Skip to comments.

U.S. dollar will "get a lot stronger than anyone can imagine"

Yahoo Finance ^

| 11/14/2014

| Joanna Campione

Posted on 11/14/2014 7:14:51 AM PST by Minsc

The U.S. dollar is on a roll. The dollar index, which measures its value versus a basket of other world currencies, is at a four-year high. John Mauldin, best-selling author and chairman of Mauldin Economics says, get used to it. Mauldin believes the dollar is going to keep rising and “get a lot stronger than anyone can imagine.” He says, “We are going to be trading stronger against nearly every currency.“ In other parts of the world, currencies are slipping as the U.S. dollar strengthens. Central banks in Europe and Japan are shifting policies to fight slowing growth and fend off deflation. Last month, the Bank of Japan boosted its quantitative easing strategy, and the yen fell to a seven-year low against the dollar on the news. The European Central Bank is expected to start its own QE program. More at the link...

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy; News/Current Events; Russia

KEYWORDS: dollar; economy; goldbugs; isil; isis; johnmauldin; russia

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

To: Gaffer

You entirely missed the point. You should have Binged John Maudlin. His are the brains cited.

Further, you should sign up for John Maudlin’s free Saturday news letter to receive his thoughts and his weekly sort through the best of the best of economic writers.

Even though free, it is really very good

Check it out

http://www.frontlinethoughts.com/

41

posted on

11/14/2014 8:50:30 AM PST

by

bert

((K.E.; N.P.; GOPc.;+12, 73, ..... Obama is public enemy #1)

To: reformedliberal

I think you are correct on your bone question.

Your prices re beef are excellent:

“Our local grocery has local whole muscle cuts available every few months. A whole NY strip goes for $5/lb. Whole rib eyes (w/lip) go for $6/lb. Tenderloin is $6/lb, but being so lean, it is a lot of good meat for the money. It is all wonderfully tender and flavorful. I remember Prime Beef and this is it. We don’t mind doing our own portioning. We stock up at these sales.

Otherwise, 1” strip steaks are $8/lb, 1” rib eyes (w/lip) are $9/lb and T-bones are $11/lb. Porterhouse are $13/lb.

No Costco within 100 miles, so I can’t speak for their offerings.”

42

posted on

11/14/2014 8:58:31 AM PST

by

Grampa Dave

(The Democrats, who run America are too old, too rich, and too very/very white elitist losers!.)

To: Grampa Dave

I think what we are looking at here is literally an emergence of "Black Gold," whose abundance could have long ago been used as a proxy commodity offset for "Gold, Gold" for an imputed backing of the greenback.

I see Europe looking to build closer ties to the US with reliable supply from the US, as energy trade deficit reverses itself and Putin's intentions become more belligerent. Oil is traded in $. I see this as being another reason that the euro will be at parity with the $- or even below in the long run.

Enviros blocked off-shore drilling, and ANWR, all in the name of preventing undocument-able AGW, yet US intuition and technology has made us awash in oil from fracking in ways the larger US gov't couldn't stop, becse it wasn;t on gov't leased land. The XL pipeline will pass and open up the oil-tar sands of Canada which will be more accessible now that (R)s are in Senate control, and (D)'s look to roll over and vote with (R)'s against a substantially weakened Obama -- and will finally be able to do so all in the name of jobs - now unobstructed by Harry Reid.

$18T in deficit will begin to shrink as the US grows out of the deficit - I see jobs will be coming back to the US from overseas at a greater pace than has already started, along with repatriation of $2T help by investors overseas now. What is needed to cement this prediction will be all branches back in (R) hands come 2016.

Let us select wise an moral leaders to usher in Reagan-esque Recovery II which dramatically changes tax policy.

FReegards!

43

posted on

11/14/2014 9:17:37 AM PST

by

Agamemnon

(Darwinism is the glue that holds liberalism together)

To: Minsc

The dollar is super strong!!!!!

Yet, groceries are more expensive than ever.

Hmmmm.

Maybe the dollar-hawks are wrong.

44

posted on

11/14/2014 9:21:42 AM PST

by

Lazamataz

(Proudly Deciding Female Criminal Guilt By How Hot They Are Since 1999 !)

To: Iron Munro

Good post. The currency markets do not in fact tell us the value of the US dollar against any standard. Thank Nixon for that. How many loaves of bread did the dollar buy 100 years ago compared to now? The US Dollar market only tells us that our POS fiat currency is faring better than Europe or Japan's POS fiat currency - considering Europe is a collection of has beens and Japan is the first in line for demographic collapse, that is no surprise.

45

posted on

11/14/2014 9:29:13 AM PST

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: Gaffer

And I guess you haven’t noticed government’s sideways response to fracking, et al via their ‘concern ecoists’ ‘informed research’ How could one NOT notice the feds aligning themselves with leftist ecoists when the EPA has proclaimed itself master, and sole determinent, ove "all waters" in the US?

46

posted on

11/14/2014 10:05:57 AM PST

by

The Sons of Liberty

(OK. Now How many votes do we need to IMPEACH and REMOVE the bastard?)

To: Minsc

Stick around:

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

I have been suggesting for several years that the U.S. Dollar would confound those anticipating its demise by starting a long secular uptrend.

In early September I made the case for a rising U.S. dollar, based on the basic supply and demand for dollars stemming from four dynamics:

-Demand for dollars as reserves

-Other nations devaluing their own currencies to increase exports

-“Flight to safety” from periphery currencies to the reserve currencies

Reduced issuance of dollars due to declining U.S. fiscal deficits and the end of QE (quantitative easing)

http://www.zerohedge.com/news/2014-11-13/why-rising-us-dollar-could-destabilize-global-financial-system

47

posted on

11/14/2014 10:34:12 AM PST

by

Para-Ord.45

(Americans, happy in tutelage by the reflection that they have chosen their own dictators.)

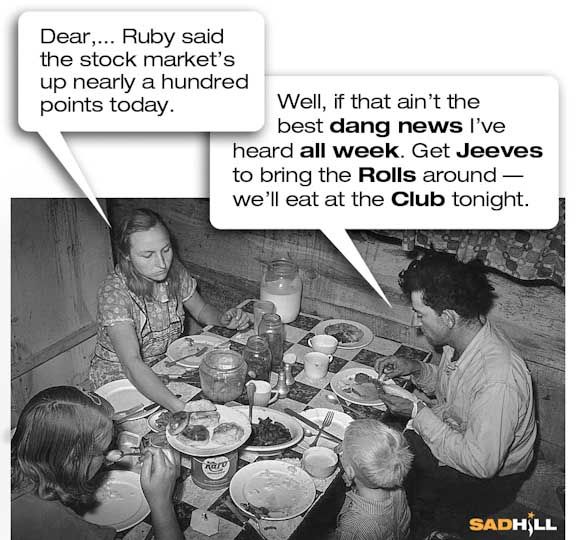

To: Minsc; All

48

posted on

11/14/2014 10:37:48 AM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Iron Munro

All the other currencies have later stage ebola, the US dollar has AIDS, it can live for a while being propped up by the Feds, but eventually...

49

posted on

11/14/2014 10:47:39 AM PST

by

sarge83

To: Minsc

"The U.S. Dollar Is On A Roll."

50

posted on

11/14/2014 10:49:08 AM PST

by

Iron Munro

(DHS has the same headcount as the US Marine Corps with twice the budget)

To: Iron Munro

That chart doesn’t really apply to this subject. Currency exchange is based on the relative value to other currencies, not itself. So this is a good thing for importers, bad for exporters. For the average consumer it’s good, but if your job depends on exports it’s not so good.

To: musicman

Another Thanksgiving Feast In The Obama Era

52

posted on

11/14/2014 10:56:21 AM PST

by

Iron Munro

(DHS has the same headcount as the US Marine Corps with twice the budget)

To: Iron Munro

Food prices have gone up like crazy in the Era of Baraq but I never see it mentioned outside FR....

53

posted on

11/14/2014 10:58:17 AM PST

by

nascarnation

(Impeach, Convict, Deport)

To: Monty22002

That chart doesn’t really apply to this subject. Of course it applies.

To say it doesn't is an elitist view.

The subject is "a stronger dollar", isn't it?.

If the dollar will buy more rubles or drachmas but less bacon and bread you might consider it stronger but people shopping for food instead of rubles wouldn't.

54

posted on

11/14/2014 11:03:47 AM PST

by

Iron Munro

(DHS has the same headcount as the US Marine Corps with twice the budget)

To: Iron Munro

55

posted on

11/14/2014 11:08:10 AM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Iron Munro

For your chart to show ‘stronger’ it would mean deflation. That’s not a good thing. The slow inflation we’ve had the last 20 years has been a mostly good thing. I know they are intentionally leaving out some sectors to make it look better. However, a ‘strong dollar’ in the currency market just means it’s trending stronger against other currencies. Not itself.

To: Iron Munro

57

posted on

11/14/2014 11:15:02 AM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: musicman

How can I have Thanksgiving now after seeing that? lol

58

posted on

11/14/2014 12:57:13 PM PST

by

SaveFerris

(Be a blessing to a stranger today for some have entertained angels unaware)

To: SaveFerris

59

posted on

11/14/2014 1:15:03 PM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Minsc

U.S. dollar will "get a lot stronger than anyone can imagine" I can imagine pretty strong. Like in the 80s when I could get 4 DM for each dollar. Sorry, don't know a DM to Euro conversion.

60

posted on

11/14/2014 1:31:56 PM PST

by

hattend

(Firearms and ammunition...the only growing industries under the Obama regime.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson