Posted on 05/16/2022 9:24:36 AM PDT by SeekAndFind

US retail gasoline prices soared to another record on Monday as global refineries struggled with adding new capacity ahead of the driving season.

Before diving into Goldman Sachs' new commodity note explaining how global refining will be tight for the foreseeable future, last week, Saudi Energy Minister said, "the bottleneck is now to do with refining ... many refineries in the world, especially in Europe and the US, have closed."

Goldman's commodity analyst Neil Mehta outlines a rash of refinery retirements, reduced Russian energy exports, recovering jet fuel demand, and tight global inventories for products, particularly diesel, have supported higher retail fuel prices.

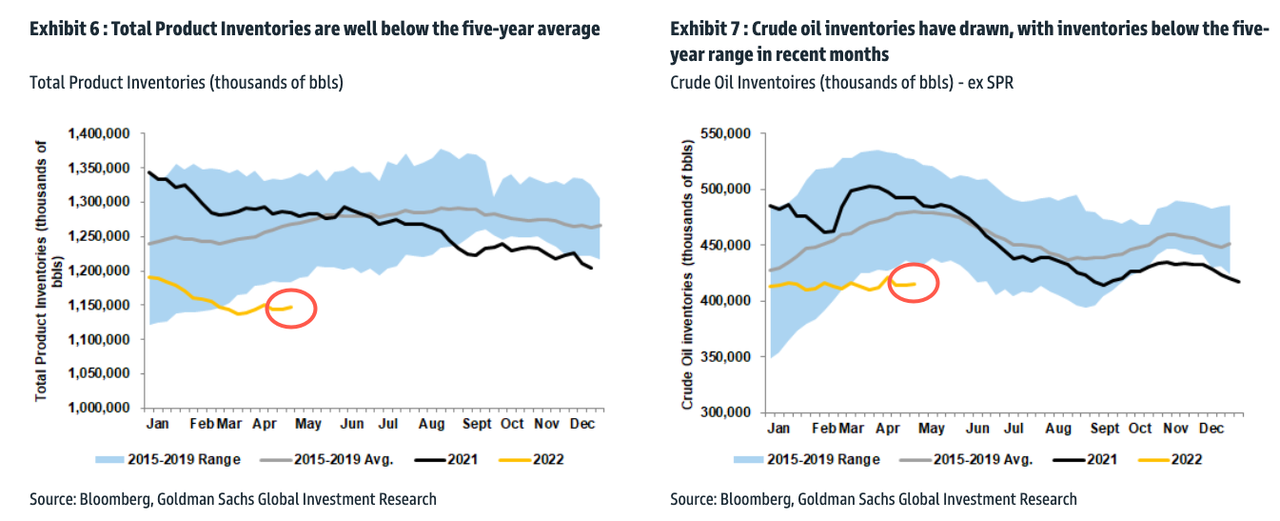

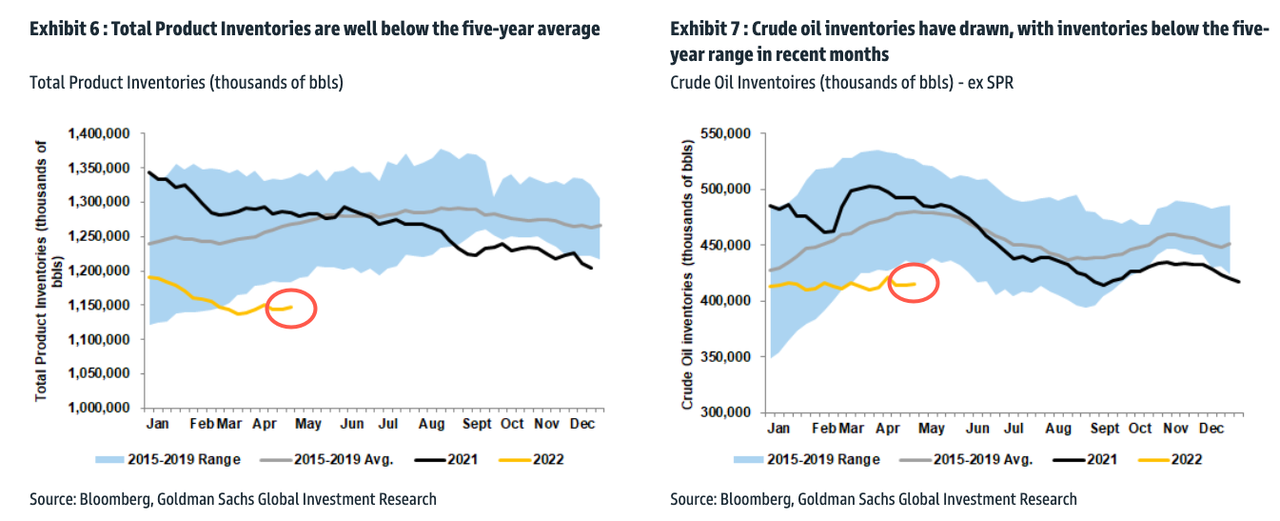

Mehta points out US product inventories are below a 10% five-year average, refining utilization rates are below normal, global natural gas prices are high, and demand for diesel remains robust.

US product and total inventories are well below a five-year average.

US refining utilization struggles to increase as the driving season begins.

"We believe the oil market needs to price to demand destruction, which will drive the least elastic prices, such as those for distillate, higher," he said, adding tight inventories could last through this year and well into 2023.

While the demand destruction has not begun yet (from what we have seen in the data), the price adjustments for refined products is starting to reprice drastically (in barrel equivalents below for easy comparisons)...

A lack of refinery capacity is the culprit of rising fuel prices. The average cost of US gas prices at the pump on Monday morning is $4.483 and $5.56 for diesel.

Today's refinery bottlenecks may suggest that even higher prices are ahead this summer as the driving season begins.

“I did that!, Right, Kammy?”

-That’s right, Joe. You flipped the switch!”

Still waiting for the “Biden lower gas prices”.

I’m still waiting for them to put his name in the story. It’s magic how these prices appeared.

I heard through the grapevine that refineries are scared to spend the money to spin back up to pre-covid production levels with the fear of either covid or Brandon reducing demand again.

summer blend! the secret ingredient is bs

Exactly! Said with a child’s comprehension.

Putin didn’t shut down 1/2 of US east coast refining capacity in the last 15 years.

Central Florida it was 4.49 Saturday.

$4.65 for regular, here in sw PA flyover country.

$4.59 this morning mid-state, but it’s only 1430 . . .

That sounds very likely.

They fell for Obama’s lies that they wouldn’t be targeted if they backed Globull Warming propaganda.

Now they know THEY are one of many targets.

so is it a raw crude supply problem, or lack of refineries? where did the refineries go we had in 2020? why aren’t they running at twice the price from 2.5 years ago?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.