Skip to comments.

Investment & Finance Thread (week June 29 - July 3 edition)

Weekly investment & finance thread ^

| June 29, 2014

| Freeper Investors

Posted on 06/29/2014 2:17:00 PM PDT by expat_panama

Yesterday was the 100th anniversary of the assassination of Archduke Franz Ferdinand in Sarajevo which sparked the war and the NYSE decided to close for the duration (more here). This week we begin the new quarter --and the second half of 2014. We'll see if the GDP for Q2 shows any improvement (1st report coming out in three weeks). Imho we're in an economy where we can still make money but it's just going to take more effort.

Review of last week here, reports/consensus coming out this week here.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-88 next last

To: catfish1957

you miss the little “/s” My bad, somehow my browser got reset to the default "no-sarcasm" setting. Wait a sec--

--there.

To: expat_panama

To: expat_panama

To: expat_panama

To: expat_panama

To: expat_panama

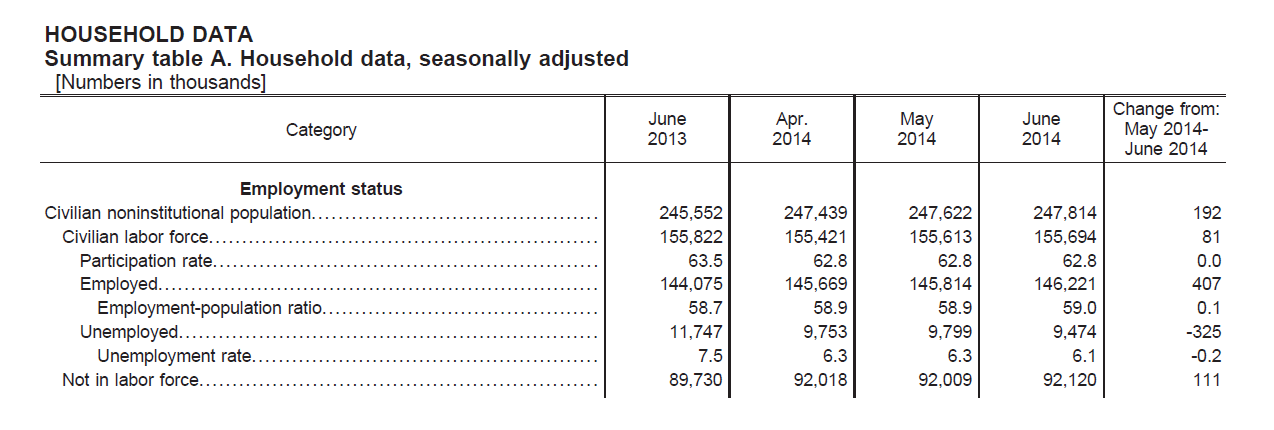

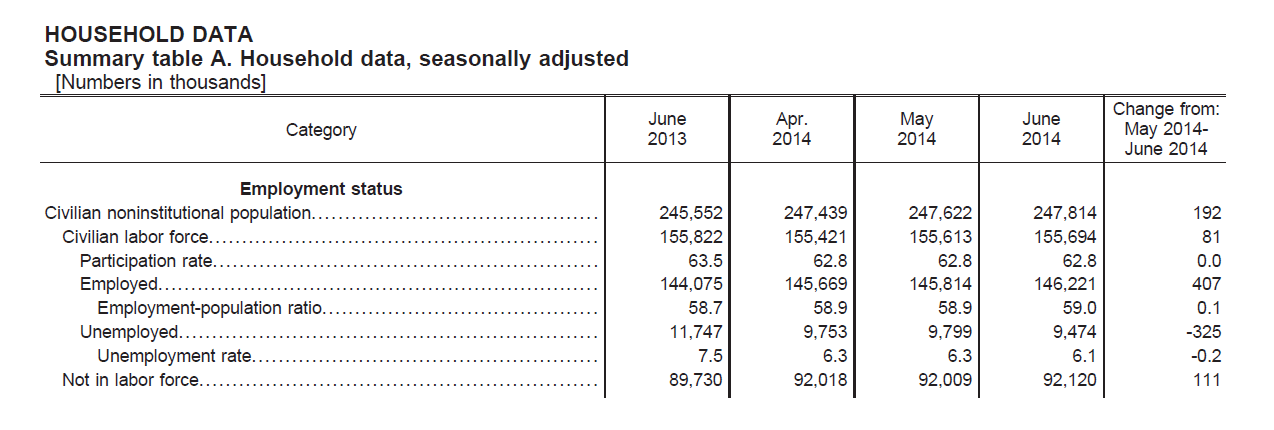

June jobless rate for people 25+

With bachelor’s degree: 3.3%

Some college: 5.0%

High school grads: 5.8%

No h.s. diploma: 9.1%

To: Wyatt's Torch

Will the market think this is good or will they be scared of a rate hike and go the other way? I get so confused.

To: expat_panama

Expat_panama: Do you use IBD and if so, do you find it worthwhile?

I read Barrons and use Morningstar presently. I am considering IBD, but don’t want to spend too much more time researching....

68

posted on

07/03/2014 5:53:50 AM PDT

by

The_Media_never_lie

(The media must be defeated any way it can be done.)

To: Lurkina.n.Learnin

LOL. Me too. I don’t know if today is a “good news is bad news” or if it’s “good news is good news”. I need a calendar...

S&P futures are up on the day but haven’t done much since the 8:30 announcement.

To: Lurkina.n.Learnin

BTW participation rate was steady so UE dropped for the “right” reasons. U6 also declined. Prior months were revised up. There’s no bad news in this report. Very solid.

To: Lurkina.n.Learnin

From Stone McCarthy Research:

First Impressions - June Payrolls Up 288,000; Unemployment Rate 6.1%

— Stone & McCarthy (Princeton) —

What follows is our first impression of the June report on the Employment Situation. In a later update, we will provide a more complete analysis.

Nonfarm payrolls rose 288,000 in June. Private payrolls rose 262,000 in the month, and government jobs were up 26,000. There was a revision in May to 224,000 (previously 217,000) and April was revised to 304,000 (previously 282,000). The combined gain for June and net upward revision of 29,000 to the prior two months suggests payroll growth remains moderate. The unemployment rate was down two-tenths to 6.1%. Hourly earnings were up 0.2%, and the workweek was flat. Altogether, we find this report consistent with a more robust labor market and one that is likely to sustain its path of steady improvements.

Our forecast was for nonfarm payrolls to rise by 210,000 in June, and was near the median in the Bloomberg survey of up 215,000. The range was from up 145,000 to up 290,000. The numbers were to the high side of expectations, and represent a solid pace of increases that have gained some momentum in the second quarter from the weather-related softness in the first quarter.

For the second quarter, payroll increases have averaged 272,000 a month compared to the up 190,000 for the first quarter. The six-month moving average is at 231,000 per month. The data does not change to our outlook for a further “measured” wind down of asset purchases to be concluded before the end of 2014. Five consecutive months of over-200,000 increases in payrolls is good news for the Fed, however, we do not look for any change in the “considerable period” before the fed funds rate lift off occurs. It may narrow the timing by a month or two, but mid-2015 is still our expectation.

Service-providers had a 236,000 rise in payrolls in June, while goods producers saw an increase of 26,000. Among goods-producers, construction was up 6,000, and manufacturing was up 16,000. Service industry hiring was up 40,000 for retail trade, and up 72,000 for trade and transportation. The solid gain in professional and business services of 67,000 included a rise of 10,000 for temporary help services. These are respectable numbers and in industries generally associated with a better quality of jobs.

Average hourly earnings were up 0.2% to $24.45 in June from $24.39 in May. The workweek was flat at 34.5.

The unemployment rate dipped two-tenths to 6.1% in June from May. This was the still the lowest since 6.1% in September 2008. The unrounded unemployment rate was 6.085%, down from the 6.297% in the prior month. Bloomberg survey expectations centered at 6.3% within a range of 6.2% to 6.4%. Our forecast was for 6.3%. The unemployment rate has been coming down more quickly than anticipated, but it will still be some time before it returns to more normal levels.

The index of aggregate weekly payrolls rose 0.4% to 117.6, after an up 0.4% reading in May and up 0.3% in April. We view this index as a measure of the quality of employment. The underlying trend remains one of moderate gains.

To: Lurkina.n.Learnin; expat_panama

To: Wyatt's Torch

No. of unemployed falls and employment increases --both more than change in population.

Huh. So much for our shrinking GDP...

To: The_Media_never_lie

...considering IBD, but don’t want to spend too much more time researching...Personally, my meager time'n'energy for research is largely spent using IBD (that and American Association of Individual Investors). Both can be given a 'test-drive' for free.

To: expat_panama

Yep. The GDP number was an aberration. The underlying economic data is very strong. can’t wait to see the conspiracy FReepers heads explode when 2Q GDP comes in at 4%. Those people are tilting at windmills and making themselves look foolish. The GOP needs to change strategy because complaining about economic growth in the election cycle isn’t going to resonate well.

To: Wyatt's Torch

when 2Q GDP comes in at 4%. Those people are tilting at windmills Predicting this stuff is not all that easy, I know I'm not up to it. What we do know for sure is that history's shown there are a lot of people who've come to a lot of grief when they underestimated the power of the American people to overcome enormous odds. These days we're seeing terrorist fanatics in harmony with freeper doom'n'gloomers all chanting that America is doooomed.

To: expat_panama; The_Media_never_lie

I am still in the free trial period of IBD. I will definitely be subscribing. Before I was hit and miss and not really going anywhere now things are going a lot better. Thanks expat for steering me there.

To: expat_panama

BTW everyone slashing 2QGDP today because of trade balance. Typical cuts are around 0.5%

To: Wyatt's Torch

They need to pivot to Big, Intrusive Government and its destructive regulations. The IRS, foreign policy, etc. They’ve got plenty to choose from.

I’d like to see them focus on urban regulations and how they generate poverty.

79

posted on

07/03/2014 9:59:49 AM PDT

by

1010RD

(First, Do No Harm)

To: Wyatt's Torch; expat_panama

80

posted on

07/03/2014 4:56:48 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-88 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson