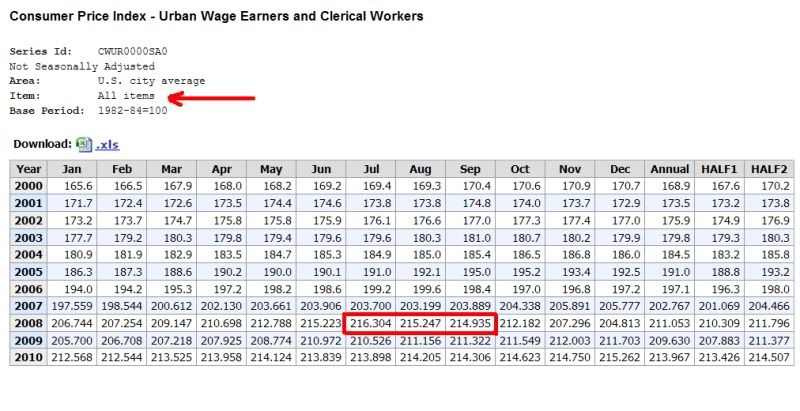

If Energy prices are NOT used, would you please explain the 5.8% COLA for 2009?

http://www.ssa.gov/cola/facts/colafacts2009.htm

What you apparently refuse to acknowledge is that federal COLA's are based upon each 3rd quarter CPI-W.

Prices have not gone up from that point in time, hence no COLA.

What did happen is those people got that price spike locked in for two years after gasoline prices went back down.

45

posted on

02/12/2011 11:53:50 AM PST

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: FromLori

46

posted on

02/12/2011 11:59:31 AM PST

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: Beagle8U

I contend that the CPI should be based on things that everyone buys just to survive. In other words, the retail prices of the things that most everyone has to purchase. Food, energy, housing, transportation, clothing, health care, etc.I profoundly disagree with your assumptions. Because in our economy, we do not have a singular choice, we have multiple choices for our 'standards.' If the rents are too high in the area I want to live, I choose a different place. If electricity goes up, I don't run the air conditioner as much, or make sure lights get turned off. When gas prices go up, I refrain from driving as much.

Your basket of goods is most affected by my consumer choices. And likely has the most competition in a consumer driven economy, and also has some of the most regulated prices. The true value of my dollar isn't reflected, nor is comparison even likely to be useful. The rents where I live would buy a large home in most parts of the country, but have been stagnant for the better part of three years. My electricity rates are far lower than most parts of the country, and my home heating costs are negligible.

But you can go down to your mom and pop convenience store and tell me what the price of a candy bar is, and likely, it's going to be the same price as it is here. Or go to the market and tell me what the prices are for cans of cat food, and probably will be the same price here as well. Both are less likely to be a loss leader to camouflage the actual value of the dollar, and even when on sale, both will have the normal retail price on the shelf.

Another example would be movie tickets. Five years ago, I'd grump that they were $7, sometimes as much as $8. Today, I'm lucky to find a movie for less than $14. Competition for our entertainment dollars hasn't changed, it's extremely strong, yet going by the CPI, that movie ticket has risen far in excess of the justified change in the value of the dollar.

I submit that the CPI computing, with or without food and energy prices, is pretty useless. I know as a consumer my dollar has lost half it's value in five years. I feel the pressures as a parent as everything costs tremendously more. Sure, the loaf of bread I buy is costing me slightly more than what it did five years ago, mostly because I changed what brands of bread I buy, and I'm getting only 16 ounces instead of the 24 oz I used to. That matches the CPI, but the bread I used to buy is now twice as expensive than it was five years ago. And there the departure comes from CPI vs real value.

47

posted on

02/12/2011 12:00:56 PM PST

by

kingu

(Legislators should read what they write!)

To: blackdog

Want a real indicator, just go by the local Home Depot and look at the empty parking lot. Two years ago, you would be circling the lot competing for a space. At least where I live.

48

posted on

02/12/2011 12:43:51 PM PST

by

itsahoot

(Almost everything I post is Sarcastic, since I have no sense of humor about politics.)

To: FromLori

check out this website for real inflation and unemployment rates

shadow stats

shadow stats

shadow stats

shadow stats

shadow stats

49

posted on

02/12/2011 12:45:50 PM PST

by

dennisw

(- - - -He who does not economize will have to agonize - - - - - Confucius)

To: Toddsterpatriot

It was too-low minimum margin requirements that caused the “bubble” that preceded the 1929 stock market crash. And the 2008 market crash happened for almost the same reason—remember the run up in the price of rice and crude oil in the commodities market during the first half of 2008?

50

posted on

02/12/2011 12:52:40 PM PST

by

RayChuang88

(FairTax: America's economic cure)

To: RayChuang88

It was too-low minimum margin requirements that caused the “bubble” that preceded the 1929 stock market crash. That's slightly different than claiming the same thing for futures contracts.

51

posted on

02/12/2011 1:12:05 PM PST

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: Oystir

I just bought a few hundred gallons of oil and some silver bars; I think 2.5% is understating it. People say commodities are going up; it is the dollar going down. I was in Quebec recently; the dollars are practically on par. That is not a good indication for Americans, especially those crossing the border to visit or do business (though a great sign for American merchants along the border; Canadian shoppers are pouring in because their money goes further and the sales tax is much less).

Our money is being de-valued in front of our faces; a really frightening thought is that people are viewing their lower home values in terms of “pre-Obama” dollars. They’d be shocked at how much less value 2011 US dollars really have in comparison to 2008 US dollars.

To: Oystir

Don’t tell me you believe that 2.5% figure.

53

posted on

02/12/2011 3:14:29 PM PST

by

packrat35

(America is rapidly becoming a police state that East Germany could be proud of!)

To: blackdog

For me the time is even shorter...I bought the cow. We now have plenty of milk and have had to learn how to make butter, yogurt, cheese, and ice cream with our extra milk.

Several years ago I saw the inflation in food coming and started using my hobby farm to get prepared. Besides the milk we produce for our consumption; eggs, chicken, duck, beef, and lamb. And a byproduct of the lamb is wool that we use to cloth the family.

I am sure that inflation will affect us but hopefully we will have a small buffer for awhile.

54

posted on

02/12/2011 4:16:27 PM PST

by

WorldviewDad

(following God instead of culture)

To: WorldviewDad

Wow! Good for you, I’m impressed. What state are you in?

55

posted on

02/12/2011 4:30:43 PM PST

by

Eva

To: Eva

Wisconsin...Home of the Green Bay Packers

56

posted on

02/12/2011 4:49:49 PM PST

by

WorldviewDad

(following God instead of culture)

To: WorldviewDad

Been there, done that. Eggs cost $3.00 per dozen when produced on our farm on a year round cost basis. We milked a nubian goat, two plus quarts a day. She ran us about 2.45 a gallon. Our sheep flock, over 200 ewes was a big loser when compared to placing all that ground into hay and forage. We patured them on 80 acres. They ate a 1,200 pound round bale of alfalfa per day when pasture season was over.There is a 24 year global oversupply of wool sitting in warehouses. My market lambs fetched about $180 each. My input costs ran about $145.

I usually broke some bones, threw out my back several times, cut, raked, and baled hay forever, injected myself with ivermectin, hoof rot vaccine, and 5 way shots twice a year while wrestling stock. Don/t even talk to me about shearing!

Farming can make you seriously old before your time. I do miss it though. My point though is that you can buy chickens @.89 per pound.

57

posted on

02/12/2011 5:08:04 PM PST

by

blackdog

To: FromLori

The legitimate way to deal with the “volatility” of food and energy prices is not to compute a pseudo-price-inflation-rate by excluding them, but to report a running average of the inflation rate including them.

58

posted on

02/12/2011 8:11:27 PM PST

by

The_Reader_David

(And when they behead your own people in the wars which are to come, then you will know. . .)

To: FromLori

We don’t have two years to deal with this green agenda on energy.

To: FromLori

Anyone who has been watching food prices for the past year KNOWS that inflation is NOT just now showing up, it’s been showing it’s ugly head for months.

Bernanke just has his head so far up his keester or he’d have admitted it already.

I think someone does ALL his shoping for him; he’s so out of touch with the real practical world of the economy he is helping to produce.

60

posted on

02/12/2011 10:32:29 PM PST

by

Wuli

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-69 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson