Posted on 11/30/2017 3:43:33 PM PST by Kaslin

In the interest of intellectual honesty and transparency, let's begin with a few important concessions to skeptics of the GOP tax reform bill: First, not every single American would be a winner under the plan. A small percentage of US taxpayers would see a tax increase (disproportionately, these would be higher-income itemizers from high-tax states), and a number of deductions that help certain people with heavy medical expenses and student loan debt would be eliminated (proponents say much or all of the resulting blow would be mitigated by lower rates and a doubled standard deduction). Second, among the "losers" would be a small percentage of middle class families and filers. Third, even using a "dynamic" score of the legislation -- which takes into account the growth-stimulating effects of tax cuts and simplification -- it is likely that the plan would add hundreds of billions to cumulative federal deficits over the next decade. The debt matters. Fourth, some Republicans believe the plan is too tilted toward corporate tax reductions (the current US statuary and effective rates are internationally uncompetitive), arguing that a small portion of those planned cuts should be redirected to families with children.

There is partisan retort to each of those first three criticisms, of course: The Democratic Party lied to the American people by promising a no-lose panacea under Obamacare, which ended up harming more people than it helped, while gut-punching millions of middle class families with skyrocketing Obamacare costs and taxes. And Obama's party, now feigning suddenly concern about deficits, cheered loudly as he nearly doubled the national debt in the span of just eight years. These points highlight Democrats' hypocrisy and opportunism; they do not, however, invalidate the concerns listed above, on the merits. The fundamental question as Senators contemplate their chamber's legislation is whether the drawbacks of the bill outweigh its benefits. I believe they do not, but in order to at least reach a point of forming rational opinions, it's imperative that we expose and correct dishonest myths about the effects of tax reform. These are the two biggest falsehoods being propagated by the Left:

(1) The GOP tax reform proposals do not help the middle class. This is flat-out wrong, period. As we've explored in great detail, with links to actual data, the vast majority of all taxpayers would receive a tax cut under the Republican plan, including roughly 75 percent of middle income households (others would see no change, and a small fraction would see an increase). This is especially true for the massive majority of middle class filers who take the standard deduction, which is set to roughly increase twofold under the legislation. As we wrote earlier, even the New York Times' analysis of the bill -- evidently unread by the paper's editorial board -- cannot escape the empirical fact that a lopsided supermajority of middle class earners stand to benefit from tax relief. I've also cited two nonpartisan analyses of the House-passed bill that determined it would lower taxes and increase incomes, on average, across every income group in America (see the above links). In doing so, I've highlighted the work of the nonpartisan Tax Foundation to illustrate these benefits, which some liberals have dismissed because of that organization's reputation for leaning to the right. For the purposes of this argument, therefore, let's look at findings from the ideologically liberal Tax Policy Center (TPC). It found that the House-passed legislation would reduce average tax bills across all five income groups from 2019 to 2027 (the end of the budget window). How about the Senate bill?

Chart from left-leaning Tax Policy Center shows Senate GOP reform bill would INCREASE after-tax incomes in '19 & '25 for *every single* income group. Yellow bar ('27 projection) assumes highly implausible total expiration of middle class cuts (see now-permanent Bush tax cuts): pic.twitter.com/7268PrtWlH— Guy Benson (@guypbenson) November 30, 2017

The blue and red bars demonstrate how taxpayers in every single income quintile, including the middle three, will see their after-tax incomes rise, due to the plan's tax cuts -- both immediately and in the medium-term. As I mention in the tweet, the yellow bar (the basis for nearly all of the misleading scare-mongering you're hearing from the Left on this front) assumes that Congress would allow all of the middle class cuts to expire after 2025. I've previously elucidated why that outcome is unlikely in the extreme, but here's Manhattan Institute Senior Fellow Brian Riedl fortifying the case persuasively and succinctly. Please read every sentence of this paragraph carefully, as it's packed with relevant information:

A Tax Policy Center analysis of the Senate bill reveals that three-quarters of all families would get a tax cut. Just 12 percent would see a tax increase — and they are concentrated among the rich. The average middle-income family would receive a tax cut of approximately $850 per year through 2025. At that point, Congress would have to vote to extend most of the family tax cuts. This vote would probably be a formality, as a similar vote five years ago to extend the Bush tax cuts for middle-class families passed the Senate 89–8. There is no appetite in Congress to steeply raise middle-class taxes. Even in the worst-case scenario, where the cuts fully expire, the typical middle-income family would receive a cumulative $7,000 tax cut in the early years, followed by a (roughly) $100 annual tax increase later. Still a good deal. How do critics portray this as a middle-class tax hike? By simply ignoring the $7,000 tax cut in the early years, assuming a full expiration after 2025, and then implying that the later tax hike is much larger. That is flat-out dishonest.

(2) The GOP tax reform proposals are just another giveaway to "the rich." President Trump insisted that millionaires and billionaires not see their income tax rate slashed under the GOP plan, and he got his way in the House-passed bill (the Senate bill would reduce the top tax bracket rate by just one point). That still hasn't stopped the Left from endlessly repeating their favorite talking point about any and every Republican tax idea ever proposed. First, I'll remind you that "the rich" already pay a disproportionately high percentage of America's tax tab. The data spells out how they contribute their "fair share" (another popular buzz phrase), and then some. Of course an across-the-board tax cut and reform plan will benefit many of the people who are shoveling mounds of cash out the door and into Uncle Sam's bottomless coffers. But can the Senate plan be broadly construed as a sweetheart deal for the very rich? Back to Riedl's analysis -- which, again, is rooted in numbers from the liberal TPC:

Even a proportional tax cut will save wealthier families more money. In 2013 (the latest year for which data are available), the typical family in the top 1 percent paid $420,000 in federal income taxes. The top 20 percent averaged $47,000, and the typical middle-income family paid $2,000. The bottom 40 percent collectively paid zero income tax. It is not easy to give the largest income-tax cuts to those who already pay no income tax. That said, the Senate bill would make the tax code even more progressive. The bottom 80 percent of families currently pay 33 percent of all combined federal taxes, yet would get 37 percent of the tax cuts. By contrast, the top 1 percent currently pays 27 percent of all federal taxes but would get just 18 percent of the tax cuts. The result would be wealthy families paying a larger portion of the federal tax burden.

So where do statistics like this "62 percent of cuts to the top one percent" assertion come from?

“Your tax plan has 36% of it going to the richest 1% in America. I don’t do that" is a thing McCain said in 2000 to GWBush. McCain went on to vote against both the 2001 & 2003 Bush cuts.

Well, current Senate bill has 62% of cuts going to top 1%. https://t.co/houHwoEcPb— Catherine Rampell (@crampell) November 29, 2017

That data point relies on the "yellow bar" assumption described earlier. She skips the entire part about undisputed middle class tax cuts over the next eight years, and jumps to a fictional 2027 universe in which Congress has green-lit a big tax increase on the middle class, leaving the remaining playing field slanted toward "the rich." This is misleading sleight-of-hand that looks intended to fool gullible people and whip up under-informed outrage. Another example of that phenomenon:

NEW: Leaked JCT report shows only 62% of Americans get a tax cut of $100 or more from the Senate GOP plan in 2019. Rest would pay about the same or more.

Among people earning $50k to $75k, 10% would face tax hike of $100 or morehttps://t.co/9kz5vjzLIv pic.twitter.com/lS6IJdEt3q— Heather Long (@byHeatherLong) November 29, 2017

Using basic arithmetic, many people might conclude this also means that 38 percent of Americans would see a tax increase. Wrong:

This doesn't say nearly what you think it says. Roughly 1/3 of filers have no tax liability, so roughly 1/3 of filers getting no tax cut is not at all surprising. There's no tax to cut. https://t.co/gfRuvkt3ld— amoylan (@amoylan) November 30, 2017

To recap: The data proves that the overwhelming majority of all taxpayers (including, if not especially, the middle class) would get a tax cut under the bill, which would also significantly improve the US business climate for corporations and small businesses, resulting in faster economic growth and nearly one million new full-time American jobs. What it would not do -- contrary to some of the scurrilous rumors and baseless claims flying around -- is create special new "tax breaks" for private jet owners, eliminate the popular mortgage interest deduction, or "kick millions off of healthcare" (a distortion that doubles as a bogus claim that poor people would get slapped with "tax increases" under the legislation). I'm not here to tell you the Republican plan is perfect. I'm here to tell you that some of the most frequently-repeated attacks from the Left against the plan are either entirely unsupported by evidence, or rest on out-of-context data points that seem to have been deliberately cherry-picked in order to mislead people.

If it gets on the Ballot, I’ll Vote for it.

My comment is based on what I see, nobody cares. It’s the same old, same old and as long as the Rats have a Super Majority here they will figure out another way IF the Ballot Proposition passes.

Ten to one a Liberal CA Judge will invalidate the Proposition if it ever sees the light of day anyway.

It won’t be on the ballot if people don’t sign the petitions.

Tax shift (SHAFT) ping!

In the interest of FRee discourse and full disclosure, as one of that unfortunate minority in the People's Republic of Pennsyltucky I'm looking at a 30 - 50% tax INCREASE.

And that will change my vote from GOP to Libertarian forever.

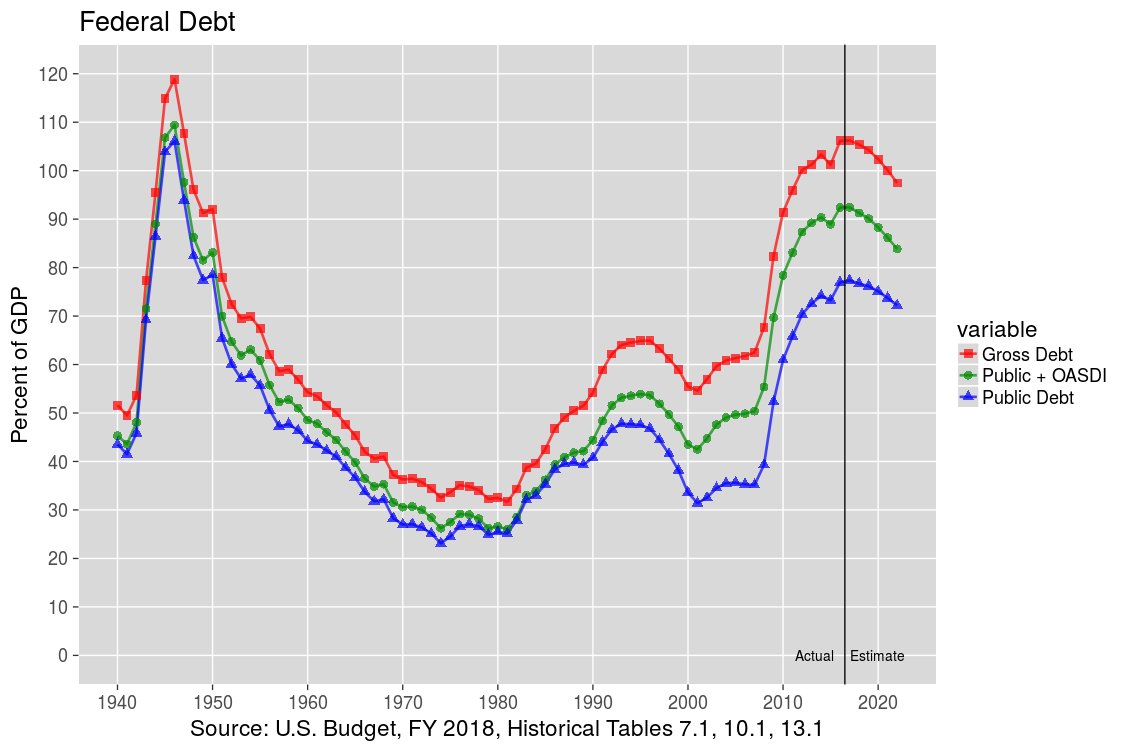

Yes, it seems very unconservative to ram through radical changes in the tax law. I guess that they don't believe in letting people adjust to any of the changes by phasing them in. The only way to be safe is to save every penny that can since you never know when they're going to change all the rules in Washington. That's especially the case judging by the following graph of the federal debt:

You can find the numbers at this link. As you can see, at 106 percent of GDP, the gross debt is much higher than it was during Reagan's 1986 tax reform (46.7% of GDP) or even Bush's 2001 tax cut (54.6% of GDP). Now we're tacking on another $1 trillion of debt according to the latest JCT report, even under dynamic scoring. All just in time for the Boomer retirement, nine years into an expansion when we have historically had recessions every 10 years or so. But maybe this time it's different.

There's also an up-to-date calculator at https://econdata.shinyapps.io/taxcuts/ that can give your tax cut and change in your after-tax income for the House and Senate bills. It gives the same results as examples put out by the House, the Senate, and the Tax Foundation.

What might happen?

1.High tax states reduce their taxes. Ha, ha, ha, ha...

2. People leave high tax states for low tax states. Real estate prices in high tax states drop; in low tax states, real estate goes up.

3. Companies can no longer get talent in high tax states because housing prices are still way too high and residents can not deduct SALT. Companies relocate to low tax states. This reinforces housing price adjustments.

4. High tax states are eventually forced to reduce taxes and taxes get some control on their spending. This will be difficult with huge public employee pension costs.

Re-establishing equilibrium will take years.

This relieves the other states from subsidizing the high tax states.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.