Posted on 12/19/2009 12:24:10 PM PST by GVnana

Harder to buy US Treasuries

Created: 2009-12-18 0:13:35

Author:Zhou Xin and Jason Subler

IT is getting harder for governments to buy United States Treasuries because the US's shrinking current-account gap is reducing supply of dollars overseas, a Chinese central bank official said yesterday.

The comments by Zhu Min, deputy governor of the People's Bank of China, referred to the overall situation globally, not specifically to China, the biggest foreign holder of US government bonds.

Chinese officials generally are very careful about commenting on the dollar and Treasuries, given that so much of its US$2.3 trillion reserves are tied to their value, and markets always watch any such comments closely for signs of any shift in how it manages its assets.

China's State Administration of Foreign Exchange reaffirmed this month that the dollar stands secure as the anchor of the currency reserves it manages, even as the country seeks to diversify its investments.

In a discussion on the global role of the dollar, Zhu told an academic audience that it was inevitable that the dollar would continue to fall in value because Washington continued to issue more Treasuries to finance its deficit spending.

He then addressed where demand for that debt would come from.

"The United States cannot force foreign governments to increase their holdings of Treasuries," Zhu said, according to an audio recording of his remarks. "Double the holdings? It is definitely impossible."

(Excerpt) Read more at shanghaidaily.com ...

I hate politicians.

Let’s stop buying their stuff now and we can restore employment.

Hang on tight. We are in for a rough ride. Ben Nelson selling out just made matters worse. I hope Nebraska looks him in the eye when he gets back there.

The American President quickly folded.

"Show me just what Mohammed brought that was new, and there you will find only things evil and inhuman, such as his command to spread by the sword the faith he preached." - Manuel II Palelogus

“Double the holdings? It is definitely impossible.”

This is clearly a reference he’s making. Who suggested they double their holdings? 0 admin presumably.

China has beefed up its navy and military might and has built thousands of miles of hardened tunnels throughout. I think they are preparing to not only protect and project their international interests, but to win the coming world war.

They already own America. Our economy, our country goes down the tubes without China.

"Show me just what Mohammed brought that was new, and there you will find only things evil and inhuman, such as his command to spread by the sword the faith he preached." - Manuel II Palelogus

The Chinese are going to go nuts when they finally see the extent of how Obama and the Democrats have vandalized their assets.

Mr. niteowl77

Cheers!

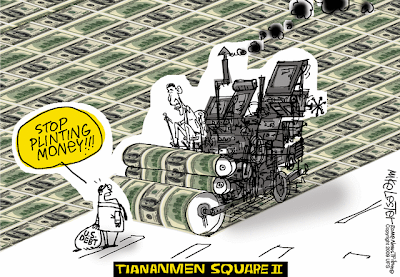

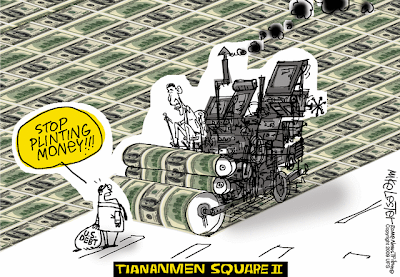

I had that posted in my office for a while. One young guy finally came and asked what it meant.

I had to forgive his ignorance, since he’s only 24. Seems he never learned about Tiananmen Square in school.

"I greatly fear that the dictators there will end up relying on the dictator's old standby to rally support when their utopia is falling apart: military adventurism."

A direct hit. That's a real fact ignored by those more concerned that Muslims will take over the world by improvised devices, stealing planes and blowing themselves up.

At the same time the US Economy is THE Financial Powerhouse that overseas investors have placed their faith and moneys, the US Government is a GIANT SPONGE on the World's Treasuries, especially when the US Govt is absorbing non-govt Financial Debt (via Bailouts) and Consumer defaults. And the US Govt wants to expand!The BEST thing China, Russia and other buyers of US Currency can do for themselves (and US) is to CUT UP daddy's credit card! THIS ain't pretty folks (a/k/a The Asset Bubble).

|

US savers have to fund those budget deficits, or they have to be reduced, or both. The game of the US government borrowing from abroad to support US domestic spending is over.

Which to my mind is a good thing, because it wasn't sustainable in the first place...

If by most you mean less than 7%, you're right.

Time to invest in wheelbarrows.

I read Market Ticker first thing every day (and Naked Capitalism, too). Good chart, but I thought fed debt was like 12 to 14 trillion???

parsy, who is proud we are the world leaders in debt

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.