Posted on 06/28/2021 1:43:23 PM PDT by blam

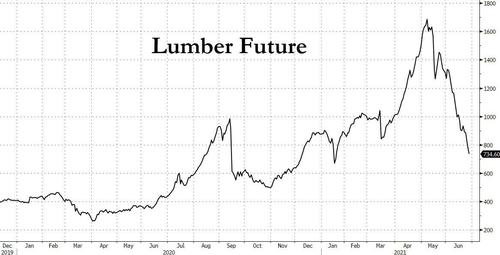

As we have been documenting daily (most recently in “More Container Ships Score “Astronomical” $100,000/Day Rates“), even as some signs of price normalization emerge, most notably the recent drop in commodity prices (lumber, copper)…

… widespread supply-chain disruptions remain and have become a serious challenge in many parts of the US economy, with large effects on both output and inflation.

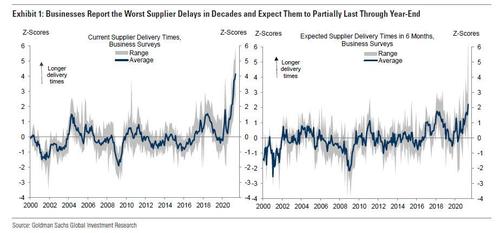

The Goldman chart below shows that businesses report the worst supplier delivery delays in decades and expect delivery times to remain longer than normal through year-end and potentially well into 2022. In special questions included in regional business surveys, a substantial majority of firms in the manufacturing sector have consistently reported experiencing supply chain disruptions over the last several months, although as the Fed’s Vice Chair for supervision Randy Quarles just said, he hopes that supply-chain bottlenecks are “likely temporary” as the economy reopens.

But what if they are not? It wouldn’t be the first time the Fed is dead wrong about something being temporary only to become permanent. For an example of that look not further than the Fed’s ballooning balance sheet which once upon a time was also a “temporary” fixture of monetary policy only to gradually become an immutable part of the Fed’s response.

To answer this and other questions, over the weekend Goldman’s economists looked at the underlying causes of the supply-demand imbalances in many areas of the economy, especially the goods sector, and discuss the timeline for normalization. The bank also discussed when and to what extent the price spikes generated by these imbalances should begin to reverse and what that means for the broader inflation outlook this year and next.

The bottom line for those pressed for time is that according to Goldman the current one-off inflationary boost from supply chain bottlenecks will eventually become a one-off disinflationary drag, with the bank expecting “fading fiscal support for households and a shift in spending to services over the next few months to ease demand pressures.” And on the supply side, look for the semiconductor shortage to improve later this year, especially for the autos sector. Overall, the contribution to year-on-year core PCE inflation from supply-constrained categories has risen from -20bp before the pandemic to +105bp today, but we expect it to decline to +35bp by end-2021 and to -55bp by end-2022

Below we pull the most notable highlights from the report:

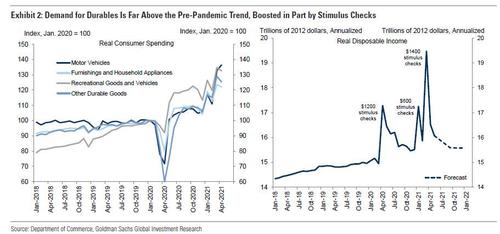

Goldman first looks at the demand side, where consumer spending on durable goods has risen to levels 15-25% above trend (Exhibit 2, left) due to the boost to disposable income from fiscal support, the unavailability of many services, and pandemic preference shifts. The further surge in demand for durables this year likely reflects the impact of the stimulus checks (Exhibit 2, right), which past experience has shown are disproportionately spent on durables and used for down payments on autos. Even under better circumstances, suppliers would likely have struggled to keep up with such a rapid surge in demand

On the supply side, there are three main contributing factors.

First, company anecdotes reveal that some businesses initially cut back because they expected demand to fall in a recession, and others had to stop production because of the virus. For example, automakers closed plants to improve safety at the start of the pandemic, resulting in a large drop in car production (Exhibit 3, left). They also reacted to the decline in demand at the start of the pandemic by ordering fewer microchips, which then led chipmakers to reduce production. Similarly, cash-strapped rental car companies that initially faced a sharp drop in demand sold roughly a third of their fleet (Exhibit 3, right).

Second, production has been hampered by supply chain disruptions, in particular the negative supply shocks that caused the global semiconductor shortage. The shortage of microchips has affected many consumer goods including electronics, appliances, and automobiles. The chip shortage caused auto production to fall for a second time over the last four months, bringing the shortfall of domestic auto production since the start of the pandemic to about 2.5mn (Exhibit 3, left). Combined with strong demand, this has resulted in a dramatic depletion of new and used car inventory (Exhibit 3, center), making it hard for consumers to find new cars and for rental companies to rebuild their fleets.

(snip)

Wait,

You mean if everyone stays at home and the government just sends them checks that this will cause supply shortages?

“Combined with strong demand, this has resulted in a dramatic depletion of new and used car inventory”

Ha, that don’t hardly say it. Couple months ago I was looking for a preowned import pickup....got a sales manager on the phone and he said “I can get you one in FIFTY days...all I need to know is how much over MSRP you are willing to pay”.....WHAT!!??

Well Obiden thinks that employers just have to compete against the government checks.

You have heard of Supply and Demand and its relation to pricing, right?

bkmk

Basically the world is waking up from Covid, something it hasn’t ever done before in history. Because of that, supply and demand systems are all messed up.

My 2017 truck with only 12k miles on it is worth as much now as when I bought it.

I wish someone would supply my demand.

So many econ geniuses here on FR!

That’s pretty much a free car, if you could cash out at the same price you paid.

All of the use, none of the cost!

Gotta love free!

When I got it, I said this will be the last vehicle I'll ever own. I still drive my 1993 Ford Ranger five miles roundtrip to the park each day with my dogs.

So.....

what about the delta bug?

(and the gamma bug? and... and...)

My son just sold his car with 24k miles on it, which he bought new, for the same amount he originally paid for it. Basically drove it for a year for free.

Intrigued, I looked up Blue book for my spouse’s SUV, again bought new, and it shows a value of between 2k and 4k above what we paid for it. Wow. Crazy.

The big downside of “just in time” delivery is the cascading effects it creates across the US when there’s a significant disruption.

This is hurting my job. We haven’t been this slow since Obama was selected

Worst case scenario I guess we start eating that one year of survival food crammed in our garage. 😆

I have a larder full of canned sardines. I’ll be fine.

😆

It won’t. JMO.

To soon for that. We still have a CW to get through.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.