Skip to comments.

5 Reasons to Buy a Home Now : Conditions are nearly perfect to get a super bargain. Don't dally.

Kiplinger's

| 9/18/2009

| Pat Mertz Esswein

Posted on 09/18/2009 4:18:26 PM PDT by SeekAndFind

If you've been waiting for home prices or interest rates to fall further before you buy a home, it's time to rethink your strategy. If you act soon, you'll be able to take advantage of historically low prices and interest rates that won't be around forever. And if you're a first-time buyer and you act very soon, you can still take advantage of an $8,000 tax credit. Here are five reasons to take the plunge now.

1. You may get a fat tax credit.

The first-time home buyer's tax credit is worth 10% of the home's purchase price, up to a maximum of $8,000. But to lock in the credit, you must close on your purchase by November 30. Given that it usually takes a minimum of 30 to 45 days to get to closing after you and the seller have a ratified purchase contract, your real deadline is closer to October 1.

You don't qualify for the credit if you owned a primary residence in the past three years. And the credit begins to phase out when adjusted gross income is more than $75,000 for single filers, or $150,000 for married couples filing jointly (those with incomes of more than $95,000 and $170,000, respectively, will not receive a credit).

Although several bills before Congress propose to extend or even expand the credit, don't count on it. Legislators are preoccupied with health-care reform and concerned about increasing the federal deficit.

The desire to lock in the credit pushed Ari Weitz, 27, of Atlanta, to buy his first home in August. Weitz began shopping in Inman Park, a vibrant neighborhood in Atlanta's Old Fourth Ward. In April, Weitz found a 1,700-square-foot townhome with three bedrooms and three and a half baths that he really liked. It was listed for $275,000.

His first two offers of $240,000 and $250,000 with $5,000 in seller-paid closing costs didn't fly, but Weitz monitored the status of the property. When he learned in July that the owner was moving out of state and had to sell, he offered $254,000. That offer was accepted, and he got the $5,000 in closing costs, too.

2. Prices are scraping bottom.

It's hard to know whether prices are as low as they'll go, but the housing market is showing signs of life. Between the first and second quarter of 2009, the S&P/Case-Shiller Home Price Indices, a measure of U.S. home prices, rose by 3%. That's the first quarter-over-quarter increase in three years.

Robert Shiller, an economics professor at Yale and a developer of the S&P/Case-Shiller Home Price Indices, says it's too soon to call the uptick a turning point. He says that it may indicate only that the decline in home prices-some 30% since the housing market's peak in mid 2006-is slowing.

The National Association of Realtors (NAR) says homes haven't been this affordable since the 1970s. Based on average income and median home price, a little more than two-thirds of California households could afford to buy an entry-level home during the second quarter of this year, compared with just less than half a year ago.

3. Foreclosures are at record highs.

Distressed sales (foreclosures and short sales) accounted for more than a third of all home-sale transactions in the second quarter of 2009-and represent an opportunity to buy a home at a deep discount.

Such homes typically sell for a 15% to 20% discount from market value. California, Arizona, Florida and Nevada continue to experience the sharpest price declines. Foreclosures will continue to rise with the jobless rate and the last wave of subprime-mortgage delinquencies, despite relief efforts by lenders and the Obama administration.

There are caveats. When REOs (real estate owned by the bank after foreclosure) hit the market, the banks receive multiple offers, often above full price. The banks prefer investors who will pay with cash over "regular" buyers who must seek financing, and they prefer conventional financing over Federal Housing Administration or Department of Veterans Affairs loans.

Buyers think foreclosures are a great deal until they see them in person and realize that often, they need a lot of work. That puts off entry-level buyers who need to save their cash for a down payment or furniture. You're more likely to find a bargain if you work with an agent who handles a lot of foreclosures and gets a heads-up on sales before they hit the market.

Short sales can also be dicey. A short sale means the lender is allowing a home to be sold for less than the mortgage amount. Short sales require patient buyers who can wait out the two to six months typically required to get approval from the bank. Meanwhile, the deal may fall through because the sellers disappear or choose not to cooperate with the process. Or the property could end up in foreclosure because the sellers haven't made their mortgage payments.

4. Rates are cheap.

If there's a silver lining to the recession, it's that interest rates will stay low. That's because investors continue to seek the safety of long-term Treasury bonds, which largely determine mortgage rates. Throughout most of this year, the 30-year fixed rate has hovered near 5%. The 5/1 adjustable-rate mortgage, which has a fixed rate for five years and then converts to a one-year ARM, recently averaged 4.8%.

Keith Gumbinger, who closely follows interest-rate trends as vice-president of financial-publishing firm HSH Associates, expects the 30-year fixed rate to stay around 5.5% for the rest of 2009, absent either a market collapse or economic growth (especially stepped-up hiring). He says that downward and upward forces on rates are canceling each other out right now.

If you can qualify for a mortgage on the home you want at today's rate, holding out for a slightly lower rate is probably a fool's errand. And, if inflation resurges, locking in today's interest rate (and mortgage payment) will look brilliant in hindsight.

To get the best rate, you must put 20% down and have a credit score of 720 or more. Many home buyers have turned to FHA-backed loans, which require a minimum down payment of 3.5% of the purchase price (see Can You Get a Mortgage?).

5. Demand is growing.

In July 2009, existing home sales rose 5% over the year before-the first year-over-year gain since November 2005, according to the NAR. That period also marked an increase in sales over four consecutive months, for the first time since June 2004 (except in the West, where sales fell by 2% between June and July).

The NAR reports that the number of homes for sale fell by 11% from the year before, and at the current pace of sales, that represents a 9.4 months' supply (a four- to six-month supply represents a market balanced between buyers and sellers).

In some areas, competition for deals can be fierce. Atlanta's Debbie Sonenshine, of Coldwell Banker, says that a good house at a good price will get multiple offers and sell quickly. What's a good house? It's clean, it shows well, and it's in a good neighborhood in a good school district.

TOPICS: Business/Economy; Culture/Society; Editorial; News/Current Events

KEYWORDS: economy; home; housing; missinglink; mortgage; realestate

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: pogo101

It depends where your at. If ya go into the more desirable areas, you’ll see very little inventory available for sale.

Crappy areas = lots of inventory.

41

posted on

09/18/2009 5:33:25 PM PDT

by

dragnet2

To: SeekAndFind

42

posted on

09/18/2009 5:34:58 PM PDT

by

stratman1969

(IMPEACH OBAMA for putting terrorist security ahead of American security)

To: SeekAndFind

I agree I was able to guy a much nicer 40 acre for my BOL than I could have gotten 2 years ago.

To: SeekAndFind

Awesome...I’m thrilled to read about this, ‘cuz a few weeks ago I set up an appointment w/ a real estate agent & will meet her on Monday.

Any advice, fellow FReepers? Thank you.

44

posted on

09/18/2009 5:39:26 PM PDT

by

ChrisInAR

(The Tenth Amendment is still the Supreme Law of the Land, folks -- start enforcing it for a CHANGE!)

To: Yossarian

No kidding and I would bet a second dip is on the way as well.

45

posted on

09/18/2009 5:40:10 PM PDT

by

HANG THE EXPENSE

(Life is tough.It's tougher when you're stupid.)

To: SeekAndFind

Fine if you have a job or some money.

46

posted on

09/18/2009 5:49:21 PM PDT

by

freekitty

(Give me back my conservative vote; then find me a real conservative to vote for)

To: SeekAndFind

Karl Denninger said something along the line of “People running out on the beach after a receeding tide to pick up all the fish should look up and see the incoming tsunami.”

47

posted on

09/18/2009 6:16:17 PM PDT

by

Oatka

("A society of sheep must in time beget a government of wolves." –Bertrand de Jouvenel)

To: SeekAndFind

I have enough cash lying around to buy a bargain, but I’m sitting this out. First, I don’t want to do anything that strengthens obama’s economy, not even a little. He will use any improvement in the numbers as a lever to move further left and destroy our country as a whole, and I’d rather miss out on profit than help him. Second, I suspect prices will drop even lower in the next phase of the Obama Recession. I’ll catch a bargain at the bottom, after obama has been voted out of office.

48

posted on

09/18/2009 6:25:48 PM PDT

by

TurtleUp

(I believe that America is good and that human life is good, so I'm a conservative.)

To: nufsed

To: nufsed

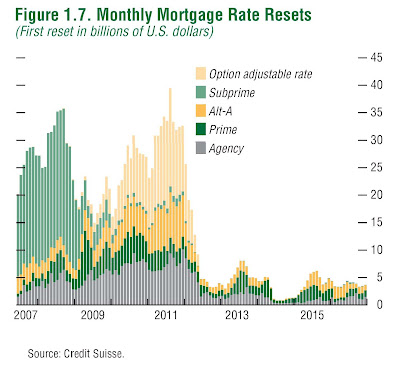

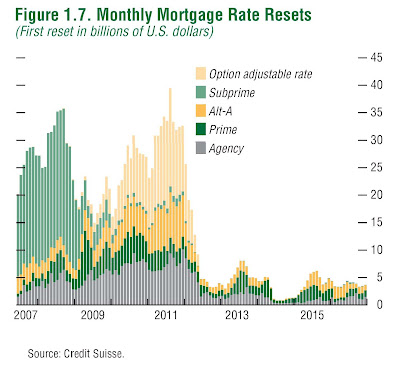

Problem with buying now is that the banks are holding about three year inventory of REO, and more adjustable mortgages are adjusting. It means another foreclosure wave is forming, but this time it will involve unemployed homeowners who barely can meet payments now before their rates adjust upward. These homes and REO’s will hit the market and drive existing home prices/equity even lower. That means more homes will be underwater, and guess what, more homeowners will walk away from their homes. It is a vicious cycle that has not finished until all the home prices truly bottom out. Right now we are not at the bottom. Buy now and you will lose value in the next two years. Numbers range from 20 to 25 percent.

50

posted on

09/18/2009 6:28:42 PM PDT

by

Fee

(Peace, prosperity, jobs and common sense)

To: Chickensoup

we have a variety of correspondent and wholesale lenders. We usually do 1 point. Most of our clients do not buy down the loan by adding additional. Fees are low. End of comemrcial.

51

posted on

09/18/2009 6:39:57 PM PDT

by

nufsed

(Release the birth certificate, passport, and school records.)

To: montag813

ToItt:

"what about waiting until the 2nd half of the “W” mt813:

"That will come in February 2011"

Not exactly. The peak will come in 2011, but the ARM resets will start seriously ramping up early next year.

In addition to that, the banks and other financial institutions are sitting on literally hundreds of thousands of foreclosures they have held off the market thus far. I verified this fact with my nephew, who is a regional President for Wells Fargo. They will not hold them off of the market forever. When they start dumping them, it will continue for years. They will stretch it out to get tax writeoffs for as many years as possible.

The dumping of held foreclosures combined with a new and even larger wave of forclosures from resetting ARMs has obvious implications for buyers. IMO, anyone who buys a home now, unless they can pay cash and scoop up a truly astounding deal, is insane. They would have an underwater mortgage in short order.

52

posted on

09/18/2009 6:40:27 PM PDT

by

Vigilant1

(The price of liberty is eternal vigilance.)

To: SeekAndFind

I'm in the process of building now (click my signature for an updating construction cam link).

Not because I think prices are great (maybe so for existing houses; not so much for new construction).

Not because I think it will be a great investment (my guess is that gold will do much better, certainly short-term and likely long-term, than house values).

Not because mortgage rates are so low (they are, in theory, but lenders are getting hyper-cautious with their appraisals and loan-to-value ratios -- especially for non-traditional construction).

Yes, buy or build a house -- but for the right reason (the providing of the type and location of shelter you need/want/can afford), not because you think you'll make a financial killing.

53

posted on

09/18/2009 6:43:51 PM PDT

by

southernnorthcarolina

(Now with ConstructionCam! Click on my name and follow the progress.)

To: Fee

The lenders I have talked to are telling me they are pacing the releases so as not to flood. They will stay with short sales longer, so there may be an increase there. Don't know how ,long that will last. I know more are coming. I look for interest to go up a point or so and that will even off some of the drop.

How far do you think prices will drop, say in San Diego? We have had a slight increase three of the last four months.

54

posted on

09/18/2009 6:44:09 PM PDT

by

nufsed

(Release the birth certificate, passport, and school records.)

To: SeekAndFind

55

posted on

09/18/2009 6:48:04 PM PDT

by

modhom

(deficits=inflation+taxes)

To: umgud

Projecting another 100,000,000 people in the next 40 years. San Diego to double in 25. I know about the baby boomers. I’m one. many will downsize and live in their own until they need assisted living.

56

posted on

09/18/2009 6:51:17 PM PDT

by

nufsed

(Release the birth certificate, passport, and school records.)

To: Vince Ferrer

You pay on the price side or the interest side. This is a time when both are low.

57

posted on

09/18/2009 6:52:35 PM PDT

by

nufsed

(Release the birth certificate, passport, and school records.)

To: nufsed

Projecting another 100,000,000 people in the next 40 years. Would those people be as prosperous/productive as the boomers they'll be replacing?

58

posted on

09/18/2009 6:59:17 PM PDT

by

umgud

(Look to gov't to solve your everday problems and they'll control your everday life.)

To: umgud

Are you asking about market value or the number of houses needed? I think our society is in for decades of lower paying jobs.

59

posted on

09/18/2009 7:06:34 PM PDT

by

nufsed

(Release the birth certificate, passport, and school records.)

To: nufsed

I think the boomers (on average) were/are very productive. I’ll call them taxpayers, not taxusers. I’m wondering if the generation behind us will have the same level of properity. I’m thinking not, especially when you look at school/student stats.

60

posted on

09/18/2009 7:10:54 PM PDT

by

umgud

(Look to gov't to solve your everday problems and they'll control your everday life.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson