Skip to comments.

Will a government shutdown delay my tax refund?

Dayton Daily News ^

| Jan. 19, 2018

| Katie Wedell

Posted on 01/19/2018 4:21:24 PM PST by Hadean

One way this potential government shutdown would be different than in the past -- there’s never been a federal shutdown during tax filing season. Nor has the government been shut down amid the implementation of a massive tax code overhaul.

The Internal Revenue Service would lose an estimated 56 percent of its workforce to furloughs if the government shuts down, according to the U.S. Treasury. And it would be happening right when the IRS is updating its guidelines and software, while also fielding questions from the public about new tax laws.

Experts told the Washington Post that even a short shutdown will set back implementation on the new tax code.

Tax filing season begins on Jan. 29. The IRS generally issues nine out of 10 refunds in less than 21 days. With the workforce cut in half, it is likely that a prolonged shutdown could lead to delayed returns and the inability to access IRS assistance phone lines.

TOPICS: News/Current Events; Politics/Elections

KEYWORDS: incometaxes; irs; refund; shutdown; taxcutsandjobsact; taxes; taxreform; tcja

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

1

posted on

01/19/2018 4:21:24 PM PST

by

Hadean

To: Hadean

One stresses a lot less by planning their deductions and payments so you are always owed a refund of $300 or less or owing the IRS $300 or less.

2

posted on

01/19/2018 4:24:35 PM PST

by

Vigilanteman

(ObaMao: Fake America, Fake Messiah, Fake Black man. How many fakes can you fit into one Zer0?)

To: Hadean

The Internal Revenue Service would lose an estimated 56 percent of its workforce to furloughs if the government shuts down, according to the U.S. Treasury. Maybe they should be encouraged to find an honest job in the private sector.

3

posted on

01/19/2018 4:25:44 PM PST

by

Vigilanteman

(ObaMao: Fake America, Fake Messiah, Fake Black man. How many fakes can you fit into one Zer0?)

To: Vigilanteman

“...Maybe they should be encouraged to find an honest job in the private sector....”

Once an employer found out about their previous IRS employment, they’d probably not be hired. Can’t say as I’d blame em.

4

posted on

01/19/2018 4:28:24 PM PST

by

lgjhn23

(It's easy to be liberal when you're dumber than a box of rocks.)

To: Hadean

Will a government shutdown delay the deportation of the dacaca illegal aliens ???

To: Hadean

No idea, haven’t gotten one since 1990.

To: Hadean

Will Congress be paid during a shutdown? Then why not the military?

7

posted on

01/19/2018 4:37:10 PM PST

by

353FMG

To: Hadean

I hope so - that’s a good bargaining chip - delaying tax refunds.

8

posted on

01/19/2018 4:38:01 PM PST

by

11th_VA

To: Hadean

I always have to write a check, so I don’t care.

9

posted on

01/19/2018 4:38:41 PM PST

by

Lurkinanloomin

(Natural Born Citizen Means Born Here of Citizen Parents__Know Islam, No Peace-No Islam, Know Peace)

To: Hadean

Simple: repeal income tax.

If not that, use a flat tax.

10

posted on

01/19/2018 4:39:27 PM PST

by

the OlLine Rebel

(Common sense is an uncommon virtue./Federal-run medical care is as good as state-run DMVs.)

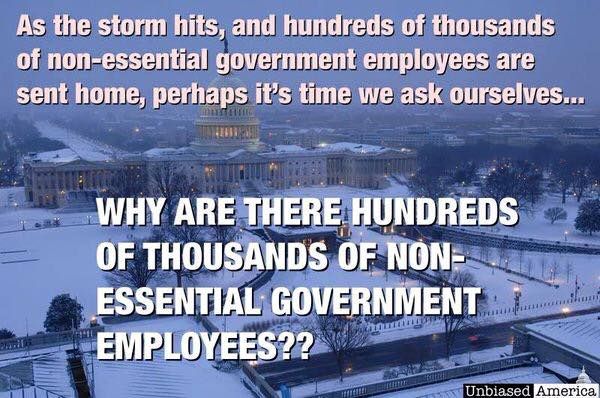

To: Hadean

11

posted on

01/19/2018 4:42:11 PM PST

by

raiderboy

( "...if we have to close down our government, weÂ’re building that wall" DJT)

To: Hadean

According to the news, the only effect the Schumer Shutdown would have on the IRS is a suspension of audits. That can’t be too bad.

To: lgjhn23

Some employers want someone that has worked for the IRS.

Those recent IRS hires know the ins and outs very well.

They can be a big asset.

13

posted on

01/19/2018 4:45:03 PM PST

by

DoughtyOne

(a/o 01/17/18 DJIA close 26,115.65, 45.993% > the morning of 11/07/16. 716.77 to 50% increase..)

To: Hadean

Only if the Democrats have their way.

To: Hadean

This is total B.S. (propaganda)

First of all they aren’t programming tax code changes for tax year 2017. the changes are mostly all for 2018- next filing season.

Also- they have enough people to process returns, look at rejects, filter out fraud etc. and get the refunds out on time.

When they are totally funded they only answered the phone 60% of the time anyway.

They have enough deemed “essential” that it won’t even bother them.

15

posted on

01/19/2018 4:46:00 PM PST

by

DOGHEAD

To: DoughtyOne

“...Those recent IRS hires know the ins and outs very well....”

Never thought of it that way. Kinda like hiring a professional burglar to design/build your security system. There’s merit to that.

16

posted on

01/19/2018 4:47:21 PM PST

by

lgjhn23

(It's easy to be liberal when you're dumber than a box of rocks.)

To: Hadean; All

17

posted on

01/19/2018 4:50:30 PM PST

by

musicman

(The future is just a collection of successive nows.)

To: Hadean

The feds will do anything possible to make a shutdown, as painful as possible, for taxpayer/voters.

Rinse, repeat; rinse, repeat; rinse, repeat.........

18

posted on

01/19/2018 4:58:08 PM PST

by

FrankR

(Journalists are shoulder-chipped playground kids afraid of being beat up...so, they write.)

To: lgjhn23

When I personally used a firm to do my taxes, I picked an agent at one that had worked for the IRS.

Thanks for the note.

19

posted on

01/19/2018 4:58:27 PM PST

by

DoughtyOne

(a/o 01/17/18 DJIA close 26,115.65, 45.993% > the morning of 11/07/16. 716.77 to 50% increase..)

To: Hadean

Jeez, I just put in for retirement benefits, I should start seeing a check 2nd Wednesday of February........ or maybe not.

20

posted on

01/19/2018 5:03:35 PM PST

by

umgud

Navigation: use the links below to view more comments.

first 1-20, 21-33 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson