Posted on 10/26/2014 10:48:06 AM PDT by expat_panama

Our investing strategy is the mix of our own personal financial needs plus expected future developments in the economy. So the buzz (on these threads) is that the biggest up-coming economic/employment changes impacting our investment choices in the next week or two are the midterm elections, Ebola, deflation, and the war on terror.

We'll share our thoughts here on what we expect, and let's rate our expectations in terms of what we've been having up til now on the 'click-to-enlarge' graphs.

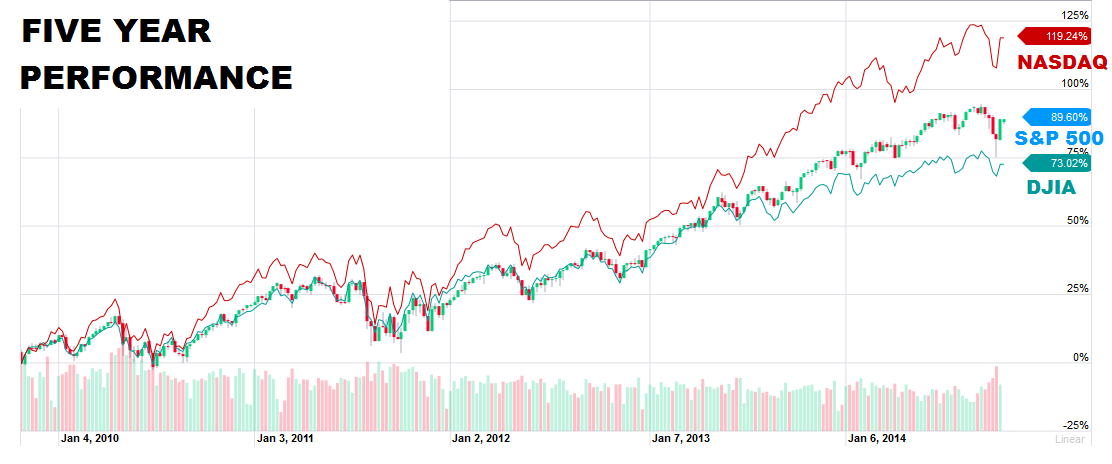

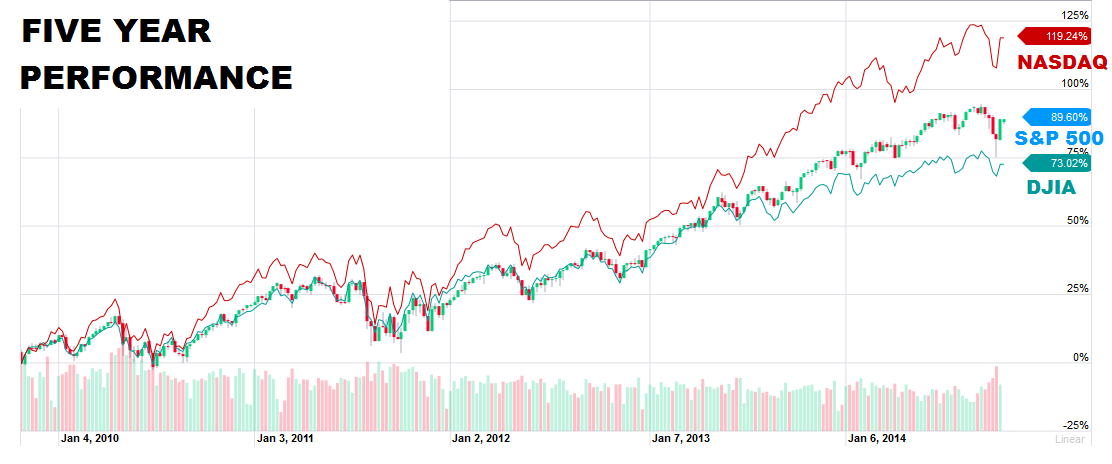

On the right margin we got 5-yr stock index performance for a back drop on our own personal expectations. Fer instance, my guess/wishful thinking is more of the same so I'll say short term up +10% and longer term +20%.

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Right below stocks is the past ten years of metals --let's guestimate our expected short&long term trends.

Finally, for discussion we ought to compare our thoughts on what we see supporting our investment expectations --what do we blame for any expected upcoming shift. OK, so we got the election.

<--Here's past party control of congress, and my personal expectations for beginning Jan. '15 is a 60% House and 65% Senate Rep. power shift. [oops, forgot the 'wishful thinking ' tag]

Other newsworthy macro factors coming up in the next couple weeks that should be affecting the economy and our investments include the spread of Ebola, inflation/deflation, war on terror, etc. So we can put at the bottom of the surveypoll/questionaire (SPQ) a vote on where we lob our blame.

OK, funtime! here's the SPQ to fill out and post:

| Change in stock indexes: | ____% short term | ____% long term |

| Change in metals prices: | ____% short term | ____% long term |

| Election results: | ____% Rep. House | ____% Rep. Senate |

| Cause of econ/investment trend (election,ebola,'flation,terror,other?): | ____________________ | |

The idea is to post the results in a graph table here and my guess is it'll take the better part of a week to get it all in. Another option we got is y'all can private reply if you don't want a public commitment -more work for me but that's OK because that way I can change your vote or even make up bogus replies to back up my own prejudices. As for how actual reality compares to our guestimates, prices come out every minute, the election's a week from Tues, and agreement on the cause should probably take a few decades...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Hmm, They halted ORB and ATK?

Statement:

Fattah Statement on Rocket Launch Failure at Wallops Island

Wednesday, October 29, 2014 04:45:00 PM (GMT)

WASHINGTON, Oct. 29, 2014 /PRNewswire-USNewswire/ —Congressman Chaka Fattah (PA-02), the lead Democrat on the House Appropriations Subcommittee on Commerce, Justice, Science and Related Agencies, which oversees funding for NASA, released the following statement on Tuesday’s failed launch of an unmanned commercial rocket that was headed for the International Space Station:

“I join with the space community in expressing my disappointment at the failed launch of the Orbital Sciences Antares rocket last night. Many people worked tirelessly to make this launch a success and while the outcome is unfortunate, I am thankful there were no injuries as a result of the explosion. I am confident that NASA and Orbital will conduct a complete and thorough investigation into the reasons for the launch failure, learn from what went wrong, and make the necessary corrections to continue to move forward with the next attempt.”

SOURCE Office of Congressman Chaka Fattah

QE is dead! Long live QE!

Stone McCarthy Analysis of Fed Statement:

FOMC Statement from Oct. 28-29: Keeps ‘’Considerable Time’’

For more information, please contact Terry Sheehan.

—Stone & McCarthy (Princeton)—

Key Take-Aways:

1. The FOMC retained the ‘considerable time’ language for its forward guidance, but overall more hawkish in tone regarding labor market and economy.

2. ‘Underutilization of labor resources is gradually diminishing’.

3. ‘Inflation in the near term will likely be held down by lower energy prices and other factors’.

4. Asset purchases cut by $15 billion; program ends in November.

The FOMC meeting statement of October 29 reflected a stronger assessment of labor market conditions, enough that it satisfied two voters who previously dissented in relation to insufficiently acknowledging the progress made by the economy and labor market. We found the tone of the statement to be substantially more upbeat that the prior version, even with the more cautious wording regarding inflation.

Our read it that this statement is a step in the direction of changing the “considerable time” language in the forward guidance to something that points to a narrowing of the expected interval before the first increase in the fed funds rate target from the 0%-0.25% in place since December 2008. We now expect that that alteration is more probable for the statement after the December 16-17 meeting.

The Committee remains data-dependent in its outlook. The statement said, “To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress—both realized and expected—toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments.”

However, the update to the economic assessment acknowledged that the labor market has indeed improved substantially, and “that underutilization of labor resources is gradually diminishing”. It continued, “The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program”.

The improvement was not enough to cause the Committee to change the forward guidance. The statement said, “The Committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored”. Thus, the gains for the labor market have as yet not offset the concerns about too-low inflation.

Our outlook remains for the first hike in the fed funds rate around mid-2015.

In the context of the end of the open-ended asset purchase program, we view this statement as the start of the transition back to more normal monetary policy. However, beyond ending the asset purchases with a final $15 billion cut effective in November, we see no immediate steps to remove any accommodation. The current enormous balance sheet “should help maintain accommodative financial conditions”. The maintenance of the “existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction” will mean the balance sheet will not begin to shrink.

As noted above, two dissenting votes were not repeated. Neither Philadelphia’s Charles Plosser or Dallas’ Richard Fisher cast a “no” vote this time around. This suggested that the statement is now in closer alignment with their respective views regarding progress in the labor market and the expectations for removal of policy accommodation.

However, the vote was 9-1. Minneapolis Fed President Narayana Kocherlakota dissented “in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level”.

This points to an evolution in the views on the FOMC, with a less dovish outlook for policy for the Committee as a whole. The shift is small, and does not indicate any great hurry on the part of the FOMC to begin the process of policy normalization, but it does indicate a shift in the balance of opinions more toward a moderate center.

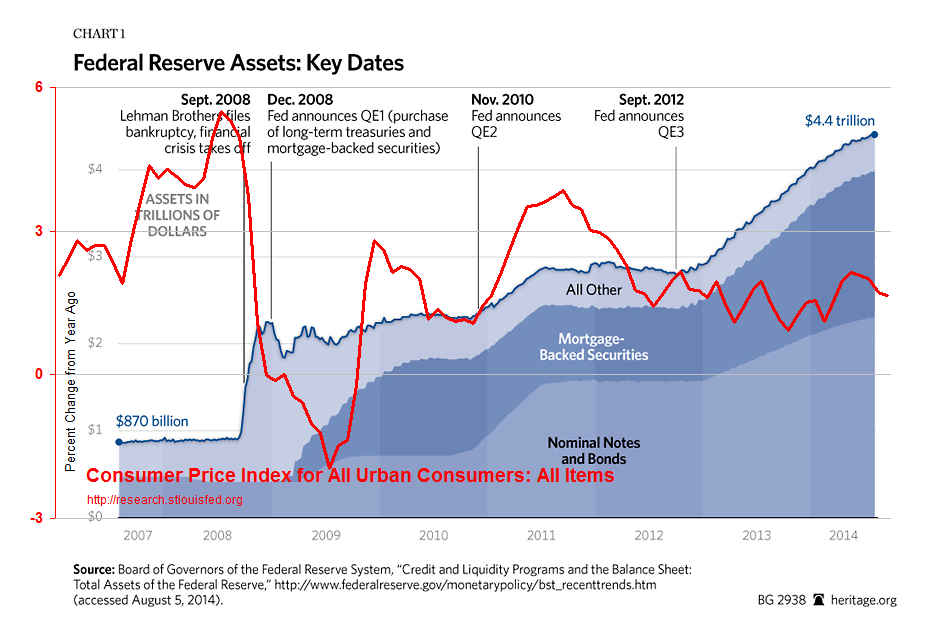

lol --that's such a crock! We've had got a number of threads going around on that theme, most of 'em talk about how the 'stock market' is rigged by QE. For a while I'd post QE along w/ the S&P500 to show how there was no affect, and on this thread at post 30 we considered whether ending QE3 would wreck the economy and found QE/jobs had no correlation either.

I've had time to look at it again and here's what I got for QE w/ inflation --

--and personally what I'm seeing is that the whole point of the Fed's bond buying was to stabilize prices, and they succeeded so they're done buying. My big question is how is this any different than what happened toward the end of 2009 and the beginning of 2011 when the Fed also stopped buying for a while?

These Charts Show How QE Rescued America From The Great Recession

and

These Charts Show How QE Rescued postponed America From The Great Recession

There fixed it.

You know ..... when the fed is printing money at near light speed, there is no good scenario of how it ends. As a dissentng view, I still stand by it. I have a feeling the Chicoms might act after QE4.

That's what we're hearing, and now they're going to stop. Last month the Fed. printed up $29B --of course last year's Sept. printing was three times that, and the record was Sept. of 2008 when $718B was printed. To tell the truth, the days of real high speed printing ended a long time ago.

...the Chicoms might act after QE4

Let me know if you can think of what they might do, though I got my doubts there even will be a QE4.

Good morning, a lovely day but yikes! Metals: g&s already down to $1206.76 and $16.92 w/ futures now seeing another -0.1.62%. Stock Indexes: increased trade volume w/ S&P flat and NASDAQ a -0.3% distribution day --now into futures @ -0.26%. So after yesterday's early profit taking in reaction to the Fed moves into today's econ reports:

Initial Claims

Continuing Claims

GDP-Adv.

Chain Deflator-Adv.

Natural Gas Inventories

Some headlines:

Her we go

‘Plunge protection’ behind market’s sudden recovery

http://www.freerepublic.com/focus/f-chat/3221193/posts

tx, nothing like a smile w/ my morning coffee.

Understanding monetary demand would be helpful to your analysis.

Here are the components:

It was a big surprise to me to that w/ ALL that printing the money supply grew more slowly than before. There really has been a big money shortage that the Fed was supposed to meet.

Just this laat year the Fed printed about a $T, and that’s just about all the growth in the total money supply. On face value, it means w/o any fed money printing we’ll in for a huge contraction.

GDP down from last Q 4.5 but more than the expected 2.0. Inflation just 1.3% —less than the expected 2.0. Stocks flat (no profit taking) and metals are crashing...

We just got an ad from Ace Hardware in our local fish wrap.

Ace is really getting the jump on Black Friday, the ad is a pre Christmas $ale.

Bingo.

Your Bernankeistic philopshy of kicking the can down the street is flawed.

The chickens will come home to roost.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.