Posted on 05/24/2023 9:05:53 PM PDT by SeekAndFind

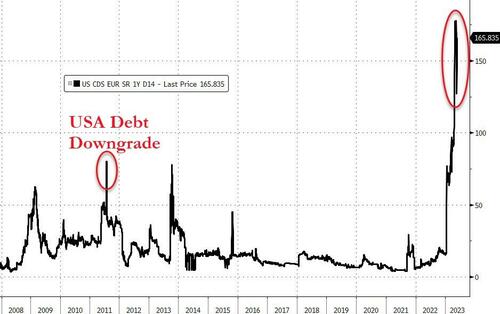

With its CDS trading like an emerging market, it is likely no surprise that Fitch Ratings has placed the United States' 'AAA' Long-Term Foreign-Currency Issuer Default Rating (IDR) on Rating Watch Negative.

CDS is trading like USA is anything but AAA-rated...

With Fitch placing the United States' 'AAA' rating on Rating Watch Negative, here is an update of a very old chart I used to published: Composite Credit Rating (across the agencies) vs. 5Y CDS Across Select Countries. For obvious reasons, US CDS isn't trading in the AAA range. pic.twitter.com/yzyN4jluA8— Michael McDonough (@M_McDonough) May 25, 2023

The T-Bill curve is not buying the calm picture being painted by Washington with the June 1st Bill yielding 7.00% today...

Debt Ceiling Brinkmanship: The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching x date (when the U.S. Treasury exhausts its cash position and capacity for extraordinary measures without incurring new debt). Fitch still expects a resolution to the debt limit before the x-date. However, we believe risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations. The brinkmanship over the debt ceiling, failure of the U.S. authorities to meaningfully tackle medium-term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to U.S. creditworthiness.

Debt Limit Reached: The U.S. reached its $31.4 trillion debt limit on Jan. 19, 2023, and the Treasury began taking extraordinary measures in order to avoid breaching the ceiling. The Treasury has stated that these extraordinary measures could be exhausted as early as June 1, 2023. The cash balance of the Treasury reached USD76.5 billion as of May 23 and sizeable payments are due June 1-2, meaning that the x-date could arrive as the Treasury indicated and before an agreement is reached or finalized with votes in the House and Senate.

X-Date Approaching: The failure to reach a deal to raise or suspend the debt limit by the x-date would be a negative signal of the broader governance and willingness of the U.S. to honor its obligations in a timely fashion, which would be unlikely to be consistent with a 'AAA' rating, in Fitch's view. Prioritization of debt securities over other due payments after the x-date would avoid a default. Similarly, avoiding default by non-conventional means such as minting a trillion-dollar coin or invoking the 14th amendment is unlikely to be consistent with a 'AAA' rating and could also be subject to legal challenges.

Debt Default Rating Implications: We believe that failing to make full and timely payments on debt securities is less likely than reaching the x-date and is a very low probability event. Such a failure would be a debt default under Fitch's sovereign rating criteria and would lead us to downgrade the sovereign IDR to Restricted Default (RD). Affected debt securities would be downgraded to 'D'. Additionally, other LT debt securities with payments due within the following 30 days would likely be downgraded to 'CCC', and ST treasury bills maturing within the following 30 days would likely be downgraded to 'C'.

Potential Post-Default Ratings: Other debt securities with payments due beyond 30 days would likely be downgraded to the expected post-default rating of the IDR. A key consideration in determining the U.S. post-default rating would be Fitch's Sovereign Rating Model (SRM) - the details of which are in the public domain. The SRM output for the U.S. stands at 'AA+'. The model applies a two-notch reduction for a sovereign that has recently defaulted, suggesting that Fitch's model-implied post-default rating would be 'AA-'. The final rating could be adjusted lower or higher via the Qualitative Overlay as per our criteria. Fitch would expect any debt default to be relatively short-lived. However, a more protracted default scenario could have more severe implications for the country's post-default ratings.

Country Ceiling to Remain at 'AAA': Fitch would expect the U.S country ceiling to remain at 'AAA' even in the scenario of a debt default. The U.S. dollar is the preeminent world's reserve currency, and we view the risk of exchange and capital controls as de minimis.

Governance Challenges: Governance is a weakness relative to 'AAA' rated peers, and the future direction of the rating is sensitive to the direction it takes. The contested 2020 presidential election, brinkmanship over the debt limit to advance political agendas, and failure to reach consensus on the country's fiscal challenges are recent signs of the deterioration in governance. Additionally, the absence of a medium-term fiscal framework and a complex budgeting process has contributed to the failure to reverse successive debt increases caused by economic shocks and other fiscal accommodations. Political partisanship has brought about repeated debt-limit brinkmanship and led to near-default episodes that could erode confidence in the government's repayment capacity.

Weakening Fiscal Outturns: Weaker-than-expected tax receipts and higher interest rates have led public finances to modestly underperform Fitch's expectations at the last review. Fitch now forecasts a general government deficit at 6.5% of GDP in 2023 and 6.9% of GDP in 2024, up from 5.5% in 2022. State and local governments overall surpluses in 2021-22 have begun to move to deficits, which accounts for part of the expected general government deterioration. A rising interest burden and growing spending on entitlements over the coming decade will keep the deficits at above 7% of GDP on average. Between 2023 and 2033 the U.S. Congressional Budget Office (CBO) May 2023 baseline includes a 2.2pp of GDP rise in spending on interest, healthcare and social security that is linked to demographics, a rising interest burden and healthcare costs.

High and Rising Public Debt Burden: General government debt fell to 112.5% of GDP at year-end 2022 (compared to 36.1% for the 'AAA' median), a decline from its 2020 pandemic peak of 122.3%. However, the ratio remains over 12 pp above pre-pandemic levels in 2019. Fitch forecasts debt to increase to 117% by end-2024. Debt dynamics under the baseline Congressional Budget Office (CBO) assumptions project that the ratio of federal debt held by the public to GDP will approach 119% within a decade under the current policy setting, a rise of over 20 pp. Interest rates have risen significantly over the last year with the 10-year Treasury yield at close to 3.7% (compared to 2.8% a year ago).

Exceptional Strengths Support Ratings: The size of the country's economy, high GDP per capita and dynamic business environment support the U.S. ratings. The U.S. dollar is the world's preeminent reserve currency, which gives the government extraordinary financing flexibility.

ESG - Governance: The U.S. has an ESG Relevance Score (RS) of '5' Political Stability and Rights and '5[+]' for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. The U.S. has a high WBGI ranking at 79, reflecting its well-established rights for participation in the political process, strong institutional capacity, effective rule of law and a low level of corruption.

Paging Mrs. Yellen...

Who could have seen this coming?

*YELLEN: WANT TO AVOID TYPE OF DAMAGE SUFFERED IN 2011 SHOWDOWN

True, it will be embarrassing when AAPL's credit rating is higher than the US

BS.

Only those who act like not spending money not yet spent is “defaulting” are causing this. Their like make every debt ceiling fiasco look like a room full of lifelong drunks swearing that THIS time the mext round will be their last round on the house.

If money is appropriated it does not have to be spent. Claw it back and don’t spend it!

Out of curiosity, I just looked it up. As of the date of the report below (5/4/2023), only two companies in the S&P 500 have a perfect AAA rating: Johnson & Johnson and Microsoft.

These two companies obviously must be punished. Their high ratings make the federal government look bad. We can’t have that. It’s darn near treason, I tell you.

RE: Fitch downgrade....

Janet Yellin: Did Abercrombie agree? I was down there buying some accessories the other day.

“ The U.S. has a high WBGI ranking at 79, reflecting its well-established rights for participation in the political process, strong institutional capacity, effective rule of law and a low level of corruption.”

Now that right there is hilarious.

It’s a full court press to blame this on the Republicans, and

we all know with the media in their pocked, that’s exactly

what they will tell the public.

If they can screw over big things like Social Security or

Welfare, they’ll make a lot of ground on it.

Hope McCarthy and company can make headway cutting some of

the spending.

.

“United States’ AAA Rating On Death Watch”

Fixed. ;)

Thanks for the latest Fear Mongering Update...

From the looks of that first line-graph, Trump actually reduced the debt slightly during his time in office.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.