Skip to comments.

Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water'

Wall Street Journal ^

Posted on 10/08/2008 5:38:00 AM PDT by Sub-Driver

Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water' More Defaults and Foreclosures Are Likely as Borrowers With Greater Debt Than Value in Their Homes Are Put in a Tight Spot By JAMES R. HAGERTY and RUTH SIMON

The relentless slide in home prices has left nearly one in six U.S. homeowners owing more on a mortgage than the home is worth, raising the possibility of a rise in defaults -- the very misfortune that touched off the credit crisis last year.

The result of homeowners being "under water" is more pressure on an economy that is already in a downturn. No longer having equity in their homes makes people feel less rich and thus less inclined to shop at the mall.

And having more homeowners under water is likely to mean more eventual foreclosures, because it is hard for borrowers in financial trouble to refinance or sell their homes and pay off their mortgage if their debt exceeds the home's value. A foreclosed home, in turn, tends to lower the value of other homes in its neighborhood.

About 75.5 million U.S. households own the homes they live in. After a housing slump that has pushed values down 30% in some areas, roughly 12 million households, or 16%, owe more than their homes are worth, according to Moody's Economy.com.

The comparable figures were roughly 4% under water in 2006 and 6% last year, says the firm's chief economist, Mark Zandi, who adds that "it is very possible that there will ultimately be more homeowners under water in this period than any time in our history."

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-85 next last

To: Presbyterian Reporter

It’s more than just a question of staying in the house. It’s goes to the fact that people who are underwater on their mortgages-—BECAUSE of the subprime mess, which most of them had nothing to do with-—have RIGHT NOW lost every penny of their *usually considerable downpayments.*

They cannot sell without bringing substantial cash to the table. Even if they have assets, they are likely in the market, which is now down so that withdrawing money is very expensive.

These are the people who have the money to keep up consumer spending (which helps the economy), but who will draw back because they (1) already lost say a $100K downpayment on their home, and (2) are paying for a $500K house that is now only worth $300K.

These are the people who otherwise would be investing in small business, spending discretionary money, buying and selling homes as they move various places to pursue better jobs and so on-—they are COMPLETELY AT A STANDSTILL and will be until the gridlock in the housing market eases, which could be decades.

Those presently the focus of the “mortgage bailout” are very differently situated viz-a-vis their “contribution” to the economy. In short, they are not net contributers. They got a free home because of U.S. GOVERNMENT “affordable housing” programs, but they contributed nothing to that transaction and won’t be a net contributor after the government bails the bank out of it.

They will go back to living wherever they were living and doing whatever they were doing. Most will really not have lost much of anything out of their own economic pocket.

But because of that, the homeowners who did put 10% or 20% down on a recent home purchase-—or who did put down enough to “be wise” and avoid PMI-—have presently LOST REAL MONEY. Their ENTIRE DOWNPAYMENT will not be recouped unless and until that housing market starts functioning again-—decades from now.

The restructuring proposals for this type of situation that I’ve seen includes the homeowner giving the lender a stake in FUTURE EQUITY. So, even unlike the subprime borrower again, this prime borrower has to PAY for getting part of his mortgage balanced forgiven.

The lender revaluates the mortgage balance to, say, market value ($300K in our example), and the prime borrower gives the lender a lien on 50% of any future profit made upon selling the house.

This is still not a giveaway of the magnitude re subprime loans.

But it “unfreezes the assets” of people who will actually contribute to the economy in the future. AND they have to give up some future profits for easing their cash flow now!

21

posted on

10/08/2008 6:01:34 AM PDT

by

fightinJAG

(Fly the flag!)

To: MrB

I have been listening to too many sob stories on Dave Ramsey show to have much sympathy for a good many of the so-called “victims” on Main Street...

Not only can we not legislate away stupidity and greed-

now we are being told it is our patriotic duty (and our children's) to subsidize it.

When I was a Realtor we sold people houses as places to put down roots and live, not as speculative investments.

Having lived through the house crash of the early 1990’s, anyone planning to move in 5 years was better off renting

But people got greedy and now many they think they can just walk away from their houses and give Uncle Sam (me and you) the keys. Lot of em are the same folks busting their butts to pay $600-$800 a month in payments on new cars and trucks that depreciated 30% the moment they drove them off the car lot

22

posted on

10/08/2008 6:01:58 AM PDT

by

silverleaf

(Fasten your seat belts- it's going to be a BUMPY ride.)

To: blueheron2

This is what I’ve been asking. I know Fannie and Freddie bundled bad loans with good loans and sold them as securities (I think). How are they worthless now? They're not worthless, but under new SarBox regs, they have to be valued today instead of longer term. That's the problem. SEC was going to revisit this "mark to market" reg.

23

posted on

10/08/2008 6:02:12 AM PDT

by

petercooper

(IQ tests for all voters!)

To: fightinJAG

I hadn’t thought of it that way. You have a good point.

24

posted on

10/08/2008 6:02:49 AM PDT

by

KansasGirl

(READ MY LIPSTICK, OBAMA IS JUST CREEPY!)

To: Sub-Driver

And nobody on this thread has mentioned we were offered mortgages of up to 150% of the value of the house during the Clinton years. So those people started out owing more than the house was worth. 10 year of payments does not reduce the principal that much so how many of these problems today are actually the result of activities 10 years ago?

To: Sub-Driver

Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water' News flash: I wouldn't be surprised if nearly 1 in 6 new car owners are 'under water' too. As long as the payments are being made, it's not a crisis. Only if you're house flipping do you have a problem.

26

posted on

10/08/2008 6:03:22 AM PDT

by

Yo-Yo

To: Sub-Driver

This is “mark to market” run amok. If the homeowner is servicing the loan and is wants to keep paying on it, then we must change the rules to allow the mortgage-holder to refrain from foreclosure.

To: Yo-Yo

These are the same people who are struck dumb when Dave Ramsey says- SELL THE TRUCK - for what it’s worth

and sign a new note with the bank for the difference

better to owe and easier to pay off $8,000 than $26,000

d’oh...

28

posted on

10/08/2008 6:08:36 AM PDT

by

silverleaf

(Fasten your seat belts- it's going to be a BUMPY ride.)

To: Yo-Yo

As long as payments are being made, it’s not a crisis at the individual level.

But it still is the source of a crisis at the industry level.

People who are upside-down on their vehicles cannot sell their vehicles without losing money and cannot buy new vehicles.

It’s a freeze.

Same in the housing market. The big difference, however, is that the plunge in housing prices-—which, unlike the auto industry, is what is causing people to be upside-down on their mortgages was 100% CAUSED BY THE U.S. GOVERNMENT through the RAT PARTY.

It is the wisest and most prudent housing consumers who are getting screwed the most-—those who put SUBSTANTIAL DOWNPAYMENTS on homes in the last 5 years. Right now they have LOST EVERY PENNY.

The subprime borrowers have LOST NOTHING. The money to bail them out goes directly to the lenders.

It is the wisest and most prudent consumers who will get the economy moving again if they are “unfrozen” in their housing asset. That’s a much more worthy investment of government funds than paying the bills for deadbeats.

Plus, as I posted upthread, most of the proposals for mortgage restructuring actually require these “good customers” to PAY for restructuring, either through fees or by giving the lender a lien on any future profits. This frees up the good customer now and allows him to go about his business and, eventually, generate profit for himself AND the lender.

UNLIKE the deadbeats.

29

posted on

10/08/2008 6:11:31 AM PDT

by

fightinJAG

(Fly the flag!)

To: KansasGirl

Thanks. I think we need to carefully evaluate things as they develop as things are not always as they appear!

30

posted on

10/08/2008 6:12:32 AM PDT

by

fightinJAG

(Fly the flag!)

To: Sub-Driver

Screw a bunch of yuppies livin' beyond their g.d. means.

In 1964 my Dril Instructor told my platoon exactly where to find "sympathy", he said it's somewhere between "sh%T and syphllis in the dictionary".

31

posted on

10/08/2008 6:13:05 AM PDT

by

gitmogrunt

(The stupidity of the American Sheeple never ceases to amaze me)

To: Yo-Yo

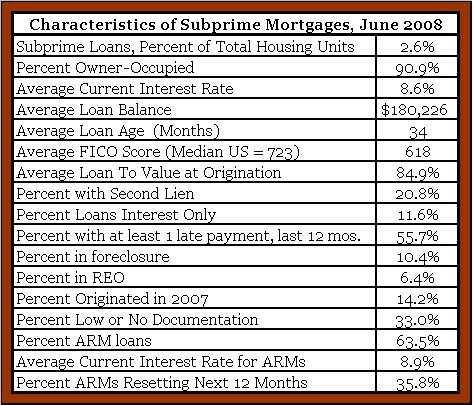

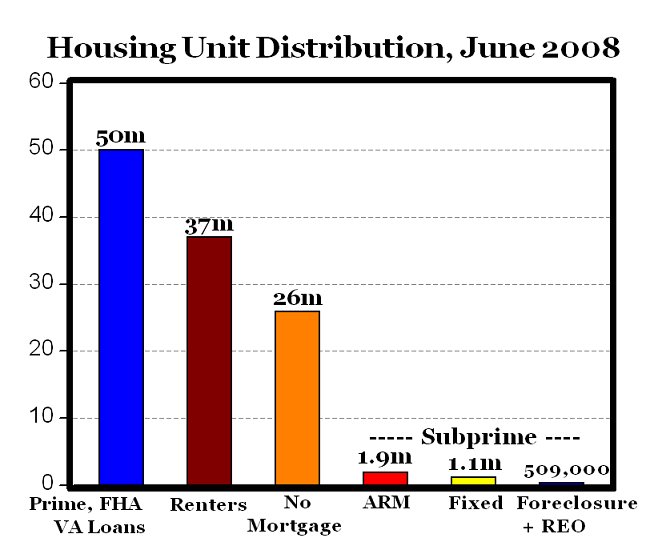

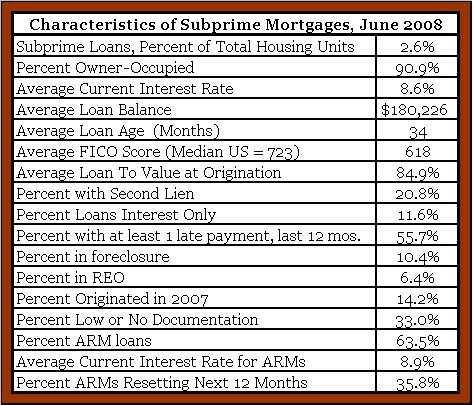

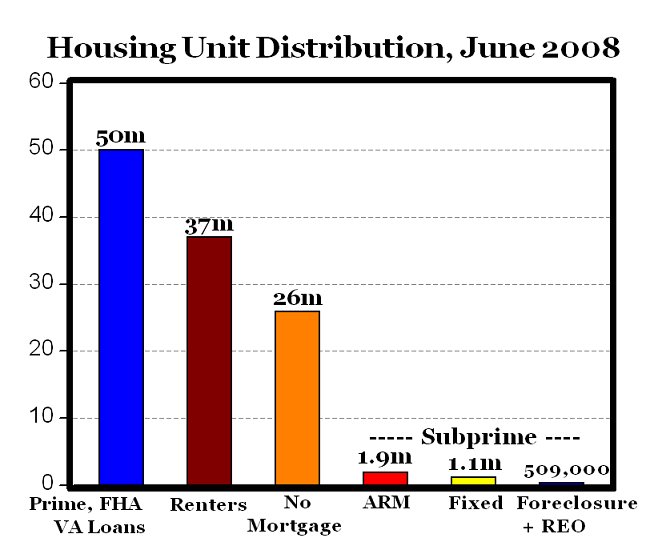

The chart above is from NY Federal Reserve data on Nonprime Mortgage Conditions in the United States for June 2008. Based on those data, the chart below shows the current distribution of housing units:

Note that the 3 million subprime mortgages represent only 2.6% of 116 million total housing units, and only 17% of subprime loans (510,000) are in foreclosure or REO. As a percent of total housing units, the subprime mortgages in foreclosure or REO represent less than 1/2 of 1 percent of all housing units (0.44%).

http://mjperry.blogspot.com/2008/08/current-subprime-mortgage-stats.html

32

posted on

10/08/2008 6:14:32 AM PDT

by

petercooper

(IQ tests for all voters!)

To: ScottinVA

How many families sold homes in the *bubble* for huge profits and then bought *upscale* using the profit as a *down-payment*?

If they increased their mortgage payments beyond their ability to pay- that was STUPID! Otherwise - there are a lot of people living well as a result of their *lucky* gamble when the housing market was heading to the stratosphere. They should sit tight for 10 years and enjoy their *homes*.

Money- it’s just paper!

33

posted on

10/08/2008 6:16:36 AM PDT

by

sodpoodle

(Man studies evolution to understand His creation.)

To: petercooper

34

posted on

10/08/2008 6:17:38 AM PDT

by

petercooper

(IQ tests for all voters!)

To: rahbert

and many buyers were underwater before their stuff was unpacked. Then these buyers bought way more house than they could afford to own.

They made the mistake.

To: gitmogrunt

An additional spin-off of this process (at least here in the midwest) is property tax inflation.

Unlimited cheap mortgages allowed the building of hundereds of thousands of new low end homes in suburbia (aka vinyl villages). The influx of marginal buyers (many with LOTS of kids) raised the school population dramatically, leading to the need to build buildings and hire staff, funded by much higher property taxes.

To: fightinJAG

Your proposal to have the lender reset a $500,000 mortgage for $300,000 with the lender taking a stake in the future profit of the house makes more sense than getting the government to do the same.

When government gets involved we know they will get political.

The government created the housing financial mess by promoting equity loans and subprime borrower loans.

I roughly calculated that the US housing stock has a value of about $12 trillion. If we can prevent more foreclosures from driving down the market value of all houses, then the US housing stock remains at $12 trillion.

As we all know in a market it only takes a small percent of sales to drive down the price on the entire inventory.

It is not only the US who is trying to prevent a meltdown in housing prices. If housing prices meltdown, it will have a ripple effect into other markets and then we have a global depression.

To: Yo-Yo

Actually, ANYONE who buys a new car is instantly under water - or to use the car trade term ‘upside down’ - to the tune of about 20% the moment it is driven off the lot. Check it out on Kelly Blue Book. The facts speak for themselves.

38

posted on

10/08/2008 6:20:42 AM PDT

by

abb

("What ISN'T in the news is often more important than what IS." Ed Biersmith, 1942 -)

To: Sub-Driver

If they would have had to put up 20% down to purchase very few would be in that condition.

When we bought our home in 1966 you either out up 20% or you didn’t buy a home.

It never should have changed.

39

posted on

10/08/2008 6:24:06 AM PDT

by

dalereed

To: MrB

1) Spend less than you earn 2) Avoid Debt 3) Build in a cash cushion 4) Have a long term plan 5) Remember it all belongs to God, you’re just entrusted with whatever He thinks you can handle. Now, who would have a problem if they followed these rules, even just the first 4, if you’re not “of faith”?

AMEN!

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-85 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson