Posted on 08/16/2025 11:17:09 AM PDT by lasereye

You can almost understand President Donald Trump’s decision to fire the head of the Bureau of Labor Statistics… and his insistence that the economy is far stronger than the employment numbers indicated.

After all, the stock market is hitting all-time highs, and the American tech sector is absolutely crushing it. With Nvidia and the rest of the Mag 7 leading the way, the U.S. is spearheading the AI revolution and leaving the rest of the world behind.

End of story… right?

Well, that depends on which economy you’re talking about.

It’s almost nonsensical to talk about “the economy,” because it’s wildly different depending on where you look.

The tech sector is booming, and most white-collar and creative jobs are still in good shape.

But outside of the tech bubble, it’s not looking so hot.

The middle class and blue-collar economy is hurting.

Inflation still stings…

The manufacturing renaissance has yet to materialize…

And wage growth is stalling.

Writing for The Telegraph, Melissa Lawford calls it the “redneck recession” because working-class workers are the worst affected.

But blue-collar workers aren’t the only ones suffering. Younger workers and those with student loans are also in a real bind.

So today, let’s pick through the numbers to see what’s really happening in “the economy,” and how it could affect your investment strategies.

Manufacturing Is Dead

American manufacturing contracted for the fifth consecutive month in July.

It’s tempting to simply blame the tariffs, but that misses the full story. We had a brief blip of manufacturing growth in December and January, but before that manufacturing had been in decline for 26 consecutive months.

Some of this is the long hangover from the pandemic. The trend since late 2021 has been to spend less on “stuff” and more on experiences.

Some of it is due to inflation biting into budgets.

And more recently, some of it is due to tariff uncertainty causing executives to sit on their hands.

But whatever the cause, the takeaway is the same: The blue-collar economy is hurting. And there is no indication it’s turning around any time soon.

The Consumer Is Loaded With Debt

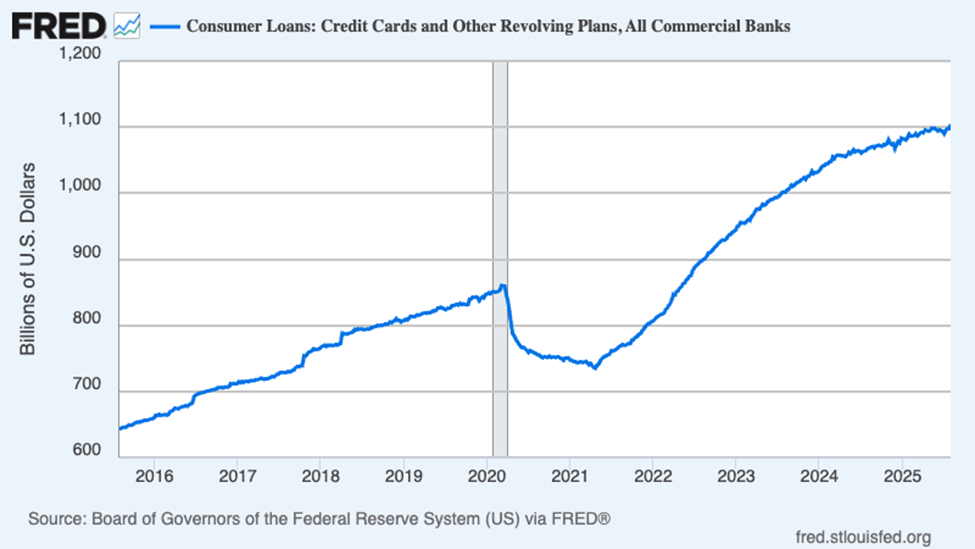

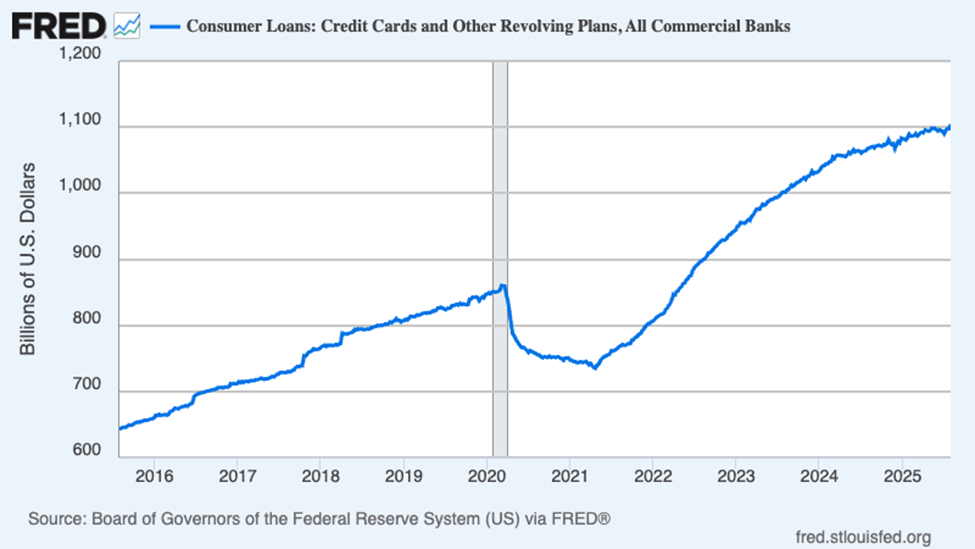

Credit card debt plummeted during the pandemic.

With most of the country getting stimulus checks, rent holidays, student loan moratoriums, and every other manner of free money, there was a debt reset of sorts.

It didn’t last.

By the end of 2021, most of the stimulus money had been burned though. By early 2022 credit card debt was back to pre-pandemic levels. It’s now a full 30% higher than its old 2020 peak.

By itself, that’s not necessarily a problem. Except that Americans are having a harder time paying the balances.

The delinquency rate on credit cards is now at the highest levels since 2012.

Student loans also look awful.

More than 10% of all student loans are reported at more than 90 days delinquent.

Debt pulls future buying into the present…nd a dollar needed to service existing debts is a dollar not available to spend.

That’s a problem… particularly when prices are rising on basic necessities.

And about that…

Today, the Bureau of Labor Statistics reported that core inflation – which filters out some of the month to month noise by removing energy and food prices – rose at 3.1% last month.

Inflation remains stubbornly sticky.

Forecasting a Recession

You’ve probably heard the old tongue-in-cheek joke that “economists have predicted nine out of the past five recessions.”

Yeah. Their track record isn’t great, and there are plenty of false alarms.

Unfortunately, the indicators that economists use to predict recessions have limitations… and they’ve become less useful than usual over the past five years.

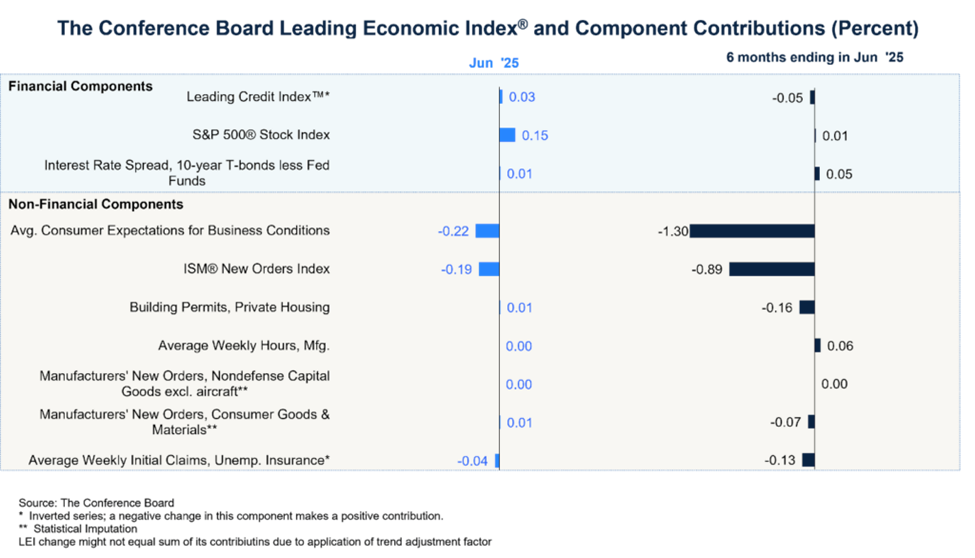

Regardless, let’s take a look at the Conference Board’s Leading Economic Index (LEI), which has historically been one of the best forecasting tools for recessions.

Think of the LEI as a dashboard of gauges that try to predict where the economy’s headed.

It blends together ten different stats – things like new jobless claims, building permits, stock prices, and manufacturing orders – into one number.

If the LEI is rising, it means the economy is likely to grow in the next few months. If it’s falling, it’s a warning sign that things could slow down.

Right now, it doesn’t look great.

Nine of the index’s indicators were flat or negative in June.

The only one that was positive was the performance of the S&P 500.

And looking at the first half of the year, not a single one of the 10 indicators was robust. All were either flattish or significantly negative.

The LEI triggered a recession signal for the third consecutive month in June.

The LEI triggered a recession signal for the third consecutive month in June.

That doesn’t mean the economy falls apart tomorrow.

It means we should be paying attention here.

So here’s the million dollar question…

Why Aren’t Stock Earnings Cratering?

If the world is crumbling, why aren’t we seeing a reaction in the stock market?

Well… we actually are.

Hypergrowth expert Luke Lango, recently broke down the numbers:

Take a look at the profit growth rates for the Magnificent 7 tech stocks (firmly in the AI Economy) and the S&P 493 (which comprises some AI Economy stocks, but also a lot of Everything Else Economy stocks)…

This quarter, the Mag 7 is expected to grow profits by 26%, versus just 2% growth for the S&P 493…

Inflation is currently running north of [3%], so the S&P 493 will essentially have NEGATIVE real profit growth for the rest of the year. Ouch!

So, how are we to navigate this?

To start, we should be invested in the strongest companies that are thriving in this environment. Stick with what’s working. For example, the Xtrackers Artificial Intelligence and Big Data ETF (XAIX,) a proxy for the AI economy. I recommended it in the Freeport Investor in December and it’s up 44% from its April lows. That’s a no brainer.

But don’t fall in love with the narrative.

Even strong stocks can get whacked in a real recession.

The best thing to do is keep a little extra cash on hand and hang on to your hedges in gold and Bitcoin.

In Freeport Investor, we’re sitting pretty in both assets. We hold three open gold positions, which are up 65%, almost 66%, and nearly 20%. And our two Bitcoin positions are in the green by 188% and 85%.

These will remain in our model portfolio for the foreseeable future.

To life, liberty, and the pursuit of wealth.

Charles Sizemore Chief Investment Strategist, The Freeport Society

Some space stocks have been flying higher this year (pun intended). For example ASTS and RKLB. A space company called Firefly (FLY) just had a successful IPO. None of these companies are eligible for the S&P 500 since they aren't yet profitable. As pointed out in the above article the S&P 500 stocks overall are not doing that well outside the MAG 7.

Where were the complainers in the MSM from 2021 through 2024? Not a peep from them about how bad it was with Biden “running” things. Biden and his democrat buddies ran the USA into the ground.

You think Investorplace is MSM?

Doom and gloom, so as to minimize Trump’s achievements.

I don’t see much of a redneck recession in Texas. And as far as the student loans in default, the sociology majors know that there is little penalty for not paying it back. Other than a bad credit score.

I never insinuated that. Merely that things aren’t as bad as they’re made out to be. The good should be emphasized, that we’re on the rebound with President Trump while China and others are doing poorly now.

This is an investment website. People go to it to understand how to invest their money.

Or are you not even talking about this article?

You're seeing something that isn't there. He is giving his analysis about how to invest in this economic environment. To do that he needs to accurately describe the environment. Is he supposed to lie?

IMO the Fed is keeping rates higher to slow the economy and to impact midterms.

So Trump didn’t wave a magic wand and fix everything all at once? Damn.

I have some shares of RKLB. A lot hinges on the success of their Neutron rocket. Sticking with it.

Its hard to conclude otherwise after the Fed’s sudden 50 bp cut just before the election.

The swamp, the establishment, whatever name you prefer has created over time a series of measures. Originally each was intended to portray a certain thing. But bias has crept into it. X is too volatile so we won’t include it. Y is too static so we won’t include it.

Concurrently, they are compared to each other. Due to Anomaly A and B they are adjusted.

What we see in Aug 2025 is legacy numbers with so many now hidden exceptions and adjustments that their reliability can be in question. They are useful to compare Jun to Jul to Aug numbers. But do the numbers really reflect reality? Somewhat...but somewhat not.

Person clearly doesn’t understand how tariffs work. This is a TDS hit piece.

Why do you think trump won? The media screamed the economy sucked and voters agreed.

Why are you so defensive and invested in this article?

I have no idea what you’re talking about.

Tariffs are not the focus of the piece. The article is about the fact that the economy is slowing and possibly headed for recession. It mentions tariffs in a single sentence.

You seem to think any mention of tariffs possibly having any negative impact is TDS, and it then follows that we should ignore everything in the article.

The Fed could reduce the Federal Funds Rate to 0% tomorrow, but that won’t do anything to reduce the 4.5% to 5% rate that investors have been demanding for U.S. Treasury bills over the last six months. THOSE rates — which underpin most business and personal loans — are elevated due to our dysfunctional fiscal policy and massive federal debt.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.