Posted on 08/16/2018 8:44:24 AM PDT by SeekAndFind

When financial markets cratered in late 2007, state pension officials assured lawmakers and the public that the damage to government retirement funds was only temporary. Pension funds are long-term investors, their story went, and pension systems would recover as soon as the market did.

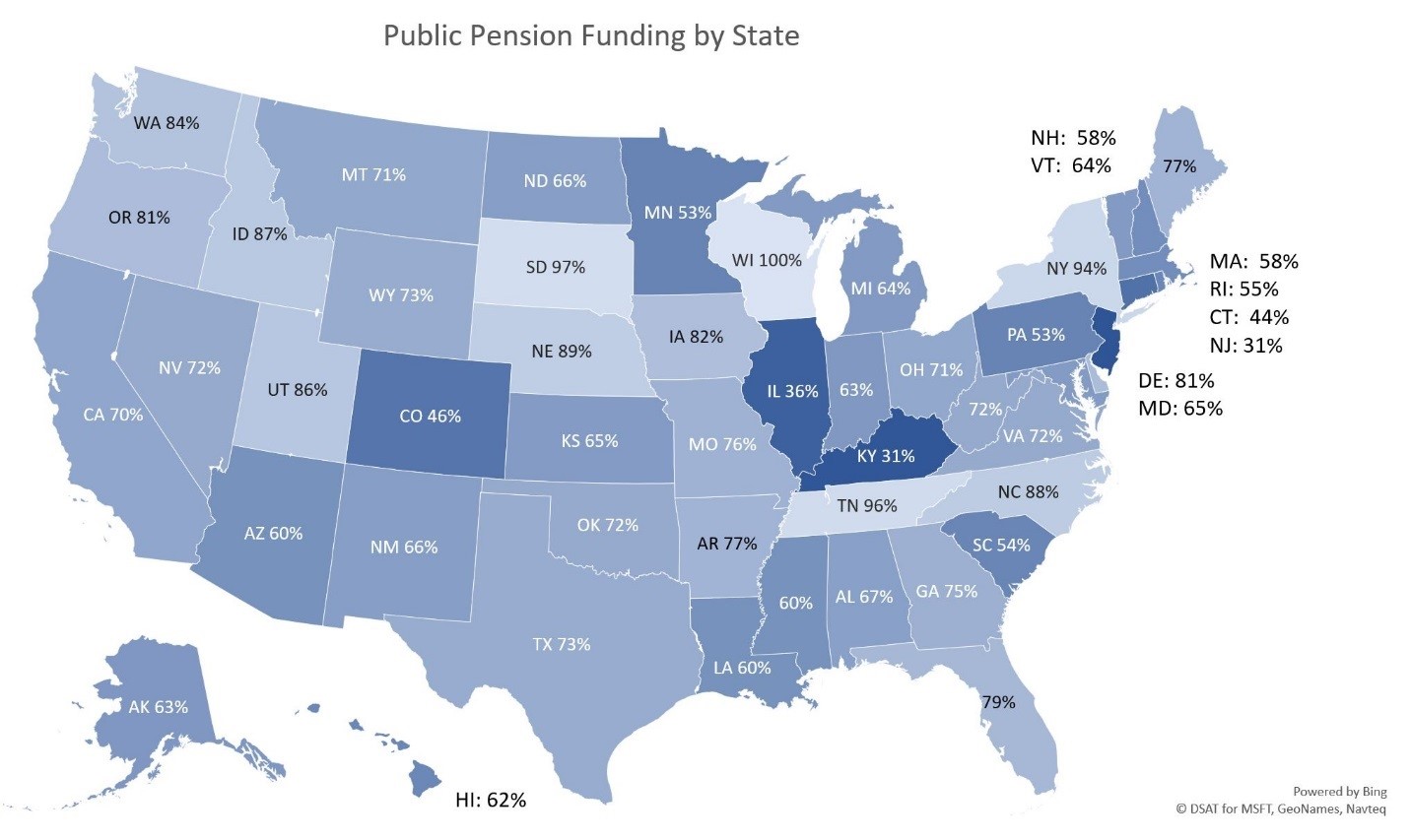

When lawmakers in Montana, for instance, asked the state treasurer whether they should be worried about the government’s ability to meet its retirement obligations, he confidently advised them to “go fishing” instead. They should have ignored him and taken action to bolster the state’s pension system, which has never recovered from the market crash. Montana’s retirement system has only about 75 percent of the money today that it needs to pay retirees, despite a nine-year stock-market rally.

Montana isn’t alone. A recent Wilshire Consulting report estimates that at the end of fiscal 2017, state government pensions nationwide were only 70 percent funded, down from 87 percent in 2007. Since the recovery began in 2009, $100 placed in a broad market-index fund would have yielded an investor about $365 today—an average compound annual gain of some 15 percent. No matter for pensions, though: thanks to a host of problems, most state and local government funds have spent a good part of the nine-year recovery heading in the wrong direction. Many are consequently ill-positioned to withstand the next market downturn, and without further cost-saving reforms, taxpayers in many states will face steep new assessments in coming years.

One problem is that these systems have grown so large, with so many workers earning new pension credits for their approaching retirements, that states’ obligations to these workers are growing relentlessly. Since 2007, state pension-system liabilities have increased to $4.52 trillion from $2.83 trillion, according to the systems’ own accounting.

(Excerpt) Read more at city-journal.org ...

The only sure answer is to continue reducing pension benefits that workers earn in order to slow the growth of future retirement bills before the gap between what states owe retirees and the money that pension funds have on hand grows so large that there’s no way to close it—and the whole system collapses.

Interesting..thanks.

I was in the tax accessor’s office yesterday. Two of the women at the front counter were sisters. Several people in the office were sitting around chatting about their personal stuff and gave the appearance that it had been going on for some time. There were mounds and mounds of paper, unlike the my previous jobs in the commercial sector which used very little paper. From stacks and stacks of paper, a woman was transcribing long numbers into a computer. They were taken off computer printed forms and it would have been short work to have moved the data from one program to another...but, no, it was being done slowly, by hand typing them in.

My thinking is, the office was severely over staffed and under efficient. But, the idea is to employ as many workers as possible as they all vote. It’s like a jobs program.

The jobs do pay pretty well and have good health benefits. Oh, and a funded retirement plan.

The best example I know of for pension funding is the Ontario teachers pension fund. They have been buying energy related firms North America wide, and have a huge surplus.

I believe I recall reading here a few years back that one thing that Illinois public servants do often is retire at age 55 or even 50 from their job and then go to a neighbouring state like Iowa or Indiana and take another public servant job there for a few years and have their Illinois pension as well as the regular salary from the new job in the other state and have pensions from both jobs when they retire from the other job a few years later.

3 words:

NO FEDERAL BAILOUT

States that chose to be fiscally irresponsible have utterly no right to dip their hands into the pockets of taxpayers in other states who did not vote for such fiscal irresponsibility. Make them eat their own cooking.

There was an article on FR last week about the new Chief of Police in Los Angeles. He’s a former Deputy Chief who “retired,” took a one time windfall payment of $1.7 million (”not knowing he was being considered as the new chief”), then became the new chief. So now he gets his pension AND an even higher salary as chief.

Better option would be a Constitutional amendment outlawing public pensions at every level. They made sense when (a) government employees made less than private sector, and (b) people had children more often than pets. With both of those conditions now flagrantly violated, it is impossible to engineer a structurally-sound pension system.

Hmmmmm.....

I wonder why they didn’t include local pension funding with the state funding, particularly since a lot of local school districts and cities rely on state funding.

I’m sure Montana’s Democrat Governor Bollocks has this all figured out.

He’ll probably have Democrat Senator Jon Tester jump a piece of coal on his tractor.

Must be nice for state government employees not to have to worry about collapsing, unconstitutional federal government Social Security.

Mismanaged state pensions that rip of a state’s taxpayers ought to be regarded as a form of embezzlement.

I am surprised at the figures for Alaska and North Dakota. With the tax revenue from the oil and gas industries it should be 100%.

ILLINOIS!!!

We are number one!

Oh, crap...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.