Posted on 07/18/2025 6:10:41 PM PDT by Angelino97

On Tuesday, the yield on the 10-year Treasury surged nearly 10 basis points in a few hours, rising above 4.49 percent. The rising yield came after the release of new price-inflation data showing that CPI growth had hit a five-month high and remained well above the Federal Reserve’s two-percent target for price inflation.

Rising yields often indicate that bond investors believe price inflation will continue to grow, so it was probably no coincidence that bond yields—especially on longer-term bonds—jumped following the report’s release.

Whatever the reason behind the rising yield, this is bad news for those who were looking for a good reason to believe that mortgage rates will significantly fall again soon. Mortgages for single-family homes closely follow the 10-year yield, and, as the 10-year yield has risen in recent years, the average 30-year mortgage more than doubled. Ity rose from under three percent in mid 2021 to above seven percent by late 2023. It has remained above six percent ever since.

Meanwhile, home prices continued to rise well into mid 2025. This combination of rising home prices and rising mortgage rates has made housing unaffordable for a growing share of propsective homebuyers.

In response to this trend, The Trump administration’s FHFA Director, Bill Pulte—a scion and nepo baby from a wealthy family of homebuilders—has demanded that the central bank intervene to force down mortgage rates in order to stimulate residential home sales and home prices.

Pulte claims that Fed chairman Jerome Powell’s lack of enthusiasm for lowering interest rates is “the main reason” that there is not more home-sales activity. Pulte concludes that Powell is “hurting the mortgage market” by “improperly keeping interest rates high.” Pulte apparently believes that more people would buy homes if only the Fed fixed the situation with lower interest rates.

When the Fed intervenes to lower interest rates, monetary inflation is required. To demand lower interest rate policy—as Pulte is doing—is to demand more inflation. At the core of this inflationist position is the misconception that rising home prices—and their negative effect on homeownership—can somehow be “fixed” or rendered irrelevant by lower interest rates.

This is not how things work, however. Even if mortgage rates were to go down again, rising prices mean homeowners would still be stuck with higher costs and higher property taxes that result from rising prices. Moreover, Pulte is wrong to even assume that Fed intervention via the policy interest rate would somehow, magically, bring down 30-year mortgage rates.

Problems with Rising Home Prices

Last week, we explored the many ways that the Federal Reserve’s monetary policy and asset purchases have fueled rising home prices. There is a close correlation between the central bank’s purchases of mortgage backed securities, the falling federal funds rate, and rising home prices. Falling interest rates have fueled rising home prices. This has led to historic lows in the affordability of homeownership, and a rising average age for home owners.

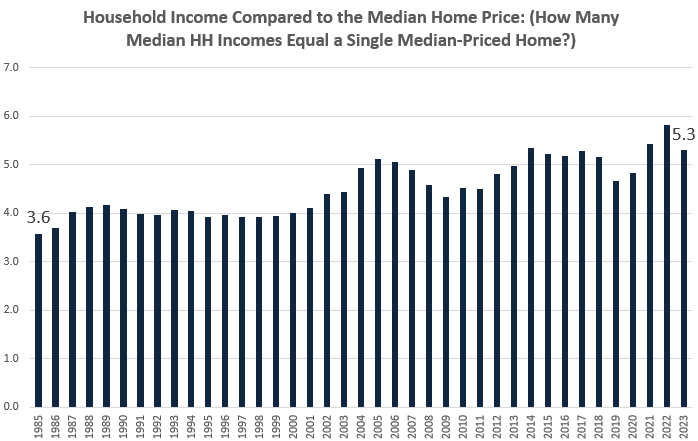

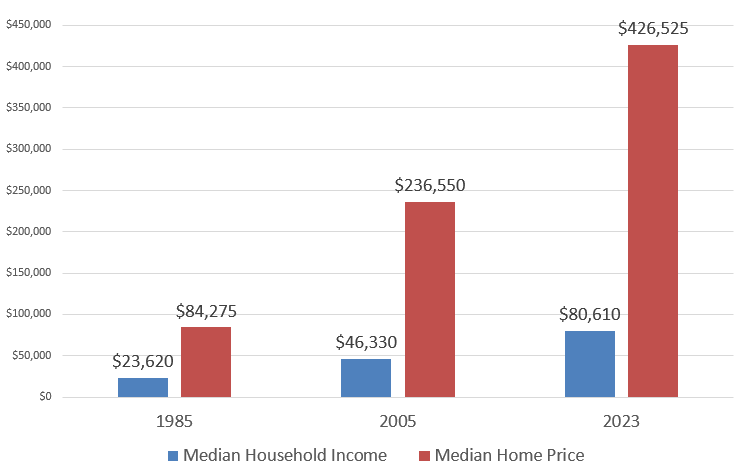

As home prices have risen, homes have become less affordable. Notably, the median home price has become much larger over time, when compared to the median household income. In 1985, for example, the median home price was 3.6 times the size of annual median household income. By 2023, the median home price was 5.3 times the median household income.

Rather than address the larger issues of asset-price inflation fueled by easy money, advocates of central planning, like Pulte, insist that the best way to “solve” the problem is to have the central bank somehow force down mortgage rates.

Assuming that the central bank has the power to do this, would it make housing more affordable? In certain ways, yes. If the only measure of affordability is the size of the monthly mortgage payment, then lower mortgage rates, all else being equal, make home purchases more affordable.

For example, a $500,000 loan at 3% for 30 years will require a monthly payment (on principle and interest) of about $2100. On the other hand, the same loan at 6% will require a monthly payment of nearly 3,000 per month.

But, monthly costs associated with a home purchase do not consist of only payments on a loan’s principal and interest. Homeowners must also pay property taxes and insurance. Home buyers must also come up with down payments which, of course, are proportional to the home price.

Thus, home-price inflation leads to higher down payments while also driving up property taxes—which are also tied to the home price. The monetary inflation that underlies rising home prices also tends to inflate the price of services like homeowner’s insurance. Principal and interest may be fixed in a 30-year mortgage, but taxes and insurance—which increase with price inflation—are not fixed. Thus, these costs are certainly not made irrelevant by falling interest rates.

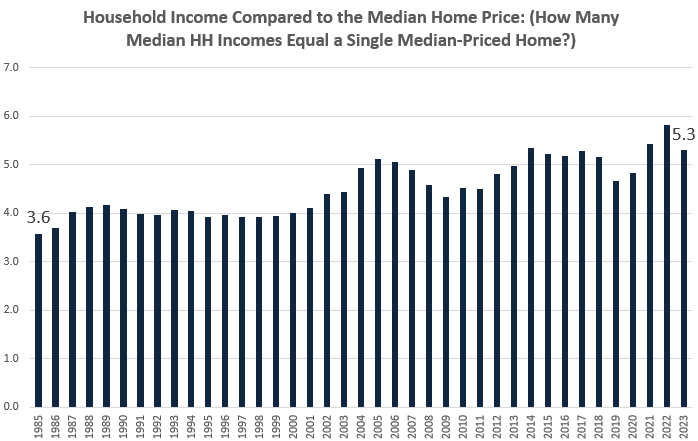

It is not surprising that, as home prices increased in the wake of the covid panic’s runaway monetary inflation, the Atlanta Fed’s affordability index plummeted to historic lows.

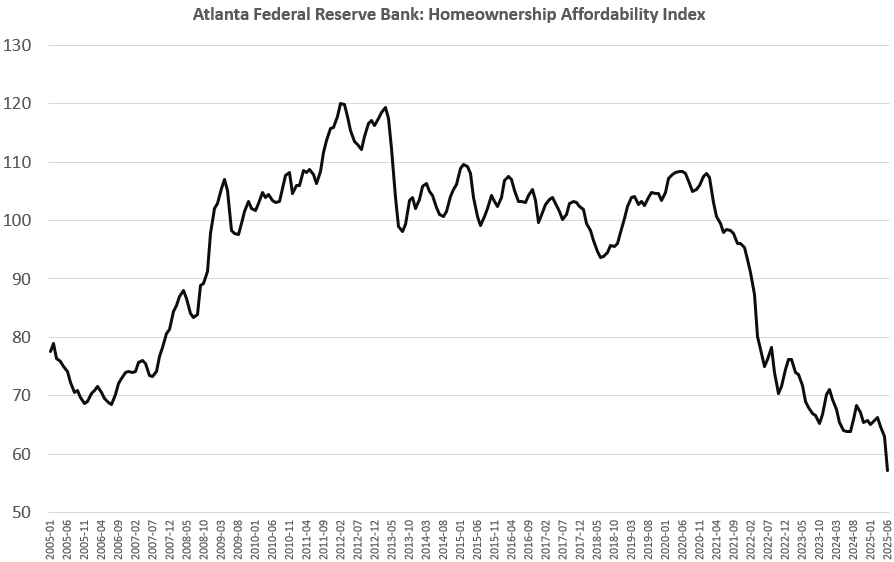

We can partly see why this happened if we compare prices and income over time. In 1985, for example, the median home price was about $81,000, but rose by 406 percent to about $426,000 in 2023.

Obviously, any taxes, insurance, and down payments that are proportional to the home price were far lower in 1985 than they are now. Moreover, as home prices quintupled from 1985 to 2023, median household income only increased by 241 percent, rising from about $23,000 in 1985 to $84,000 in 2023.

These rising prices took their toll on affordability, even as interest rates were falling. For example, from 2006 through 2021, the average mortgage rate fell consistently. Yet, during most of that period, the affordability index only moved sideways.

Moreover, this proved to be unsustainable. The problem with constantly falling interest rates is that, eventually, they get so low that there’s not room to move downward. In 2021, mortgage rates were at or near all-time lows. Yet, the very small uptick in average mortgage rates that occurred from 2021 to 2025—with rates still below historically normal levels—caused affordability to collapse.

So, Pulte is simply wrong if he’s claiming that the Fed would increase the affordability of homes if only Jerome Powell would intervene to force down mortgage rates.

Does the Fed Have the Power to Reduce Mortgage Rates?

Finally, we have to ask ourselves if the Fed even has the ability to somehow force down mortgage rates by lowering the Fed’s policy interest rate. It appears that this may be possible some of the time.

For example, from 2008 to 2022—a period when bond investors showed little concern over deficits or price inflation—both long-term and short-term yields declined as the Fed cut the target policy interest rate.

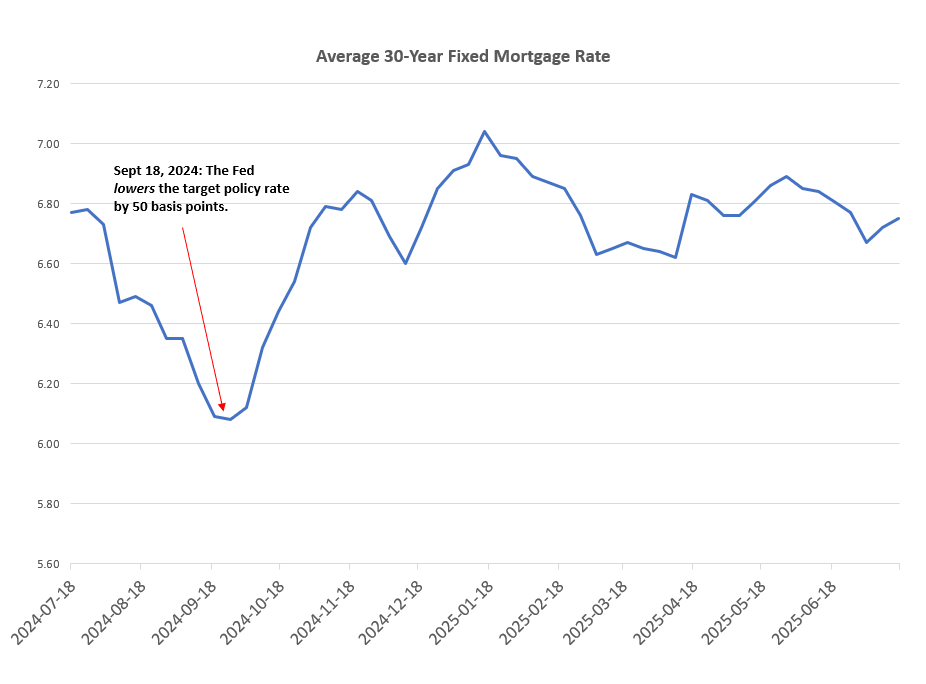

Those days, however, appear to be over. For example, when the Fed cut the policy rate in September of last year, the average mortgage rate increased.

In the wake of the Federal Reserve’s extreme monetary inflation of 2020-2021, and as federal deficits continue to mount bond yields are likely to increase if the Fed tries to embrace a new easy money stance pushing lower interest rates.

Not only is Pulte wrong that falling mortgage rates necessarily make homeownership more affordable, he is also probably wrong that the Fed can reduce those rates by targeting a lower policy rate.

If Pulte really wanted to see homes become more affordable, he would push for less monetary inflation and for lower federal deficits. He would push for the Fed to reduce its balance sheet of mortgage backed securities. All that, however, would lead to falling home prices, and that would run afoul of the administration’s Wall Street allies who incessantly demand more asset price inflation.

They don’t live on the streets so of course they rent houses.

Point is compared to US population their numbers are very small and therefore they can not affect house prices significantly. There are several other factors with much bigger impact on home prices.

i’ve been seeing this tripe since the 70;s when housing broke the 100k barrier. nobody can afford a house anymore, they wept. yet somehow people still buy houses and keep them. funny how that works. all these experts cry, weep and moan, but the average joe still buy his house and lives in it. he may struggle (i know i did), but people still continue to buy.

When prices rise, people complain because they can't afford a house.

When prices fall, people complain because they're losing equity.

The question is legal versus illegal. I do know many citizens are having trouble finding anything but entry level, part time jobs. Remove the illegals and let’s figure out where we are.

All it will take is getting the illegals out of the country en masse.

Unfortunately, Trump has completely caved, or maybe more accurately, bait-and-switched us on that.

“They all have to go home”? Lasted about as long after election as “Lock her up”.

Exactly!

No. Stop all work visas.

Get rid of the 50 to 60 million illegals in the country!

There will be a massive economic adjustment, but the result will be glorious for all Americans.

Remove illegals. Also, I wouldnt mind some kind of property cap on people and businesses so that corps. stop buying up all the homes and renting them out.

Century of Enslavement: The History of The Federal Reserve (2014 | FULL DOCUMENTARY)

https://rumble.com/v3yak4a-century-of-enslavement-the-history-of-the-federal-reserve-2014-full-documen.html The Solari Report https://solari.com/

They Are Gambling the National Security of the U.S. on a Single Point of Failure

https://youtube.com/watch?v=nIwTbiru4uk&si=X7lF8Jp0Jbye5chq

The Crossfire Hurricane Report’s Inconvenient Findings.

https://www.cato.org/commentary/crossfire-hurricane-reports-inconvenient-findings

“You are splitting hairs. The fed has a whole raft of tools it uses to pressure the banking system to reach its target.”

Being accurate is not splitting hairs.

Can you provide a source for the .2% assertion? I have said it before in most cases there is nothing temporary about H-1B’s. They bring their spouses over on some othe immigrant visa and have an anchor baby or 2 in our country and never leave. I see it in my own city and communities.

No matter if they bring spouse it is still only one house they need to rent. This thread is about why house prices are high. Not about spouses of h1-b visa workers.

You can do a simple search ..how many H1-B Visa’s are granted each year. Compared to USA population it is way less than fraction of 1 percent.

Should be. However... taxes and fees are much higher now. It's ridiculous that sales taxes around here run 10 percent or more, when in the past they were about 3 to 4 percent. Same goes for property taxes, and income taxes. The government (all kinds) keep taking a larger bite out of earned income, making the cost of goods ever higher as a percentage net income.

The culprit is greed in government. And to a lesser extent, private entities. Why is it that tips were traditionally between 7-1/2 to 15 percent, yet restaurants are now demanding 20 to 25 percent? Here in California, a recent law lets restaurants charge an 18 percent cost of living fee, in addition to still wanting a tip to be paid?

The old days were better, since you had more of your income left over in order to buy stuff you needed.

I just had some new windows installed in my home today, by a local reputable firm. The three workers chatted away in Spanish while working. Only one worker spoke in English to us, one worker didn't understand any English. They did excellent work so I didn't ask if they were legal or not.

It seems to me that most local construction jobs at homes around me are done by Spanish speaking workers. Last year I had new fences installed, same thing. One exception is a deck I had built over a decade ago, they spoke Vietnamese but no English. Otherwise, Spanish speakers (I understand some due to classes I took in college, but not fluent).

I live in a 55+ community in Palm Desert, in the summer I hand out ice cream to all of the landscapers it is hotter than hell out there, there is ONE of the 14 landscapers that speak a word of English I don’t know if they are legal but I can’t believe they work everyday in 120* weather keeping the golf course, trees trimmed, sprinkler systems, all maintained!! I really hate to say this HOWEVER I can’t imagine Caucasian’s doing this work in this heat, back in the day maybe, but NOT today they are far to spoiled!!!

Yes, similar story here even in NH.

I hired a local roofing company to replace the roof on my house.

They showed up the first week in May.

The foreman was a local white guy.

He mostly sat in the truck all day.

The crew all piled out of a van with MASS plates.

Six young guys and two young women.

The guys were all on the roof.

The ladies were primarily on the ground.

They were all from Ecuador.

They looked like the people that you see in the pictures from Machu Pichu.

People from up in the Andes.

None of them were over 5’ 4” tall.

However, I watched one of the ladies throw a bundle of shingles up on her shoulder and climb the ladder to the roof like it was nothing.

It was kinda impressive for a woman who may not have been 5’ tall.

Marry a gal like that and be happy with your home improvement projects! My wife won't get on a ladder, can't blame her being in her 70's with weak bones. But she does help me carry lumber from my truck. Good catch, over 50 years now.

I hear you. I tried hiring a local young guy on the block to help me on back yard hill work. Caucasian. Always late to show up, talked a lot while taking lots of breaks, but eager to take the money (paid him by the hour, my mistake). I should have known better, his dad was too lazy to mow or dig his own lawn. Spoiled Americans (generally not 1st or 2nd generation, the laziness kicks in later). I wish foreigners coming here were all legal, until then we have to wait and see if citizens will actually get motivated to do hard work.

$400k doesn’t get you a SFH in Lawrence, Massachusetts - the WORST crime-plagued city in Eastern MA.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.