Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

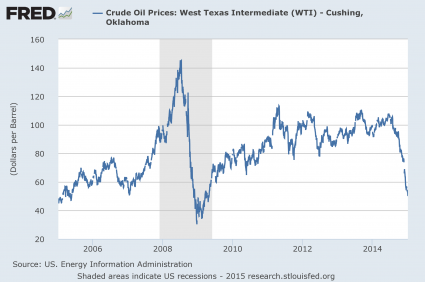

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Me too brother, me too. (or sister, as the case may be)

I voted for Reagan and I remember the 1973 oil crisis very well, which was manufactured when the Egyptians convinced the Saudis to harm the U.S. For our support of Israel. And yes, falling oil prices were a boon during an actual, strong, producing U.S. Economy. Today, we have a very different scenario, a stock market manipulated and rigged beyond comprehension, and a global economy tied together unlike any other time in human history. Not to mention debts that are beyond the ability of our nation to repay.

If you can afford to buy that car you can afford ten dollars a gallon for gas, it probably gets at least eight miles to the gallon if you go easy on the pedal. If you don’t go easy on the pedal you can’t afford to buy tires for it. It could probably burn up a new pair of radials on the rear in about two starts.

You should buy a Viper with an 8.4 L engine! I wonder what the gas mileage is on that car?

It was reported today that many supertankers are being leased out for long leases.

Is there anyone on here that does believe that this is a totally man made crisis aimed at getting rid of the middle class? All the while importing an ignorant and cheap new source of labor from south of our border?

Just the way I see it.

Wow ... under Bush, high oil prices were bad. Under Obambi, low oil prices are bad. Gotta love the media. O.o

With the CRA, helped by the government loan machines Fannie and Freddie, marginal borrowers were mainstreamed shifting the whole lending curve.

Economists at the National Bureau of Economic Research concluded that banks undergoing CRA-related regulatory exams took additional mortgage lending risk. The authors of a study entitled "Did the Community Reinvestment Act Lead to Risky Lending?" compared "the lending behavior of banks undergoing CRA exams within a given census tract in a given month (the treatment group) to the behavior of banks operating in the same census tract-month that did not face these exams (the control group).

This comparison clearly indicates that adherence to the CRA led to riskier lending by banks." They concluded: "The evidence shows that around CRA examinations, when incentives to conform to CRA standards are particularly high, banks not only increase lending rates but also appear to originate loans that are markedly riskier." Loan delinquency averaged 15% higher in the treatment group than the control group one year after mortgage origination.

This is bull. Millions of people now have more money to spend on other things. This will be a shot in the economies arm except in states that will raise gas taxes like California.

Not me. I intend to enjoy it for as long as it lasts. I’m just wondering when the boom is going to be lowered and we’re hit with a sudden humongous hike in gas prices.

The price of oil collapse was NOT just PRIOR to the 2008 financial crisis; By October, 2008, the price of oil had DOUBLED in the past year. It was during the subsequent RECESSION that the collapsed demand for oil caused the price of oil to drop.

THIS oil collapse is caused by a surge in supply, not a collapse in demand.

lol

I haven’t heard one person tell me why cheap oil or gas is bad!

Everyone has more money to spend on other things, everything is cheaper to transport, cheaper to travel, ect.

And from what I’ve read, farmers aren’t having any trouble selling corn to companies making fuel.

Deflation, the D word worse than the Depression word.

I had to stop and look to see who wrote this. Nope it wasn’t Tyler Durden. Had me fooled.

It wasn’t a Saudi and Egyptian manufactured crisis that raised the price of oil. The Saudis weren’t economic illiterates and harming their largest customer wasn’t in their interest. Getting paid in non-depreciating dollars was in their interest.

Nixon abandoning the Bretton Woods monetary regime was the pivot for the rise in oil prices. Inflation ensued, and with oil priced in dollars OPEC’s real income declined along with the dollar’s value. The increase in oil prices in nominal dollars brought its price back to the long term trend line in real dollars.

Nixon, Ford and Carter tried price controls and other regulations that resulted in shortages and less supply. Reagan knew enough to scrap all that and let market forces work to increase supply and lower the cost of oil. Fracking has similarly increased supply. The drop in price is partially due to an increase in supply. But it’s been big enough that it surely has to be some OPEC producers trying drive out their competition.

“Not to mention debts that are beyond the ability of our nation to repay.”

And how exactly are you calculating that? Percentage of GDP?

I want to know why the price of everything else hasn’t dropped because it is cheaper for trucking companies. They always used the rising price of gas as an excuse to raise the prices, so now cut the prices.

You’d think that the cost of commercial transportation and all petroleum based products would start falling. Wonder why it has not?

Not happening yet, and reports seem to indicate it won't happen soon. But, we will see...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.