Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

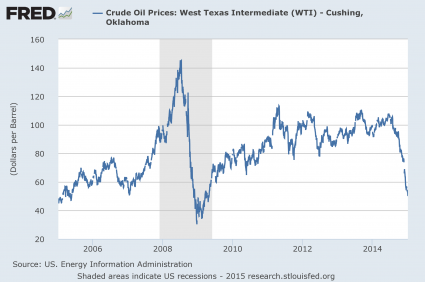

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Well put. The financial markets are a mirage, a lie basically. The only reason they went nuts since 2008 was the transfer of $4 Trillion by the Fed. The real economy you spoke of is reeling, and so are most Americans.

If oil prices stay low for the next 3-4 months, then what do you see happening to the transport companies, the derivatives, and the markets?

My understanding is that the supply:demand imbalance is only about 1.5 million bbl per day, which is under 2% of the total production.

Normally, producers would scale back a bit and the price would moderate.

What we have now are a bunch of producers who are pumping like crazy to raise cash (Iran, Russia, etc.) and the OPEC countries are not cutting back to stabilize prices.

It would take very little to pull 1.5 million bbl out of production, if they wanted to...

That’s the way I see it. About four years ago I told a man who was old enough to remember the thirties that I considered it a depression and he said that I was wrong because, “We don’t have soup kitchens like the thirties.” I asked him what he thought of forty million or so people using “food stamps” as most still refer to the EBT cards. I think we are in a situation where all the dirt is bing swept under the rug figuratively speaking. I think it is well over forty, maybe even fifty million now using EBT cards and that is just one benefit program. If all those people were standing in line at soup kitchens I doubt that anyone would try to say we are NOT in a depression.

“The current US Depression (and yes I too believe we are in one)”

we are. and I doubt we will climb out anytime soon if ever. There will be those that do well. And some that do OK. But for most, its not coming back.

Combine this with an evil govt, racism against whites, militant LGBT, hatred of Christianity.....IMO the 30s Depression, although physically more brutal, will be a picnic compared to what’s coming (and already happening).

The bond market is the key. Based on what I am reading...on both the mainstream media and the fringe stuff.

I think the oil issue is the catalyst, but once the derivatives fail it will/could roll downhill from there.

Consider what happen in Switzerland last week. Billions were lost in minutes. That could be the trigger. If that happened in Hong Kong the whole house of cards comes down.

It is all connected.

For the past 10 years The Fed and the ECU had the option of lowering rates to perpetuate the problem by kicking he can down the road. They have no more bullets in the chamber.

If you use the same metrics we used as in the 30's, you are absolutely right.

The government has changed the stat methodologies and the unemployment rate reported now is an out in out lie. Even in the 30's we had these mini-rallies which gave the impression things were getting better. Government honesty is the one biggest difference.

Deflation is goof if you are completely debt free.

What I think a lot of people are doing is thinking “micro” instead of “macro.”

Yes, if you personally are debt free and living on stores of cash it is good. You will pay less and your dollar becomes stronger. That is good for the individual.

On the macro side, companies use debt to buy capital assets to build or expand their companies. Paying off those debts becomes more difficult during deflation. The capital needs are stressed and expenses have to be cut to keep up with the debt service.

Now think about who has huge debt service. The fist that comes to mind is the Gov Of the U.S. what expenses are going to be cut to service the debt? I know we all think the gov has a ton of places to cut. Do you think they will cut EBT or military spending?

When the government has to service their debt, where are they going to get the dollars to do so? Dollars that are being hoarded. They will increase taxes. And the rich are not going to foot this bill. Gas tax is the obvious first choice. Other types of consumption taxes and tariffs is the second place. That drives production even lower.

The end result is dollars sitting around, production dropping, and people out of work.

Until the last widget that everyone wants rolls off the production line, and the production line itself is liquidated to pay off that debt.

Then you have one widget, that everyone wants, and the folks with cash are jumping over themselves to get it.

That does not end well for anyone.

The Feds will just print it. You are pretty ignorant about everything....

catfish, SkyPilot was the one who wrote “US in Depression”. I was just responding.

And yes, there are plenty of fools, even here on FR, that still believe Govt Economic Data. There are unemployed who will never find a job except maybe selling second hand junk or a few side jobs. That spells a very “depressing” future for all.

Ok, they print it. And the fed buys Bonds. So you increase the debt service. Of course, the fed will repay a portion of that interest, but it increases the money in circulation. The only thing that will cause is a steeper inflation when productivity slows to a stop.

The end result is the same.

I should add, where will the government spend that printed money? They will spend it on interest. They won’t spend it on services. They won’t spend it on capital improvements. They won’t spend it on “shovel ready jobs.” Nothing will be produced. The money will be sucked up, just as it was in Japan for the past twenty years.

I have a hard time understanding that when companies match 50~100% on the investment. Tough to consistently do better than that.

Some companies do that.

If you’re not getting a big boost the 401 is a stranglehold on your money that makes no sense.

I’ve only seen 50% match or better. Some companies use it for bonus but only if you participate.

You have to do all of your planning with the reality of the IMF’s ‘SDRs’ in mind; that is the ultimate purpose of their monetary manipulations.

They are working hard to demolish national governments, looking forward to their beloved “Man of Sin” taking the reigns.

Even for the unprepared, the chaos will be short lived. Daniel’s 70th week is seven years long, the first 3.5 years of which is the monetary chaos that is approaching.

.

Now that's a barrel of laffs!

(Actually thought it was very clever.)

The 50% is up to a quickly reached limit in most cases.

They use the accounts to replace their potential retirement plan vulnerability. Once the cap is reached, further commitment to the plan becomes risky and foolish. The Roth is a better bet for most.

.

I had a Vega and always kind of wanted a Pinto.

Very functional for a kid.

They get a bad rap but I ran the dickens out of mine for a long time, aluminum engine block and all.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.