Posted on 10/20/2024 11:18:39 PM PDT by RomanSoldier19

The International Monetary Fund's latest fiscal monitor report has predicted that the global public debt will surpass $100 trillion this year.

The report stated that the debt margin will reach 93% of global GDP by 2030, exceeding its 99% peak during COVID-19 driven by intense spending pressures and sluggish economic growth. The figures are projected to reach 93% of global gross domestic product by the end of 2024 and approach 100% by 2030, IMF said in its fiscal monitor report released Tuesday.

(Excerpt) Read more at ibtimes.com ...

Consider for Election

People have a penchant for sending nearly all incumbents back into Congress. As the War on Poverty and the Great Society began the budget for defense was 46% of outlays and payments to individuals 28%. For 2024 estimated defense shrinks to 15.2% and payments to individuals grows to 72% of outlays. In 1964 federal debt was $312 billion and 46% of GDP but has grown to $34 trillion and 122% of GDP through 2023. Federal debt at 122% of GDP is where countries like Greece reside. Unfunded Social Security and Medicare promises to add a total of $163 trillion.

Clearly, expenses provide the solution but concentrating power with ossified politicians got us here. The ‘American Dream” is life, liberty, and the pursuit of happiness. An impenetrable defense and a sound civil justice system secure life and liberty. The pursuit of happiness always meant spiritual wellbeing and not government largess.

When not ignoring expenses with Continuing Resolutions, Congresses and Administrations sustain the alternate reality of Base Line Budgeting. Under this program, previous year appropriations increase for estimated inflation and enhancements and are compounded for ten years. The Office of Management and Budget then scores reductions in the rate of growth as “budget cuts”.

These concerns are dismissed by saying the national debt is an obligation we owe ourselves. However, foreign individuals and countries hold substantial amounts, and they are not “we”. Faced with such lunacy, pragmatic buy and sell decisions on world markets can create an uncontrollable cascade for the Fed.

Partial Bibliography:

Baseline (budgeting)

https://en.wikipedia.org/wiki/Baseline_(budgeting)

Inflation in the United States

https://imprimis.hillsdale.edu/inflation-united-states/?utm_campaign=imprimis&utm_medium=email&_hsmi=203168297&_hsenc=p2ANqtz-82xURNeJJMzDQHVm7PSB4ix2csHWYa2JoC5siwcRfou_PeylHsfk3F-08hCQN_xb12Lof0ZgNyM3PCc88tqJub4nTyHQ&utm_content=203168297&utm_source=hs_email

Federal Debt and Unfunded Entitlement Promises

https://www.cato.org/blog/federal-debt-unfunded-entitlement-promises

Our national debt now equals all the money in the world!

https://freerepublic.com/focus/f-chat/4260683/posts https://www.americanthinker.com/blog/2024/08/our_national_debit_now_equals_all_the_money_in_the_world.html

Federal Budget Historical Tables (OMB) Table 6.1

https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Ftrumpwhitehouse.archives.gov%2Fwp-content%2Fuploads%2F2020%2F02%2Fhist06z1_fy21.xlsx&wdOrigin=BROWSELINK

U.S. National Debt by Year

https://www.thebalancemoney.com/national-debt-by-year-compared-to-gdp-and-major-events-3306287

U.S. Debt Clock

http://usdebtclock.org/

Cheer up. As with people and businesses, a heavy debt load for a nation is a spur toward healthy reforms that cut waste and increase productivity. Major scientific and technological advances also tend to get fast tracked into wide adoption.

We are the largest debtor nation with 35 trillion of that 100 trillion global government debt. With only 5 per cent of the global population we own 35% of the global debt and yet, we are still borrowing to fund other nations’ wars and defense as well as shoveling out foreign aid to them.

The world should get a mulligan and we start over.

Was about to state something similar, instead we can add only some 40% of population pays any income tax making the situation even worse.

deliberate set up for the globalist reset

No, it doesn't. Not even close.

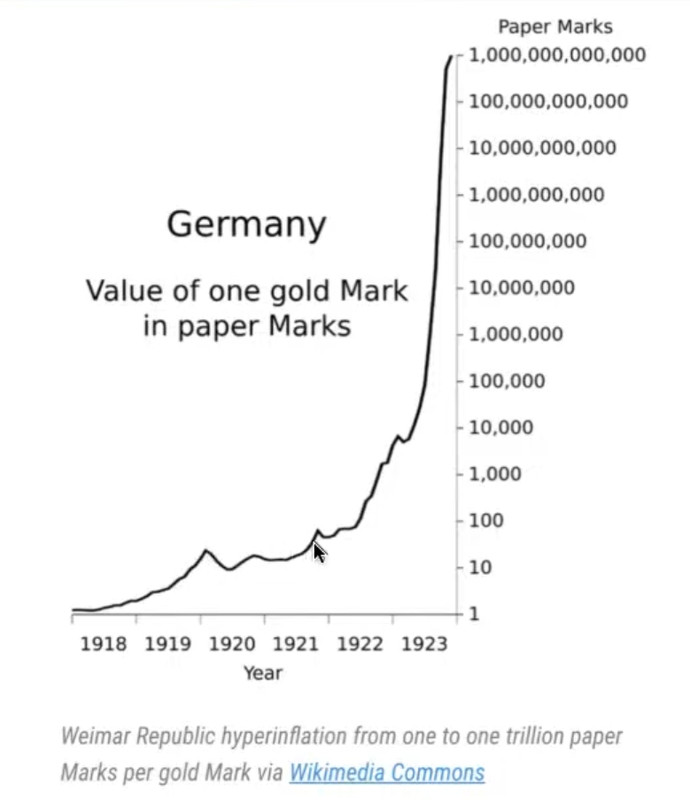

Consider how a dollar is created - out of thin air, as it is fiat currency, and then loaned to the federal government. Interest is owed from the gitgo. These dollars are instruments of debt. A dollar is a derivative of real money.

Then, consider the nature of fractional reserve banking (or, bankstering, as it really is). And, its compounding.

As a result, all the REAL money in the world would not be able to "pay back" the dollars of the debt. The M2 "money" supply, which consists itself of derivatives, is $21T - that in of itself pales to global debt.

Also, of note, the US total debt according to USdebtclock is $102T, so 'Global Public Debt' is most certainly much higher. Unfunded liabilities is double the title of the post, at $220T.

There are two competing entities for a financial reset. As you state, the globalists - the likes of CDBCs and slavery. The other, those working towards sound money systems, backed by PMs. Only one of these will win.

“there’s PLENTY of money to go around! the problem is everyone owes it to someone else”.

Usury

Default is the only reasonable remedy

IMO this is one reason the Founders specified gold and silver as the only currency. PMs are very difficult to subject to usury. A debtor can just take their currency somewhere else rather than pay it to a creditor at interest.

I guess that there are two ways to look at this:

1. The Earth is 100 trillion dollars in debt.

2. Somebody owes the Earth 100 trillion dollars.

https://www.vanticatrading.com/post/imf-head-we-didn-t-know-the-effects-of-money-printing

How could they not know??

About this global debt that is unhindered by national borders and is enslaving the entire general population, to whom do they owe the interest and repayments of its principal? Who holds the deed to this planet and all its resources? Eh?

Just WHO or WHAT entity has this much loose cash to lend out?

Bingo

yup - this also is true

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.