Skip to comments.

Singapore Challenges U.S. Tariffs Amid Trade Dispute

Development discourse ^

| 4th April 2025

Posted on 04/07/2025 11:37:31 PM PDT by Cronos

Singapore expresses disappointment over U.S. tariffs on its exports despite a free-trade agreement and trade deficit with the U.S. Trade Minister Gan Kim Yong emphasizes diplomacy over retaliation and highlights talks with the U.S. to resolve concerns. Singapore will review economic forecasts due to the escalating issue.

In a move that has sparked international economic tension, Singapore's trade minister expressed disappointment over the U.S. imposition of a 10% tariff on its exports, despite a free-trade agreement and trade deficit with the United States

Trade Minister Gan Kim Yong, speaking at a press conference, assured that Singapore would not pursue retaliatory measures but would instead focus on diplomatic dialogue to resolve the issue. He acknowledged the government would reassess economic forecasts in light of the tariff situation.

TOPICS: Business/Economy; Foreign Affairs

KEYWORDS: asia; bloggers; concerntroll; concerntrolling; singapore; tariffs; tds; trade

Navigation: use the links below to view more comments.

first 1-20, 21 next last

unlike Singapore's trade relationships with China and Malaysia, where Singapore exports more than it imports, Singapore's imports from the U.S. exceed their exports to the USA. This means the U.S. enjoys a trade surplus with Singapore.

Singapore applies zero tariffs on US products, as long as they qualify as originating goods under the FTA's rules of origin. The exception is Singapore's goods and services tax, which applies to both imported and domestic goods, at the rate of 9 per cent. And certain goods like alcohol and tobacco face excise taxes

1

posted on

04/07/2025 11:37:31 PM PDT

by

Cronos

To: Cronos

Critics of the Trump tariffs are quick to point out that the US has trade surpluses with Singapore and the UK, but ignore the facts that the US has huge trade deficits with most of Asia and Europe.

To: Cronos

By the way, I've noticed that all Zeepers are critical of the Trump tariffs. That fact alone tells me that Trump is taking the correct course of action.

>> Singapore applies zero tariffs on US products, as long as they qualify...

yeah, that other detail

4

posted on

04/08/2025 12:03:12 AM PDT

by

Gene Eric

To: Cronos

I was just in Singapore. It has banks and insurance and shipping. If they sell products to the US they are made somewhere else. And its this issue of being used as a pass through for Chinese goods coming to America that causes the 10% tariffs. Singapore is a very rich country with very little manufacturing. They make money on their port, their tourism and the fact that they have rule of law. But its also the new Hong Kong. A place where China meets the West. China can export to Southeast Asian countries who do little more than packaging before they send the items to the US. That hole needs to be plugged.

5

posted on

04/08/2025 12:05:17 AM PDT

by

poinq

(thics and customs and did not take an oath to the country. And did not follow the country's traditio)

To: Right_Wing_Madman

Yup. I am pro tariff. The anti-tariff crew all voted for Kamala anyway.

To: Right_Wing_Madman

Then we should tariff the ones who have tariffs on us AND who have trade deficits on us.

The US has a trade surplus with Singapore, and Singapore has close to 0 tariffs on US goods

7

posted on

04/08/2025 12:35:42 AM PDT

by

Cronos

To: poinq

From https://oec.world/en/profile/country/sgp

$32.9 billion worth of goods to the United States, with the main products being vaccines, blood, antisera, toxins, and cultures

op Exports to the US (2023):

Vaccines, blood, antisera, toxins, and cultures: $6.15 billion

Other Edible Preparations: $3.05 billion

Nucleic Acids: $2.99 billion

Machinery Having Individual Functions: $1.83 billion

Semiconductor devices: $0.543 Billion

Refined Petroleum: $1.79 billion

Orthopedic appliances: $1.04 Billion

Chemical Analysis Instruments: $0.91 Billion

From the USA, Singapore imports:

Crude petroleum: $7.75 billion (so the refined petroleum comes out of this I guess)

Gas Turbines: $4.3 billion

Planes: $3.81 billion

Aircraft parts: $3.4 billion

Machinery:L #1.9 billion

Integrated circuits: $0.99 billion (they probably process some of this back to the $0.5 b in exports of semiconductor devices exported back to the USA)

8

posted on

04/08/2025 12:45:05 AM PDT

by

Cronos

To: poinq

As to

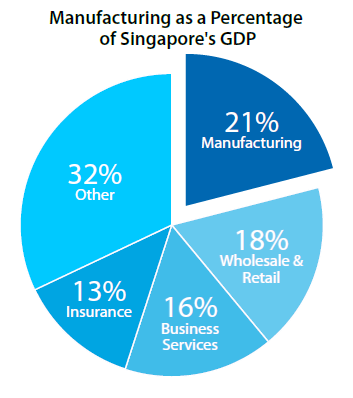

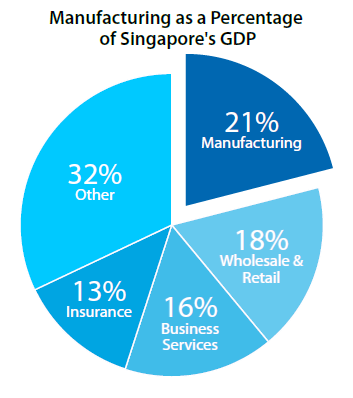

ingapore is a very rich country with very little manufacturing That isn't true -

The manufacturing sector is 21% of the economy --> $167 billion vs overall GDP of $673 billion.

The manufacturing sector is 21% of the economy --> $167 billion vs overall GDP of $673 billion.

Singapore manufactures: 1. Electronics: Singapore is a global hub for electronics manufacturing. It produces semiconductors, integrated circuits, computer peripherals, and consumer electronics. Companies like STMicroelectronics and GlobalFoundries have significant operations there, making it a leader in high-tech components

2. Chemicals and Petrochemicals: The country has a robust chemical industry, particularly on Jurong Island, a major industrial hub. It manufactures petrochemicals, specialty chemicals, and refined petroleum products like gasoline, diesel, and jet fuel. ExxonMobil and Shell are among the big players with refineries in Singapore.

3. Biomedical and Pharmaceuticals: Singapore is a growing center for biomedical manufacturing, producing pharmaceuticals, medical devices, and biotechnology products. It’s home to facilities from companies like Pfizer, Novartis, and GlaxoSmithKline, focusing on high-value drugs and diagnostics.

4. Precision Engineering: This sector includes machinery, equipment, and components for industries like aerospace, automotive, and electronics. Singapore manufactures precision tools, optical instruments, and industrial machinery, supporting both local and global supply chains.

5. Aerospace: The country is a key player in aerospace manufacturing and maintenance, producing aircraft components, engines, and avionics. Companies like Rolls-Royce and Pratt & Whitney have facilities there, and Singapore is known for its aerospace repair and overhaul services.

6. Transport Equipment: Beyond aerospace, Singapore manufactures marine and offshore equipment, such as ships, rigs, and parts for the maritime industry, leveraging its strategic port location.

9

posted on

04/08/2025 12:51:12 AM PDT

by

Cronos

To: poinq

Regarding the port - you are right that it is a cornerstone of Singapore, but it isn’t the largest form — Port of Singapore said that in 2022 it made $3.36 billion from Singapore.

With Singapore’s GDP at approximately 501 billion SGD in 2023, this translates to roughly 35 billion SGD from the broader maritime industry. The port itself, as the linchpin, likely generates a fraction of this—potentially 5 to 10 billion SGD—when factoring in PSA’s revenue, Jurong Port’s contributions, and MPA’s service fee

Singapore has gone beyond being just an entrepot as it was pre-1960s, but significantly “value adds” to items imported into Singapore — as for example it imports crude oil from the USA and then exports refined oil and oil products to a number of countries including the USA

10

posted on

04/08/2025 12:55:01 AM PDT

by

Cronos

To: Gene Eric

Singapore imposes very few tariffs on U.S. goods exported to its market, largely due to the U.S.-Singapore Free Trade Agreement (FTA), which has been in effect since January 1, 2004. Under this agreement, Singapore applies a Most-Favored-Nation (MFN) zero-duty rate to nearly 100% of its tariff lines for U.S. goods, meaning almost all American exports enter Singapore duty-free. The FTA eliminated tariffs on all U.S. goods by January 1, 2013, and also exempts them from Singapore’s merchandise processing fees.

There ARE exceptions are you point out and these are:

1. Alcohol - note that this is applied to all imported alcohol (and nearly all of it is imported into Singapore)_— not just US - distilled spirits face rates like S$11.20 per liter of pure alcohol, while beer is taxed at S$0.60 per liter.

2. Tobacco products - again, these are on all tobacco imports - taxed at S$0.427 per gram, with additional duties on other tobacco forms.

3. Motor Vehicles: Excise duty is 20% of the customs value, plus an additional registration fee that scales with engine size, significantly increasing costs for larger vehicles. This affects U.S.-made cars but isn’t unique to them.

In practice, since over 99% of U.S. goods enter duty-free under the FTA, the only significant costs are the GST and, for the exceptions above, excise taxes.

These measures aren’t targeted at the U.S. but apply to all countries equally, reflecting Singapore’s status as a free port with one of the world’s most open trade zones

11

posted on

04/08/2025 12:58:32 AM PDT

by

Cronos

To: Cronos

Then we should tariff the ones who have tariffs on us AND who have trade deficits on us. Even if the tariffs are eliminated, we still will have deficits with most other countries simply by virtue of our population size vs theirs. The concept that we must have a trade surplus with everyone is shear insanity.

12

posted on

04/08/2025 4:11:00 AM PDT

by

Sir_Humphrey

(I'll support Trump when I think he's right. I'll oppose him when I think he's wrong. As it should be)

To: Cronos

Singapore is China’s Mini-Me..............

13

posted on

04/08/2025 4:20:21 AM PDT

by

Red Badger

(Homeless veterans camp in the streets while illegals are put up in 5 Star hotels....................)

To: Right_Wing_Madman

I noticed that pattern as well.

14

posted on

04/08/2025 5:46:26 AM PDT

by

Tench_Coxe

(The woke were surprised by the reaction to the Bud Light fiasco. May there be many more surprises)

To: Red Badger

redbadger “Singapore is China’s Mini-Me..”

Why do you say that? I mean yeah, “Communist” China is more “technocratic oligarchy” China, and off the top of my head I see 3 similarities:

1. Single-party dominant system —> Singapore is dominated by the People’s Action Party, but opposition parties are legally allowed unlike China

2. centralized control - but then arguably Singapore is a city state of 290 square miles while CCPC is 3.7 million square miles —> 12,800 times larger. And a centralized control city is way easier of course.

3. Bureaucracy based on Confucian ideals

What are the similarities that you see?

15

posted on

04/08/2025 6:07:34 AM PDT

by

Cronos

To: Cronos

They are mostly ethnic Chinese......................

16

posted on

04/08/2025 6:10:21 AM PDT

by

Red Badger

(Homeless veterans camp in the streets while illegals are put up in 5 Star hotels....................)

To: poinq

Singapore is little different than penguin island in that regard.

17

posted on

04/08/2025 6:15:13 AM PDT

by

Sirius Lee

("Never argue with a fool, onlookers may not be able to tell the difference.”)

To: Cronos

Singapore is like Chicago. The Area is close, between 250 and 300 square miles. The population is closer to the size of the Chicago metro area. The GDP is almost exactly the same. But Singapore lacks heavy industry. They take something off a ship add value in some way, then back on the ship. Since Singapore residents average near $150,000 a year and since there is a huge low wage Malaysian population available a few miles away, the largely Chinese population is able to create things they don’t want in China, but using many Chinese parts. Take Tictok for example. In China where it originated, under another name. It can incorporate in Singapore, change its language and name, then it comes to America.

I grant that Singapore is often not a complete pass through like Vietnam or Mexico can be. But it does take advantage of its position of being, Chinese without being in China. Profits often role back to China through ownership or the purchase of Chinese parts.

That is a problem that is hard to figure out. In fact many products within America itself are actually over 50% Chinese while stating that they are made in America. I am not at all sure how tariffs are placed on products that are mostly Chinese or partly Chinese or completely Chinese, while being shipped to America from a third country.

18

posted on

04/08/2025 6:20:27 AM PDT

by

poinq

(thics and customs and did not take an oath to the country. And did not follow the country's traditio)

To: Cronos

yup, the company I work for will likely buy a $1.5M system for performing electrical component failure analysis from a company in Singapore.

19

posted on

04/08/2025 6:25:18 AM PDT

by

jurroppi1

(The Left doesn't have ideas, it has cliches. H/T Flick Lives)

To: poinq

20

posted on

04/08/2025 6:25:38 AM PDT

by

Cronos

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

The manufacturing sector is 21% of the economy --> $167 billion vs overall GDP of $673 billion.

The manufacturing sector is 21% of the economy --> $167 billion vs overall GDP of $673 billion.