Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

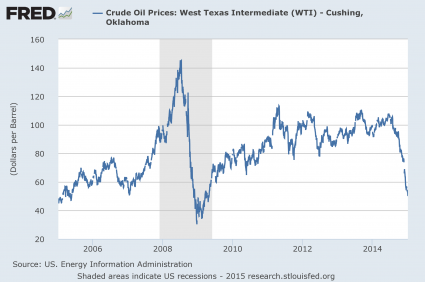

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Let's see.....we have a fictitious bubble economy, with a Federal government that is addicted to "cheap money", incredible debt and annual deficits, and six figure Trillions in unfunded mandates for entitlements.

Hmmmmmm......

Someone here on Free Republic basically called me an idiot, just the other day, for enjoying (and wanting) these low gas prices ... LOL ...

I think this is what sober analysts are considering with the utmost seriousness:

Guess What Happened The Last Time The Price Of Oil Crashed Like This?

In this case derivatives could protect the owners of the high risk bonds that are liable to default.

There’s nothing wrong with derivatives per se but they do need a regulated market. There was a huge problem with credit default swaps during the housing bubble because you were able to buy swaps betting against contracts that you weren’t a part of. It was like taking out life insurance on someone else and benefiting if they died.

lower fuel prices also mean

CHEAPER FLIGHTS

CHEAPER DRIVING

CHEAPER MANUFACTURING COSTS

CHEAPER FOOD DUE TO CHEAPER SHIPPING COSTS

I think the Saudis are doing it to drive Fracking out of business, it will become too expensive to frack because Saudi oil is cheaper

they did that to Texas! In the 1970’s, remember? All you people over 55? Texas oil became too expensive because American wages were too high to keep pumping oil that the saudis put out for pennies on the dollar

They might be employed in the energy business, or have a lot invested and a lot to lose.

A lot of folks in the US energy production business are already getting laid off, and it will get much worse when the some of the contracts come up for renewal.

Oil price drops bring pain to Texas, North Dakota: Fed

Falling Oil Prices Cause Concern In North Dakota and Minnesota

Falling Oil Prices Have North Dakota Migrants Rethinking The Boom

States like Alaska are already predicting a half Billion dollars in loss of expected energy tax revenue for 2015, and I don't think prices have even hit bottom yet.

In turn, every bar, restaurant, hotel, apartment building, and grocery store in an oil boom area, from PA to OK, is going to feel tremendous pain unless price go back up again soon.

Thanks.

Before we can begin repairs, we first have to purge the falsehoods.

#1 is the notion of a “world/international community”. The planet is inhabited by radically incompatible clans, tribes, and nations, whose normative means of interaction is warfare, stimulated by hatred and blood lust.

It has always been true, and it will always be true.

Covering it up and lying about it is making the upcoming explosion much larger than it needs to be.

The Fed isn’t in the business of making loans to energy companies. They aren’t at risk in the slightest.

The crude was controlled by the Seven Sisters.

The sound of Truth always has a clear solid ring to it.

Well, there s only one solution. Obama has to be given the Nobel Prize... For Economics, stat! That should fix everything, much like giving him the Nobel Peace Prize gave us peace throughout the world.

I am buying more gasoline and driving more so the oil companies can make up the losses with volume.

I am doing my part to keep this house of cards together!

I don’t believe it’s the economy-crashing disaster that some are making it out to be.

HOWEVER ... “if” it truly were that kind of a disaster to our economy, then just slap a $20 or $30 a barrel tax on all imported oil into the USA, but none for domestic oil ... :-) ... and give all the tax money to the domestic oil industry! Boom times are back again like gangbusters for the USA ... LOL ...

But ... no, I don’t think we need to do that. For those who think it is that kind of disaster, you might want to work on that solution ... :-) ...

Right.

Low oil, and other commodities, prices are just a symptom od the lack of growth that is destroying the world’s economy.

The world’s wealth has gone to governments to ‘invest’ and the ‘returns’ are lousy.

I believe the subject was about banks, which the FED has a habit of bailing them out.

“They will have more money to spend in other parts of the economy, money for college payments, money to save or pay off other debt, etc.”-——it appears that most of the ‘fuel’ money savings for the average citizen is being utilized for increased health insurance payments and other rising healthcare costs which is not the base one wants for healthy economic growth......especially when you’re paying more for less.

Financial markets could be rocked, but the underlying (real) economy will be hurt much less, and will also benefit from lower oil prices in many ways.

A natural resources suddenly becomes abundant and inexpensive crashes the world financial markets, film at 11:00.

Read “The Harbinger.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.