Posted on 07/27/2021 9:27:29 PM PDT by SeekAndFind

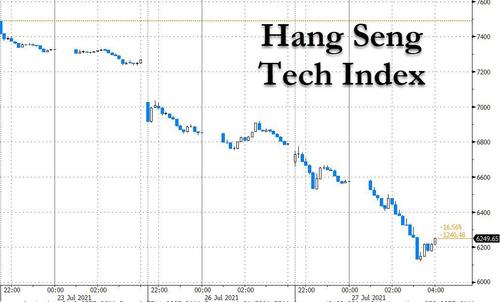

Earlier today we said that with Chinese stocks suffering historic losses, HK's tech sector imploding..

... and liquidation fears spreading to other, more serious products such as bonds and FX, it was only a matter of time before China's "National Team", i.e., the local plunge protection team, came out in full force to preserve confidence in centrally planned markets.

Well, just a few hours later, we learned that sure enough, the local Chinese bat signal summoning the plunge protectors has been activated with local press Securities Daily reporting that "the plunge is unsustainable" and will gradually stabilize. And since the media is merely a propaganda outlet to local state and central planners, it is telegraphing what will come next: a massive ramp in Chinese stocks.

Here is Bloomberg's Simon Flint with more:

China’s state media has fired the first salvos at stock sellers, including articles in Wednesday’s Securities Journal and in the Securities Daily. The latter suggests that the recent plunge in China’s stock market is unsustainable. However, Chinese stocks remain at risk and the yuan under pressure in the absence of such reassurance from the authorities. More substantively, this week’s likely Chinese Politburo meeting looms even larger.

If the agenda-setting body can persuade markets that the regulatory bombardment won’t broaden further, or can offer the promise of macro-loosening to offset the impact -- the rot may stop. Of course, a belated appearance by the “national team” to support markets -- as a follow-up to Wednesday’s media blitz -- could also help.

- The Xtrackers Harvest CSI 300 China A-Shares ETF continued to decline overnight -- it’s slide since July 22 is worth ~9.3% in yuan terms -- versus the 7.8% selloff in the CSI300 index it is designed to track.

- Tuesday saw an outflow of $0.6b through the Northbound corridor -- although this was a mere -0.9 standard deviation event after Monday’s 1-year record outflows (-2.5 standard deviations, by way of comparison).

Opinion is divided on the overall macro-economic impact -- which should dictate the extent the shock permeates overall risk markets. Bloomberg Economics remains relatively sanguine. However, a number of others are starting to count the macroeconomic cost. Goldman Sachs, in a July 27 note, imply that the 7.8% drop in the stock market since the close on July 22 will shave ~15bps from GDP growth. This will presumably be larger if uncertainty about the risks of a broadening of the crackdown are not quickly assuaged.

And sure enough it appears that the plunge protectors are already in, with Hang Seng surging 1.7%, Meituan which just suffered its biggest drop in history is up 12% - its biggest gain since March 2020, shares of techedu New Oriental Shares surging 15%, and tech giants Alibaba and Tencent are both up more than 1% and rising fast.

In short, expect a "remarkable" and "completely unexpected" meltup as the National Team steps in first, and then the BTFD reflex kicks in, the same reflex which as we detailed earlier...

... means that it now takes a record 2.6 days in the US for even a violent market dip to be fully bought. Surely China can't be far behind.

bump

bump

Should be called the Bat Wuhan Plunge

My AMD stock is up $6.01 today to $97.02 : )

Finally going up and I hope it stays up. AMD nearly doubled everything in sales and profits this past year according to its earning report yesterday.

Excerpt from an article I found: “For the full 2021 financial year, AMD said it sees revenues growing 50% from 2020 levels, indicating a total of around $14.65 billion.”

More detail from another article:

https://www.marketbeat.com/stocks/NASDAQ/AMD/earnings/

RE: My AMD stock is up $6.01 today to $97.02 : )

You’re lucky they’re not listed in China or Hong Kong. :)

They have the chips made in Taiwan.... once the invasion starts all bets are off.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.