Skip to comments.

GOP Whiffs On Bank Reform, Big Time

Investors Business Daily ^

| July 21, 2016

| Editorial

Posted on 07/22/2016 4:07:28 AM PDT by expat_panama

Financial Crisis: The Republican platform put forward in Cleveland is a lively and conservative document, full of great ideas to make America great again. But one thing stands out as a truly bad idea: reviving the partly-repealed Glass-Steagall Act.

"We support reinstating the Glass-Steagall Act, which prohibits commercial banks from engaging in high risk activities," says the platform document.

What? It was one of the Democrats' big talking points during the 2007-2008 financial crisis and after that a major cause of the panic was due to Bill Clinton in 1999 foolishly going along with the Republicans to get rid of Glass-Steagall...

...only problem is, it isn't true...

...It actually increased costs to consumers, but didn't really make the banking system safer...

...Glass-Steagall wasn't "repealed." The only part that was eliminated was one that kept banks from being affiliated...

Repeal of that provision had nothing -- zero -- to do with the financial crisis. It's a myth...

...securities had nothing to do with the crisis."

As we've noted literally dozens of times before, the financial crisis' origins lay in Bill Clinton's decision in the early 1990s to use Big Government to force banks to make mortgage loans to low-income people who were bad credit risks.

The banks did as they were told -- they were threatened, actually -- and then, when trillions in loans predictably went bad, the banks were demonized and scapegoated by the left...

...that's how Dodd-Frank, the worst financial law in modern history, was born...

...to believe that simply restoring one part of Glass-Steagall will end "too-big-to-fail" for banks. Not so... ...less profitable and arguably much weaker.

Let's hope the next Congress forgets this bad idea...

(Excerpt) Read more at investors.com ...

TOPICS: Business/Economy; News/Current Events; Politics/Elections

KEYWORDS: 114th; 2008; 2016issues; banking; banks; doddfrank; economy; globalism; investing; mortgagecrisis

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-71 next last

If anyone wants to look, here are

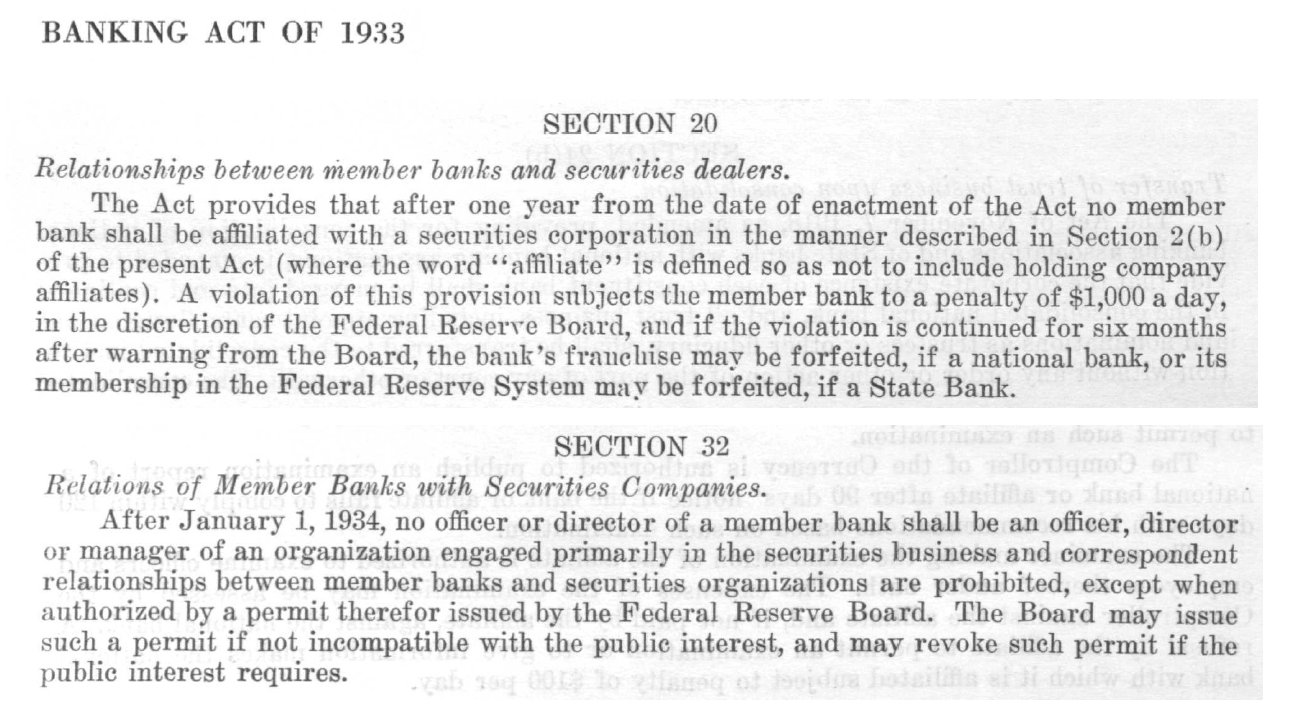

all 32 Sections of the original 1933 Glass-Steagall Act, and

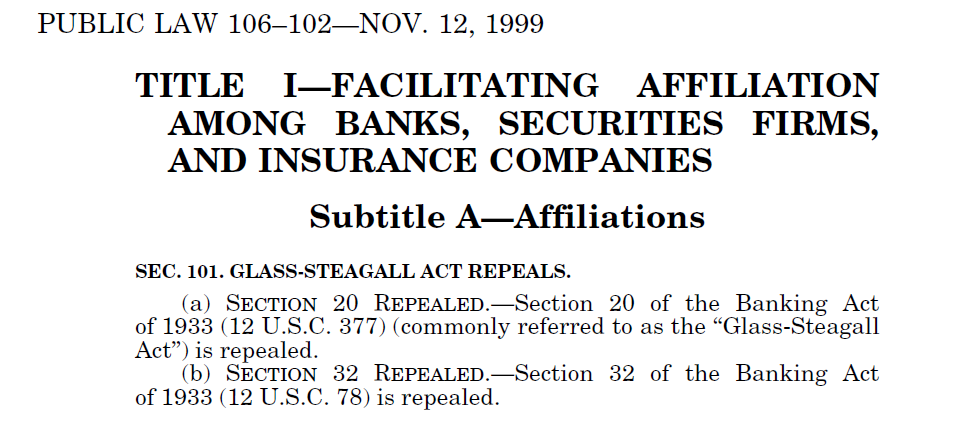

this is the 1999 Act that included this section:

--that removed Sections 20 and 32 or the 1933 act--

and still left in all the other 30 sections with that stuff about separation of "commercial and investment banks". Can we all agree that deleting two irrelevant sections out of 32 sections is not what we want to call a "repeal"?

To: expat_panama

If IBD thinks reinstatement of Glass-Stegall is a bad idea...it is a good idea for America. Having seen the beast from inside the repeal of Glass-Stegall led to such financial manipulations and ties across entities that it puts taxpayers on the hook for bad banks risky decisions.

2

posted on

07/22/2016 4:24:52 AM PDT

by

rstrahan

To: expat_panama

If the crooked banksters are against it, then I’m definitely for it.

To: expat_panama

...It actually increased costs to consumers, but didn't really make the banking system safer... Is IBD Editorial Writer referring to "it" as Glass Steagall? With banking chaos in the early 30's I would think it would be hard to separate out increased costs due to G-S versus other factors.

4

posted on

07/22/2016 4:29:26 AM PDT

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: expat_panama

I heard that a major factor in the lifting of Glass Steagall was the personal influence of Robert Rubin (of Citicorp, and a big Dem), who was an adviser to Bill Clinton.

To: expat_panama

I’d like to be the first to welcome the n00bs to your econ threads. Welcome.

6

posted on

07/22/2016 4:45:12 AM PDT

by

1rudeboy

To: expat_panama

Right, so though it is important, saying “banking this and that” should have been mentioned into the weeds in these speeches? Do you really think the ignorant masses would have understood such details? No.

There will be time and place for this. It is a small man’s carping is part of the anti-Trump IBD mantra.

I used to read that paper, but it is but a GOPe tool now.

7

posted on

07/22/2016 5:21:20 AM PDT

by

CincyRichieRich

(Who is John Galt? The New Normal is not acceptable.)

To: expat_panama

If “repeal” of the Glass-Steagall Act caused the “Great Recession” wouldn’t the blame rest squarely on Bill Clintons shoulders, not GWB’s?

8

posted on

07/22/2016 5:33:53 AM PDT

by

Lurkina.n.Learnin

(It's a shame enobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

Welcome to "Oops Friday"! Major stock indexes hit a profit taking 1/3% bump yesterday in rising trade while precious metals also continue basing, gold just over $1,300 and silver just under $20. Futures traders see metals leaping now (heat map: +1.05%) and the FT's can't make up their minds about stocks (they'll either go up or go down).

No new econ stats today, fwiw numbers for construction have been coming in 'unexpectedly' much better than thought.

News:

Win or Lose, Trump Will Make a Lot of Money - Steven Strauss, USA Today

Pence and Trump's Corporate Welfare Gospel - David Cay Johnston, TDB

Mike Pence Soared, Ted Cruz Is Finished - Larry Kudlow, National Review

Trump's Mixed Messages to Wall Street - Sheelah Kolhatkar, New Yorker

Why New Bull Market May Just Be Getting Started - Shawn Langlois, MW

Partisanship, Animus and Market Volatility Lie Ahead - Doug Kass, RM

Question Now Is Whether or Not Sense Can Prevail - Jeffrey Snider, RCM

To: Crash Fistfight

If the crooked banksters are against it, then I’m definitely for it.Ahh, we've decided to be easily manipulated have we? Let's see, this link proves crooked banksters don't want you to give me your life savings....

To: 1rudeboy

...welcome the n00bs to your econ threads...Us nOObs rule and anyone who doesn't like nOObs belongs elsewhere! It's like how I tell everyone if they don't like the way I speed in my car then they should stay off the sidewalk...

To: expat_panama

Has anyone here talked to Bankers / Financial Adviser types off the record post: Sarbanes Oxley and Dodd Frank?

I have and I will go further than they do. Let's go back and review all the financial changes from the Clinton years as well and essentially scrap them all, start over, and if you can find a diamond in each of these goats @$$es then put it in the new Financial Bill, if not keep the Bill to less than 200 pages, empower the SEC, scrap FINRA, and that is just for starters.

Let the debate begin..

12

posted on

07/22/2016 5:55:24 AM PDT

by

taildragger

(Not my Monkey, not my Circus...)

To: expat_panama

Nobody forced the banks to develop CDS’s and MBS’s and fraudently sell them around the world while boasting of ripping their customers’ faces off.

If the mortgages had merely gone bad, the banks could have taken their lumps. It was these new financial instruments that forced the bailout.

13

posted on

07/22/2016 5:56:20 AM PDT

by

Wolfie

To: Lurkina.n.Learnin

....wouldn’t the blame rest squarely on Bill Clintons shoulders, not GWB’s?Aw never! The only reason that the super smart Bill Clinton went along with the stupid Great Repeal/Deregulation was becuase those idiot Republicans fooled Clinton into signing it. Just like how that dunce GWB fooled the smartest Senator Hillary into signing on to the useless foolish Iraq War that Genius Obama is continuing.

Now that I think of it, I could probably be a great dem speech writer...

To: expat_panama

Thank you for that link. It was very informative eye popping. Everyone here should read that carefully.

15

posted on

07/22/2016 6:06:44 AM PDT

by

BipolarBob

(I'm not racist but I do profile.)

To: expat_panama

“Now that I think of it, I could probably be a great dem speech writer... “

Well you certainly got the right spin goin for ya. Like a centrifuge. LOL

16

posted on

07/22/2016 6:10:15 AM PDT

by

Lurkina.n.Learnin

(It's a shame enobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wolfie

banks to develop CDS’s and MBS’s and fraudently sell them around the world while boasting of ripping their customers’ faces off.

Whoa neat! Hating those filthy exploiting capitalist pin-stripe boys is sooo much fun.

Hey everyone, it's time to sing our favorite Wobbly Songs!

To: BipolarBob

Don’t tell anyone, but for every click I get paid $1.35...

To: rstrahan

the repeal of Glass-Stegall led to such financial manipulations and ties across entities that it puts taxpayers on the hook for bad banks risky decisions.Before it was repealed, were taxpayers on the hook when banks wrote crappy mortgages?

19

posted on

07/22/2016 6:17:34 AM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: expat_panama

“the financial crisis’ origins lay in Bill Clinton’s decision in the early 1990s to use Big Government to force banks to make mortgage loans to low-income people who were bad credit risks. The banks did as they were told — they were threatened, actually — and then, when trillions in loans predictably went bad, the banks were demonized and scapegoated by the left... ...that’s how Dodd-Frank, the worst financial law in modern history, was born...”

Yelp. Truths the lame stream media will never report, which is why Trump needs to get this information out so that low information voters can realize what government intervention in the markets and social engineering does.

20

posted on

07/22/2016 6:23:29 AM PDT

by

SharpRightTurn

(White, black, and red all over--America's affirmative action, metrosexual president.)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-71 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson