.png)

Posted on 11/29/2014 6:49:24 AM PST by blam

Myles Udland

November 28, 2014

Oil is still falling.

In afternoon trade on Friday, West Texas Intermediate crude prices in the US dropped more than 10% to settle at $66.15 a barrel, a more than $7.50 drop in just 24 hours.

At one point on Friday, WTI futures briefly breached $66.

Brent crude prices, which are the global benchmark, also cracked $70 a barrel on Friday.

Earlier this week, WTI prices were at around $76 and Brent prices were near $80.

(snip)

.png)

(snip)

(Excerpt) Read more at businessinsider.com ...

These aren’t frozen, they’re fresh but I have my doubts as to just what it is. You’d have to see them on a grill to know what I mean. Don’t smell like hamburger grilling and whatever that is flaming up doesn’t behave like beef fat, it’s strange.

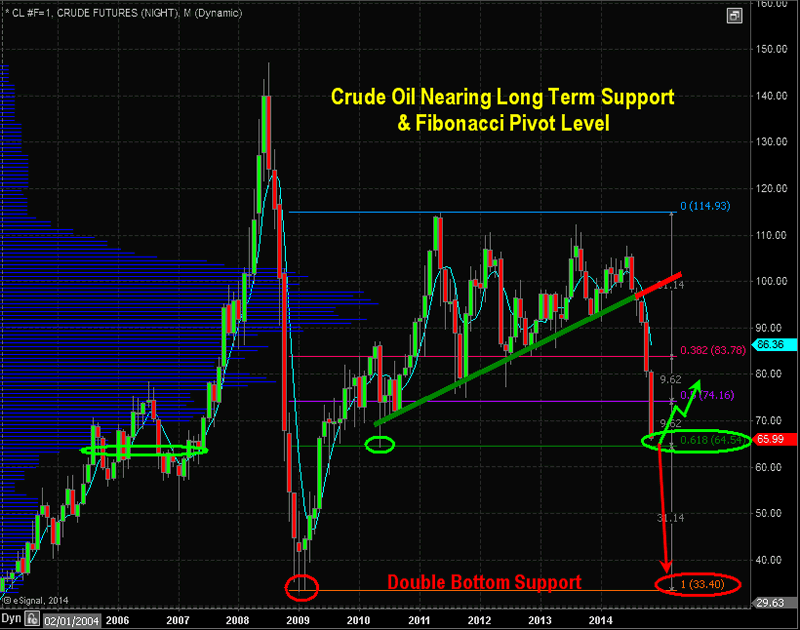

Crude Oil Conclusion:

In short, I think what crude oil is doing is healthy and needed for several reasons. If I let my bias/option shine through, I feel the big oil and gas companies have been taking advantage of us with their ridiculously high gas prices over the last seven years. The multi-billion dollar, cash rich corporations need a little wakeup call. And the hair cut in their share price should be great for investors. This allows them to build or re-enter new positions at a better price with a higher dividend yield. I will be watching the hourly and daily charts for a bottoming/bounce formation in the next week. But any bounce could be short lived as sellers appear to be aggressive still.

Still waiting for letters to arrive announcing price roll backs because of falling oil prices. Now that will happen any day now.../

PA Ping!

If you see posts of interest to Pennsylvanians, please ping me.

Thanks!

Thanks Ghost of SVR4

“I have forgotten what beef tastes like.”

Not us.

But, I’ve gotta figure out a way to keep those little beef bullion cubes from falling into the flames as we’re grilling them...

...guess I could try them on kabobs.

Bacon is pricey.

All day long.

I know what you mean.

My thoughts on that is we do not export oil per se so any disruption of that magnatude will move prices up smartly in the US as international sources for oil outside the US begin selling at far higher prices. Our domestic production increase has not quite made us oil independent, rather, it has made the US less dependent and the gap still would have to be filled with much higher cost oil. A removal of 20% of the world oil tonnage would be significant. However, I don’t think it will happen. A major importor of oil from the Persian Gulf is China. I don’t think Iran would wish to tangle with them.

Those are really cheap ones that have to be packaged and frozen. These aren’t frozen. How would they keep rendered pink slime fresh packaged, let alone manage to make it look like actual ground chuck? The fat burning smokes like burning vegetable oil or something.

I won’t get them again, even trying them was a response to the cost. I just wondered if anyone else had experienced this or if it’s something peculiar to a certain well-known grocery chain headquartered here in NC.

From a long term perspective a 5% drop is not getting “crushed”. Not inconsequential, but its far from devastating.

For example, its hard for long term shareowners to think of Exxon as a “loser” given its stellar performance over the long haul and its excellent annual dividend growth rate, averaging over 10% for the past five years. Most people would love to get a 10% raise every year! Just saying.

LOL!!!! Good post.

Sometimes a certain type of economic logic turns into a self-fulfilling prophecy.

A series of steps taken by and against Japan in the runup to WW2 come to mind.

Russia and America would both benefit by higher prices. Basically every supplier not in the ME would benefit. That is a considerable amalgamation of self-benefit.

I’m thinking overreaction.

Mexicans in the Carniceria might actually grind it fresh for you as you watch

More naked shorting of gold by the Fed & allied banks. I wonder if they’re doing the same with oil as a way to weaken Russia?

The big question is not why oil is going down; it’s why the toilet paper dollar and other fiat currencies are so strong?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.