Skip to comments.

U.S. dollar will "get a lot stronger than anyone can imagine"

Yahoo Finance ^

| 11/14/2014

| Joanna Campione

Posted on 11/14/2014 7:14:51 AM PST by Minsc

The U.S. dollar is on a roll. The dollar index, which measures its value versus a basket of other world currencies, is at a four-year high. John Mauldin, best-selling author and chairman of Mauldin Economics says, get used to it. Mauldin believes the dollar is going to keep rising and “get a lot stronger than anyone can imagine.” He says, “We are going to be trading stronger against nearly every currency.“ In other parts of the world, currencies are slipping as the U.S. dollar strengthens. Central banks in Europe and Japan are shifting policies to fight slowing growth and fend off deflation. Last month, the Bank of Japan boosted its quantitative easing strategy, and the yen fell to a seven-year low against the dollar on the news. The European Central Bank is expected to start its own QE program. More at the link...

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy; News/Current Events; Russia

KEYWORDS: dollar; economy; goldbugs; isil; isis; johnmauldin; russia

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-65 next last

Calling all tin foil hat members that were warning that the US dollar would be removed as the international trading currency, which would in turn cause a massive unprecedented depression.

How's that working out for you?

1

posted on

11/14/2014 7:14:51 AM PST

by

Minsc

To: Minsc

My only question is what stocks, instruments, etc. that Joanna is hawking right now and for whom.

2

posted on

11/14/2014 7:18:52 AM PST

by

Gaffer

To: Gaffer

As Europe is slowly taken over by the muslims or Russians, the dollar should remain the defacto world currency. But the Chinese will be breathing down our necks.

3

posted on

11/14/2014 7:21:12 AM PST

by

refermech

To: Minsc

I actually googled this “Midwestern girl on the east coast”. You seriously aren’t trying to hold her up as the be-all and end-all authoritative source on finance and world economy are you?

4

posted on

11/14/2014 7:21:18 AM PST

by

Gaffer

To: Gaffer

This isn’t the first article I’ve seen about the current strength of the dollar. It’s true.

5

posted on

11/14/2014 7:21:50 AM PST

by

Minsc

To: Gaffer

Take a look at the currency charts, pick your source and decide for yourself.

6

posted on

11/14/2014 7:22:34 AM PST

by

Minsc

To: Minsc

It may seem stronger relative to other currencies

But its absolute value, what goods it will actually buy in the marketplace, is less and less every day.

7

posted on

11/14/2014 7:22:54 AM PST

by

Iron Munro

(DHS has the same headcount as the US Marine Corps with twice the budget)

To: Minsc

How's that working out for you?Time will tell. For now, this is just the dollar being slower in the race to the bottom than the euro or yen.

8

posted on

11/14/2014 7:24:00 AM PST

by

Paine in the Neck

(Socialism consumes EVERYTHING)

To: refermech

Even with your assertion, parts of which I agree with, operative, I am not so rosy as to the underlying strength this so-called expert attests. ILLUSION coupled with government subterfuge and behind the scenes actions that just perpetuates debt, liabilities and the true picture may be enough - for a short time, but ultimately won’t prevail.

9

posted on

11/14/2014 7:24:32 AM PST

by

Gaffer

To: Minsc

You can take your buck on our future, that’s okay. It won’t last.

10

posted on

11/14/2014 7:25:08 AM PST

by

Gaffer

To: Minsc

The decrease in oil prices and as a result our decrease in oil imports and increases in our oil exports is making our $ stronger each day. This week, I filled the gas tank on my pickup for $2.85 per gallon. A month ago it was $3.30/gallon, and we thought that was a good price. Every gas tank fill up by an American means more disposable means they get to keep more money in their pocket.

Lower fuel prices can mean lower food prices. We bought our monthly 4 pack of boneless rib eyes at $6.99/ pound this week versus $9.99 last month.

One of the best kept secrets with the crisis in Iraq/Syria/? and other oil producing countries, is how the price of gasoline and oil in America keeps coming down.

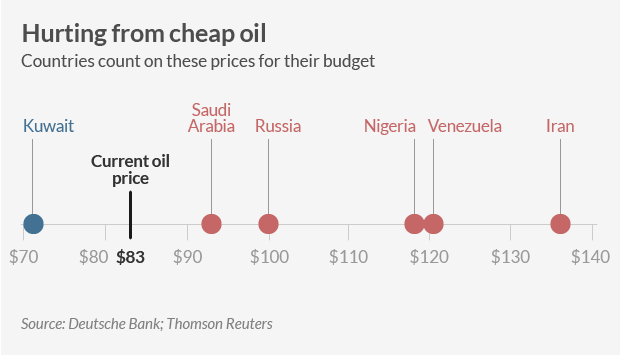

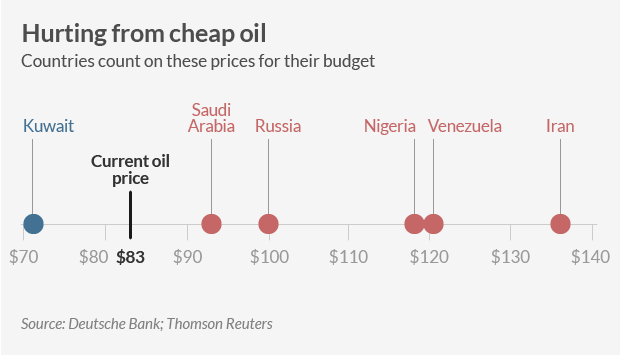

Increased U.S. production is helping to create an oil surplus on world markets, driving down prices despite a myriad of threats to oil supplies, and doing more to crush Russia’s economy than the sanctions imposed by the U.S. and European Union, said Chris Faulkner, chief executive of Breitling Energy.

http://www.washingtontimes.com/news/2014/sep/8/us-oil-surplus-eases-prices-in-global-crises/?page=all

This is also preventing the Opecker Princes from doubling their price on oil to again cause another major economic recession around the world.

The price of oil on the open market is kicking the Opecker Princes, Putin and the thugs in charge of Venezuela really hard below their economic belts.

11

posted on

11/14/2014 7:26:28 AM PST

by

Grampa Dave

(The Democrats, who run America are too old, too rich, and too very/very white elitist losers!.)

To: Minsc

Yeah....if it’s on the internet, it HAS to be true, doesn’t it?

12

posted on

11/14/2014 7:26:32 AM PST

by

Gaffer

To: Minsc

Seems to me I've heard a line like that before.

If you strike me down, I shall become more powerful than you could possibly imagine.

13

posted on

11/14/2014 7:27:44 AM PST

by

Mastador1

(I'll take a bad dog over a good politician any day!)

To: Minsc

I’m glad there is someone else around here who sees it. On the theory that trends, especially commodity trends, especially currency trends, can sometimes go on a lot longer than you would ever imagine.....I am starting to think the USD “rally” will go on for a heck of a long time. The “dollar to zero” crowd is just simply wrong.

I am not sure how this will affect gasoline more than it has.

14

posted on

11/14/2014 7:27:50 AM PST

by

Attention Surplus Disorder

(At no time was the Obama administration aware of what the Obama administration was doing)

To: Gaffer

So true, Our debt problem will be our undoing if not dealt with soon.

To: Grampa Dave

Lower fuel prices can mean lower food prices. One would think. But GOVERNMENT always finds a way to even out costs with what it thinks they SHOULD be. TAXES....taxes imputed at incentives, punishment and equalization. Any gains from this will be short-lived, IMO. GOVERNMENT has to finance its voter-base largess and they will not stop at just that.

16

posted on

11/14/2014 7:29:39 AM PST

by

Gaffer

To: Minsc

17

posted on

11/14/2014 7:30:20 AM PST

by

wastedyears

(I may be stupid, but at least I'm not Darwin Awards stupid.)

To: Minsc

U.S. dollar will "get a lot stronger than anyone can imagine", Despite interference from the 0bama regime, the steady move toward energy independence and away from mideast oil, should be a big boost to the dollar and the economy.

18

posted on

11/14/2014 7:30:49 AM PST

by

The Sons of Liberty

(OK. Now How many votes do we need to IMPEACH and REMOVE the bastard?)

To: Minsc

Most currencies are falling rocks. The dollar is just falling slower than the rest.

Or, is this another sign of deflation? There are many.......

19

posted on

11/14/2014 7:33:40 AM PST

by

Arlis

To: The Sons of Liberty

And I guess you haven’t noticed government’s sideways response to fracking, et al via their ‘concern ecoists’ ‘informed research’ about the [ooga booga] terrible effects of fracking on our geological safety?

The true fact is that government, THIS rabidly liberal infested government actually thinks our energy costs should align with other countries (i.e., much much higher) and they will spend their last breaths to make it so.

20

posted on

11/14/2014 7:34:44 AM PST

by

Gaffer

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-65 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson