Posted on 05/02/2022 7:03:03 AM PDT by JonPreston

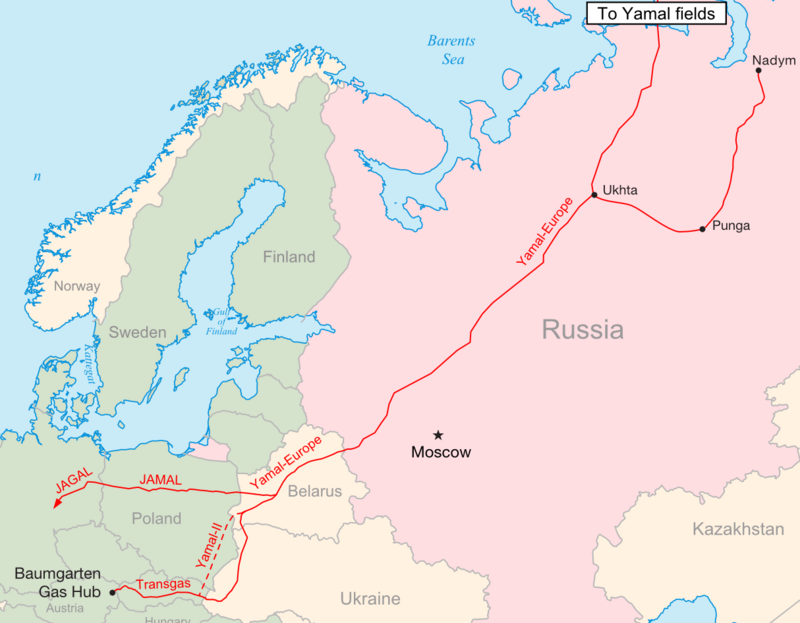

Russian gas giant Gazprom has not booked any gas transit capacity via the Yamal-Europe pipeline for the third quarter, Interfax news agency reported on Monday, citing the latest auction results on the GSA Platform.

(Excerpt) Read more at financialpost.com ...

Doesn’t Ukraine have coal deposits?

Coal is verboten, as per Greta Thunberg

This means Germany and Europe are boycotting Russian nat/gas. They are building LNG terminals to bring in Algerian and other Middle Eastern nat/gas.

Germany in particular is fast tracking LNG import terminals. The more the merrier. Then the Germans can send nat/gas to other European nations via existing pipeline networks.

Spain will be ideal for a colossal LNG import terminal. To use in Spain and send to the rest of Europe.

Ah...this is for Q3, we’re still in Q2 and Germany is currently buying Russian oil as fast as it can because new LNG terminals are a year away, at best. Merkel should have listened to Trump, eh?

But not to worry....$## billion on the way. Gosh...I hope they stop raping our country.

“Germany in particular is fast tracking LNG import terminals. Then the Germans can send nat/gas to other European nations via existing pipeline networks.”

The problem is that there will be 3 or 4 winters to get through before anything actually flows from those terminals.

Oil is not nat gas and isnt a substitute for it.

They'd better also fast-track building their own LNG carrying ships. I doubt there's currently enough idle LNG ships out there to supply western Europe.

They could just continue to use the relatively inexpensive gas brought in by pipeline, but if they want to spend loads of money signaling their virtue... well, I guess its their money... or rather the money of their population and industries.

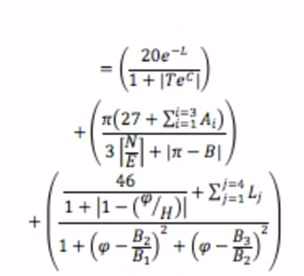

? Is that like: e=mc2 but running through a pipeline ?

But it can’t be if: π r2 because π are round, Cake r🔲

Now I’ve got a headache.

Tell that to dennisw, he brought it to the thread.

Formula even looks painful to me, so I just bypass it.

Late this last week, I saw a report that Germany is now importing 35% of their Natural Gas from Russia - down from 48% just prior to the war. Some of that drop might reflect seasonal factors, as gas demand surges during the Winter, but big moves are underway to replace suppliers and use other energy sources where possible (like electrical generation).

They (and the rest of Europe) are definitely making sincere efforts (spending significant investment) to be able to replace Russian gas and oil. A lot of new capacity and facilities have received expedited (emergency speed) regulatory approval, and long planned options have suddenly been funded.

It looks like Russian oil might be essentially replaced by the end of this year. There will be a European meeting Wednesday (4 May) to discuss the next (6th) round of sanctions, and the phasing out of Russian oil by the end of the year was to be the highlight. Apparently the recently re-elected Orban Administration in Hungary is strongly opposed to it however. The rest of the Countries may go ahead with their own plans anyhow (seems likely).

Russian gas is physically a lot harder to replace, especially for Eastern Europe. Those that prepared, like Poland and the Baltics, can get through the coming Winter cold turkey. For the following Winter (2023-24), Europe is on track to be only marginally dependent on Russian gas, and be much better able to withstand a sudden cutoff.

Russian gas exports to Europe are about 10% of global production, so it is a huge opportunity for other producers to acquire significant market share. At first, some Russian production will just have to be capped, as it can’t physically move to new buyers, and shortages during the transition will likely drive up prices.

But once other producers make up the shortfall, Russia will likely be trying to sell their (now surplus) gas at steep discounts, potentially driving down prices. That period of likely much lower Russian export volumes and (much?) lower prices, and having to sell at sanctions-busting smuggler’s discounts, will seriously impact the Russian economy and Government budget. It will basically crash into the wall this year, and the floor will drop out next year.

Easy one.

D-R-I-N-K-T-H-E-C.O-O-L-A-I-D

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.