Posted on 12/02/2018 12:13:44 PM PST by blam

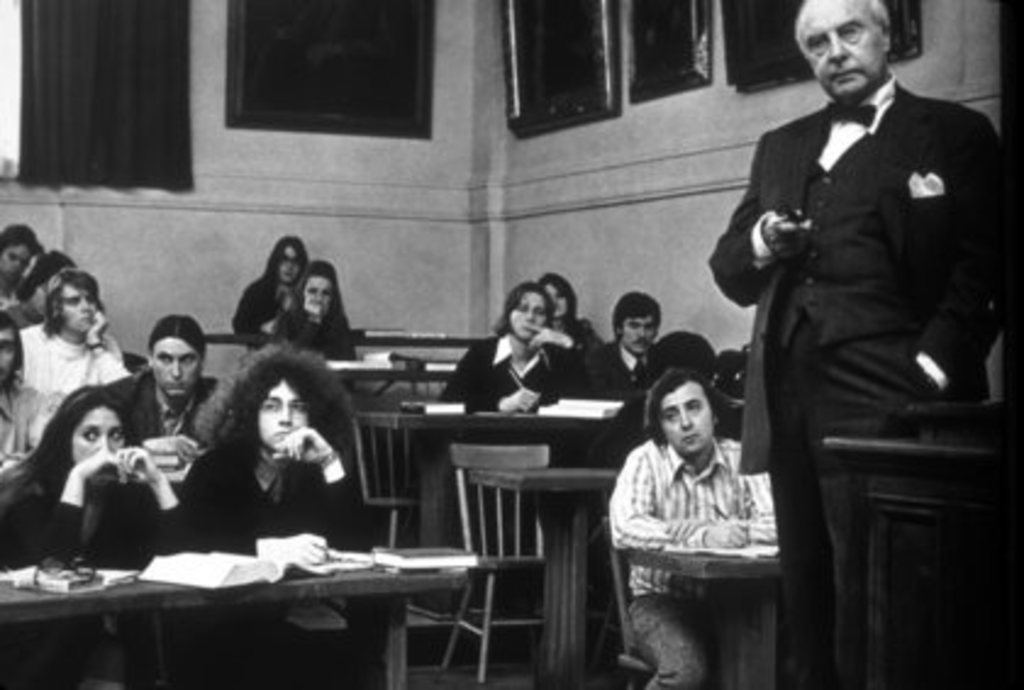

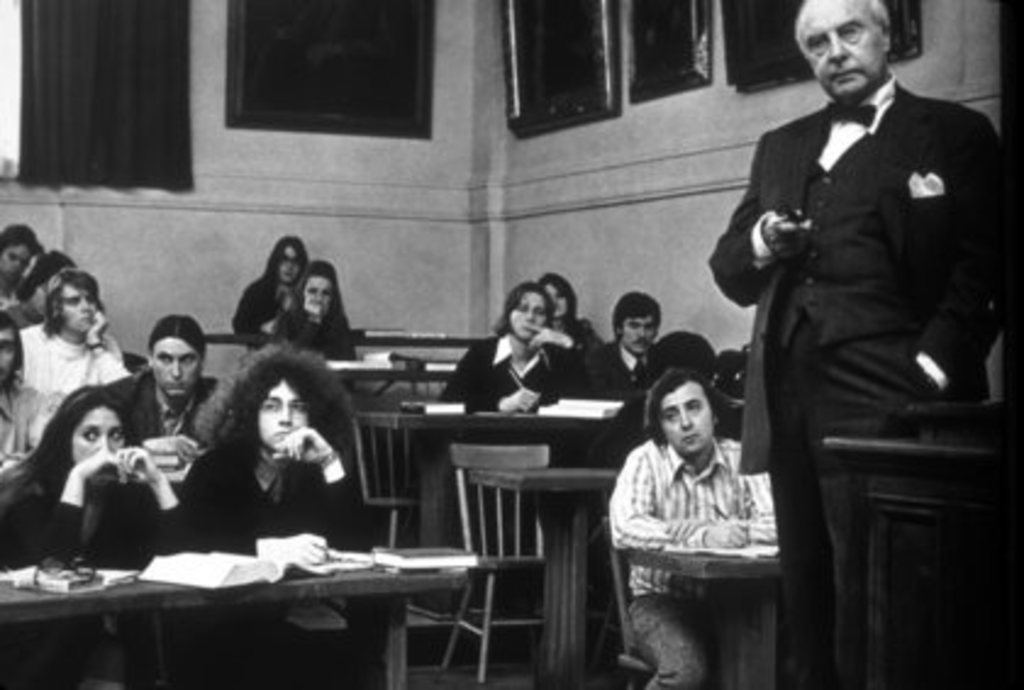

* John Hussman — the outspoken investor and former professor who's been predicting a stock crash — says traditionally diversified portfolios are set to offer their worst returns since the Great Depression over the next 12 years.

* Hussman explains why he sees a US stock market drop of more than 60% coming, and breaks down why the Federal Reserve's past actions have created the situation.

There's never been a worse time to be a conventional portfolio manager.

Well, maybe back in the deepest, darkest throes of the Great Depression that crushed the US economy way back in 1929. But not for the past 90-or-so years.

At least that's what John Hussman thinks. The former economics professor and current president of the Hussman Investment Trust has crunched the numbers and found that the future looks historically bleak for investors who aim for a traditionally diversified mix of holdings.

His methodology looks at a portfolio with 60% invested in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills — and it's designed to assess the expected total return over a forward 12-year horizon.

Hussman finds that at the stock market's all-time peak in September, this mix of investments was set to produce total returns of just 0.48% over that 12-year period. As you can see below — as signified by the blue line — that's the lowest since the Great Depression era of 1929.

Even though bond yields recently climbed and US stocks took a 10% hit, Hussman notes that the expected return climbed to just 1.29%, still Great Depression lows. This fact shows just how far stretched the market is right now —

(snip)

(Excerpt) Read more at businessinsider.com ...

> this mix of investments was set to produce total returns of just 0.48% over that 12-year period <

Not 0.47% or 0.49%, but 0.48%. And over 12 years. I am always suspicious of predictions like that.

IIRC correctly Hussman has predicted TEOTWAWKI 20 times in the last twenty years. He was - sort of - right twice. 2000 and 2008 sucked.

John Hussman is a hedge fund guy. As an example the return of his Strategic Growth Fund HSGFX over 10 years is -5.41% annualized. The fund has a 1.37% expense ratio!

The S&P 10 year return is 275% (14.17% annualized).

The guy is a LOSER.

Having said that — no one can predict the market and crashes occur. Best bet is to invest in a diversified portfolio over decades, e.g. low expense index funds like Vanguard, and leave it alone.

Amazing how Trump’s presence in the White House triggers doomsday scenarios in the minds of many.

It’s what they want to happen. Not what will happen.

By preaching it, they hope to make people get out of the market and thus make the index go down. The self-fullfilling prophecy.

Absolutely. I have friends that implored me to sell when the market went down (repeatedly over 4 decades). I stayed in, they sold. And they lost money from selling on the way down and missing out on the market when it recovered and kept going up.

Don't panic!

BS article using a horrible portfolio that would not produce decent results.

There are much better options.

Wells Fargo does nicely for me.

Two years retired and still haven’t touched the main nut yet!

He’ll be out there telling how he predicted it, if it ever happens. Thirty years from how, he’ll forget to mention he had been predicting in non-stop for 50 years.

Sooner or later he may be half right. Amazing that so many of these perm-bears advisers have any clients.

Value investors cannot understand today's markets, which are All Momentum, All The Time. Under any traditional, honest method of valuing equity assets, the markets are quite insane. But betting that way is the fastest way to lose money. If one believes market prices are at immoral levels because price discovery is completely broken, the better course is to simply find alternative ways to invest your capital.

Funniest line of the day !!

Invest ALL your money with Hussman? He has ALL the answers.

Business Insider

Partner with Yahoo

[The leftist Business Insider is doing its best to help tank the economy.]

Yes, that’s why they’re partners with Huff Po Light Yahoo.

s&p futures up +43.00

nasdaq futures up +131

gonna be a YUGE up day tomorrow

I'd say the current correction is over ... new highs by Christmas ... then off to the races.

My inve rents doing good. Bought a bunch of cheap houses for cash returns way North of 15%.

My inve rents doing good. Bought a bunch of cheap houses for cash returns way North of 15%.

If profits are good; the market will be good. Foreign money poring in will be the added bonus.

Did he say this before or after the recent 500+ bump?

Even though bond yields recently climbed and US stocks took a 10% hit, Hussman notes that the expected return climbed to just 1.29%, still Great Depression lows. This fact shows just how far stretched the market is right now —

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.