Skip to comments.

Investment & Finance Week in Review (Thread -Sept. 21 edition)

Weekly investment & finance thread ^

| Sept. 21, 2014

| Freeper Investors

Posted on 09/21/2014 11:32:29 AM PDT by expat_panama

| Investment & Finance Week in Review (Thread -Sept. 21 edition) Prices finally picked a direction and went for it --topping a super week w/ metals collapsing, an FOMC meeting, Scottish Vote not to do anything, new IRS rules, stocks leaping, and the Alibaba IPO hype, |

|

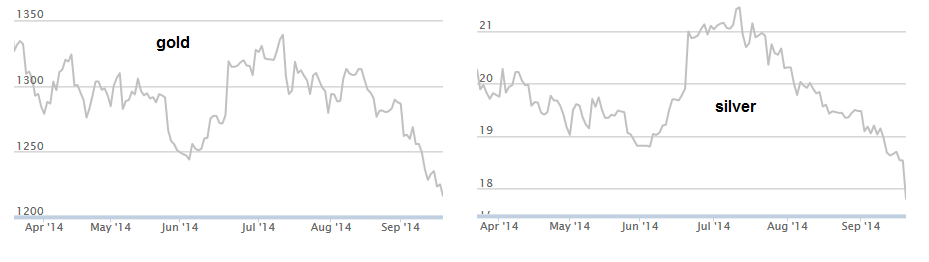

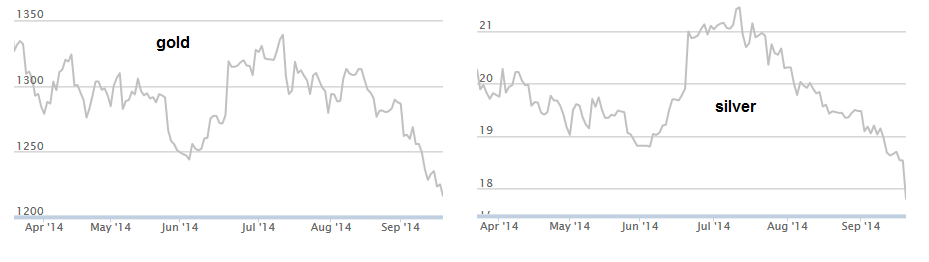

--and in the lull before the end of Q3 and beginning a new earnings season. One thing at a time; metals finally broke in to newer lower levels as support folded, |

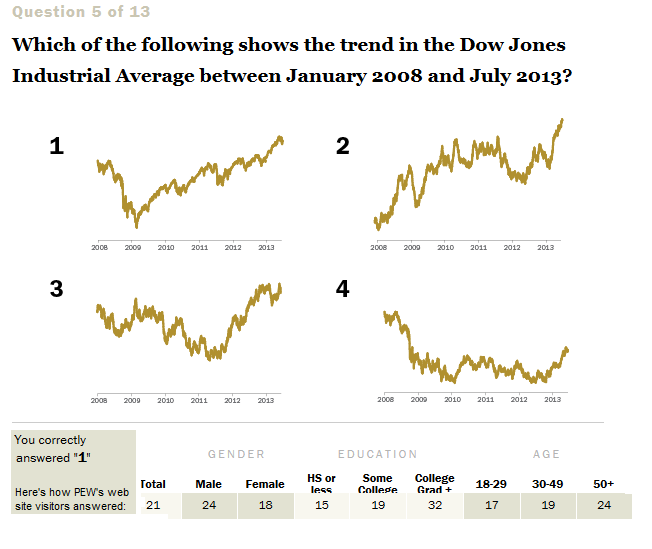

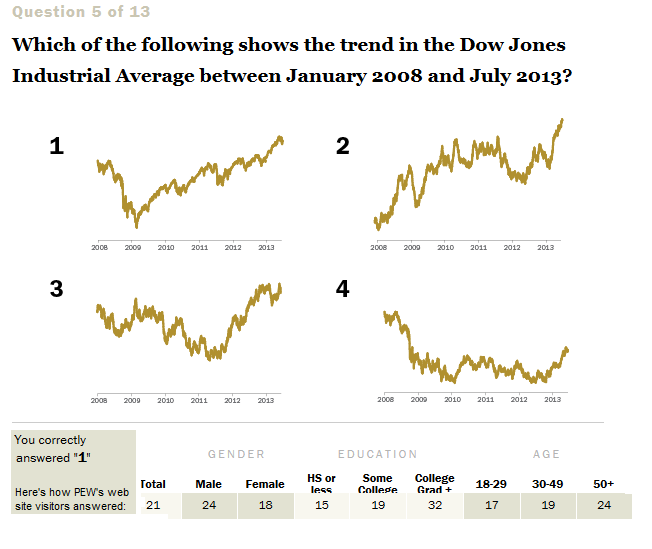

...and stock traders made up their minds deciding to respect the 50-day moving average support and rebound prices into what IBD calls "market in confirmed uptrend. As long as we're charting our brains out here we have got to look at a set the PEW folks asked their internet visitors about. (Kudus to Chgogal. Again.) The 'News Quiz' (thread here) was meant to let folks see how they matched answers with others; here's the Q that raised our eyebrows: |

...but what amazed Chgo & me was how few people got it right. I mean, the fact that viewers scored worse than chimpanzees -picking at random-- means that the problem isn't lack of info, it's and excess of wrong info. Kind of makes me wonder (1) which guess most people think stocks have been doing and (2) where they got that idea... |

|

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-73 next last

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

...weekend free time ping...

To: expat_panama

3

posted on

09/21/2014 12:42:24 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

4

posted on

09/21/2014 12:42:58 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

“Kind of makes me wonder (1) which guess most people think stocks have been doing and (2) where they got that idea...”

Probably from reading various threads here on Free republic.

5

posted on

09/21/2014 12:48:52 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Chgogal

To: expat_panama

This country and its dang tax laws. I read that three times and it's still not too clear. Thankfully there is that “reasonable interpretation standard.” Whew!

7

posted on

09/21/2014 4:37:04 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

Yikes --futures traders have prices plunging for just about everything today w/ metals leading the fall and stocks right behind! Yahoo & Google say it's China's fault though it might also be the quarter-end window dressing. Today's only major report is Existing Home Sales. Morning reading:

To: expat_panama

To: Wyatt's Torch

That's exactly the post I was putting together!!!

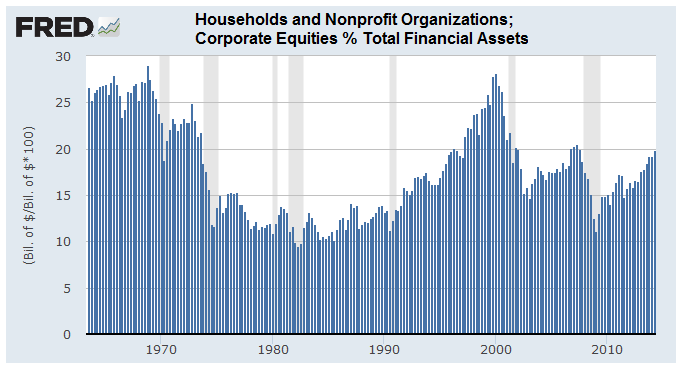

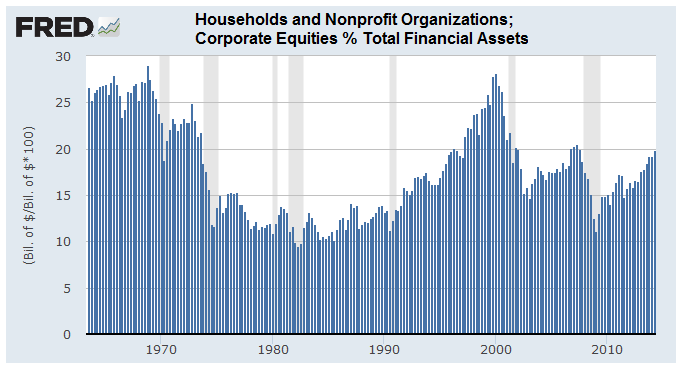

We got the US Investors Are Loaded Up With Stocks in the morning reading list but the graph tells the story (imho). The flow of funds doesn't lie. OK, so liars quote the FofF all the time but what this says to me is that 2014 is NOT 1982 for stocks. Maybe for jobs but stocks are more like '65 or '97.

or '00 & '08...

To: expat_panama

But think about the fundamentals and identifiable issues (bubbles? contagions?) that drove the collapses in 2000 and 2008. Do those exist today?

To: expat_panama

What's up with iron ore?

To: Wyatt's Torch

That last down arrow is a guess for future prices because nobody knows for sure what happens next until it’s happened. Am looking for the PBS source —it’s all over twitter but I’d sure like to know where the arrows came from...

To: Wyatt's Torch

2000 and 2008. Do those exist today?Agreed --which is why my first guess [operative word] was that we're more likely back when Sir Alan was whining about 'irrational exuberance' --years before the crash.

To: Wyatt's Torch

What's up with iron ore? Hmmm. Thinking that iron ore is to steel what steel is to manufacturing, the canary in the mineshaft...

To: expat_panama

Steel (all grades) as well as copper have been hit hard. Likely China.

To: expat_panama

Steel (all grades) as well as copper have been hit hard. Likely China.

To: expat_panama

To: Wyatt's Torch

The flow of funds doesn't lie. OK, so liars quote the FofF all the time...--and now that I look at it I think that's what's really happened here. PBS won't say where J. Lyons Fund Mgmt. got their numbers for their graph, but when the world looks at the Fed's data on privately held stocks % private financial assets they get this:

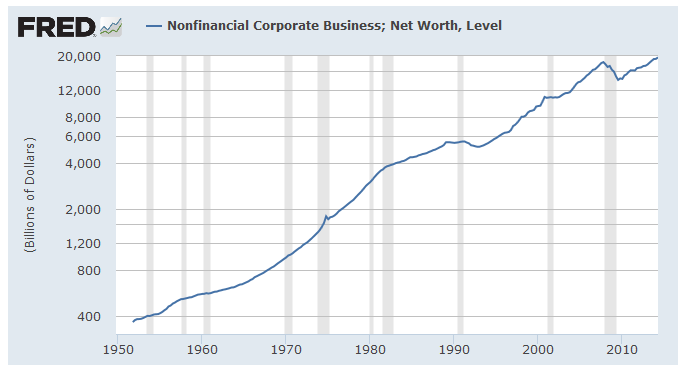

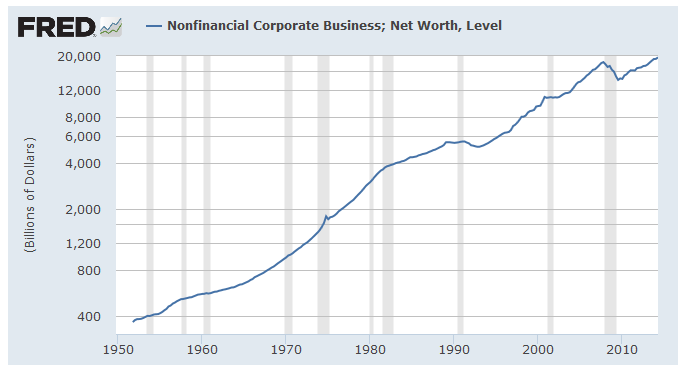

Not only do we see no big deal any more, but now we remember that most stocks are owned by institutions, not individuals. If we're concerned about stock prices and money available to buy then we want to think about how total corp net worth (total market cap) is doing:

The numbers are irrefutable. Before the recession growth going back to 1950 averaged 7% yearly. The past seven years stock investments have grown yearly at just one percent.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson