Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

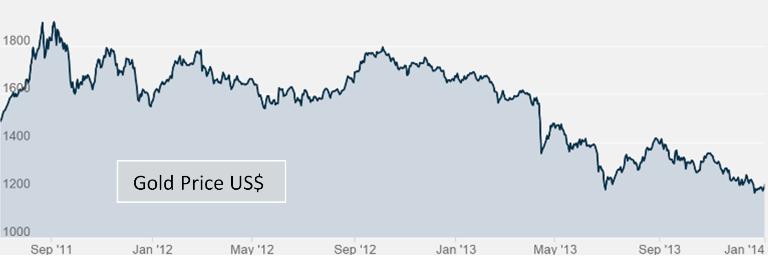

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

That won't last forever.

Because they are gold bugs. They see every scenario as a reason to buy gold. And they make crap up to entice others to buy gold.

Why wouldn't that also prop up gold?

Eventually our national debt and the end of the dollar as the international reserve currency will drive it back up.

“How Could Gold Bugs Have Been So Wrong In 2014?”

Simple, they fail to understand that gold is no different than stocks and it’s price is controlled in the same way.

Brokers and traders skim the cream off the top and buyers are stuck with what’s left in the bucket, except the buyers gets to pay for it all.

Gold is valued in dollars, and the value of those dollars is manipulated just like the rest of the stock market.

Gold has intrinsic value, paper currency does not.

Gold cannot be inflated to worthlessness, paper currency can be.

Gold cannot be declared worthless or "reverse split" by government fiat, paper currency can be.

Gold maintains its purchasing power over centuries, paper currency always goes to zero purchasing power.

Gold is real money, paper currency is currency and there is a difference.

I don't look at physical gold or silver as an investment. Holding physical gold and silver is an insurance policy.

“And they make crap up to entice others to buy gold.”

The same people who panicked and liquidated their 401K’s at the market bottom during the financial crisis.

“Eventually our national debt and the end of the dollar as the international reserve currency will drive it back up.”

So it will be different when it’s value is based on the Yen or British Pound?

That is an interesting way to look at it. I have been a long time holder of silver coins and I do not plan on selling them anytime soon.

Nonsense. That’s around the time people were buying up ad space to unload their gold holdings. That isn’t the act of people who “have your best interests in mind” and who live to make other people wealthy.

Money usually goes to gold when times are uncertain (the financial crisis, for example).

Right now the stock market is doing well, so money is going there. When the next crash comes, money will go right back into gold.

And our Constitution mandates that money is to be in gold and silver. Currency is paper and legally the paper has to be backed in gold. Roosevelt illegally took us off the gold standard and we have been having trouble ever since.

Just think.

Out there somewhere there’s a guy.....

.....who converted everything into Gold Bullion, Bitcoin and “call” options on crude oil.

(He should have bought P-Marlowe Coins instead!)

The only reason to sell silver coins is if you run out of food or ammo.

I tend to look at gold as insurance and silver as insurance/investment. I’m a rank amateur on this stuff, but my logical, reasoning brain tells me that if silver is selling for less than what it costs to produce it and that it is being used heavily in production processes...at some point the value has got to go up.

But at the end of the day, the “insurance” aspect makes it a no lose proposition.

Yup.

The US dollar is very strong and gold is flat against that currency. Against the Yen, the Pound, the CDN$ gold is up this year.

The Yen will soon be worthless so the price of gold in that currency will spike to infinity. Neither the Pound nor the Yen will replace the US dollar as a reserve currency.

For us, I think so. The defeat of the dollar will likely devalue it a lot. That is likely to drive prices up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.