Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

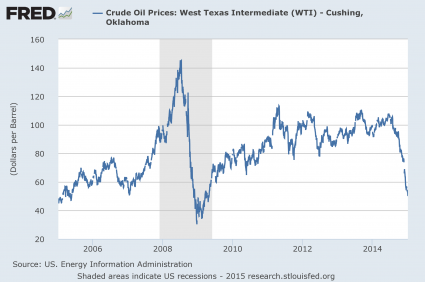

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

It was the Egyptians convincing the Saudis in1973. This is documented history. And yes, we have over 100 Trillion in unfunded mandates, from Social Security, to Medicare, to pensions, to welfare. Look that up as well. There is no way we can pay this, barring a massive “reset” or the collapse of the dollars followed by a new world currency in the realm of SDR backing.

Takes a while for inventory that was bought with higher transit costs to turn over. That, and companies are slow to cut into newfound profit until the market forces them to do so.

I’m benefitting as much as anyone else from gas prices falling as they have, with no apparent end in sight. But it’s not all blue skies and white fluffy clouds on the horizon as a result. Several states are going to be hit hard by this. Quite a few financial institutions are becoming questionable again.

I’ve said it before and will likely get flamed, but I’d slap a tariff on OPEC oil and use it to subsidize domestic production. OPEC is a cartel. OPEC is dumping cheap oil in an attempt at wrecking a domestic industry. They’ve succeeded before. We’re not exactly stable economically, I don’t like what I see if this continues to spiral downward.

But, I can fill up my car for $25 now, not that long ago it was twice that. Hope it’s worth it spread across the millions of others who are benefitting likewise, because there will be trouble resulting from this in the middle of the country.

This is economic gibberish. Granted, some oil workers may be laid off or see their wages or hours cut, and oil producers may have to tighten their belts for a while, after years of rolling in the clover. But hundreds of millions of American consumers who don’t depend on oil patch will have a lot more money in their pockets because of lower gasoline and oil prices. I’m currently enjoying an extra $300 or so of monthly savings in gasoline and home heating oil expenses, and I’m not planning on burying that dough in a can in the back yard. We’re actually seriously considering a long vacation, something we haven’t indulged in for over three years, so the lodging industry, restaurants, and others will benefit from my (and millions of others) improved cash position.

We may even give some thought to upgrading our wheels; both family cars have well over 200,000 miles on them. And we probably won’t be looking at some econobox tin can deathtrap.

The point is, the money most people save on fuel will be spent on other things, benefiting other sectors of the economy.

“Change happens at the margins. Gresham’s Law applies to bank loans as well as money. The CRA created an incentive to loan to poor credit risks. “Redlining” is logical. Bad assets and poor credit risks are anathema to sound lending.”

“With the CRA, helped by the government loan machines Fannie and Freddie, marginal borrowers were mainstreamed shifting the whole lending curve.”

Fannie and Freddie don’t make loans. They provide a secondary market and moreover they deal in low yield conforming paper.

The fuel for the bubble was trillions of dollars of non-conforming high yield paper written by Fannie and Freddie’s private sector rivals. Private sector lenders dominated the mortgage market during the bubble years and invented the NINJA loans, the option ARMS, the 100% plus loans, the whole gamut of very high risk paper.

Subprime mortgage lending to risky borrowers developed during the late 1990s by investment banks and pure mortgage lenders that were not covered by the CRA in any fashion. It was an immensely profitable business and they couldn’t have cared less about the CRA. Ameriquest, Argent, Countrywide pretty much invented the game and Wall Street was more than eager to fund it.

Orange County was ground zero of the subprime industry. I watched it develop and knew some of the players. Not one of them was ever concerned with what the government was doing. They had warehouse loans from Wall Street players who wanted high yield paper. They were writing all the crappy paper that they could because they were making thousands and thousands of dollars on each loan that they wrote. A kid right out of high school could get a job writing mortgages and make hundreds of thousands of dollars a year. It was easier to become a mortgage broker than to be a barber.

And every bar, restaurant, hotel, apartment building, and grocery store in areas of the country that have not been rolling in the clover due to the fracking boom will see increased sales and lower costs.

Enjoy the belt-tightening. We've had a blast watching an ever-larger portion of our paychecks disappear into our fuel tanks for the last several years.

The way the fed is printing money, deflation is not going to happen. And even if it did, the U.S. economy did fine amidst 40 years of deflation during the industrial revolution: we went from being a nobody colony to being a global superpower.

BAML: Dr. Copper Is Shouting 'Sell' Chinese Stocks

"The price of copper (Dr Copper) is used as a gauge of future economic activity."

bttt and to sleep on

The demise of Bretton Woods in 1971 is also documented history. Since it’s economic history it may escape the attention of those who don’t study the dismal science.

Scrapping Bretton Woods had the effect of stoking the fires of inflation. That caused all prices in the United States to rise. That includes oil. If there had been no Yom Kippur War and no Arab oil embargo the price would still have risen to to its long term trend in real, inflation adjusted dollars. Which oddly enough is where the price of oil settled.

“And yes, we have over 100 Trillion in unfunded mandates, from Social Security, to Medicare, to pensions, to welfare. Look that up as well. “

It’s your claim, you get to provide the evidence to back it up. What’s important is the ability to cover any payments due out of current income and not its sheer number. That’s the nature of the funded public debt as set up by Alexander Hamilton and continued to this day. The US Treasury has never once missed a payment through all the wars, depressions, whatever. If that 226 year record is about to end I’d like to see the evidence.

One way to measure economic risk is to look at the interest rate demanded of a borrower. A high risk client will have to pay a high interest rate. Last time I looked the Treasury isn’t paying much for the money that the Congress borrows. Evidently the market doesn’t agree with you that the sky is about to fall.

My husband interviewed for a job with a small oil & gas company, and now it doesn’t look good. They said they aren’t sure they are going to do any hiring now.

Some of us are hurt by lower oil prices.

So, those of us either a bit older or who at least are willing to research rather than pontificate, know that it has happened repeatedly. And it will happen again.

Yup

Bring back the ‘Uptick’ rule.

I think we can make it into the quadrillions before things get too serious ....

Don’t you just hate that...frickin FReepers.

I could see the Russians trying to create some international incident that would cause the prices to spike back up.

You guys care to Opine?

Ever read ‘The Big Short’???

I agree with you and would add that lower oil prices have a huge stimulative effect on the economy.

It is essentially as if we’ve got a QE-4 (quantitative easement) without the Fed lifting a finger.

Having energy deflation is good for energy-dependent economies.

Furthermore, there will be less need to for the FED to raise interest rates in the near future.

It’s $1.64/gallon, right now, where I live.

Companies didn’t undertake projects where it cost as high as $80.00 a barrel to bring the oil up. The bigger corporations didn’t have to borrow but the smaller ones did in quite large sums. Now many hedged production by selling oil on the futures market so they locked in higher prices. What you have is a slow motion collapse the longer it stays low.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.