Posted on 03/15/2015 12:07:44 PM PDT by NRx

The bull market in stocks turned six last Monday, and despite some rocky stretches — like last week, when the market fell — it has generally been a very pleasant time for money managers, who have often posted good numbers.

Look more closely at those gaudy returns, however, and you may see something startling. The truth is that very few professional investors have actually managed to outperform the rising market consistently over those years.

In fact, based on the updated findings and definitions of a particular study, it appears that no mutual fund managers have.

(Excerpt) Read more at nytimes.com ...

Efficient market hypothesis once again proven true...

Index funds work well for a long-term "buy & hold" strategy. I use a mix of index funds (for long-term investing) and managed funds (where I sell occasionally for short-term gains).

Nothing beats a market index that has:

... no cost

... no risk management

... no concern for loss of capital

... And propelled higher by the Plunge Protection Team at the Federal Reserve that has prevented a meltdown since quantitative easing began by buying index derivatives.

How could anything do better than a no cost, manipulated index?? Seems impossible.

Please update this evaluation after the next collapse and we can compare all the alternative strategies over a complete market cycle.

Keep in mind that an index is simply a list of stocks that someone has chosen to include in the list.

A large index like the S&P 500 has more stocks and covers a broader range of the market than a smaller index like the Dow Jones Industrials, but both indexes are simply lists of stocks that someone has picked.

Bubba,

I realize what an index is. My points remain true.

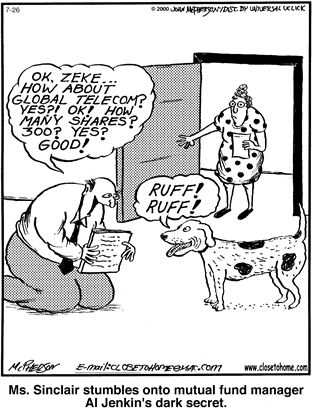

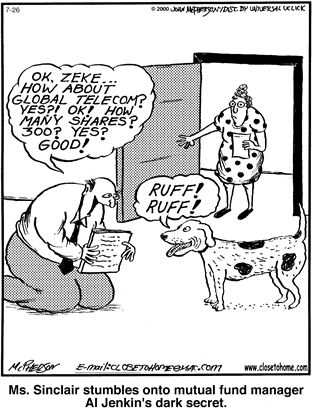

Insider trading. Next question. (^_^)

Your points are a good argument for diversification across multiple asset classes. As an argument against indexing, I think they are rather anemic.

“Your points are a good argument for diversification across multiple asset classes. As an argument against indexing, I think they are rather anemic.”

Not surprising.

You already have a belief system, confirmed by recency bias and supported by the support of hundreds of billions of Central Bank dollars that are preventing serious declines.

This will work until it no longer works. Up until that time, your bias will be reconfirmed. You will be pleased with your gains.

If very fortunate, the Central Banks and (in the final stages) the IMF will be able to keep it up for a couple more years tops.

Unfortunately, investors like you will no longer have the skills to use a steering wheel. After that, many people will remember too late that asset preservation means something as they lose most of what they have. Not 10%. Most, meaning far more than half.

May you not be among them. I do encourage you to stop back and update your thread when we reach that point.

As for diversification among asset classes... Just when you need diversification to help the most, if fails the worst. They all die like rats in a corner.

Either you will eventually learn to steer, or you will hire someone to do so. The alternative is unthinkable.

Forbes has a recent article that says managers are stealing 70 per cent from money market funds.

LOL. Please tell me you are joking. There have been innumerable studies done going back to the 1950’s ALL of whom consistently demonstrate that long term, actively managed portfolios overwhelmingly tend to underperform their respective indices. Jack Bogle has been writing on this subject since at least the 1970’s. Recency bias my @$$.

It sounds like you have been drinking deep from the well of the Ausrtian School’s Kool-Aid. The problem is that these same predictions of global economic collapse and a hyperinflationary inferno have been around since at least the early 1930’s. And it hasn’t materialized.

Do you have a cite? Money market funds make so little, I don’t see how anyone can steal from them. What am I missing?

Please also stop back to update things.

I will leave you with a question...

If the stock market is so fantastic, why are Central Banks stepping in to purchase futures and other derivative contracts to prop it up every time it begins to fail and looks dicey? Why is that necessary?

I have no idea whether stocks are going up or down in the near future. Nor do I particularly care because, in keeping with my earlier point, I own more than stocks. But I will note that stocks have been the best performing asset class over the last roughly 200 years. They have outperformed all other broad asset classes over every decade since 1900 excepting only the 1930’s which was deflationary, the 1970’s which was inflationary and the 2000’s which was skewed by the end of the decade financial panic. Stock market declines and even crashes are a bit like the flue. They come around with an unpleasant degree of regularity and you just roll with, assuming you are adequately diversified.

Again it sounds like you are confusing asset classes with indexing. Your argument against stocks may, or may not hold water in the neat term. But it does not make an argument for long term active portfolio management.

Interesting, we were just talking about that on a related thread, but the thing is that the fed does not buy common stock (much less derivatives/futures) so they can't move share prices. Loony leftists like to say the government's all powerful but in real life the Fed's small potatoes. Right now Fed banks got about $4T --mostly T-bills plus a few mortgages. Total corporate assets (from page 124 of the Flow of Funds) for non-financial businesses is $37T. The Fed --or any governmental agency for that matter-- couldn't control the free market even if it wanted to. Central planning is a lie --one that works great only for pundits and politicians.

The Fed and Central Banks in other countries buy futures contracts on broad market indexes and derivatives on the same. If you Google it, you will find plenty of information.

Certainly, the Fed has expanded its balance sheet with huge amounts of bond buying, forcing money into the stock market and making it attractive for companies to begin stock buy-backs with such low rates.

It goes beyond that though. I recently sold my investment management firm after 27 years of being involved. Every trader I know, who sits at a terminal every day and watches what is happening tells me that an unseen hand is stepping in at every dicey decline to save it from disaster.

Central banks around the world are buying stocks. When you have lots of money, the easiest way to get exposure is with futures on indexes - or other derivative contracts.

As a sample to save you time...

http://www.zerohedge.com/news/2014-08-30/its-settled-central-banks-trade-sp500-futures

http://nypost.com/2014/10/20/plunge-protection-behind-markets-sudden-recovery/

http://www.zerohedge.com/article/us-government-buying-stocks

http://business.time.com/2013/04/26/why-are-central-banks-suddenly-buying-stocks/

http://www.zerohedge.com/news/2015-03-11/how-boj-stepped-143-times-send-japanese-stocks-soaring

I bought Apple stock for $86 last May 2014 and so far it has gone up to a high of 35%

Pick 1 stock and you can do very very well : )

“I bought Apple stock for $86 last May 2014 and so far it has gone up to a high of 35%

Pick 1 stock and you can do very very well : )”

I congratulate you on your good fortune. But picking one stock easily lead to steep losses as well as gains. Or it can do very little. The future is unpredictable.

Coulda, woulda and shouda are the laments I have for other stocks I passed on.......

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.