Skip to comments.

This Week --December 11 Budget Decision; Investment & Finance Thread

Weekly investment & finance thread ^

| Dec. 7, 2014

| Freeper Investors

Posted on 12/07/2014 8:02:25 AM PST by expat_panama

Soap box time.

Even as we speak the hired help in Washington are working out how to deal with the fact that the current budget continuing resolution expires this Thursday. We got rumors galore on what they're coming up with but let's face it-- this is just not their strong point. We're in a situation where the hired help is going to need our intensive supervision. I know it's a lot of work to keep 'em in line but it's what we do.

We can google here to find your congress contact info and I found this site good for senators and this one for my house member. Congress has been hearing how the loony press wants everyone to agree w/ the loopy left on more tax'n'spending. It's our job to tell 'em we need:

- spending cuts on 'human recourses' (which gets most spending),

- personal and corporate tax cuts on both incomes and capital gains,

- borrowing limited by congress --no more 'blank checks'.

Let's remind congress:

The constitution says congress decides how much to tax and how much to spend and president is required to either comply or get nothing. If the president chooses a government shutdown then so be it. We can wait for January 6, 2015 and let the 114th congress override his veto. You must neither vote for business as usual nor even vote to restrict debate and allow others to conduct business as usual.

There simply is no more money to be spent. The BLS, the BEA, the Census Br, and the Federal Reserve have the facts and the facts speak for themselves:

- that 12 million people lost their jobs w/ the 110th congress--

- 4 million more went w/ the 111th bringing the total to 16 million job losses that have not yet been replaced,

- of those that did keep their jobs, over 3 million were demoted from full to part time work,

- the median family income has been slashed 9%,

- real per capita wealth has fallen.

The money is simply no longer there.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * *

btw, the current state of investments is fine; stocks at all time highs and precious metals continues to stabilize its 3-week base. For now.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

To: palmer

...Plunging oil prices,,, ,,,biggest drop... ... five-year low... ...drop in energy prices...

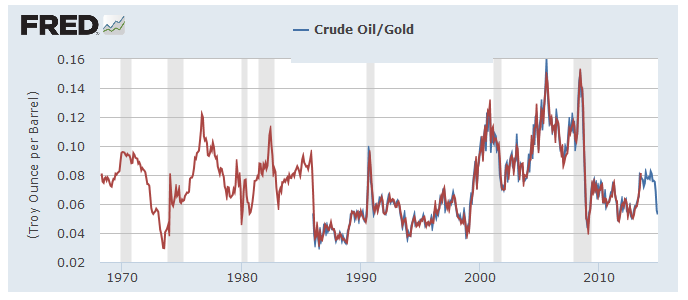

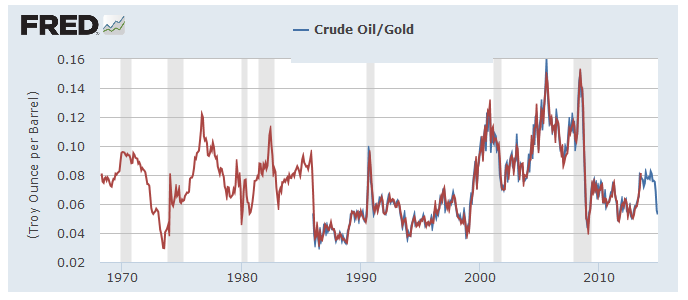

If our attention span is just the past four years then we can say oil's supposed to be around $100/bbl. Then again, four years isn't a very long time when it comes to understanding prices and the minute we think in terms of ten or twenty years we start thinking of today's $60 as still being on the high side --for inflation adjusted real prices that is. Bottom line here is that no matter what people say, the normal price of oil--

--averages $50/bbl over time

--and meanwhile varies from $18 to $150.

To: expat_panama

Do oil priced in gold :-)

To: Wyatt's Torch

oil priced in goldwhy not, this place needs a little excitement; --first let me put another cooling fan on my cpu....

To: Wyatt's Torch

here we go,

--had to gear down and take my time.

Gold standard's not really what we'd call 'stable prices'...

To: expat_panama

Depends upon what you use as the measuring stick, dollars or gold. Or oil. Or wheat.

My contention is that gold is the historically stable value, and everything else fluctuates against it, both up and down.

I suppose that as long as everything is tied together in a relatively free global market, then its all copacetic.

IMO, none of these currencies or commodities represent wealth. The only wealth that has been of value throughout human history is organized, productive human activity and creativity.

Often called “work.”

45

posted on

12/11/2014 10:41:07 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

WTI <$60/bbl - lowest since 2009

To: abb

Thank you for the affirmation on XOM. I'll check the dividends and look at some charts. I think Scottrade had it as one of the top stocks to invest in.

I'm in kick myself mode. AA was at low 7-8-9 for a long time last year; now it's up to 17. The dividends were too low. Very short sighted.

That's going to be the story of my short life in the stock market, the ones that got away. And there are a lot now. WAG is another one I saw at high 40's and thought wait. Waited too long. Several more like that but not all. Some haven't done too well and those I fear may go belly up or just.

F pushed up to 17; now it's back at 15 where it's been for ages. Last year Forbes listed it as a good buy because there wasn't sufficient interest in its potential. So it goes.

47

posted on

12/11/2014 12:29:59 PM PST

by

Aliska

To: Aliska

You need to know that I have been a long-term, buy and hold investor for almost forty years. Back when I started out in the mid ‘70’s I did some short term trading, including some on margin.

Then one time I got a margin call. It didn’t take but once to realize that wasn’t for me, and that my strategy needed to change. “Get rich quick” was entirely too risky.

So any opinions I have will reflect that worldview.

48

posted on

12/11/2014 12:39:37 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

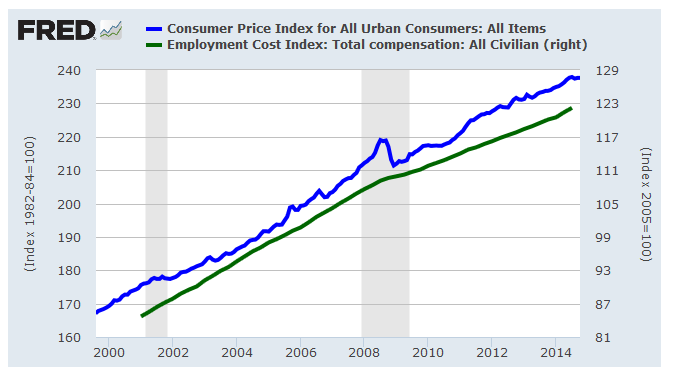

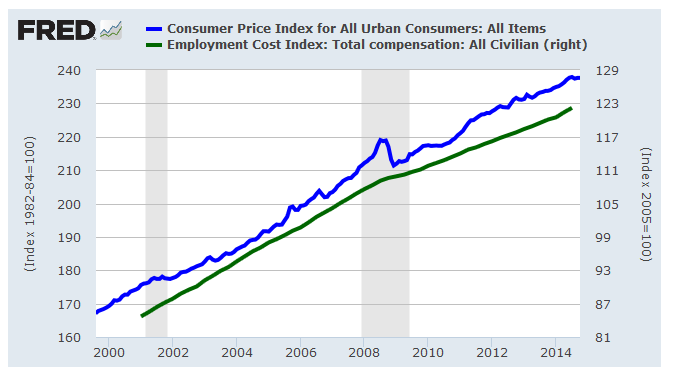

gold is the historically stable value, and everything else fluctuates against itWe can say that but most people care about whether or not their money will be enough to buy the things that they're shopping for --namely food, clothing, shelter, etc. Compared to those things people really don't buy gold that often. That's why America's decided to regulate the value of the dollar so wages track consumer purchases as much as possible. imho they've been doing a pretty good job:

To: expat_panama

50

posted on

12/11/2014 1:57:08 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Many people say that ownership of “land” is the ultimate money and store of wealth. But think about this - ownership is predicated on nothing but a piece of paper on file at the clerk of court office a “deed.” And that “ownership” is dependent upon the performance of a just and honest legal system. Ain’t real comforting, is it?

Maybe lead and dry powder is the ultimate store of wealth?

51

posted on

12/11/2014 2:13:20 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

“Maybe lead and dry powder is the ultimate store of wealth?”

Damn good hedge anyway.

52

posted on

12/11/2014 3:08:41 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: abb

I never bought on margin. Scottrade gave me quite a large one in ratio to the amount I kept in the account. I knew not to play the market with borrowed money. But there it was in front of me every day. Then when I became inactive, they took most of my margin away.

I'm 73 years old so long-term has no appeal; somebody else or nobody will get the benefit of it. I don't want to think about why that matters right now but it does.

I wish I had a mind for some of the more complicated plays. But you have the right idea and have a sensible approach to investing.

Get rich quick. The real thing that appealed to me about playing around day and swing trading was that I pretended that my life depended on it and I was doing real work. I never was worth anything when I worked. When I would make a modest gain sometimes in an hour or less most traders wouldn't bother with, it made me feel like I had accomplished something after all.

I lost money, too, but my first and only year of it I had a very modest net gain. Now I am afraid to jump in again as I struggled to get where I am which could have been a whole lot better like those couples who call Bob Brinker but my life fell apart financially actually before and when I was divorced. I never had a 401K or anything like what those people do. A few are single and give him the credit for teaching them how to invest their money. But I think they were part of a generation that had more external forces in their favor than now, could be wrong about that.

53

posted on

12/11/2014 5:27:51 PM PST

by

Aliska

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Happy Friday and for stocks a great day for profit taking! After yesterday's half % gain in mixed volume stock index futures are plunging -0.61%. Metals again in mirror image climbing. Reports in a couple hours coming for the PPI and Mich. Sentiment. Also:

To: abb

Money is anything that is widely used for making payments and accounting for debts and

credits.That's what I've been getting too, that money is a medium of exchange ("trade you $3 for that book"), unit of account ("owning a car worth $2,000 and a guitar worth $1,500 means my stuff is worth $3,500"), and a store of wealth ("maybe I set aside my $3 for a rainy day"). Land and gold can be used for storing wealth but they don't work well for the other two things. The link was interesting though the ten things they listed on the first page had a lot of repeats (imho).

What we were talking about before is how we want the gov't to regulate the dollar's value and pegging on precious metals just didn't work out well.

To: Aliska

73 years old so long-term has no appealThere are insurance companies that are willing to bet their money that we got about a decade we can count on. That's enough time for say, a typical stock fund to double. Something else is that ten years from now those same tables say we'll have get another eight years after we've done the ten --and then it goes on and on.

My thinking is that we can either create more than enough wealth or we can find ourselves without enough to meet our needs, so I work for the 'more than enough' side. Beyond that there's lots of good people'n'things I can pick from for getting what's left over when I'm done.

To: expat_panama

57

posted on

12/12/2014 6:20:05 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Everybody blames Nixon for ending the gold standard...--because he was a Republican. Our paper money used to say "gold certificate" and federal contracts were payable in gold until FDR stopped both in '33 --that's what took us off the gold standard. What Nixon did only affected exchange rates, and that was mainly out of a dispute w/ France.

To: Lurkina.n.Learnin; expat_panama

59

posted on

12/12/2014 7:01:28 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Oil always goes back up. May take awhile but it will. Good time to be buying energy stocks, I think.

60

posted on

12/12/2014 7:04:03 AM PST

by

Qwackertoo

(Worst 8 years ever, First Affirmative Action President, I hope those who did this to us SUFFER MOST!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-82 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson