Posted on 10/10/2025 9:19:41 PM PDT by SeekAndFind

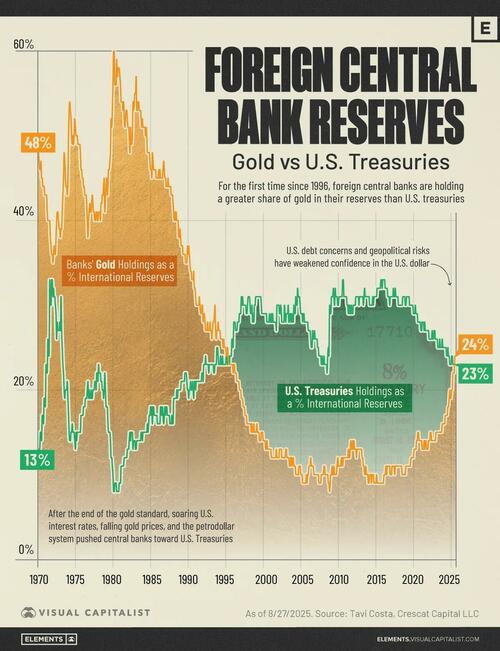

Central banks have crossed a symbolic line: their combined gold reserves now exceed their U.S. Treasury holdings for the first time in nearly three decades.

The crossover underscores a gradual diversification away from dollar-denominated securities and toward hard assets.

This visualization, via Visual Capitalist's Bruno Venditti, tracks how these shares have evolved from the 1970s to today.

The data comes from Crescat Capital macro strategist Tavi Costa.

After the end of Bretton Woods, soaring real interest rates and the rise of the petrodollar steered reserve managers toward U.S. Treasuries through the 1980s and 1990s.

In the 2000s, the dollar’s depth and liquidity reinforced that preference. Since 2022, however, heavy official gold buying has picked up again — 1,136 tonnes in 2022, a record — with 2023 and 2024 maintaining historically strong accumulation. The trend is even more striking considering that nearly one-fifth of all the gold ever mined is now held by central banks.

| Date | Gold Holdings As a % International Reserves | U.S. Treasuries Holdings As a % International Reserves |

|---|---|---|

| 1/30/1970 | 48% | 13% |

| 1/29/1971 | 43% | 23% |

| 1/31/1972 | 36% | 32% |

| 1/31/1973 | 39% | 31% |

| 1/31/1974 | 50% | 17% |

| 1/31/1975 | 50% | 15% |

| 1/30/1976 | 44% | 18% |

| 1/31/1977 | 41% | 20% |

| 1/31/1978 | 41% | 23% |

| 1/31/1979 | 44% | 18% |

| 1/31/1980 | 60% | 8% |

| 1/30/1981 | 54% | 11% |

| 1/29/1982 | 51% | 13% |

| 1/31/1983 | 57% | 13% |

| 1/31/1984 | 51% | 15% |

| 1/31/1985 | 46% | 17% |

| 1/31/1986 | 46% | 16% |

| 1/30/1987 | 44% | 18% |

| 1/29/1988 | 41% | 19% |

| 1/31/1989 | 37% | 21% |

| 1/31/1990 | 37% | 19% |

| 2/28/1990 | 36% | 20% |

| 1/31/1991 | 30% | 21% |

| 1/31/1992 | 29% | 23% |

| 1/29/1993 | 27% | 23% |

| 1/31/1994 | 27% | 23% |

| 1/31/1995 | 24% | 24% |

| 1/31/1996 | 23% | 28% |

| 1/31/1997 | 19% | 31% |

| 1/30/1998 | 16% | 31% |

| 1/29/1999 | 15% | 31% |

| 1/31/2000 | 14% | 29% |

| 2/29/2000 | 14% | 29% |

| 3/31/2000 | 14% | 29% |

| 4/28/2000 | 13% | 29% |

| 5/31/2000 | 13% | 29% |

| 6/30/2000 | 14% | 28% |

| 7/31/2000 | 13% | 28% |

| 8/31/2000 | 13% | 28% |

| 9/29/2000 | 13% | 28% |

| 10/31/2000 | 13% | 29% |

| 11/30/2000 | 13% | 28% |

| 12/29/2000 | 13% | 28% |

| 1/31/2001 | 12% | 29% |

| 2/28/2001 | 12% | 28% |

| 3/30/2001 | 12% | 29% |

| 4/30/2001 | 12% | 28% |

| 5/31/2001 | 12% | 28% |

| 6/29/2001 | 12% | 28% |

| 7/31/2001 | 12% | 28% |

| 8/31/2001 | 12% | 28% |

| 9/28/2001 | 13% | 27% |

| 10/31/2001 | 12% | 30% |

| 11/30/2001 | 12% | 30% |

| 12/31/2001 | 12% | 30% |

| 1/31/2002 | 12% | 30% |

| 2/28/2002 | 13% | 29% |

| 3/29/2002 | 13% | 29% |

| 4/30/2002 | 13% | 30% |

| 5/31/2002 | 13% | 29% |

| 6/28/2002 | 12% | 28% |

| 7/31/2002 | 12% | 28% |

| 8/30/2002 | 12% | 28% |

| 9/30/2002 | 12% | 28% |

| 10/31/2002 | 12% | 30% |

| 11/29/2002 | 12% | 29% |

| 12/31/2002 | 13% | 28% |

| 1/31/2003 | 13% | 29% |

| 2/28/2003 | 12% | 29% |

| 3/31/2003 | 12% | 29% |

| 4/30/2003 | 12% | 30% |

| 5/30/2003 | 12% | 28% |

| 6/30/2003 | 11% | 28% |

| 7/31/2003 | 11% | 29% |

| 8/29/2003 | 12% | 29% |

| 9/30/2003 | 12% | 28% |

| 10/31/2003 | 11% | 29% |

| 11/28/2003 | 12% | 28% |

| 12/31/2003 | 12% | 28% |

| 1/30/2004 | 11% | 30% |

| 2/27/2004 | 11% | 29% |

| 3/31/2004 | 11% | 29% |

| 4/30/2004 | 10% | 31% |

| 5/31/2004 | 10% | 30% |

| 6/30/2004 | 10% | 30% |

| 7/30/2004 | 10% | 32% |

| 8/31/2004 | 10% | 31% |

| 9/30/2004 | 11% | 31% |

| 10/29/2004 | 11% | 31% |

| 11/30/2004 | 11% | 30% |

| 12/31/2004 | 10% | 29% |

| 1/31/2005 | 10% | 29% |

| 2/28/2005 | 10% | 29% |

| 3/31/2005 | 9% | 28% |

| 4/29/2005 | 9% | 29% |

| 5/31/2005 | 9% | 29% |

| 6/30/2005 | 9% | 28% |

| 7/29/2005 | 9% | 28% |

| 8/31/2005 | 9% | 28% |

| 9/30/2005 | 10% | 28% |

| 10/31/2005 | 9% | 28% |

| 11/30/2005 | 10% | 28% |

| 12/30/2005 | 10% | 27% |

| 1/31/2006 | 11% | 27% |

| 2/28/2006 | 11% | 27% |

| 3/31/2006 | 11% | 27% |

| 4/28/2006 | 12% | 26% |

| 5/31/2006 | 11% | 25% |

| 6/30/2006 | 11% | 25% |

| 7/31/2006 | 11% | 27% |

| 8/31/2006 | 11% | 26% |

| 9/29/2006 | 10% | 26% |

| 10/31/2006 | 10% | 27% |

| 11/30/2006 | 10% | 26% |

| 12/29/2006 | 10% | 26% |

| 1/31/2007 | 10% | 26% |

| 2/28/2007 | 10% | 26% |

| 3/30/2007 | 10% | 25% |

| 4/30/2007 | 10% | 25% |

| 5/31/2007 | 9% | 24% |

| 6/29/2007 | 9% | 24% |

| 7/31/2007 | 9% | 24% |

| 8/31/2007 | 9% | 24% |

| 9/28/2007 | 10% | 23% |

| 10/31/2007 | 10% | 24% |

| 11/30/2007 | 10% | 23% |

| 12/31/2007 | 10% | 23% |

| 1/31/2008 | 11% | 24% |

| 2/29/2008 | 11% | 23% |

| 3/31/2008 | 10% | 23% |

| 4/30/2008 | 10% | 23% |

| 5/30/2008 | 10% | 23% |

| 6/30/2008 | 10% | 22% |

| 7/31/2008 | 10% | 24% |

| 8/29/2008 | 9% | 25% |

| 9/30/2008 | 9% | 24% |

| 10/31/2008 | 8% | 30% |

| 11/28/2008 | 9% | 29% |

| 12/31/2008 | 10% | 29% |

| 1/30/2009 | 10% | 31% |

| 2/27/2009 | 11% | 31% |

| 3/31/2009 | 10% | 31% |

| 4/30/2009 | 10% | 32% |

| 5/29/2009 | 11% | 31% |

| 6/30/2009 | 10% | 30% |

| 7/31/2009 | 10% | 32% |

| 8/31/2009 | 10% | 31% |

| 9/30/2009 | 10% | 31% |

| 10/30/2009 | 11% | 31% |

| 11/30/2009 | 12% | 30% |

| 12/31/2009 | 11% | 30% |

| 1/29/2010 | 11% | 31% |

| 2/26/2010 | 11% | 31% |

| 3/31/2010 | 11% | 31% |

| 4/30/2010 | 11% | 31% |

| 5/31/2010 | 12% | 31% |

| 6/30/2010 | 12% | 31% |

| 7/30/2010 | 11% | 33% |

| 8/31/2010 | 12% | 33% |

| 9/30/2010 | 12% | 31% |

| 10/29/2010 | 12% | 31% |

| 11/30/2010 | 12% | 31% |

| 12/31/2010 | 12% | 31% |

| 1/31/2011 | 12% | 31% |

| 2/28/2011 | 12% | 30% |

| 3/31/2011 | 12% | 30% |

| 4/29/2011 | 13% | 29% |

| 5/31/2011 | 12% | 30% |

| 6/30/2011 | 12% | 29% |

| 7/29/2011 | 13% | 30% |

| 8/31/2011 | 14% | 29% |

| 9/30/2011 | 13% | 30% |

| 10/31/2011 | 13% | 29% |

| 11/30/2011 | 14% | 29% |

| 12/30/2011 | 13% | 30% |

| 1/31/2012 | 14% | 30% |

| 2/29/2012 | 13% | 30% |

| 3/30/2012 | 13% | 30% |

| 4/30/2012 | 13% | 31% |

| 5/31/2012 | 12% | 31% |

| 6/29/2012 | 13% | 31% |

| 7/31/2012 | 13% | 31% |

| 8/31/2012 | 13% | 31% |

| 9/28/2012 | 13% | 30% |

| 10/31/2012 | 13% | 31% |

| 11/30/2012 | 13% | 31% |

| 12/31/2012 | 13% | 31% |

| 1/31/2013 | 13% | 31% |

| 2/28/2013 | 12% | 31% |

| 3/29/2013 | 12% | 31% |

| 4/30/2013 | 11% | 30% |

| 5/31/2013 | 11% | 31% |

| 6/28/2013 | 10% | 32% |

| 7/31/2013 | 10% | 31% |

| 8/30/2013 | 11% | 31% |

| 9/30/2013 | 10% | 31% |

| 10/31/2013 | 10% | 31% |

| 11/29/2013 | 10% | 31% |

| 12/31/2013 | 9% | 31% |

| 1/31/2014 | 9% | 31% |

| 2/28/2014 | 10% | 30% |

| 3/31/2014 | 10% | 30% |

| 4/30/2014 | 10% | 30% |

| 5/30/2014 | 9% | 30% |

| 6/30/2014 | 10% | 30% |

| 7/31/2014 | 10% | 31% |

| 8/29/2014 | 10% | 30% |

| 9/30/2014 | 9% | 31% |

| 10/31/2014 | 9% | 31% |

| 11/28/2014 | 9% | 31% |

| 12/31/2014 | 9% | 31% |

| 1/30/2015 | 10% | 31% |

| 2/27/2015 | 9% | 32% |

| 3/31/2015 | 9% | 32% |

| 4/30/2015 | 9% | 32% |

| 5/29/2015 | 9% | 32% |

| 6/30/2015 | 9% | 32% |

| 7/31/2015 | 9% | 32% |

| 8/31/2015 | 9% | 33% |

| 9/30/2015 | 9% | 33% |

| 10/30/2015 | 9% | 32% |

| 11/30/2015 | 9% | 33% |

| 12/31/2015 | 9% | 33% |

| 1/29/2016 | 10% | 33% |

| 2/29/2016 | 10% | 33% |

| 3/31/2016 | 10% | 32% |

| 4/29/2016 | 11% | 32% |

| 5/31/2016 | 10% | 32% |

| 6/30/2016 | 11% | 32% |

| 7/29/2016 | 11% | 31% |

| 8/31/2016 | 11% | 31% |

| 9/30/2016 | 11% | 31% |

| 10/31/2016 | 11% | 30% |

| 11/30/2016 | 10% | 31% |

| 12/30/2016 | 10% | 31% |

| 1/31/2017 | 10% | 31% |

| 2/28/2017 | 11% | 31% |

| 3/31/2017 | 11% | 31% |

| 4/28/2017 | 11% | 32% |

| 5/31/2017 | 11% | 31% |

| 6/30/2017 | 10% | 31% |

| 7/31/2017 | 11% | 32% |

| 8/31/2017 | 11% | 31% |

| 9/29/2017 | 11% | 31% |

| 10/31/2017 | 11% | 31% |

| 11/30/2017 | 11% | 31% |

| 12/29/2017 | 11% | 30% |

| 1/31/2018 | 11% | 30% |

| 2/28/2018 | 11% | 30% |

| 3/30/2018 | 11% | 30% |

| 4/30/2018 | 11% | 30% |

| 5/31/2018 | 11% | 30% |

| 6/29/2018 | 10% | 30% |

| 7/31/2018 | 10% | 31% |

| 8/31/2018 | 10% | 31% |

| 9/28/2018 | 10% | 31% |

| 10/31/2018 | 10% | 31% |

| 11/30/2018 | 10% | 30% |

| 12/31/2018 | 11% | 30% |

| 1/31/2019 | 11% | 31% |

| 2/28/2019 | 11% | 31% |

| 3/29/2019 | 11% | 31% |

| 4/30/2019 | 11% | 31% |

| 5/31/2019 | 11% | 31% |

| 6/28/2019 | 11% | 30% |

| 7/31/2019 | 11% | 30% |

| 8/30/2019 | 12% | 30% |

| 9/30/2019 | 12% | 30% |

| 10/31/2019 | 12% | 30% |

| 11/29/2019 | 12% | 30% |

| 12/31/2019 | 12% | 29% |

| 1/31/2020 | 13% | 29% |

| 2/28/2020 | 13% | 29% |

| 3/31/2020 | 13% | 30% |

| 4/30/2020 | 13% | 29% |

| 5/29/2020 | 14% | 29% |

| 6/30/2020 | 14% | 29% |

| 7/31/2020 | 15% | 28% |

| 8/31/2020 | 15% | 28% |

| 9/30/2020 | 14% | 28% |

| 10/30/2020 | 14% | 28% |

| 11/30/2020 | 14% | 28% |

| 12/31/2020 | 14% | 27% |

| 1/29/2021 | 14% | 27% |

| 2/26/2021 | 13% | 28% |

| 3/31/2021 | 13% | 28% |

| 4/30/2021 | 13% | 28% |

| 5/31/2021 | 14% | 27% |

| 6/30/2021 | 13% | 28% |

| 7/30/2021 | 14% | 27% |

| 8/31/2021 | 14% | 27% |

| 9/30/2021 | 13% | 27% |

| 10/29/2021 | 13% | 27% |

| 11/30/2021 | 13% | 27% |

| 12/31/2021 | 14% | 27% |

| 1/31/2022 | 14% | 26% |

| 2/28/2022 | 14% | 26% |

| 3/31/2022 | 15% | 26% |

| 4/29/2022 | 15% | 26% |

| 5/31/2022 | 14% | 26% |

| 6/30/2022 | 14% | 27% |

| 7/29/2022 | 14% | 26% |

| 8/31/2022 | 14% | 26% |

| 9/30/2022 | 14% | 27% |

| 10/31/2022 | 14% | 27% |

| 11/30/2022 | 14% | 26% |

| 12/30/2022 | 15% | 26% |

| 1/31/2023 | 15% | 26% |

| 2/28/2023 | 15% | 26% |

| 3/31/2023 | 15% | 25% |

| 4/28/2023 | 15% | 25% |

| 5/31/2023 | 15% | 25% |

| 6/30/2023 | 15% | 26% |

| 7/31/2023 | 15% | 25% |

| 8/31/2023 | 15% | 25% |

| 9/29/2023 | 15% | 25% |

| 10/31/2023 | 16% | 26% |

| 11/30/2023 | 16% | 25% |

| 12/29/2023 | 16% | 25% |

| 1/31/2024 | 16% | 25% |

| 2/29/2024 | 16% | 25% |

| 3/29/2024 | 17% | 25% |

| 4/30/2024 | 17% | 25% |

| 5/31/2024 | 17% | 24% |

| 6/28/2024 | 17% | 24% |

| 7/31/2024 | 18% | 25% |

| 8/30/2024 | 18% | 24% |

| 9/30/2024 | 19% | 24% |

| 10/31/2024 | 20% | 23% |

| 11/29/2024 | 19% | 23% |

| 12/31/2024 | 19% | 23% |

| 1/31/2025 | 20% | 24% |

| 2/28/2025 | 20% | 24% |

| 3/31/2025 | 22% | 23% |

| 4/30/2025 | 22% | 23% |

| 5/30/2025 | 22% | 23% |

| 6/30/2025 | 24% | 23% |

As political uncertainty and geopolitical risks continue to fuel safe-haven demand, this purchasing momentum has also lifted prices: gold surpassed $4,000 an ounce for the first time ever in October 2025.

Crossing above Treasuries signals that reserve managers are prioritizing durability, portability, and neutrality over yield.

According to the IMF, gold’s share of global reserves climbed to about 18% in 2024, up sharply from mid-2010s levels, reflecting a structural reweighting toward tangible assets.

Seen as an alternative to heavily indebted fiat currencies, especially the U.S. dollar, the share of gold in central bank reserves has increased most among emerging market economies. China, Russia, and Türkiye have been the largest official buyers over the past decade.

If you enjoyed today’s post, check out U.S. Dollar Index Falls 10.1% in 2025, Steepest Drop in Three Decades on Voronoi, the new app from Visual Capitalist.

Won’t be long folks can kiss the Dollar bye,bye..

No problem here. Just print more treasuries. Solved.

Right but they will be worthless.

You are an idiot!

What is money?

a medium of exchange.

in and of itself a piece of

paper in your wallet is worthless.

That means you need to trust

the person you are making the

exchange with and they trust you.

Gold is just a rare metal.

If my family is hungry a

basket of corn and some beef steaks

is worth far more than that coin.

But you won’t give me that food, unless

I have something you value.

Paper money works as does gold coins.

You don’t have time for me to do work

for you in payment.

That is exactly why ALL money is

just a way to trade my labors for yours.

Money itself is useless.

Y’all get it?

Lighten up Francis.....

And I should take his word for it...why?

Gold is Tresuries bookmark

You are the idiot as paper money is losing value and that is called devaluation...In Germany they used to get paid several times a day due to the paper currency being devalued and would literally use wheel barrows to buy food with.... Where all this is heading is digital currency and they can set the rate to whatever they want...The Federal Government already has it ready and it is called Fedcoin...

The devaluation of the US$ is in fact the only possible way to decrease the US debt. All those holding the $$$ are seeing their asset diminish in value.

When a Prince goes to King school, one of the mandatory courses is Currency Devaluation 101. Kings in debt have been shaving the size of coins since the beginning

With Digital it all goes away in a puff of smoke and they then can tell you what you can spend money on or stop you from spending money at all if you run a fowl of the US Government..a win-win for them...doing it in China now, soon in England... Batter will be the new trading method...if you have something to batter.

You didn’t read what I wrote, or perhaps I wasn’t clear enough. Paper money has no value, or gold without the trust that is does have value.

Trust cannot be measured on a scale.

The devaluation of the US$ is in fact the only possible way to decrease the US debt.

- - - - - - -

You can just not pay it. That will be a great precedent that will make people not want to loan to the government.

Our inflation causes a deflation in the value of the dollar.

There is definitely not enough above ground gold for the world’s population with the central banks gobbling it all up. Even without central banks holding any gold there is less than 1 ounce for every man, woman and child on earth. It’s possible that it might be impossible to obtain.

Right but they will be worthless.

= = =

Maybe not. Remember the TP shortage?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.