Skip to comments.

Investment & Finance Thread (week July 20 - July 26 edition)

Weekly investment & finance thread ^

| July 20, 2014

| Freeper Investors

Posted on 07/20/2014 4:02:51 PM PDT by expat_panama

Year-to-date wrap-up time.

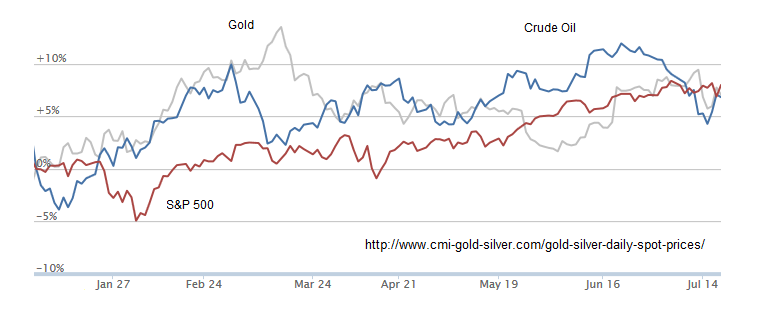

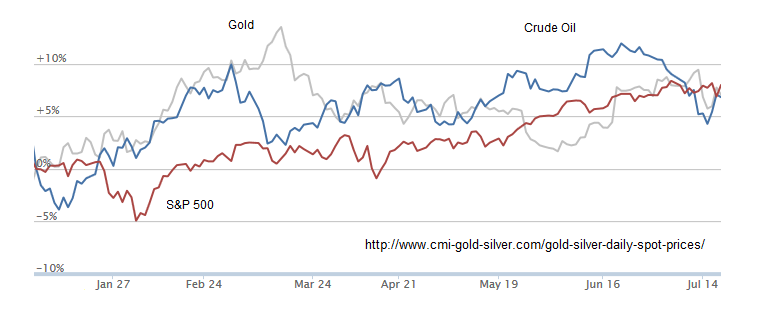

General markets varied a lot but right now they're all together at 5-10% up so far. Actually that's pretty good as it represents a 5-year doubling time. click to enlarge |

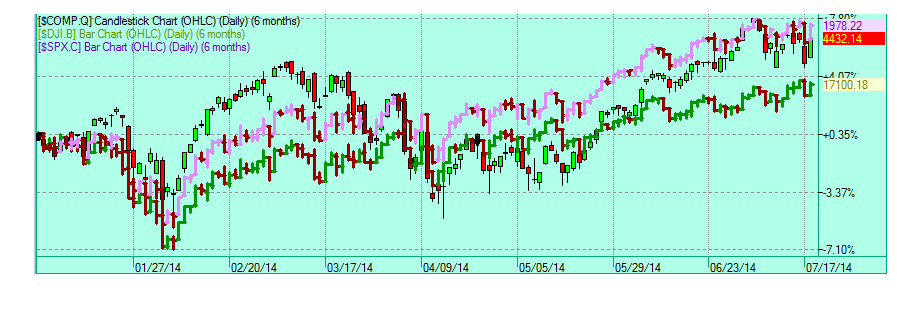

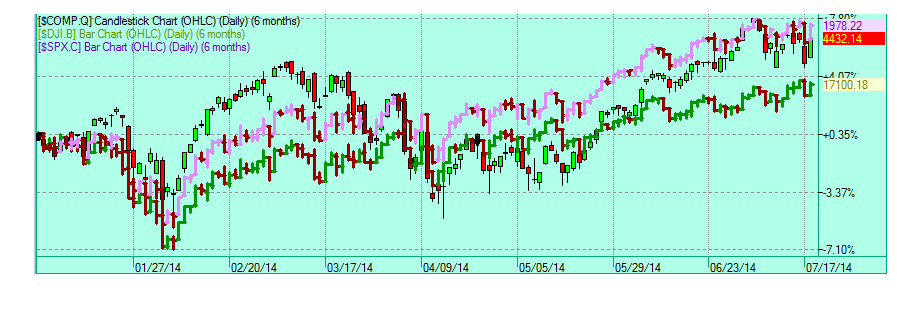

A closer look at stock indexes so far this year are showing roughly the same track but my dim eyes are somehow seeing us having a plateau for the past 3 weeks. That's usually a good sign; witness the run-up after the mid-April basing. click to enlarge |

.As Torch says, "Discuss".

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 last

To: Wyatt's Torch

“The SEC’s Going After S&P. “The parent of Standard & Poor’s, which is defending against a $5 billion lawsuit by the federal government over its credit ratings, said on Wednesday it may soon also face U.S. Securities and Exchange Commission charges over another set of ratings,” reported Reuters’ Jonathan Stempel and Sarah Lynch. “In a regulatory filing, McGraw-Hill Financial Inc said it received a “Wells notice” on July 22 indicating the SEC is weighing filing civil charges for alleged securities law violations over S&P’s ratings of six commercial mortgage-backed securities transactions issued in 2011.”

Willie Sutton would be envious.

61

posted on

07/24/2014 9:45:25 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Didn’t we do that chart? Initial claims as a percent of the workforce?

To: Wyatt's Torch

What’s the scoop on going after Standard and Poors? Political?

63

posted on

07/24/2014 2:47:43 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

I read somewhere today that Facebook was real close to passing IBM’s market cap. Sure enough yahoo puts IBM at 194.85B and Facebook at 192.42B. I find this amazing. IBM has 431,212 employees, Facebook 6,818. There is no doubt in my mind that investment wise Facebook has more potential I just don’t completely understand why.

IBM

http://en.wikipedia.org/wiki/IBM

Facebook

http://en.wikipedia.org/wiki/Facebook

64

posted on

07/24/2014 7:05:42 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

IBM at 194.85B and Facebook at 192.42B. I find this amazing. IBM has 431,212 employees, Facebook 6,818It brings to mind how a couple decades ago everyone was amazed that Microsoft's marketcap was bigger than GM --how one office bldg in Wash. could be do more than aallll those factories.

The way the world's wealth creation has been evolving is that while factories and labor are nice, it's information that makes the difference. Come to think of it, that's the way it's always been...

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Happy Friday Morning everyone! Yesterday saw both metals'n'stocks flat but now the futures guys say it's stocks down and metals up. This week's reports are wrapping up w/ durable orders this morning. Headlines from the One-Outa-20-Believable news service:

- Geopolitical Tensions Weigh on German Economy, Data Suggest Wall Street Journal - 1 hour ago Geopolitical tensions are weighing on the German economy, suggesting that the country faces growth risks in the third quarter after what was likely a flat a second quarter, data published Friday indicate.

- Europe shares mixed; Ifo data misses; RBS up 13% CNBC.com

- Obama names Ireland in attack on tax policies of US firms Irish Times - 5 hours ago President Barack Obama: “I don't care if it's legal - it's wrong,” he told a California audience. “You don't get to choose the tax rate you pay.

- McDonald's Japan Calls Foul on Chinese Chicken Wall Street Journal - 3 hours ago A woman holding an umbrella walks past a McDonald's restaurant, operated by McDonald's Holdings Co. Japan in Tokyo. Bloomberg News.

- Wall Street: Fooling All the People All the Time - Chris Arnade, Guardian

- What You Think About Inflation Is Wrong - Megan McArdle, Bloomberg

- Greenspan: Can't Stop Bubbles w/out a Crunch - Greg Robb, MarketWatch

- Economy Looks Better...So Why Do We Worry? - Everett Rosenfeld, MSN

- 7 Charts That'll Make You Feel Good Today - Matt Phillips, Quartz

- Traders Are the Walking Dead on Wall St. - Howard Gold, MarketWatch

- Analyst: Apple Could Be Obsolete in 3 Years - Arjun Kharpal, CNBC

To: expat_panama

Durable goods up .7% Vs .5% estimate.

67

posted on

07/25/2014 5:36:11 AM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

yet indexes are down a percent. We’re either ignoring the news or it’s “good-news=higher-rates=bad-news” time again.

To: expat_panama

To: expat_panama

To: expat_panama

To: Wyatt's Torch

thanx, thinking I’ll have to add it to the freeper/investor page..

To: Wyatt's Torch; expat_panama

73

posted on

07/26/2014 10:47:44 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson